The crypto market is rising today, extending its gains for a second straight session. The total cryptocurrency market capitalization increased by around 1%, now standing at around $3.07 trillion, while the 24-hour trading volume stood at $91.4 billion, according to market data.

Most major assets are trading in positive territory, reflecting continued risk appetite despite relatively low volumes.

TLDR:

- The crypto market extended its gains for a second day, with the total market cap up around 1%;

- About 9 of the top 10 coins traded higher;

- Analysts warn that Bitcoin still struggles below $90,000, with holiday trading volumes reinforcing a volatile, high-resistance market;

- 10x Research says compressed volatility and option positioning point to a potential multi-week uptrend if the breakout holds;

- BTC key levels: upside above $89,000 – $90,500, downside risk below $86,000, with deeper support near $82,000;

- ETH needs a firm break above $2,980-$3,000 to unlock a rise towards $3,150-$3,300;

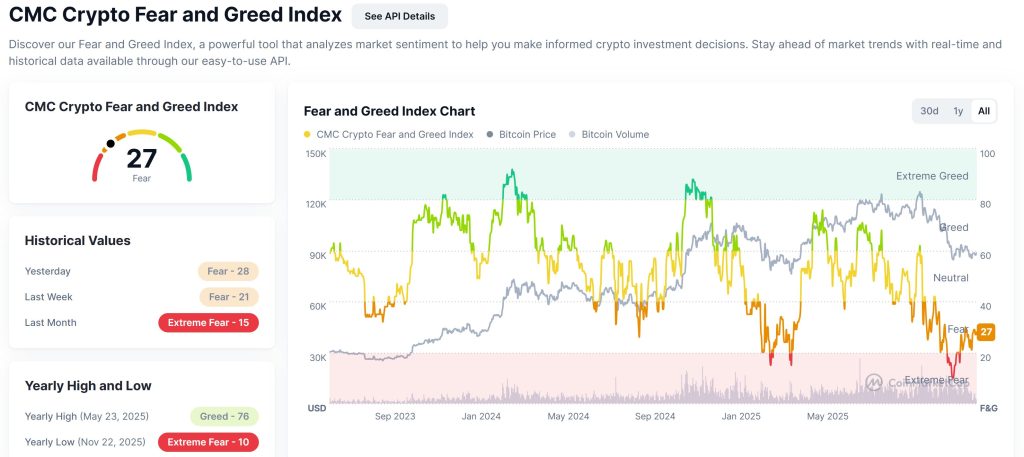

- Market sentiment remains cautious, with the Crypto Fear & Greed Index at 27 (fear);

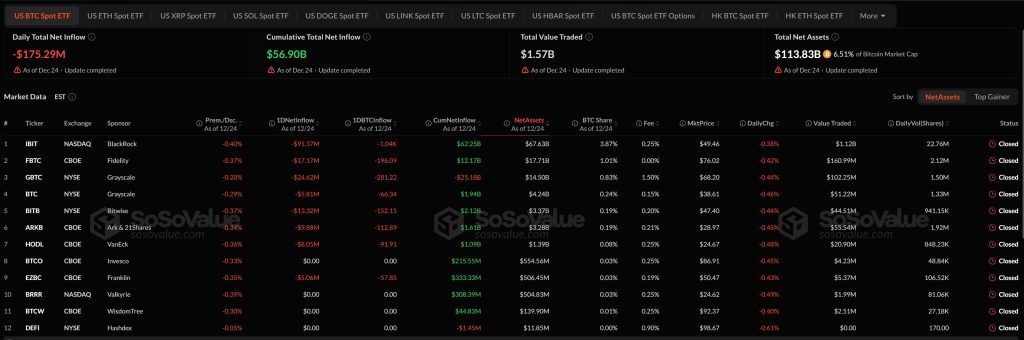

- No ETF data for December 25 due to Christmas market closure;

- Furthermore, Russian Sberbank is exploring loans backed by cryptocurrencies.

Crypto Winners and Losers

At the time of writing, 9 of the top 10 cryptocurrencies by market cap have seen gains in the past 24 hours.

Bitcoin (BTC) is up 1.4%, trading at $88,681, as it continues to hold above the $88,000 level after the recent consolidation.

Ethereum (ETH) rose 1.3% to $2,964, extending modest gains as it remains just below the psychological $3,000 level.

BNB (BNB) is slightly higher, up 0.1% to $840, while XRP (XRP) added 0.1%, trading at $1.87. Solana (SOL) rose 0.7% to $122.80, regaining some ground although it remained lower in the weekly period.

Among the first 10, Dogecoin (DOGE) was the worst performer, down 1.2% on the day and trading at $0.1257, extending its short-term decline.

Beyond large caps, several smaller tokens saw significant gains. Islamic coin (ISLM) led the market with an increase of 86.5%, followed by WOLFwhich jumped 65.6%. zkPass was also a standout, up 46.3% and ranking as both a top gainer and trending asset.

