- Only 1% of Polygon investors were profitable.

- The metrics suggest that buying pressure is increasing.

Since moving from MATIC to POL, Polygon faced pricing issues. However, things might improve soon.

Notably, a bullish trend has appeared on the POL chart, which could lead to massive growth.

A bullish pattern on the Polygon chart

Polygon has witnessed significant price corrections in recent times. According to CoinMarketCapPOL price fell more than 3% last week. The downward trend continued over the last 24 hours, with its value falling by 1%.

At the time of writing, the token was trading at $0.3682 with a market cap of over $2.8 billion, making it the 31st largest crypto.

Due to the continued decline in prices, the majority of investors have been excluded from profits. To be precise, only 10.3 thousand POL addresses were beneficiaries, which represented just over 1% of the total investors.

Source: In the block

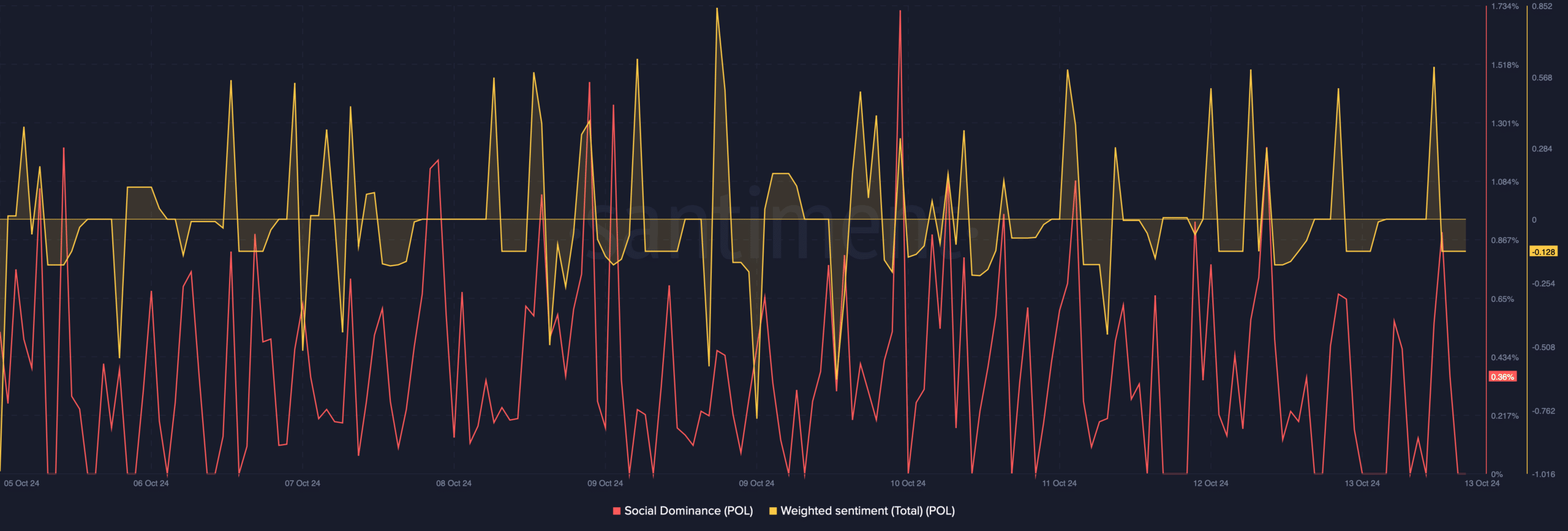

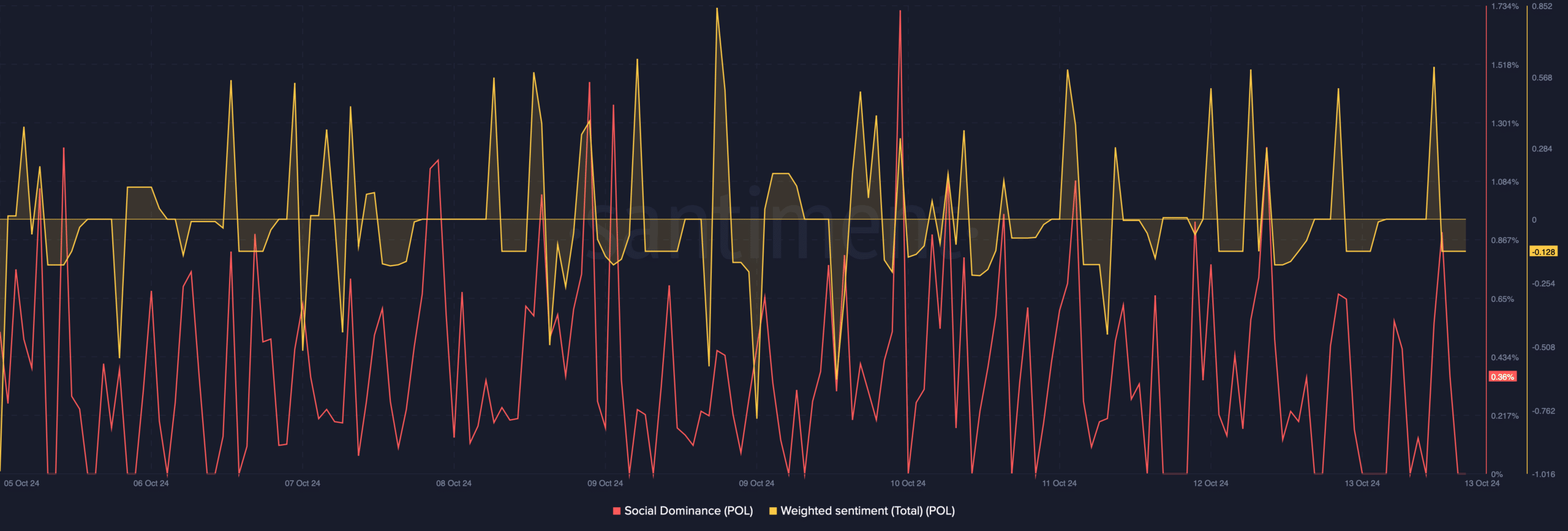

This also negatively impacted the token’s social metrics. For example, the token’s social dominance fell last week, reflecting a decline in its popularity.

The weighted sentiment has also entered the negative zone. This meant that bearish sentiment around POL was dominant in the market.

