The global cryptography market is again in the red, down 2.2% in the last 24 hours to 3.91 billions of dollars, according to the latest market data. The total volume of crypto exchanges increased slightly to $ 178.5 billion, but prices are largely negative in the main active ingredients.

TLDR:

- The cryptography market sees red, with 9 of the 10 best parts in the past 24 hours;

- BTC at $ 111,401 and ETH at $ 4,001;

- Trump’s United Nations commitment to block the occupation of the West West Bank facilitates the short -term geopolitical risks;

- The index of fear and greed increases slightly to 41 but remains near the fear area;

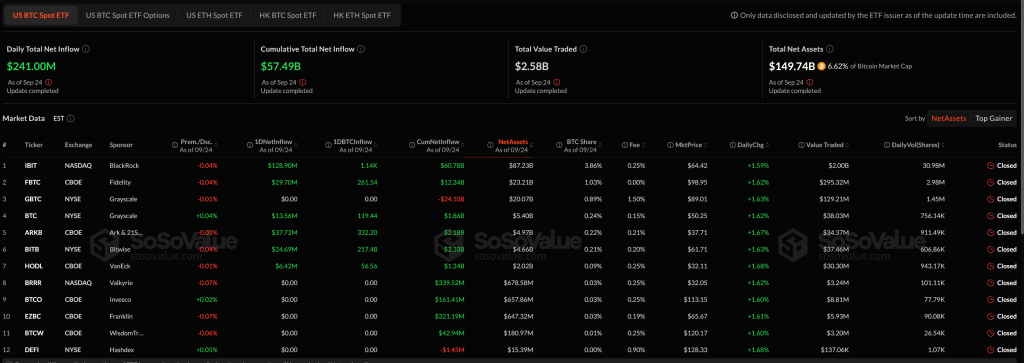

- The FNB BTC Spot see $ 241 million in entries led by IBIT and ARKB, pushing cumulative entries to $ 57.49 billion;

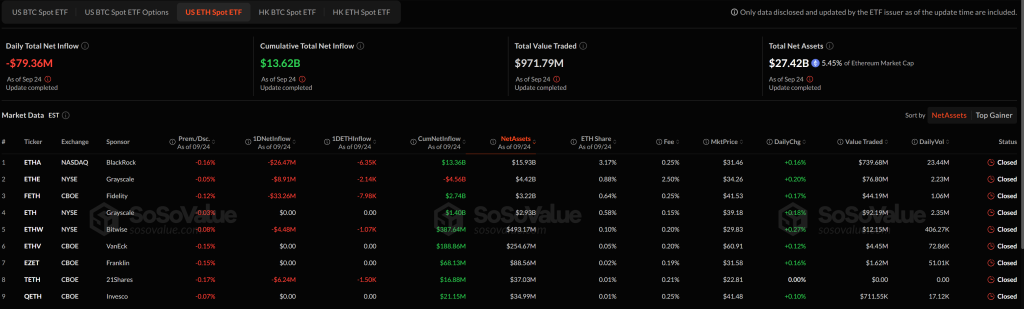

- Eth Spot ETF records $ 79.36 million out of outings, with Feth and Etha displaying the biggest buyouts;

- Nine best European banks are united to launch a stablecoin in euros by 2026 under the rules of mica;

- Analysts say that the market awaits stronger macro signals before new positioning.

Winner of crypto and losers

At the time of writing this document, nine of the 10 best cryptocurrencies by market capitalization display daily losses.

Bitcoin (BTC) Negotiate $ 111,488, down 1.4% on the day and 3.6% during last week.

Ethereum (ETH) is down 4.2% in 24 to 4006.79 $, one of the more steep drops among the best parts.

Solana (soil) leads the losses, lowering 5.2% on the day and more than 8% per week, at a price of $ 201.23.

DOGECOIN (DOGE) also had a sharp drop, lowering from 4.9% to $ 0.2312.

BNB (BNB) is the only major part showing green, just 0.1% to $ 987.30, despite a drop of 7 days by almost 3%.

Among the trendy tokens, Aster is down 12.4%, while Loring Landy Games And Hyperliquidal also slipped.

Upwards, SUMMIT leads the best winners of the day with an overvoltage of 80.4%, followed by Punkstrategy (+ 32.5%) and Concord (+ 8.9%).

Despite the isolated gains among small caps, the wider market remains under pressure while the main active ingredients recover the earnings made earlier this month. Traders take care of signs of stabilization or deeper corrections, because macro and regulatory factors weigh on feeling.

