The crypto market is down today, with the total cryptocurrency market cap falling 3.0% to $3.78 trillion, according to data from CoinMarketCap. Meanwhile, 24-hour trading volume stands at $192 billion, reflecting reduced activity as major cryptocurrencies turn red.

TLDR:

- Global crypto market cap fell 3.0% to $3.78 billion;

- 8 of the top 10 coins and most major currencies in the red;

- BTC fell 3.5% to $109,373, while ETH slipped 3.6% to $3,868;

- The Fed’s 25 basis point rate cut and the end of quantitative tightening in December signal the return of liquidity;

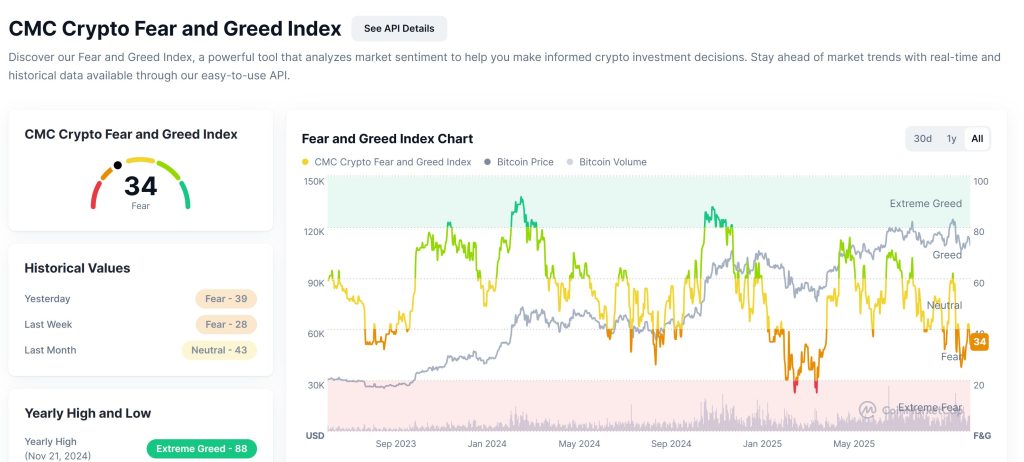

- The Fear and Greed Index dropped to 34 (fear);

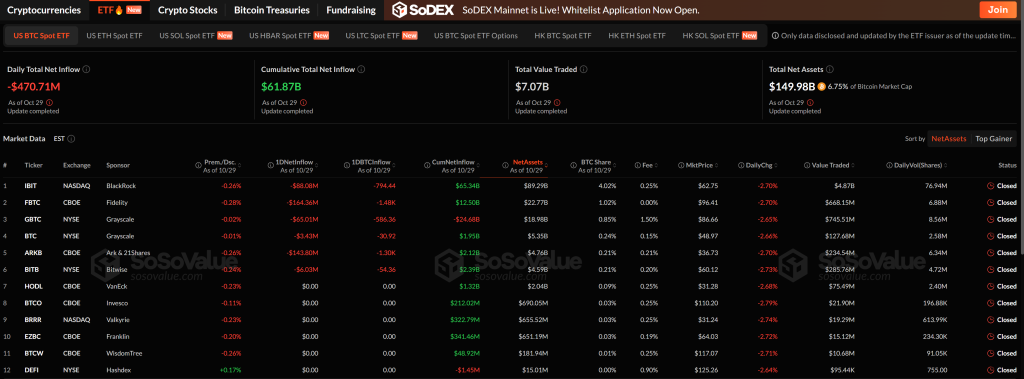

- BTC ETFs saw outflows of $470.7 million;

