November 14, 2025 – Oh my God, what is happening? Let’s ask the big question: why is crypto broken? The market was hit hard, with total capitalization dropping 5.6% to $3.38 trillion in the last 24 hours.

.cwp-coin-chart path svg { strokewidth: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

6.04%

Bitcoin

BTC

Price

$96,924.81

6.04% /24h

Volume in 24 hours

$105.12 billion

7d price

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

the main asset, fell below the key level of $100,000, hitting a low of $95,900: the weakest since May.

.cwp-coin-chart path svg { strokewidth: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

9.47%

Ethereum

ETH

Price

$3,244.76

9.47% /24h

Volume in 24 hours

$45.55 billion

7d price

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

fell more than 6% to $3,208, while altcoins like

.cwp-coin-chart path svg { strokewidth: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

8.92%

Solana

GROUND

Price

$143.62

8.92% /24h

Volume in 24 hours

$13.23 billion

7d price

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

and meme tokens lost 5-7%.

More than $1.1 billion in leveraged positions have been wiped out, intensifying the decline of DeFi, NFT, and Layer-1 tokens.

Traders are on edge, but is this the end of the uptrend or just a necessary correction?

EXPLORE: 9+ Best High Risk, High Reward Cryptocurrencies to Buy in 2025

The Perfect Storm: Why Crypto is Broken

The sell-off stems from a mix of global economic pressures, technical outages and widespread fear. The appetite for risk has disappeared from the broader markets. The Nasdaq-100 fell 2.05%, the S&P 500 fell 1.66% and even gold showed weakness as recession fears grew. A temporary shutdown decision by the U.S. government sparked short-lived optimism, but profit-taking quickly followed.

Late October CPI data and weak jobs reports (ADP showed -11,250 jobs per week) reduced the chances of a December Fed rate cut to less than 50%, dampening hopes for easier funding.

Excess leverage made the situation worse. Around $960 million in positions were liquidated, including $827 million in long BTC contracts, triggering a chain reaction of forced sales. Over $1.38 billion in liquidation in the last 24 hours.

Long-term holders sold 815,000 BTC over the past month, increasing supply pressure while ETF inflows slowed: $795.8 million left BTC funds in just five days. Growing US-China trade tensions and tensions in the AI sector (SoftBank sold its stake in Nvidia) hurt crypto-related stocks, with mining companies like CleanSpark down 8% and Hut 8 down 9%.

On-chain data shows clear signs of capitulation: the Crypto Fear & Greed Index fell to “Extreme Fear” at 15, the lowest since February. Retail sentiment has deteriorated and MVRV ratios indicate overvaluation.

The sentiment on CT (crypto Twitter) can be summarized as: high inflation, Fed uncertainty, and maximum leverage manipulation.

November’s historic average gain of 42% now seems unrealistic, distorted by outliers like 2013’s 449% rise, while the current month is down 15%.

