The cryptocurrency market is trading lower today, with the total market capitalization down 3.9% to $3.54 trillion, according to data from CoinMarketCap. However, the 24-hour trading volume reached $223 billion, indicating a slight recovery in activity despite the decline in the overall market.

TLDR:

- Global crypto market cap fell 3.9% to $3.54 billion;

- 9 of the first 10 coins fell;

- BTC -2.8% to $104,577, ETH -6.4% to $3,493;

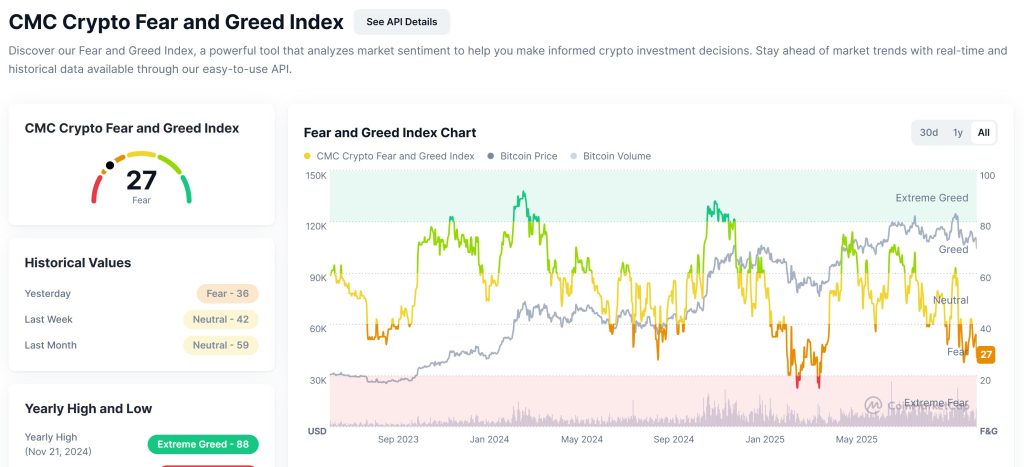

- The Fear and Greed Index plunged to 27 (fear), from 36 yesterday;

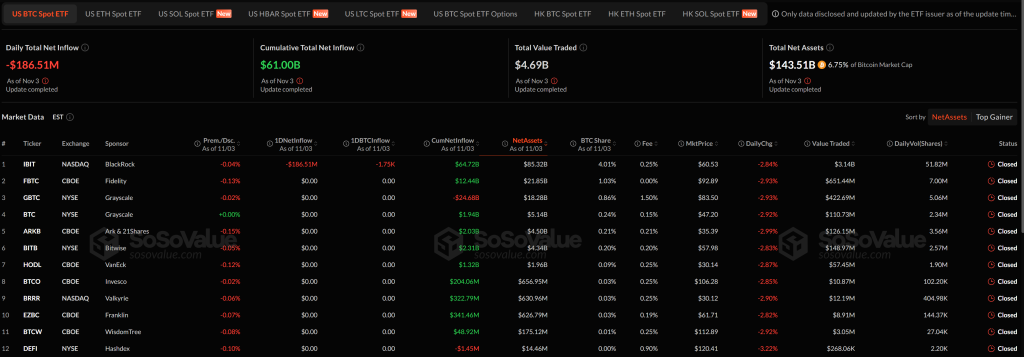

- BTC ETFs saw outflows of $186.5 million;

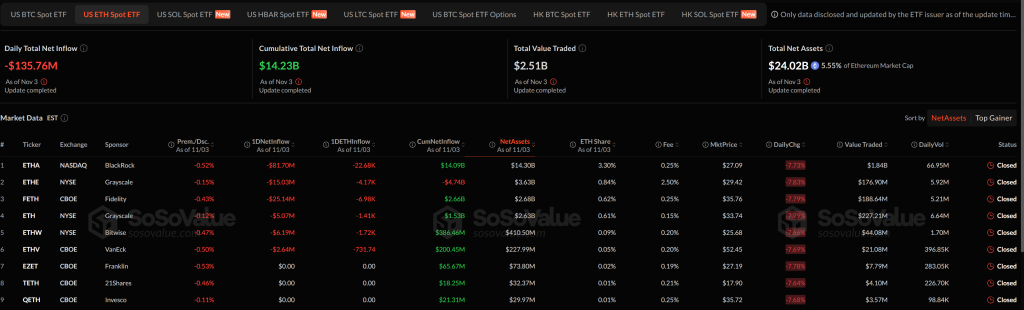

- ETH ETFs saw outflows of $135.76 million;

