The crypto market is trading lower today, with the total market cap down 1.1% over the past 24 hours to $3.02 trillion, according to market data. The decline comes amid widespread weakness in core assets, while trading activity remains elevated, with 24-hour volume at $98.49 billion.

TLDR:

- The crypto market cap fell 1.1% to $3.02 billion, with significant losses across major assets;

- Galaxy Research Claims Bitcoin Didn’t Really Hit $100,000 After Adjusting for Inflation;

- BTC consolidates near $87,000, with key support between $85,000 and $86,000 and downside risk towards $80,000;

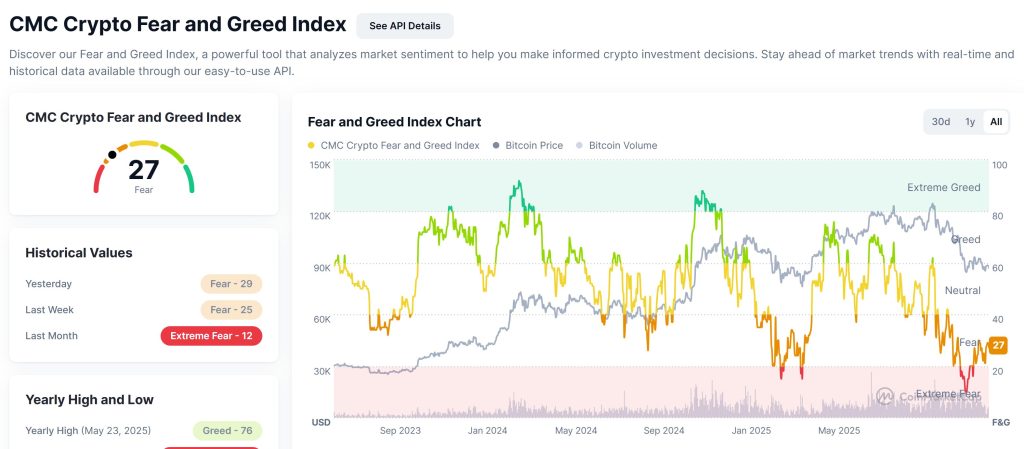

- Market sentiment remains weak, with the Fear and Greed Index at 27 (fear);

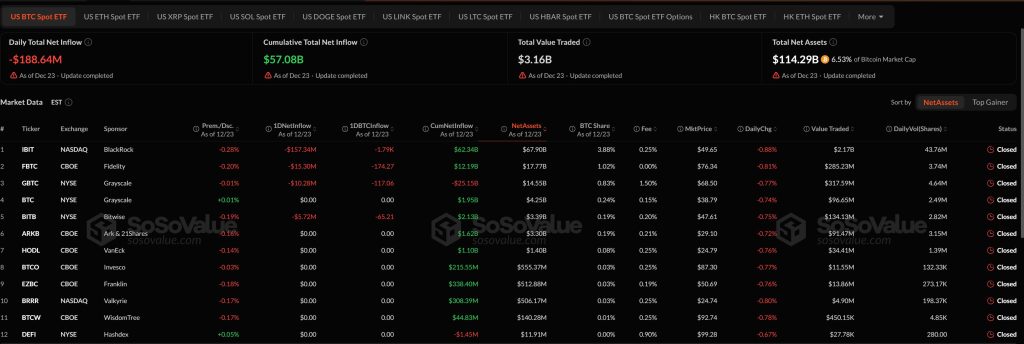

- U.S. spot Bitcoin ETFs saw net outflows of $188.6 million on Dec. 23, led by BlackRock’s IBIT;