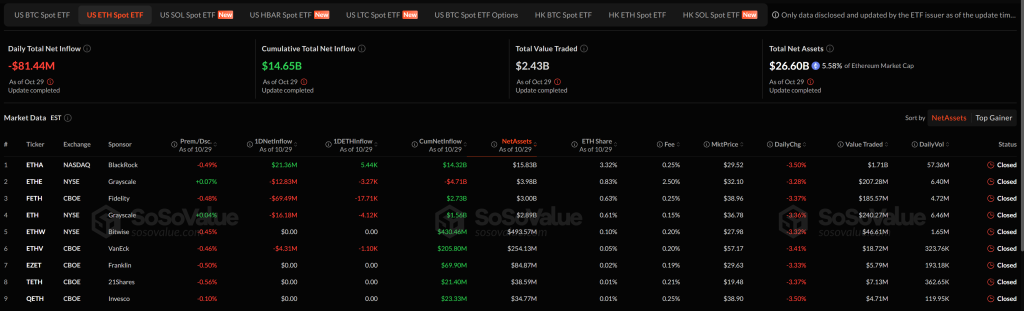

- ETH ETFs saw outflows of $81.44 million;

- AUSTRAC fined CryptoLink A$56,340 (US$37,085) for non-compliance with the AML law.

Crypto Winners and Losers

At the time of writing, 8 of the top 10 cryptocurrencies by market cap have declined over the past 24 hours.

Bitcoin (BTC) fell 3.5%, now trading at $109,373, maintaining a market cap of over $2.18 trillion.

Ethereum (ETH) slipped 3.6% to $3,868, while BNB (BNB) fell 0.5% to $1,107.

XRP (XRP) recorded a decline of 4.4% to $2.54, and Solana (SOL) lost 3.9%, now priced at $190.92.

The biggest drop among the top 10 comes from Dogecoin (DOGE)which fell 4.4% to $0.1872.

Despite the broader slowdown, a few altcoins saw impressive gains. Aurora (AURORE) jumped 65.1% to $0.08555, while Jelly-Ma-Jelly (JMJ) And Anvil (ANVL) increased by 50.6% and 44.0%, respectively.

On the other hand, PepeNode (PNODE) And BlockchainFX (BFX) tops the list of trending tokens despite declines of 19.7% and 5.7%, demonstrating strong retail interest amid market volatility.

Meanwhile, Switzerland-based asset manager 21Shares has filed an application with the US Securities and Exchange Commission (SEC) to launch a hyperliquid exchange-traded fund (ETF) (HYPE) amid growing institutional appetite for altcoin-related investment products.

The move came just weeks after Bitwise filed a similar hyperliquid ETF, highlighting intensifying competition among asset managers to capture investor demand for exposure to decentralized trading ecosystems.

The HYPE token powers Hyperliquid’s decentralized exchange, offering fee discounts to users and serving as a gas token for its blockchain.

Bitcoin Remains Strong as Altcoins Lag Despite Fed Rate Cut, End of QT

The US Federal Reserve’s latest 25 basis point rate cut went as expected, sending Bitcoin briefly down to $109,000.

However, the real market mover was the Fed’s confirmation that quantitative tightening (QT) will end in December, signaling the return of liquidity that could fuel risk assets. Analysts say this could pave the way for an “alternate season”, although past trends show such optimism often fades quickly.

In 2024, the first rate cut triggered a strong recovery, but this fizzled in September, only to be revived by Trump’s election victory later that year.

Despite these momentums, most altcoins have failed to regain their 2021 highs, while Bitcoin remains the only asset in a consistent upward trend.

Major tokens like ETH, SOL, and XRP remain more than 40% below their highs, showing a market still in a consolidation phase.

Analysts view the current market as a reset rather than a crash, where liquidity is shifting rather than expanding. Both Solana and XRP appear to be stabilizing, with record futures open interest near $3 billion each on CME.

Levels and events to watch next

At the time of writing, Bitcoin is trading at $109,295, down 0.68% on the day. The coin consolidated after failing to maintain momentum above $112,000 earlier this week. For now, BTC’s intraday range is between $108,800 and $110,200, suggesting a cautious market tone.

A break above $111,800 could trigger a move towards $114,500 and potentially $118,000, where previous resistance areas lie. On the other hand, failure to hold current support could open the door to $107,500, followed by a stronger support zone around $105,000.

