The crypto market is slightly higher today, extending its gains after the recent downturn. The total cryptocurrency market capitalization increased by around 0.7%, reaching around $3.04 trillion, while the 24-hour trading volume stood at around $69.9 billion, according to market data.

TLDR:

- The crypto market rose today, with the total market cap up about 0.7% to $3.04 billion;

- AI-related tokens remain under heavy pressure, down around 75% year-over-year;

- Optimism for Bitcoin was briefly boosted by Elon Musk’s predictions of strong U.S. economic growth in 2026;

- BTC continues to consolidate below key resistance, with support around $86,000 to $87,000;

- ETH remains limited below $3,000, with moderate volume and key support near $2,800-$2,700;

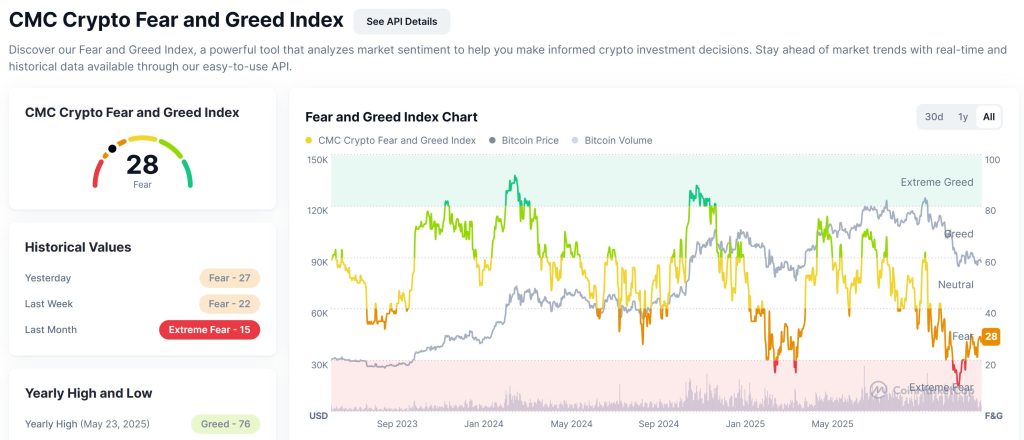

- Market sentiment remains cautious, with the Crypto Fear and Greed Index at 28 (fear);

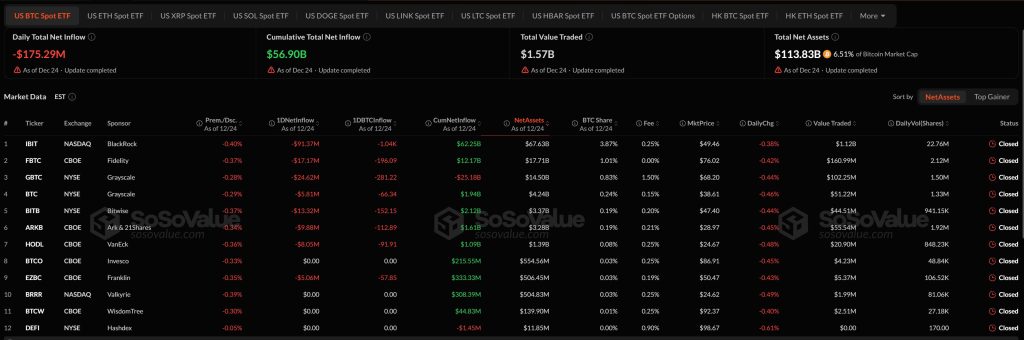

- US spot Bitcoin ETFs saw net outflows of $175.3 million;

- US Spot Ether ETFs also lost $52.7 million;

- Major Russian exchanges have confirmed their readiness to regulate cryptocurrency trading.

Crypto Winners and Losers

At the time of writing, most major cryptocurrencies are trading in the green over the past 24 hours.

Bitcoin (BTC) is up 0.7%, changing hands at $87,414, holding near recent highs.

Ethereum (ETH) is flat on the day, trading at $2,924, but has gained 3.2% over the past week.

BNB (BNB) climbed 0.5% to $840, while XRP (XRP) is up 0.6%, trading at $1.87.

Solana (SOL) added 0.3%, now priced at $121.76, although it remains down over the past seven days.

Dogecoin (DOGE) rose 0.2% to $0.127, continuing its gradual recovery.

Looking at the strongest actors, Strong (BIFI) dominated the market, surging 197% to $312.55, making it both the biggest gainer and one of the fastest growing assets. ZER0BASE followed by a 69.9% jump to $0.1533, while Minidoge gained 73.3%, trading at $0.878.

In contrast, losses among large-cap assets were limited. Cardano (ADA) slipped 0.7% to $0.357, while WhiteBIT Coin (WBT) fell 0.3% to $56.51. TRON (TRX) was down 1.1%, trading at $0.2796, marking the weakest performance among the top 10.

Meanwhile, after a strong rally in 2023 and much of 2024, artificial intelligence-focused crypto tokens have swung sharply in the opposite direction.