DISCOVER: 10+ next cryptos to 100X in 2025

BTC Price Action: From Euphoria to Exhaustion

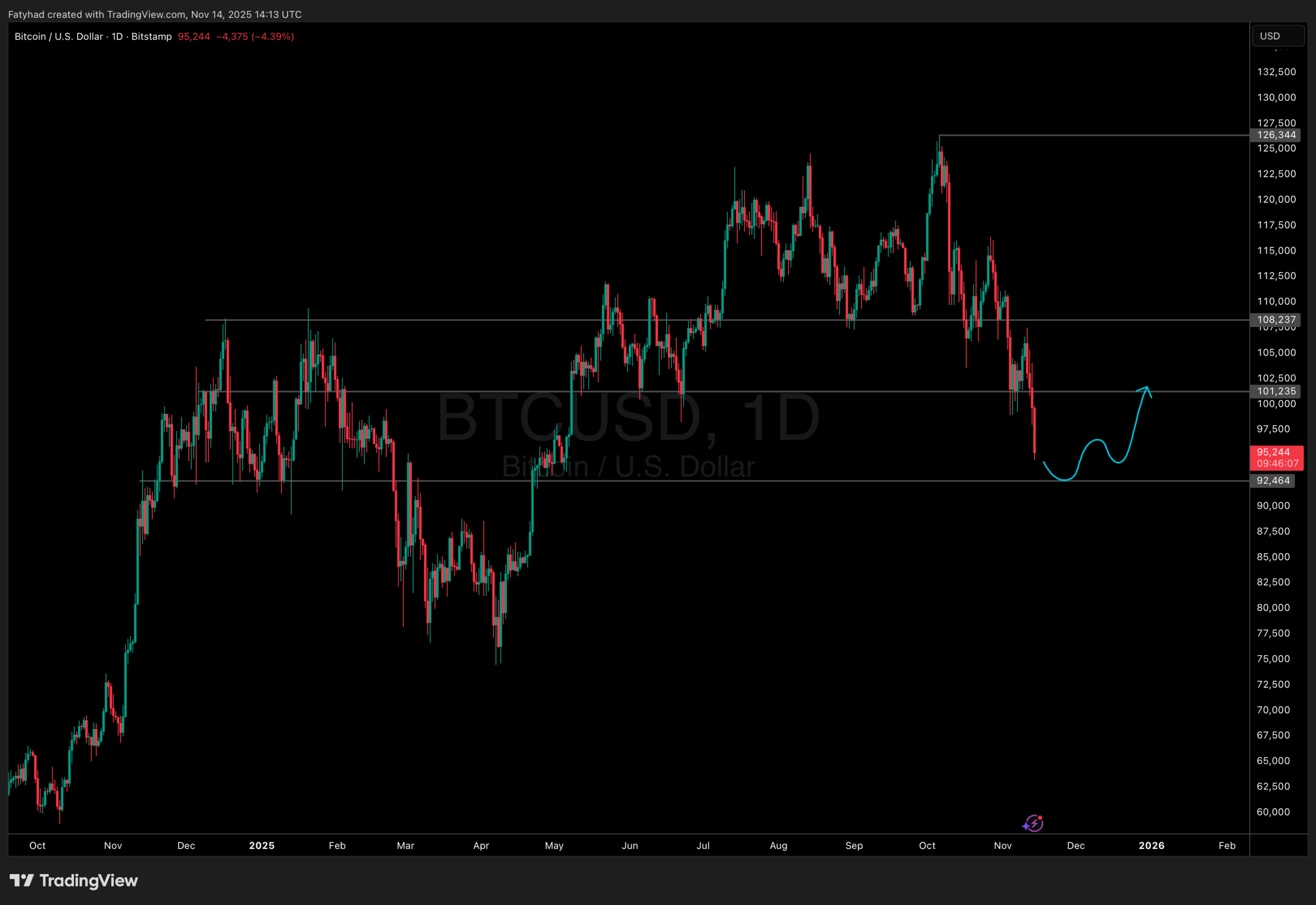

Bitcoin’s chart reflects fatigue. After hitting $126,296 in October, BTC made lower highs and broke supports at $102,800 and $100,000. The daily trend reversed, with two consecutive lows confirming bearish control. The RSI stands at 40.07, neutral but with falling volume which limits hopes of a rapid recovery.

However, some indicators offer hope. Foreign exchange outflows have reached record levels and institutions have accumulated 4 million BTC this year, more than 20% of the total supply.

Whales like “66kETHBorrow” bought $1.34 billion worth of ETH, betting on a rebound. Trendline models suggest a worst-case decline to $55,000, but a decline between $80,000 and $95,000 is more likely, keeping the decline between 37 and 56%, less severe than previous bear markets.

Will we see something like this?

(Source: Coingecko)

EXPLORE: Bitcoin Bleeds Below $100,000, But This Layer 2 Is Booming: Bitcoin Hyper ICO Crushes $27.5 Million

When will crypto recover? Bullish catalysts on the horizon

The bottom may be near. Analysts see support between $90,000 and $98,000, with a possible rebound between $108,000 and $114,500 by the end of the month if ETF flows return and macroeconomic conditions stabilize. The Fed ends its quantitative tightening on December 1, which could free up $50 billion in liquidity, similar to China’s recent decision. New rules like the GENIUS Act could incentivize yield-bearing assets, attracting institutions that currently hold only $300 billion to $400 billion of crypto’s $3.55 trillion market cap.

Looking ahead, the forecast for 2025 remains strong: $145,000 to $200,000 by the fourth quarter, according to Bitfinex and HC Wainwright, driven by halving cycles that peak 12 to 18 months after April 2024.

This decline is a “healthy reset” after the institutional rush of 2025, bulls say. Long term holders, keep stacking. The bull market is not over, it is taking a break. The recovery could begin in December, paving the way for BTC above $130,000 in 2026.

Key takeaways

-

More than $1.1 billion in sell-offs, weak macroeconomic data and reduced expectations for Fed rate cuts triggered a sharp market sell-off.

-

Bitcoin’s break below $100,000 and extreme fear metrics show a collapse in sentiment, although some on-chain metrics suggest potential accumulation.

The post Why is Crypto Broken? When will crypto recover? appeared first on 99Bitcoins.