In the United States, the property of cryptocurrencies has increased in recent years, but it remains far from widespread.

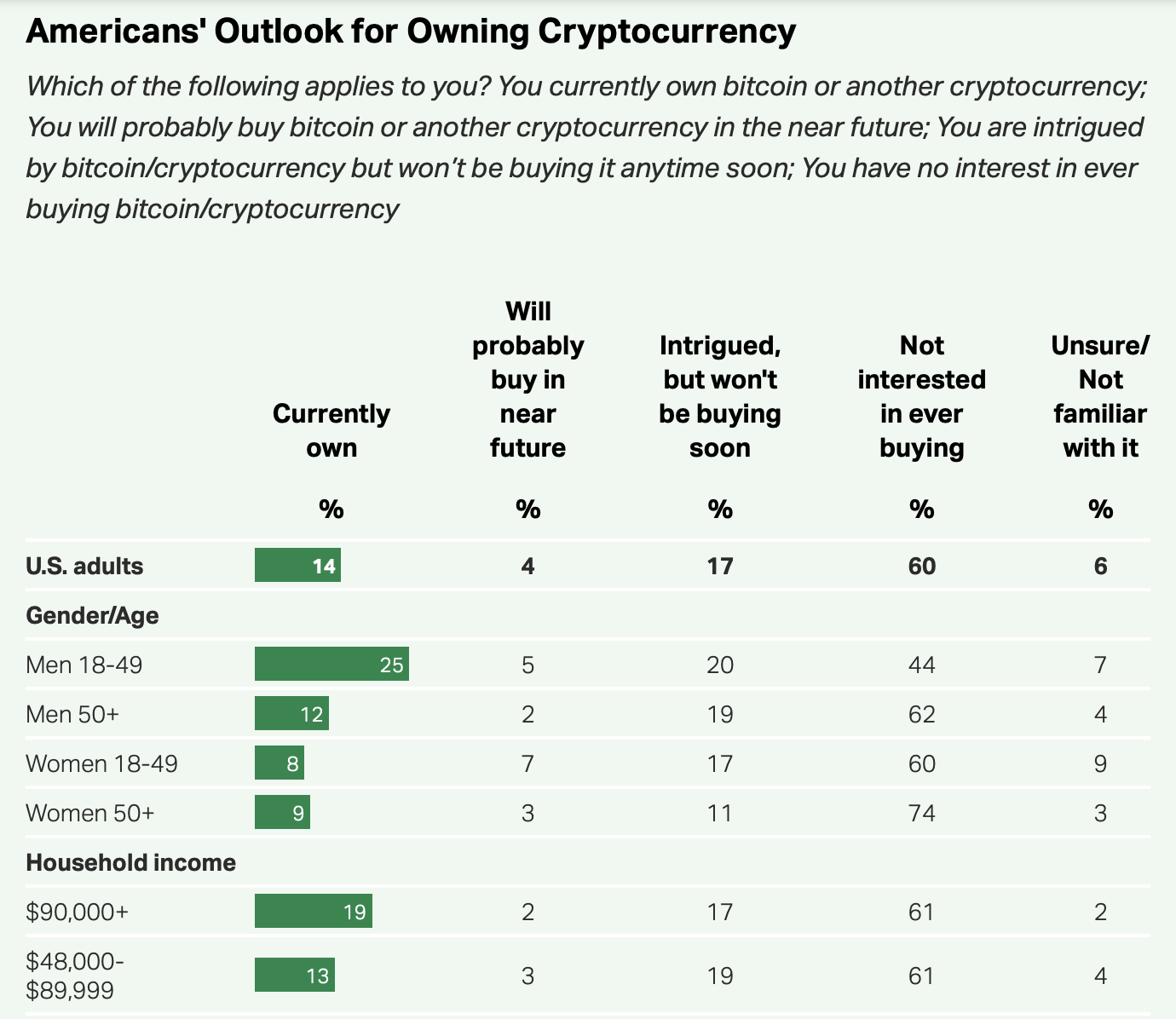

Today, around 14% of American adults report Have digital assets like Bitcoin or Ethereum. Although this marks a clear increase in figures to a figure in 2021, most Americans continue to stay on the sidelines.

For many, the risk factor occupies an important place. More than half of respondents say they consider cryptocurrency as a very risky investment, another third labeling a little risky. These concerns seem to prevail over the excitement concerning blockchain innovation or the future potential of digital finance.

Younger men and high wages open the way

The property of cryptography is far from being distributed uniformly. Men under the age of 50 are the main adopters, with 25% in this group reporting assets in crypto. On the other hand, only 8 to 9% of women – without the age – according to them to have a digital currency. Likewise, adults with higher income and university degrees are much more likely to be involved in cryptographic space.

This demographic fracture suggests that exposure to crypto is still concentrated among those who have both risk appetite and financial literacy to explore emerging technologies.

Familiar name, unknown concept

Almost all Americans say they have heard of cryptocurrency, but only 35% claim to understand it beyond a basic level. For many, there remains a complex and abstract financial product. This knowledge gap, associated with titles on scams or volatility, continues to discourage a wider participation.

Even among those who are intrigued by the idea, only 4% say they plan to buy crypto soon, while 60% do not show any interest.

Regulatory clarity can change feelings, but slowly

The introduction of the federal cryptography regulations have sparked a debate on security, surveillance and innovation. Although clearer rules can improve long -term confidence, it is unlikely to stimulate an immediate vague adoption. For the moment, cryptocurrency remains a niche that holds for younger and high -income men, while the general public expects stronger incentives – or less risks.