Source: Santiment

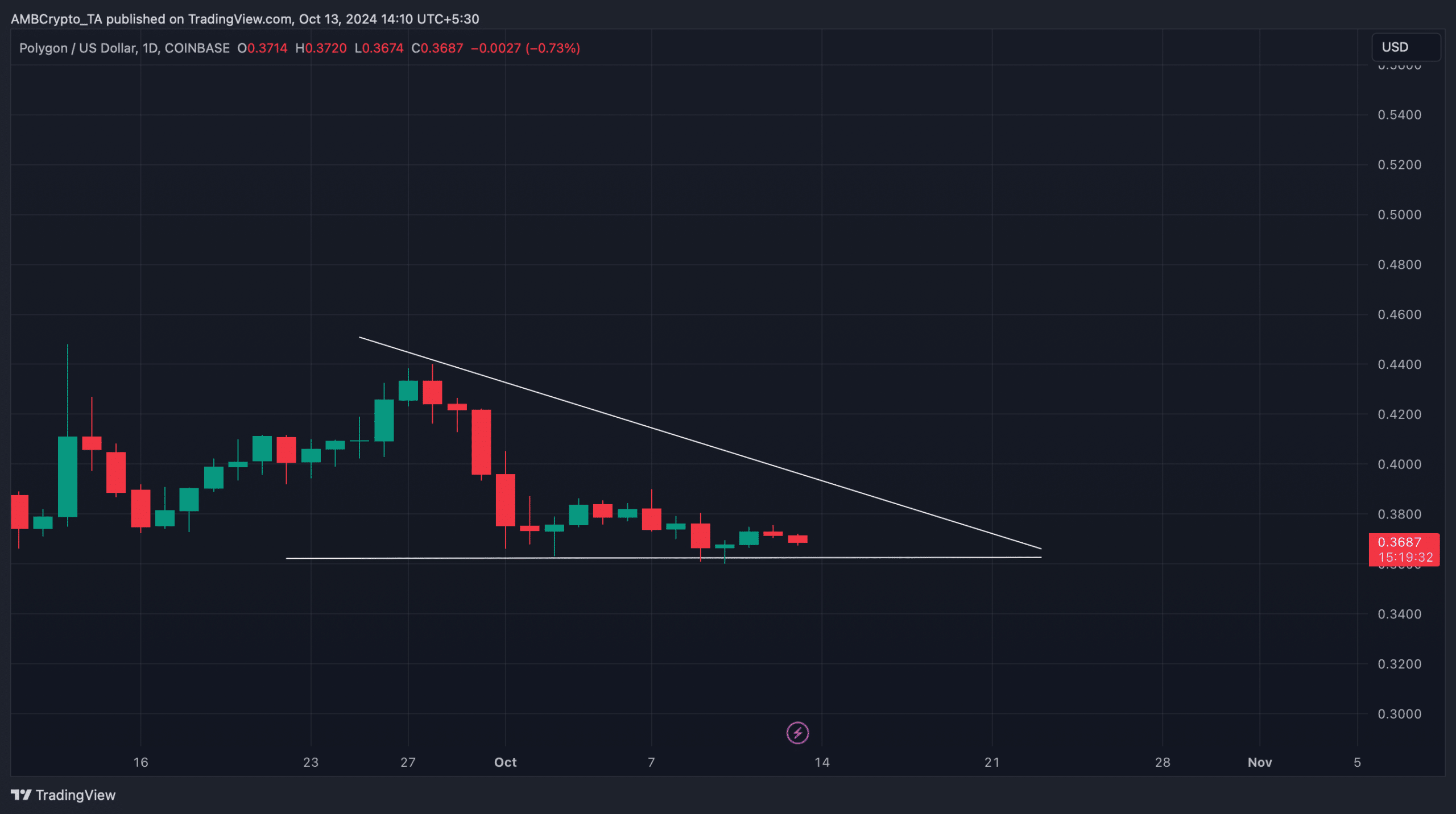

