Cryptography market in disorders: Bitcoin and Altcoins faced with significant drops. With new tense macroeconomics and low technical signals, investors are skeptical. Is a major reversal imminent or simply a market correction? Let’s analyze the situation.

The opposite winds have struck the cryptography market

Several important events have contributed to Shake the cryptography market In recent days. First, the announcement of Trump Media $ 2.5 billion plan Building a Bitcoin treasure has sparked mixed reactions among investors. While some see it as a sign of Increasing adoption of cryptocurrencyOthers remain cautious due to the uncertainty surrounding the real intentions of the American president.

Simultaneously, more negative events have also weighed on general feeling. The closure in March of the Russian exchange platform Guarantx, which continues to whiten the funds via the tornado money despite American sanctions, illustrates the persistent challenges in terms of Regulation and security in the cryptographic ecosystem. Likewise, the recent deliberations of 33 tokens per gate.io and 4 tokens per cornerbase led to Net price reductions. This reflects the turbulence that certain players in the industry face.

Consolidation or start of a lower cycle?

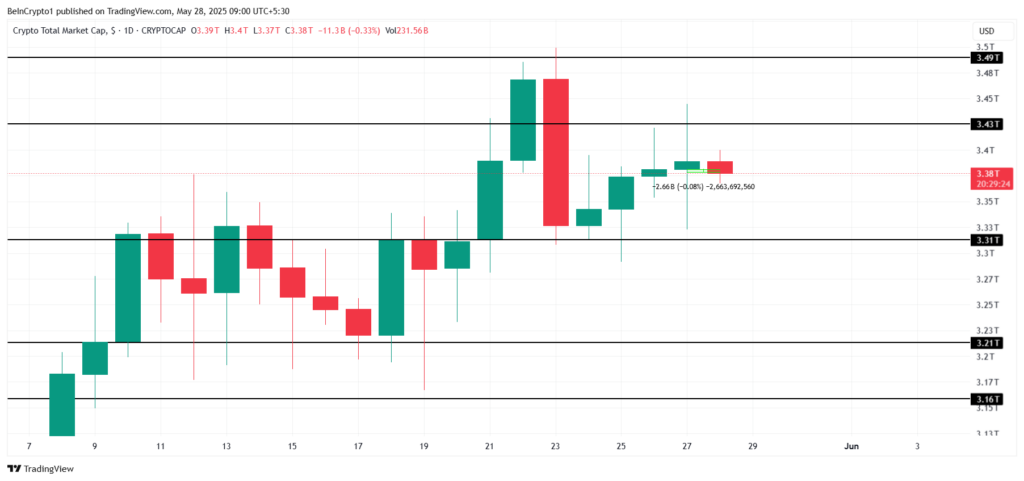

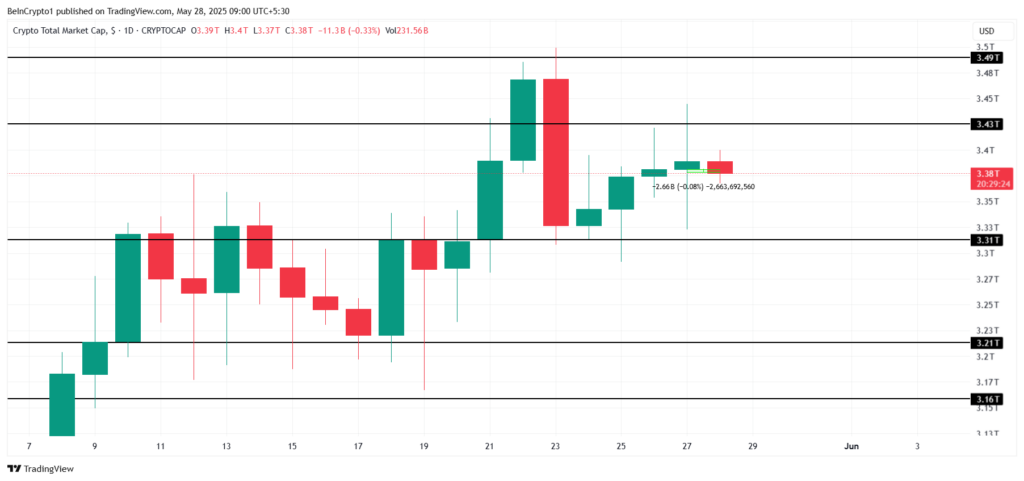

Faced with this news, the global cryptography market has known significant volatility These last hours. After reaching a summit of 3.43 dollarsTotal market capitalization retired to 3.38 dollars, remaining stuck below this level of key resistance. This consolidation phase reflects an hesitation in investors, pending lighter signals on the future market orientation.

Likewise, Bitcoin, despite the brief surpassing $ 110,000has trouble holding above, reflecting a Lack of conviction among buyers. In addition, Altcoin Monero fell 13% in 24 hours, ending its recent upward trend. These divergent movements illustrate the current fragility of the feeling of investors.

Is it time to buy on Bitget in the middle of the drop?

Although the slowdown in the crypto market raises legitimate concerns, it could also pave the way to New opportunities for experienced investors. Indeed, identified the levels of support, as 3.31 billions of dollars For total capitalization or $ 106,265 for Bitcoin, could represent interesting purchasing areas in the event of a rebound.

Likewise, a bullish breakthrough of the key resistance to 3.43 dollars could trigger a new rally. It would help Recover recent losses. Finally, a recovery of Monero of sound $ 348 support could report a favorable trend reversal for this altcoin.

Although the current drop in the cryptography market raises questions, it does not erase long -term perspectives in the sector. As always, the ability of investors to seize the opportunities offered by volatility will be crucial to navigate successfully through these turbulence.

More on this subject ::

Non-liability clause

This article is for information purposes only and should not be considered as investment advice. Some partners presented on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.