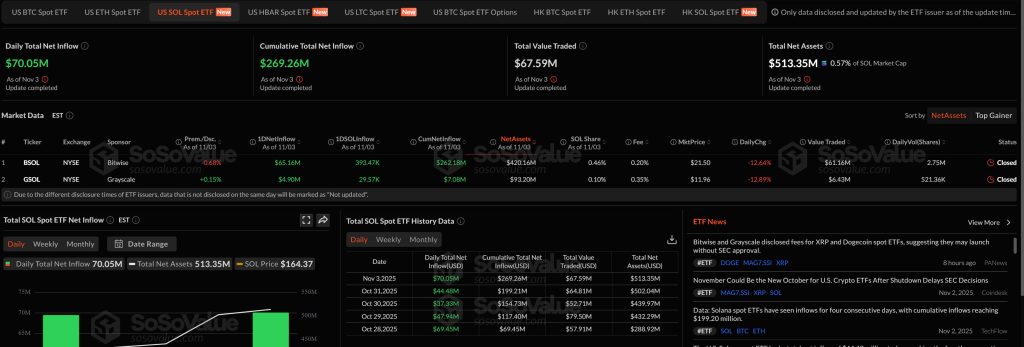

- SOL ETFs bucked the trend with inflows of $70.05 million;

- Strategy announced an offering of euro-denominated preferred shares to fund more Bitcoin purchases;

- FTX withdrew plans to restrict repayments in 49 jurisdictions after backlash from creditors.

Crypto Winners and Losers

At the time of writing, 9 of the top 10 cryptocurrencies are in the red over the past 24 hours.

Bitcoin (BTC) slipped 2.8% to $104,577, with a market cap of around $2.08 trillion.

Ethereum (ETH) fell 6.4% to $3,493, while BNB (BNB) lost 8.3% and is now trading at $946.

XRP (XRP) fell 6.7% to $2.25, and Solana (SOL) suffered one of the steepest declines among the majors, down 11.0% to $157.

Dogecoin (DOGE) slipped 6.6% to $0.1625, while Cardano (ADA) extended losses to $0.5349, down 7.4% over the past 24 hours.

Despite the economic slowdown, a few altcoins stood out with remarkable gains.

Jelly-Ma-Jelly (JMJ) jumped 183.3%, followed by Decreed (DCR) with a jump of 150%, and Zcash (ZEC) up 19.4%.

Meanwhile, trend tokens are included Dash, DecreedAnd Zcashreflecting renewed interest in privacy and masternode-based cryptocurrencies amid increased volatility.

Meanwhile, Strategy, Michael Saylor’s Bitcoin-focused company, announced plans to launch a euro-denominated credit instrument under the symbol STRE, marking its first-ever issuance aimed at European and global institutional investors.

The company intends to offer 3.5 million shares of its 10% Series A Perpetual Preferred Stock, with proceeds intended for general corporate use and additional Bitcoin acquisitions.

The announcement coincides with Strategy’s latest Bitcoin purchase of 397 BTC worth $45.6 million, made between October 27 and November 2.

Bitcoin Slips Below $107,000 on ETF Outflows and Market Whale Selling Pressure

Bitcoin fell 2% in early Asian trading, slipping below $107,000 amid continued ETF outflows and profit-taking by large holders.

The move continued the market’s cautious tone following the $19 billion loss in late October, with traders viewing the pullback as a consolidation after a period of volatility.

On-chain data shows that institutional accumulation has slowed, with inflows falling below new Bitcoin issuance for the first time in seven months, according to Capriole Investments founder Charles Edwards.