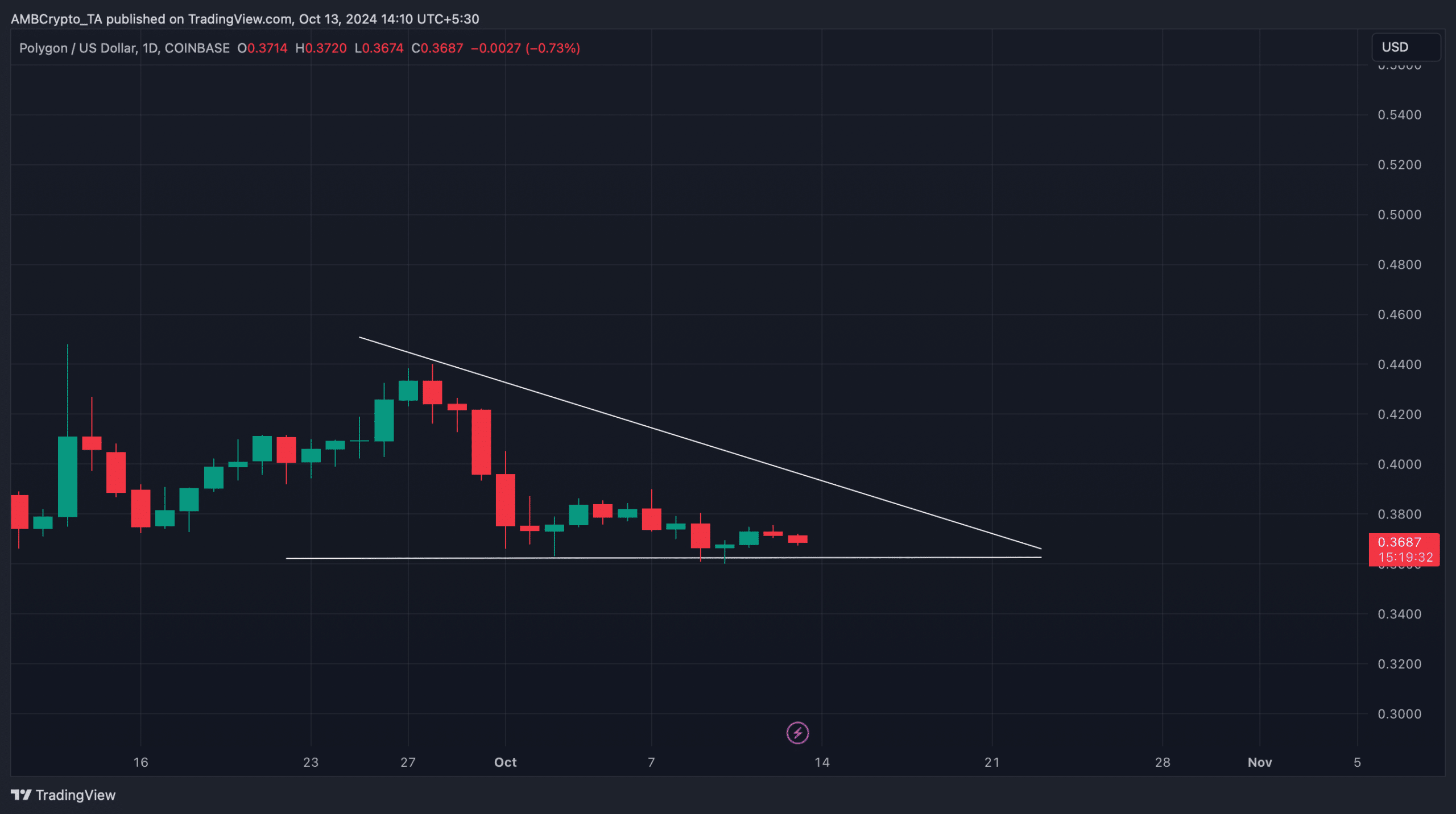