Meanwhile, the drop in Ethereum below $ 4,000 sparked massive liquidation, with the 0xa523 portfolio losing their 9,152 ETH position worth $ 36.4 million. Wipeout brings its total losses to more than $ 45.3 million, leaving the account with less than $ 500,000 to do.

The commitment of the West Bank of Trump softens the risk of the Middle East, BTC Eyes Key Levels

Bitunix analysts claim that the feeling of the market has been briefly stabilized after former American president Donald Trump assured the Arab leaders of the United Nations General Assembly that he would block any Israeli annexation of the West Bank.

This decision is interpreted as a temporary geopolitical de -escalation, described as a “red light” in Israel, and arrives in the midst of calls renewed for the recognition of the Palestinian state.

While the softening of the tension of the Middle East has increased short-term appetite, Bitunix analysts warn that macro attention remains blocked on the political path of the American federal reserve and the upcoming labor data.

In Crypto, BTC is consolidated between $ 111,000 and $ 113,000, with a downward risk if the support band of $ 109,000 at $ 107,000 fails.

Uplining, the resistance zone of $ 118,000 to $ 122,000 contains short positions concentrated, which makes a break above its key to find a bullish momentum.

Levels and events to watch next

Bitcoin (BTC) is negotiated at $ 111,401 when writing the editorial’s time, down 1.71% in the last 24 hours. The assets lost momentum after failing to pass $ 115,000 and is now approaching a critical short -term support area.

If the BTC falls below $ 111,000, the decrease targets are at $ 109,000 and $ 107,000, which could trigger long liquidations.

Uplining, any rebound around $ 114,000 will face resistance, with an escape greater than $ 118,000 necessary to recover the bullish structure.

Meanwhile, Ethereum (ETH) is subjected to higher pressure, lowering from 3.67% to $ 4,001.57. ETH briefly held the psychological bar of $ 4,000 before slipping below for lunch.

If the drop continues, the following key supports are $ 3,950 and $ 3,800. Uplining, recovery targets include $ 4,150 and the resistance band from $ 4,300 to $ 4,400. A sustained closure above $ 4,400 would be required to resume the momentum upwards.

Meanwhile, the feeling of the market has improved slightly but remains cautious. The CMC crypto fear and greed index is now at 41, against 39 yesterday, although still well below last week reading 51. Although technically in the “neutral” range, the index has been hanging from the “fear” area for several days.

This modest rebound suggests that traders are still uncertain, weighing geopolitical changes and macroeconomic opposite winds. With BTC and ETH exchanging key support levels, the market seems to wait for lighter signals before engaging in new positions.

The FNB Bitcoin Spot US recorded a net influx of $ 241 million on September 24, continuing their rebound after the previous outings. The cumulative net influx has now increased to $ 57.49 billion, while total assets under management increased to $ 149.74 billion, which represents 6.62% of Bitcoin market capitalization.

The Ibit of Blackrock led with $ 128.90 million in net entries, followed by ArkB with $ 37.72 million and the FBTC with $ 29.70 million.

The Graycale BTC fund also experienced $ 13.56 million in fresh capital, while Bitb de Bitwise added $ 24.69 million. The GBTC remained flat with a zero influx. Ibit dominated commercial activity with $ 2 billion in volume, highlighting the continuous interests of investors.

The FNB of the American points Ethereum recorded a net output of $ 79.36 million on September 24, marking another day of feeling of investors. Despite retirement, cumulative entries in all ETH and ETH total $ 13.62 billion, while total assets under management amount to $ 27.42 billion, representing 5.45% of Ethereum’s market capitalization.

Feth de Fidelity led the outings with $ 33.26 million in redemptions, followed by the BlackRock Etha, which saw $ 26.47 million leaving the fund.

The Bitwise ETHW lost $ 4.48 million, while Teth of 21Shares recorded $ 6.24 million in outings. Only the Qeth of Graycale and Invesco ended the day unchanged, without new entries or exits reported.

Meanwhile, nine major European banks, including Ing, Unicredit, Danske Bank and Caixabank, have united their forces to launch a stable that was supported by the euro by the second half of 2026.

The initiative, based in the Netherlands and the search for licenses from the Dutch central bank, will operate under the EU Mica regulatory framework and aims to offer an alternative to the Stablecoin markets dominated by the United States.

The post why is the crypto broken down today? – September 25, 2025 appeared first on Cryptonews.

Nine European banks will launch a stablecoin to support the Euro regulated by Mica which will contribute to strategic autonomy in Europe in payments.

Nine European banks will launch a stablecoin to support the Euro regulated by Mica which will contribute to strategic autonomy in Europe in payments.