The shift reflected a broader tone of risk aversion as stocks advanced, driven by tech gains and Amazon’s OpenAI deal, while the dollar strengthened on reduced expectations of rapid U.S. rate cuts.

Analysts say October’s correction eliminated excessive debt, leaving the market in a rebuilding phase. Rachel Lin, CEO of SynFutures, noted that long-term holders remain stable and currency outflows persist, which is generally a positive sign.

For now, the market is expected to move sideways as traders monitor ETF flows and signals from the Fed, with a weaker inflation reading likely to reignite buying momentum later this month.

Levels and events to watch next

At the time of writing, Bitcoin is trading at $104,370, down 2.04% on the day. The asset extended its decline after losing support near the $107,000 level as intraday sentiment turned defensive.

BTC is currently fluctuating between $104,000 and $106,000, a range that suggests consolidation following recent selling pressure.

A decisive move above $106,500 could pave the way for a rebound towards $109,000 and $112,000, where previous resistance has capped gains.

On the downside, a break below $103,500 could expose the market to deeper losses, with the next notable support located around $101,000 to $100,000, a key psychological zone watched by traders.

Meanwhile, Ethereum is trading at $3,477, down 3.48% over the past 24 hours. The coin weakened after repeatedly failing to hold above $3,700, suggesting sellers remain in control.

If ETH recovers $3,550, it could attempt to rebound towards $3,750 – $3,900. However, a decline below $3,450 could open the door for a steeper correction towards $3,300 – $3,250, where stronger buying support had previously appeared.

Meanwhile, market sentiment has turned sharply bearish, with the Crypto Fear and Greed Index falling to 27, signaling “fear.”

The index stood at 36 yesterday, 42 last week and 59 a month ago, reflecting a steady erosion of investor confidence as cryptocurrency prices continue to fall. The sharp decline underlines the market’s growing caution, with traders reducing their exposure amid price volatility and diminishing risk appetite.

Bitcoin spot exchange-traded funds (ETFs) in the United States saw $186.5 million in outflows on November 3, signaling renewed selling pressure on institutional products, according to SoSoValue data.

The cumulative total net inflow now stands at $61.0 billion, with combined net assets valued at $143.5 billion, representing 6.75% of Bitcoin’s market capitalization. Total trading volume for the day reached $4.69 billion, reflecting continued activity despite the broader market slowdown.

Among individual issuers, BlackRock’s IBIT led outflows with $186.5 million, while Fidelity’s FBTC, Grayscale’s GBTC and Ark & 21Shares’ ARKB saw no new inflows. Despite this decline, BlackRock’s fund remains dominant with $85.3 billion in total assets, followed by Fidelity’s $21.8 billion and Grayscale’s $18.2 billion.

Spot Ethereum ETFs also saw outflows of $135.76 million on November 3. Among the nine listed ETFs, BlackRock’s ETHA saw the largest outflow of $81.7 million, followed by Fidelity’s FETH with $25.1 million and Grayscale’s ETHE with $15 million.

Other issuers, including Bitwise, VanEck and 21Shares, also reported smaller buybacks as institutional sentiment cooled alongside the Ethereum market decline.

Total cumulative net inflow now stands at $14.23 billion, while total net assets have fallen to $24.02 billion, representing 5.55% of Ethereum’s market cap. Daily trading volume across all funds reached $2.51 billion, reflecting high trading volume amid falling prices.

In contrast, Solana spot ETFs saw net inflows of $70.05 million on Nov. 3, marking their fourth consecutive day of positive flows, according to SoSoValue data.

The total cumulative net inflow now stands at $269.26 million, with total net assets reaching $513.35 million, or 0.57% of Solana’s market capitalization. The total trading value for the day was $67.59 million.

Of the two ETFs listed, Bitwise’s BSOL dominated with $65.16 million in inflows, while Grayscale’s GSOL added $4.9 million.

At the same time, FTX abandoned its controversial proposal to limit repayments in dozens of countries after strong opposition from creditors, notably Chinese.

The article Why is crypto down today? – November 4, 2025 appeared first on Cryptonews.