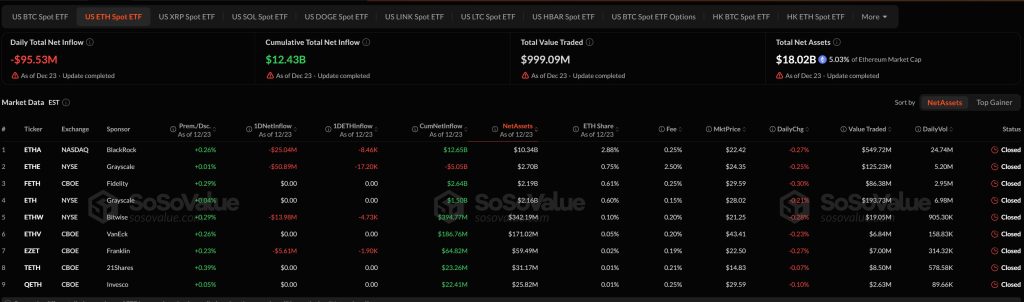

- US Spot Ether ETFs also saw outflows of $95.5 million, reversing the previous day’s inflows;

- Institutional activity continues, with Bitmine adding nearly $1 billion worth of ETH in December.

Crypto Winners and Losers

At the time of writing, most of the top 10 cryptocurrencies by market cap were in the red over the past day.

Bitcoin (BTC)) is trading at $86,780, down 0.8% over the past 24 hours, although it remains slightly higher on the weekly time frame.

Bitcoin’s market capitalization stands at around $1.73 trillion, maintaining its dominance despite the broader downturn.

Ethereum (ETH) fell 1.5% to $2,919, with a market capitalization close to $352 billion.

Among the biggest drops in the top 10, Solana (SOL) fell 2.3% to $121.36, while BNB (BNB) slipped 1.6% to $835.76. XRP (XRP) also fell 1.8%, trading at $1.85.

Dogecoin (DOGE) is down 2.2% on the day, changing hands at $0.1274, while Cardano (ADA) recorded one of the steepest losses among large caps, falling 2.3% to $0.3554.

Outside of the majors, some tokens posted gains. SQD led the market with an increase of 43.7%, followed by Quantum Resistant Ledgerwhich soared 31%, and pippin, up 21.8%, standing out as notable outperformers amid an otherwise risk-free session.

Meanwhile, Galaxy Research said that Bitcoin may have reached new highs in nominal terms, but it has yet to truly break through the $100,000 mark once inflation is taken into account.

Galaxy head of research Alex Thorn said Tuesday that Bitcoin has never surpassed six figures after adjusting for inflation using 2020 dollars, although the asset hit an all-time high above $126,000 in October.

Bitcoin Dominance Rises as Altcoins Face End-of-Year Pressure

Bitcoin’s share of the crypto market continues to rise as trading activity slows towards the end of the year, keeping altcoins under sustained pressure, according to Wintermute’s latest market update.

The report indicates that capital rotation is away from smaller tokens and toward Bitcoin and Ethereum, dampening expectations of an altcoin rally typically seen after strong moves in Bitcoin.

The market as a whole remains weak, with Bitcoin falling below $87,000 and Ethereum trading near $3,000 over the past 24 hours. Altcoins saw larger losses, led by the NFT sector, which fell more than 9% as risk appetite faded.

Earlier in the week, high volatility triggered liquidations of around $600 million on Monday, followed by another $400 million on Wednesday and Thursday.

Despite a partial rebound towards $90,000, Bitcoin price action remained limited. Open interest in Bitcoin and Ethereum perpetuals fell by a total of $5 billion, reducing leverage but leaving markets exposed to sharp moves amid limited liquidity.

Traditional financial players continue to enter this sector despite recent market volatility, providing a more sustainable basis for future growth.

Bitmine added an additional 67,886 ETH worth $201 million to its treasury, bringing December’s total purchases to approximately $953 million.

Levels and events to watch next

At the time of writing on Tuesday, Bitcoin was trading near $86,926, down about 0.6% on the day. Earlier in December, BTC attempted to rebound towards the $92,000-$94,000 area but failed to maintain its momentum, resuming its broader downtrend that began after peaking above $120,000 in October.