A new report shows the sector has entered a deep correction, wiping out tens of billions of dollars in value as investor appetite cooled and market conditions tightened.

Data compiled by CryptoPresales.com shows that AI tokens lost about 75% of their combined value year-over-year, wiping about $53 billion from the market.

Elon Musk’s Call for US Growth Sparks Optimism for Bitcoin

Bitcoin traders are once again focusing on macro signals after Elon Musk said the US economy could enter a phase of rapid growth starting in late 2026, with “double-digit” GDP expansion possible in the near term.

Although Musk’s comments were not aimed at crypto, they were quickly picked up by investors looking for signs of improving liquidity and greater risk appetite following Bitcoin’s recent pullback.

This outlook comes as rate cuts from the US Federal Reserve have put macroeconomic conditions back at the center of the Bitcoin price discourse. Proponents such as Anthony Pompliano argue that faster economic growth could provide a favorable backdrop for scarce assets, while others say Musk’s predictions, while controversial, often point to real technological changes driven by artificial intelligence.

According to Linh Tran, market analyst at XS.com, Bitcoin’s recent price action highlights the market’s sensitivity to monetary policy expectations rather than key economic data.

Last week, K33 also said that Bitcoin’s prolonged selling pressure from long-term holders may be approaching its limits after years of steady distribution.

Levels and events to watch next

At the time of writing on Wednesday, Bitcoin is trading around $87,366, down slightly following another choppy session. Over the past 24 hours, BTC has struggled to gain momentum, repeatedly failing to hold above nearby resistance.

More broadly, Bitcoin continues to trade well below its recent highs. The last few weeks show a clear downward trend from the October high near $125,000, followed by a sharp correction in November and a slower consolidation phase in December. Buyers are now defending the $86,000-$87,000 zone, which has served as short-term support.

If BTC manages to recover and hold above $88,000, this could open the door for a recovery towards $90,000 and potentially $92,000. On the downside, a clear break below $86,000 could expose the price to further weakness towards $84,000, with deeper support approaching $82,000.

Ethereum is currently changing hands at around $2,921, down slightly on the day. Similar to Bitcoin, ETH has seen uneven price action, with sellers stepping in with each upward attempt.

Over the past week, ETH has been stuck in a relatively tight range, struggling to reclaim the psychologically important $3,000 level. Volume remains subdued, suggesting traders are waiting for a clearer directional signal before committing to larger positions.

A sustained move above $2,980 to $3,000 could shift near-term momentum in favor of the bulls, with upside targets around $3,150. If selling pressure resumes, ETH could revisit support near $2,800, followed by a larger pullback towards $2,700.

Meanwhile, crypto market sentiment remains cautious, with the Crypto Fear and Greed Index sitting at 28, firmly in the fear zone. The figure is virtually unchanged from 27 yesterday, indicating that investor sentiment has stabilized at low levels rather than improving significantly.

Although the index has recovered from the extreme fear levels seen last month (15), it still reflects hesitation in the market.

US spot Bitcoin ETFs recorded another day of net outflows, with $175.29 million flowing out of funds on December 24, according to the latest data.

The releases were generalized on the main products. BlackRock’s IBIT led the decline with $91.37 million in net outflows, followed by Grayscale’s GBTC at $24.62 million and Fidelity’s FBTC, which saw $17.17 million leave the fund. Bitwise (BITB) and ARK 21Shares (ARKB) also saw smaller outflows.

US Spot Ether ETFs also saw a net outflow of $52.7 million on December 24, ending a brief streak of inflows, according to the latest data.

Outflows were led by Grayscale’s ETHE, which saw $33.78 million exit the fund, followed by BlackRock’s ETHA with $22.25 million in net outflows. In contrast, Grayscale’s ETH trust (ETH) saw a modest inflow of $3.33 million, standing out as the only product to attract capital during the session.

Overall trading activity on US ETH ETFs reached $689.44 million, while total net assets stood at $17.86 billion, equivalent to approximately 5% of Ethereum’s market capitalization.

At the same time, the Moscow Stock Exchange and the St. Petersburg Stock Exchange confirmed their willingness to launch regulated cryptocurrency trading once the Russian legislative framework comes into force by mid-2026.

According to local reports, the exchanges’ announcements came following the Bank of Russia’s December 23 publication of a regulatory concept setting July 1, 2026 as the deadline for developing comprehensive legislation on cryptocurrencies.

The article Why is crypto rising today? – December 25, 2025 appeared first on Cryptonews.

AI-driven crypto tokens lost about 75% of their value year-over-year, wiping about $53 billion from the market.

AI-driven crypto tokens lost about 75% of their value year-over-year, wiping about $53 billion from the market. Major Russian exchanges confirm they are ready to regulate crypto trading by mid-2026, as the legislative framework nears the implementation deadline.

Major Russian exchanges confirm they are ready to regulate crypto trading by mid-2026, as the legislative framework nears the implementation deadline.