- The cryptocurrency market experienced growth of 2% on Wednesday, which resulted in short $ 258 million in the last 24 hours.

- Bitcoin joined over $ 109,000 after the American trade agreement with Vietnam and an increase in the money supply of the M2.

- Ethereum, XRP and Solana gathered 7%, 3%and 4%respectively, as the Altcoin market recovered.

Bitcoin (BTC) rebounded at $ 109,000 on Wednesday, while the US agreement with Vietnam and an increase in the world money supply M2 sparked a sharp increase in its open interest (OI), which increased to 689.78K BTC worth around $ 75 billion. The wider market of cryptocurrencies has rallied alongside BTC, with the best altcoins Ethereum (ETH), XRP and Solana (soil) increasing 7%, 3%and 4%respectively.

Bitcoin, Crypto Market Rally on Vietnam Trade Deal and M2 Mas Masy Surge

The cryptocurrency market experienced a rebound on Wednesday, increasing 2% to recover its market capitalization by 3.5 billions of dollars.

The rally follows the announcement of President Donald Trump on Wednesday, saying that the United States had obtained a trade agreement with Vietnam which would facilitate certain prices previously imposed on Vietnamese exports.

As part of the agreement, a tariff of 20% will apply to Vietnamese imports to the United States, while the “transfosapping” in the United States faces a 40% more serious levy, according to Trump. He also noted that Vietnam will open its market in the United States with no rate on all American imports in the country.

“In order, they” will open their market in the United States “, which means that we can sell our product to Vietnam at zero prices” “” wrote President Trump in a social position on Wednesday.

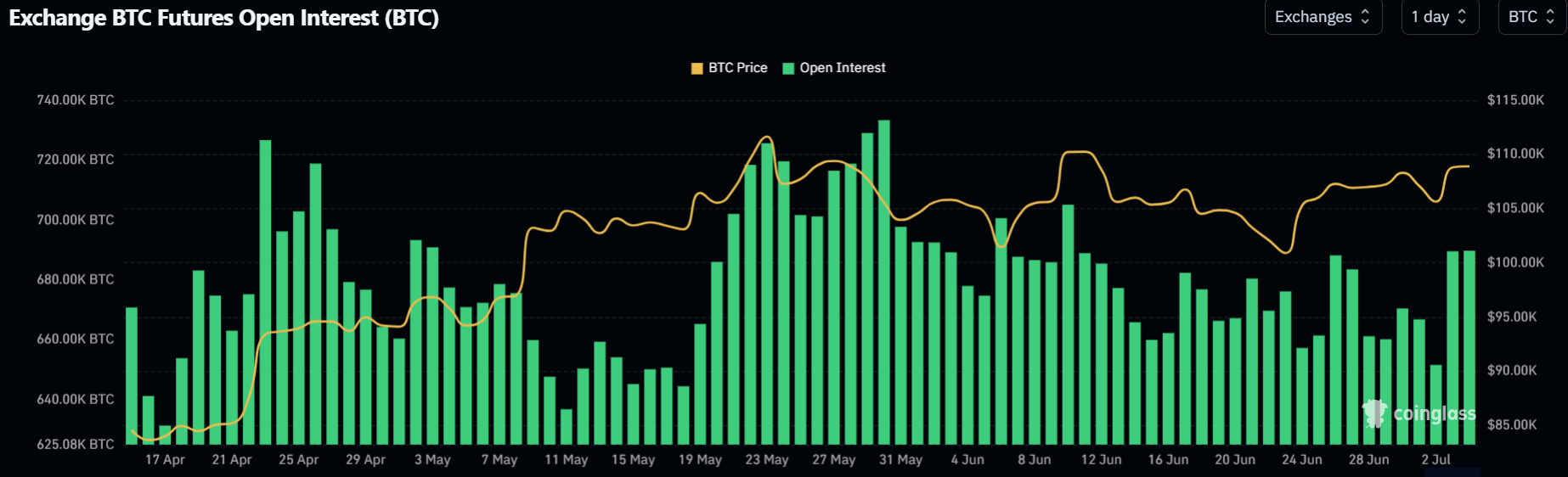

Development has triggered an increase in bitcoin, the upper cryptocurrency gathering 3% in the last 24 hours. The gains pushed the BTC above $ 109,000 – a little less from its summit of $ 111,970, which provides its open interest (OI) from 651.66K BTC to 689.78K BTC, according to Coinglass data. Open interest is the total value of current contracts on a derivative market.

BTC open interest. Source: Coringlass

Bitcoin’s rise in power could also be attributed to the increase in the US money supply M2, which increased by 4.5% in annual sliding in May to a summit of $ 21.94 billions of dollars, according to Kobeissi’s letter. The rally marks the 19th month of consecutive growth in the United States, exceeding the summit of 21.86 billions of dollars previous in March 2022.

The M2 is a measurement of the money supply in the global economy, as followed by central banks, including species, check deposits, savings accounts and deposit certificates which are available for expenses and investments.

Bitcoin tends to follow changes in the global and American money supply with a lag of three to six months. The global M2 monetary mass is currently lagging behind by 3 months, which suggests that the first crypto could extend its rally in the coming months.

BTC vs global liquidity M2. Source: Zerohedge

Meanwhile, the Bitcoin thrust at $ 109,000 sparked a rally among altcoins, Car Ethereum, XRP and Solana recorded gains of 7%, 3%and 4%, respectively, in the last 24 hours. The wider Altcoin market has also experienced significant gains, most parts in the top 100, seeing an increase of more than 7%.

The sharp increase in the cryptography market sparked $ 320.6 million in liquidation, including $ 62.8 million in long liquidations and $ 258.5 million in short liquidations, in the last 24 hours, according to coqueglass data.