- Bitcoin spends above $ 111,000 on Thursday, entering an unexplored territory and triggering large market optimism.

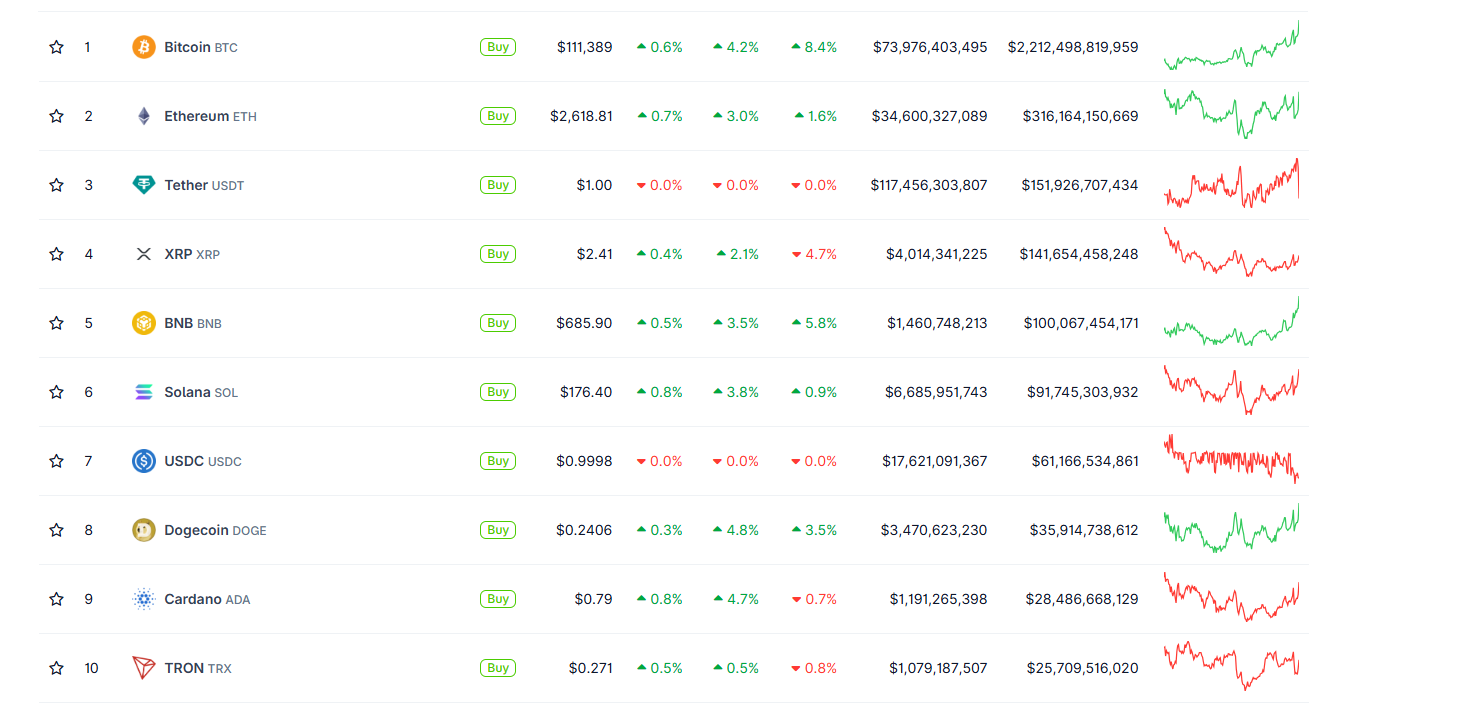

- The cryptography market is negotiated Thursday in green, with major altcoins like ETH, ADA and SOL after BTC’s advance.

