The global market capitalization of cryptocurrency fell 2.2% in the last 24 hours, now to 3.83 billions of dollars, according to the latest data. The volume of negotiation can reach $ 237.1 billion, but the main digital assets remain under pressure down as the feeling of investors is weakening.

TLDR:

- The cryptography market slides more deeply, with 9 of the 10 best parts;

- BTC at $ 109,027 and ETH at $ 3,894;

- The index of fear and greed falls to 32, the lowest since April;

- BTC faces a deeper correction as long -term holders achieve $ 3.4 million in profits;

- ETH fights nearly $ 3,900, the Bulls requiring an escape of $ 4,400 to regain control;

- US BTC SPOT ETFS See $ 258.46 million on outings;

- US ETH ETFS Publish $ 251.20 million on outings;

- Dry, Finra launches probe on suspect stock movements linked to cryptographic cash plans;

Winner of crypto and losers

At the time of writing this document, nine of the 10 best cryptocurrencies by market capitalization are in red.

Bitcoin (BTC) fell 2.1% over the day to $ 109,252, down 6.6% compared to last week.

Ethereum (ETH) fell 3.3% in the last 24 hours, trading at $ 3,895 and recording a weekly loss of 13.9%.

Solana (soil) leads to the losses of the day among the main active ingredients, lowering from 4.6% to $ 193.51, extending its drop from 7 days to 20.7%.

XRP (XRP) is down 3.3% to $ 2.74, while BNB (BNB) Slipped 4.8% to $ 941.32.

DOGECOIN (DOGE) Posed from 3.5% more to $ 0.2247, marking a weekly drop of 18.4%.

Among the trendy tokens, Plasma,, AsterAnd Avantis Attract attention, but not for the right reasons. Aster Slipped 5.4% to $ 1.86, while Avantis took a clearer dive, diving 22.6% at $ 1.54, making it one of the biggest daily losers.

On the other hand, a few less known tokens have become artists off the day. Sqd leads with a massive gain of 94.8%, followed closely by Concordwhich increased by 66.6%. Xpl wrapped is also increasing, displaying an increase of 65.2%.

Meanwhile, the feeling of bitcoin has decreased sharply, the Crypto Fear & Greed index falling to 28, the lowest since April, while the BTC has dropped below $ 109,000 and triggered fresh liquidations.

The index dropped 16 points overnight, reflecting growing fear on the market despite the prices that are still well above the previous downs, highlighting a widening gap between the feeling and the action of prices.

Bitcoin faces the potential correction as the signal of the metrics of onchain exhaustion

Bitcoin shows signs of a deeper correction, long -term holders achieving benefits at the levels generally observed near the market cycle.

According to Glassnode, 3.4 million BTC in the gains made and the slowdown in ETF entries suggest the exhaustion of investors after the recent drop in the Fed rate. BTC recently dropped to a four -week $ 108,700, falling below key support levels.

Markus Thielen of 10x Research warned that many investors positioned for a rally of the fourth quarter could be caught off guard, with a current price action that oscillates near the previous stop zones. Glassnode also pointed out that the benefit / loss ratio has reached extreme peaks three times this cycle – each previously marking a peak of the cycle – the printing of a cooling phase is likely.

An additional constraint is observed in the SOPR and NUPL indicators. Some short -term holders are now sold at a loss, and the NUPL for new investors is close to zero, which can lead to a new capitulation. Analysts warn that renewed drop pressure could dominate unless the market momentum is coming back quickly.

Levels and events to watch next

Bitcoin is negotiated at $ 109,027 when writing the editorial’s time, largely flat the day after a sharp drop in recent summits. The asset tests a key support area after losing more than $ 6,000 last week, which argues the concerns of the additional decline if $ 108,700 give in.

If BTC breaks below this level, the next major support is at $ 107,000, followed by $ 105,000. Uplining, the Bulls will seek to recover the band from $ 111,000 to $ 113,000 to avoid other cascade liquidations. A decision supported above $ 115,000 is necessary to submit the feeling in favor of buyers.

Meanwhile, Ethereum is negotiated at $ 3,894, up 0.47% in a modest rebound after a high sale earlier in the week. The ETH remains vulnerable, hovering just below the psychological level of $ 4,000, after going from almost $ 4,750 earlier this month.

If the ETH does not hold above $ 3,850, the support is at $ 3,750 and $ 3,600. A short -term recovery could face resistance at $ 4,000, with other obstacles at $ 4,200 and $ 4,400. Bulls need a break greater than $ 4,400 to regain control and challenge the summits of September.

The feeling of the market took a lively turn towards caution. The CMC crypto fear and greed index is now at 32, slipping into the “fear” category after hovering in “neutral” territory for weeks. The index went from 41 yesterday and 52 last week, reflecting a feeling of growing discomfort among investors.

