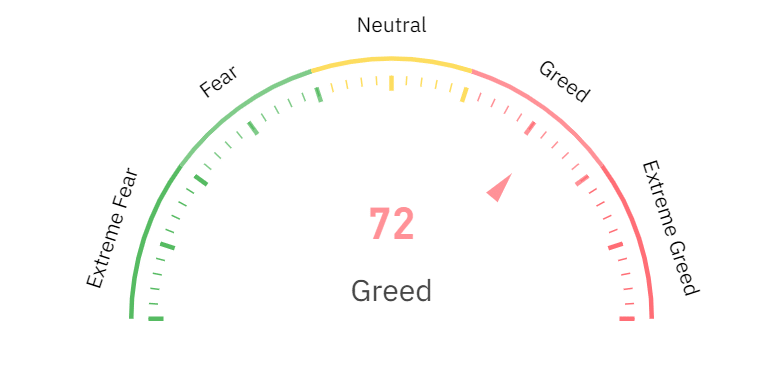

- Market sentiment is currently in the “greed” zone, pushing more traders to buy and pushing up cryptocurrency prices.

- Short liquidations have dominated recent trading sessions, signaling strong bullish momentum.

Over the past 24 hours, the crypto market has seen a significant drop in trading volume, falling by over 30%.

However, despite this decline, the overall market capitalization increased slightly. So why is crypto growing, despite trading volume dropping?

Positive Market Sentiment Drives Crypto Prices Soaring

Positive market sentiment is one of the main reasons for the upward trend in cryptocurrency prices. According to Coinglass data, market sentiment remained optimistic.

The Fear and Greed Index, a popular indicator of investor sentiment, is currently showing “greed.”

Source: Coinglass

This high level of greed often signals increased buying activity as more traders are motivated by FOMO (fear of missing out).

This sentiment may answer the question of why crypto is rising today, as FOMO leads to more buying, pushing prices higher.

When the Fear and Greed Index highlights greed, it usually indicates that traders are rushing to enter the market. This creates buying pressure, pushing up prices of major assets.

However, it is important to note that market corrections often follow this type of rally, as FOMO can quickly turn into FUD (fear, uncertainty, and doubt), causing volatility in the market.

Bitcoin Price Surge Supports Market Growth

Another key factor explaining the rise in cryptocurrencies is the positive price development of Bitcoin, the largest cryptocurrency in terms of market capitalization.

Over the past few days, Bitcoin broke through its resistance level of $63,000 and continued to climb, maintaining a price above $68,000.

In the last trading session, Bitcoin even reached $69,000, contributing to the overall rise in market capitalization.

Bitcoin’s price stability above key resistance levels provides a strong foundation for the entire crypto market, as its performance often sets the tone for other assets.

As Bitcoin maintains its upward trend, other cryptocurrencies have followed suit, further pushing the market higher.

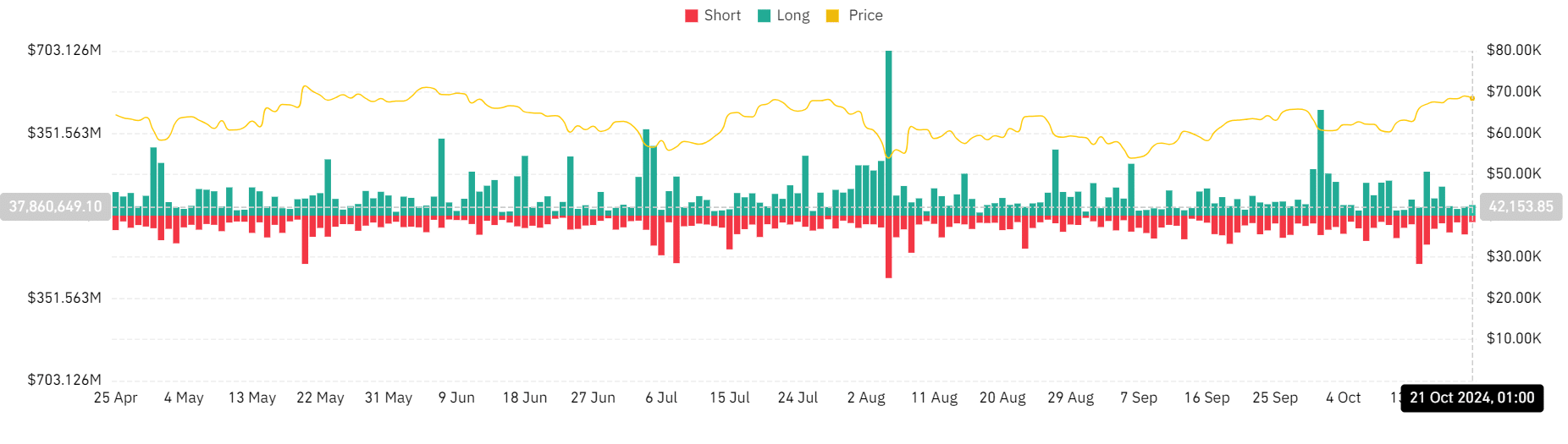

Short Liquidations Drive Prices Up

An analysis of the cryptocurrency liquidation chart shows another reason why cryptocurrency is rising. There has been a notable increase in the liquidation of short positions over the past few days.

As of October 8, short liquidations totaled approximately $71 million, while long liquidations totaled $41 million.

In the next trading session, the short and long liquidations were almost equal, at around $28 million.

However, in the most recent session, short liquidations reached almost $80 million, compared to just $38 million for long liquidations.

Source: Coinglass

This trend of increasing short liquidations indicates that traders betting on falling prices are being forced to close their positions as prices continue to rise.

As short positions close, buying pressure increases, leading to further price increases, making the market more bullish.

Why is crypto rising?

The crypto market’s upward movement can be attributed to several factors, including positive market sentiment reflected in the Fear and Greed Index, strong Bitcoin price performance, and liquidation of short positions.

Together, these elements drive the market higher, even as trading volume declines.

Although the current trend is positive, traders should be aware that rapid price increases can quickly lead to market corrections.