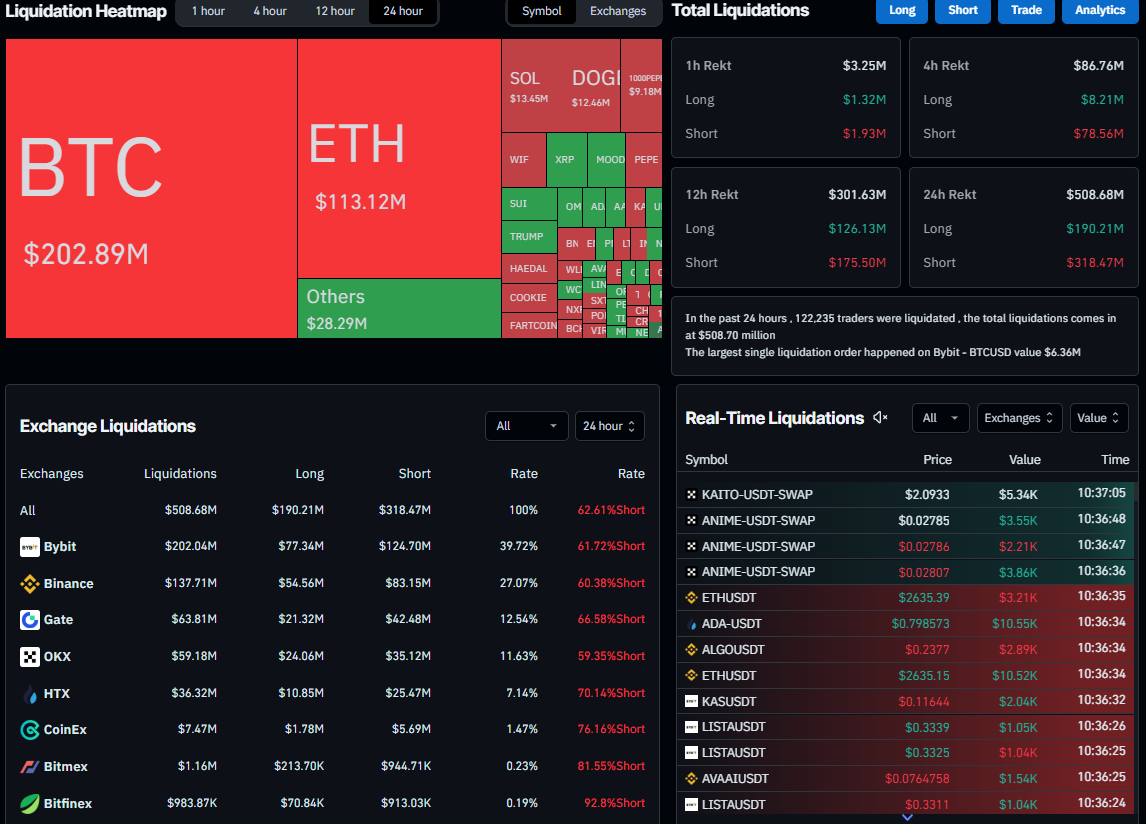

- Coinglass data show that more than $ 500 million in leverages have been liquidated in cryptographic markets in the last 24 hours.

Bitcoin (BTC) hovers over $ 111,000 Thursday, entering a uncharted territory and fueling a large rally through the cryptocurrency market. With BTC now in Discovery Price mode, the main altcoins like Ethereum (ETH), Cardano (ADA) and Solana (soil) followed suit, pushing the global market into green. According to Correglass data, the net movement has sparked more than $ 500 million in leverages in the cryptographic markets in the last 24 hours, highlighting the intensity of the break.

Why will the cryptography market join today?

The cryptography market is negotiated Thursday in the green, with the largest cryptocurrency by market capitalization exceeding $ 111,000 after the escape of its summit of all time on Wednesday.

The main reason for the market rally is that Bitcoin enters the unexplored territory and triggering large market optimism. Bitcoin’s technical perspectives on the daily graph suggest a continuation of rally, targeting its key psychological resistance to $ 120,000, supported by recent developments on the bond market, discussed in the previous one report.

BTC / USDT daily graphics

The main altcoins like ETH, ADA and Sol followed the example of BTC and exchanged in green, as shown in the Coingecko graphic below.

Co -CorquiLass liquidation Heatmap The data show that the cryptography market rally had triggered a wave of liquidation, with more than $ 500 million in lever -ended positions in the last 24 hours. In particular, 62.61% were short positions, emphasizing the excessive positioning of the market, which can still feed the rally through short compressions. The largest liquidation occurred on the appeal, where a BTCUSD position worth $ 6.36 million was liquidated.

Chart of the liquidation thermal card. Source: Coringlass

What is the next step for Crypto?