Meanwhile, Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remains stuck below a key level as markets drift into a seasonal lull.

“Bitcoin has struggled to break above the $90,000 level during a busy macroeconomic data release schedule, and price action appears to be forming a falling wedge with downside risk,” he said.

“As we head into the holiday season, trading volumes follow their usual seasonal lull, which generally reinforces the choppy, high-resistance environment currently observed.”

Bitcoin Near Inflection Point as Options, Volatility Signals Align – 10x Research

Bitcoin has spent weeks moving sideways, masking deeper changes in market positioning that could trigger a decisive move. According to 10x Research, a rare alignment of option positioning, compressed volatility and technical exhaustion is forming, a combination that has historically preceded sustained trends rather than short-lived price spikes.

The firm notes that capital remained largely on the sidelines after the October 10 crash, with ETF outflows accelerating after the hawkish October 29 FOMC meeting. While the technical sell-off seemed all but over in late November, Bitcoin failed to rebound as investors turned to year-end outperformers, leaving BTC without significant inflows.

As year-end positioning is reset and new risk budgets come into play, 10x Research says several overlooked metrics are starting to align. If the current breakout holds, the pattern portends a potential multi-week uptrend, making upcoming signals on key charts crucial to confirm if a broader trend is underway.

Levels and events to watch next

At the time of writing, Bitcoin is trading around $88,681, up about 1.7% in the last 24 hours. Price action improved from recent sessions, with BTC pushing higher after defending the mid-$86,000 zone earlier this week.

More broadly, Bitcoin remains well below its October peak, near $125,000, after a sharp correction in November and a consolidation phase until December. Over the past week, BTC has been trading in a relatively tight range, with short-term support between $86,000 and $87,000.

A sustained move above $89,000 would likely open the door to a test of $90,500, followed by near resistance at $92,000-93,000. On the other hand, a loss of $86,000 could expose BTC to further weakness towards $84,000, with deeper support closer to $82,000.

Ethereum is currently changing hands at around $2,967, showing a larger daily gain of around 2.2%. ETH’s rebound was more decisive than Bitcoin’s last session, with the price regaining ground after several failed attempts earlier in December.

Despite the rebound, Ethereum remains capped below the key psychological level of $3,000. Over the past week, ETH has traded unevenly, reflecting low conviction while volume remains subdued.

A firm break and hold above $2,980 to $3,000 would likely shift near-term momentum in favor of the bulls, with upside targets around $3,150 and potentially $3,300 if further buying occurs. If sellers regain control, ETH could revisit support near $2,850, with a larger pullback exposing the $2,700 to $2,750 range.

Meanwhile, according to the latest data from CoinMarketCap, crypto market sentiment remains firmly in the fear zone. The Crypto Fear and Greed Index stands at 27, broadly unchanged from the previous day, signaling continued caution from investors.

Although sentiment has improved slightly from last month’s extreme scare of 15, it remains well below neutral levels.

With US stock markets closed for Christmas, there were no updates to ETF flows on December 25.

On December 24, US spot Bitcoin ETFs extended their losing streak, recording $175.29 million in net outflows. Selling pressure was widespread, led by BlackRock’s IBIT, which saw an outflow of $91.37 million.

Grayscale’s GBTC followed with $24.62 million in outflows, while Fidelity’s FBTC lost $17.17 million. Bitwise (BITB) and ARK 21Shares (ARKB) also saw smaller buybacks.

US Spot Ether ETFs also turned negative, posting $52.7 million in net outflows and ending a short streak of inflows. Grayscale’s ETHE led the decline with $33.78 million in outflows, followed by BlackRock’s ETHA with $22.25 million. Grayscale’s ETH trust (ETH) was the only product to see inflows, adding $3.33 million on the day.

The total trading volume on US ETH ETFs reached $689.44 million, while net assets stood at $17.86 billion, representing approximately 5% of Ethereum’s total market capitalization.

Meanwhile, Sberbank is exploring lending backed by cryptocurrencies as Russia’s financial sector accelerates its push into digital assets ahead of the country’s regulatory deadline of mid-2026.

Vice President Anatoly Popov told TASS that the bank was ready to collaborate with regulators to develop infrastructure for such services, potentially expanding Russia’s crypto ecosystem beyond trading toward collateralized financing.

The article Why is crypto rising today? – December 26, 2025 appeared first on Cryptonews.

Bitcoin hovered near $87,000 in holiday trading as Asian stocks edged higher, with analysts saying low liquidity was keeping prices stable despite a consistent risk-off mood.

Bitcoin hovered near $87,000 in holiday trading as Asian stocks edged higher, with analysts saying low liquidity was keeping prices stable despite a consistent risk-off mood. Russian President Putin said the United States is interested in mining cryptocurrencies at the Zaporizhzhia nuclear power plant.

Russian President Putin said the United States is interested in mining cryptocurrencies at the Zaporizhzhia nuclear power plant.