Meanwhile, Ethereum is trading at $3,865, down 0.99% over the past 24 hours. The coin is hovering near the $3,850-$3,900 area after slipping from its weekly high near $4,100.

If ETH rises above $3,950, it could attempt to retest $4,200 and then $4,400, where selling pressure has repeatedly capped rallies. However, a decline below $3,800 could lead to a larger pullback towards $3,650 to $3,700 in the near term.

Meanwhile, market sentiment has become slightly more bearish, with the Crypto Fear and Greed Index falling to 34, signaling “fear.”

The index was at 39 yesterday and 43 a month ago, indicating a steady decline in confidence as traders remain cautious about price volatility. This change reflects continued uncertainty in the market, with participants refraining from taking aggressive positions while awaiting clearer signals of macroeconomic developments.

U.S. Bitcoin spot exchange-traded funds (ETFs) saw a sharp reversal on Wednesday, seeing $470.7 million in outflows, according to SoSoValue data.

The total cumulative net inflow now stands at $61.87 billion, with total net assets valued at $149.98 billion, representing 6.75% of Bitcoin’s market capitalization.

Among funds, Fidelity’s FBTC led outflows with $164.36 million, followed by Ark & 21Shares (ARKB) with $143.8 million and BlackRock’s IBIT with $88.08 million. Grayscale’s GBTC also saw $65.01 million leave the fund.

US Ethereum spot ETFs also saw $81.44 million in outflows on Wednesday. The total cumulative net inflow now stands at $14.65 billion, while the total net assets are valued at $26.60 billion, representing 5.58% of Ethereum’s market capitalization.

Among the nine ETFs, BlackRock’s ETHA was the only major fund to post gains, raking in $21.36 million. In contrast, Fidelity’s FETH saw the largest outflow with $69.49 million, followed by Grayscale’s ETHE with $12.83 million and Grayscale’s ETH with $16.18 million.

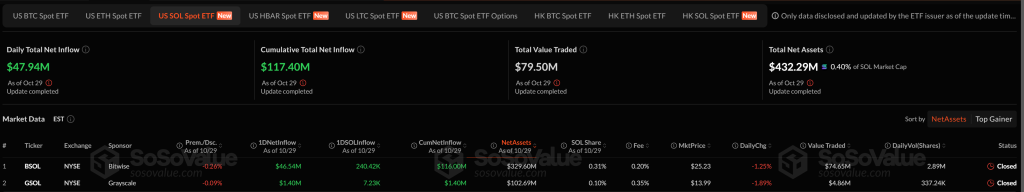

In contrast, Solana U.S. Cash ETFs saw $47.94 million in net inflows on Wednesday. The total cumulative net inflow now stands at $117.40 million, with total net assets reaching $432.29 million, or 0.40% of Solana’s market capitalization.

Among the two listed ETFs, Bitwise’s BSOL led with $46.54 million in inflows, while Grayscale’s GSOL added $1.40 million. Total trading volume across the two funds stood at $79.50 million for the day.

Meanwhile, Australia’s financial intelligence agency, AUSTRAC, on Thursday imposed a fine of AU$56,340 (US$37,085) on crypto ATM operator CryptoLink.

The action comes after the regulator’s Crypto Working Group, established last year, discovered late reporting of large cash transactions and “weaknesses” in CryptoLink’s AML rules.

The article Why is crypto down today? – October 30, 2025 appeared first on Cryptonews.

Fed Chairman Jerome Powell says President Trump’s tariffs are causing a "higher overall inflation."

Fed Chairman Jerome Powell says President Trump’s tariffs are causing a "higher overall inflation."

https://t.co/r0fqJzPJ8O

https://t.co/r0fqJzPJ8O AUSTRAC has sent an infringement notice to crypto ATM operator CryptoLink for late reporting of large transactions and weaknesses in the AML framework.

AUSTRAC has sent an infringement notice to crypto ATM operator CryptoLink for late reporting of large transactions and weaknesses in the AML framework.