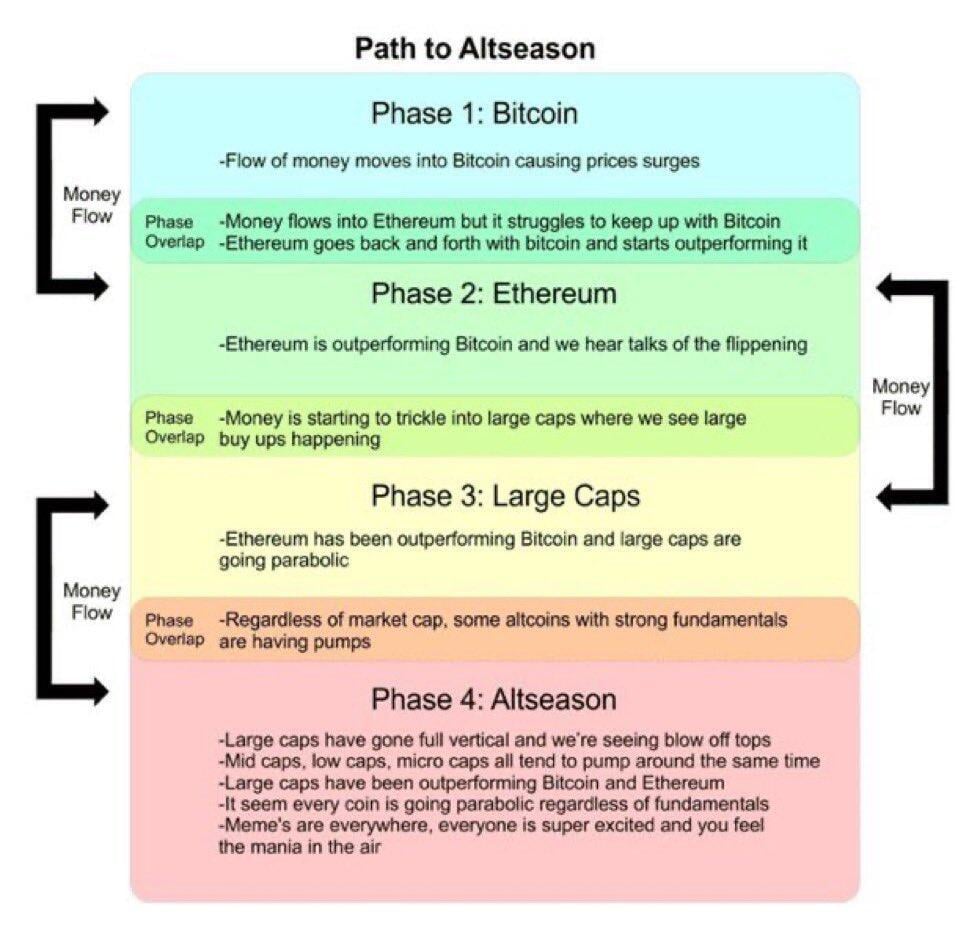

As explained in the graph below, traders should monitor the rotation of capital. Given the level of all Bitcoin times, the market is probably in phase 1 (the money flow in BTC causing an increase in prices) or the transition to phase 2. Ethereum could start to surpass bitcoin soon, and large capitalization altcoins could start to see the entries.

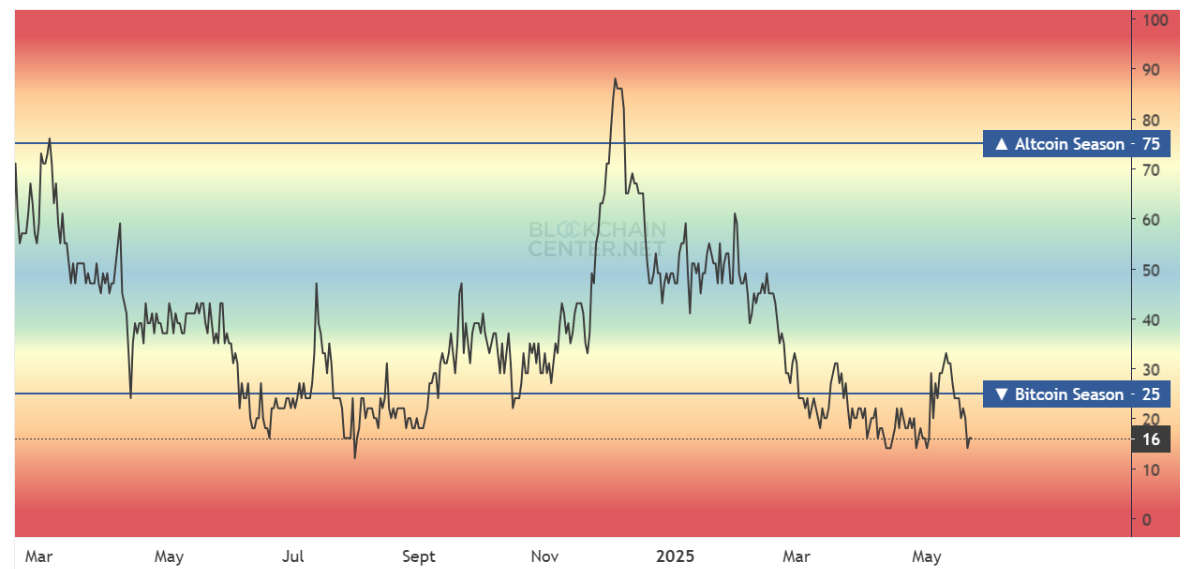

The Alts-Season (phase 4) generally intervenes after these anterior phases, because the Blockchaincenter.net Altcoin.net season index is currently 16. The metric indicates that altcoins have more room for growth, and investors always prefer to invest their money in phase 1.

Altcoin season index. Source: Blockchaincenter.net