This drop in feeling reflects the wider market retracement, with the key support areas of BTC and ETH. With merchants frightened by macro uncertainty and recent price reductions, the change suggests that participants withdraw on the key line, awaiting stronger signals before placing aggressive bets.

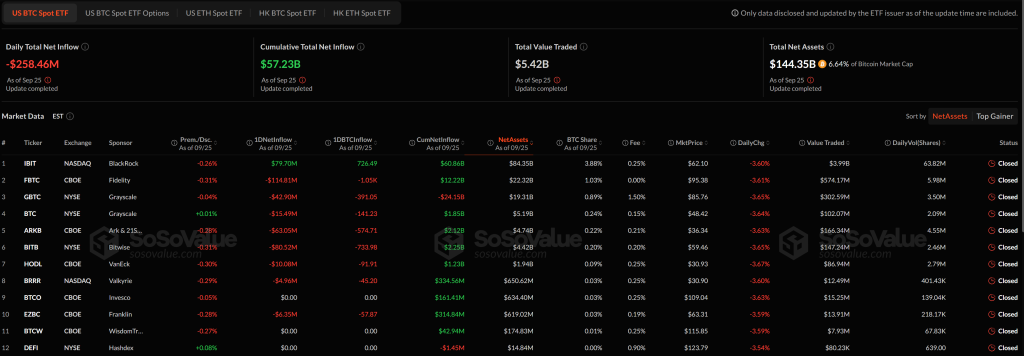

The FNB Bitcoin Spot US displayed a clear net output of $ 258.46 million on September 25, interrupting their previous recovery sequence. Despite this setback, the cumulative net influx remains substantial for $ 57.23 billion, with total assets under management at $ 144.35 billion, representing 6.64% of Bitcoin market capitalization.

The FBTC of Fidelity led withdrawals with a flow of $ 114.81 million, followed by Bitb from Bitwise with 80.52 million dollars and Arkb with $ 63.05 million.

GRAYCALE GBTC also saw $ 42.90 million withdrawn from the fund. Only Ibit from Blackrock recorded a notable influx of $ 79.70 million. Ibit also carried out a commercial activity, with almost $ 4 billion in volume, indicating sustained attention to investors despite wider outings.

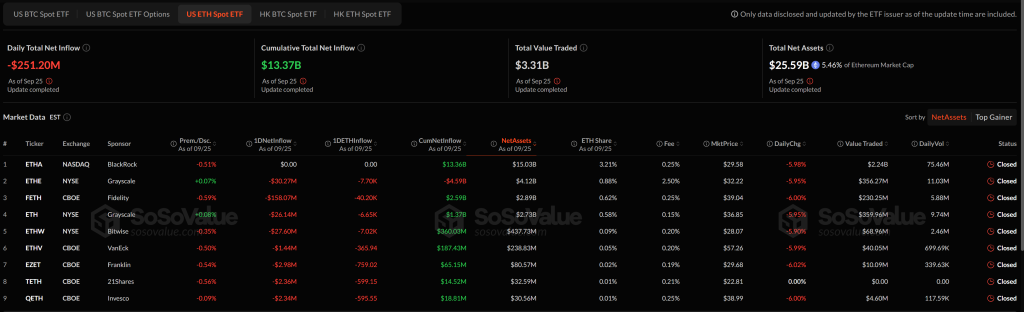

The FNB of the US Ethereum American points recorded an steep net output of $ 251.20 million on September 25, reflecting increased sales pressure and taking off the confidence of investors. Despite this drop, cumulative net entries remain $ 13.37 billion, while total assets under management are now $ 25.59 billion, around 5.46% of Ethereum market capitalization.

Feth de Fidelity saw the largest withdrawal of a day at $ 158.07 million, followed by Etha de Blackrock with an exit of $ 30.27 million.

The ETHE and ETH Funds in Graycale lost $ 26.14 million and $ 26.14 million, respectively. The Bitwise ETHW also recorded $ 27.60 million in outings. No ETF has recorded influx for the day, highlighting the gain in profit and general prudence among the institutional investors of the ETH.

Meanwhile, American regulators are investigating the unusual movements of stock prices before public announcements of more than 200 companies that plan cryptographic cash strategies. The dry and finra investigate the potential violations of the rules for negotiating initiates, in particular around the selective sharing of non -public information.

The post why is the crypto broken down today? – September 26, 2025 appeared first on Cryptonews.

American regulators run after actions that have increased in front of Crypto Treasury News, while non -crypto companies rush to take care of digital assets.

American regulators run after actions that have increased in front of Crypto Treasury News, while non -crypto companies rush to take care of digital assets.