Over the past few weeks, Bitcoin has been trading in a descending range, with repeated rejections below $90,000 and increasing selling pressure during rallies. The chart shows that BTC fell below several short-term support levels in November, with buyers now defending the $85,000-$86,000 zone.

A sustained move below this zone could expose a decline towards $82,000, with a deeper pullback opening the door to the psychological $80,000 level. On the upside, BTC would need to reclaim $90,000 to signal stabilization, with further resistance near $95,000.

Ethereum is trading around $2,926, down about 1.2% in the last 24 hours. The chart shows that ETH continues to underperform after losing the $3,200-$3,300 range earlier in November. Since then, price action has remained strong, with lower highs and limited follow-up rebounds.

ETH briefly fell below $2,900 in recent sessions before finding near-term support, but momentum remains fragile. If selling resumes, the next key level on the downside is around $2,800, followed by stronger historical support around $2,650.

On the upside, a recovery above $3,000 would be the first step towards price stabilization, with further resistance near $3,200.

Meanwhile, crypto market sentiment remains firmly in the fear zone, with the Crypto Fear and Greed Index reading 27 at the time of writing. The index has shown little improvement in recent days, reflecting continued caution among market participants.

Although sentiment has recovered slightly from last month’s extreme low of 12, it remains well below neutral levels, suggesting investors are still hesitant to take risks.

U.S. spot Bitcoin ETFs saw net outflows of $188.64 million on Dec. 23, extending the recent cooling in institutional demand.

BlackRock’s iShares Bitcoin Trust (IBIT) led the outflows, losing $157.34 million on the day. Fidelity’s FBTC followed with $15.30 million in outflows, while Grayscale’s GBTC saw $10.28 million leave the fund. Bitwise’s BITB also saw a lower outflow of $5.72 million.

Cumulative net inflows across all US spot Bitcoin ETFs are $57.08 billion. The total trading value between products reached $3.16 billion, while total net assets stood at $114.29 billion, equivalent to approximately 6.5% of Bitcoin’s total market capitalization.

US Spot Ether ETFs reversed course on December 23, posting net outflows of $95.53 million after a day of inflows earlier in the week.

Grayscale’s ETHE accounted for the largest share of outflows, losing $50.89 million on the day. BlackRock’s ETHA followed with $25.04 million in net redemptions, while Bitwise’s ETHW saw $13.98 million exit the fund. Franklin’s EZET also saw capital outflows of $5.61 million.

Cumulative net inflows into US Ether spot ETFs remain at $12.43 billion. The total trading value between the products reached $999 million, while the total net assets stood at $18.02 billion, representing approximately 5.0% of Ethereum’s total market capitalization.

Meanwhile, BlackRock is recruiting staff for the next stage of its crypto campaign, posting new roles in digital assets in New York, London and Singapore, while expanding a team that now covers tokenization, stablecoins and crypto market structure.

Robert Mitchnick, who leads BlackRock’s digital assets strategy, recently flagged a recruiting drive, saying the firm was hiring for several senior roles within its digital assets team in New York, London and Asia.

The article Why is crypto down today? – December 24, 2025 appeared first on Cryptonews.

Bitcoin may have reached new highs in nominal terms, but it has yet to truly break through the $100,000 mark once inflation is taken into account.

Bitcoin may have reached new highs in nominal terms, but it has yet to truly break through the $100,000 mark once inflation is taken into account. Wintermute data confirms retail altcoin trading rotation towards Bitcoin and Ethereum as dominance increases and supply pressure increases through the end of the year.

Wintermute data confirms retail altcoin trading rotation towards Bitcoin and Ethereum as dominance increases and supply pressure increases through the end of the year. BlackRock is expanding its crypto team with new digital assets roles in New York, London and Singapore, recruiting from associates to senior executives in product, research and compliance.

BlackRock is expanding its crypto team with new digital assets roles in New York, London and Singapore, recruiting from associates to senior executives in product, research and compliance.