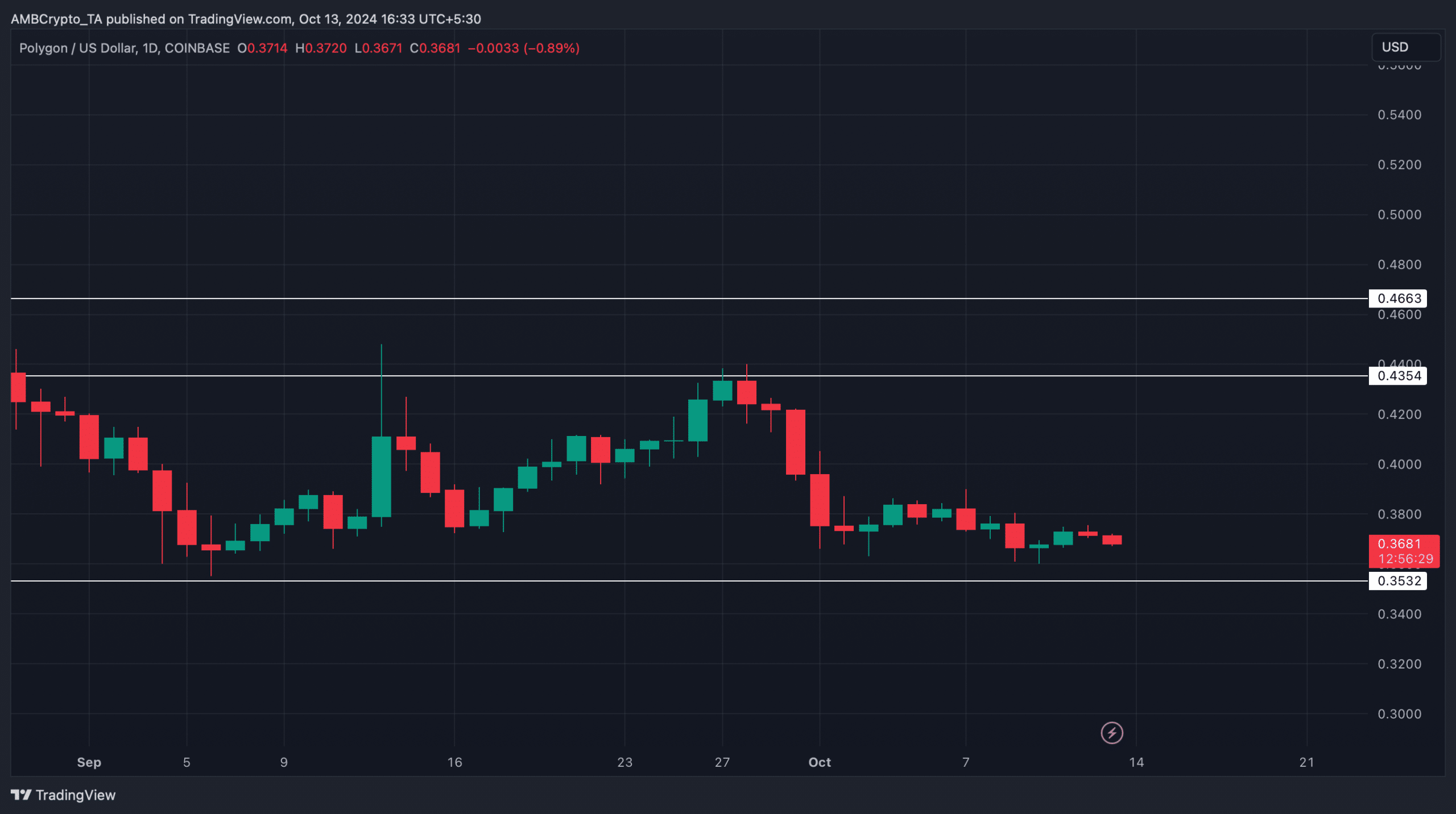

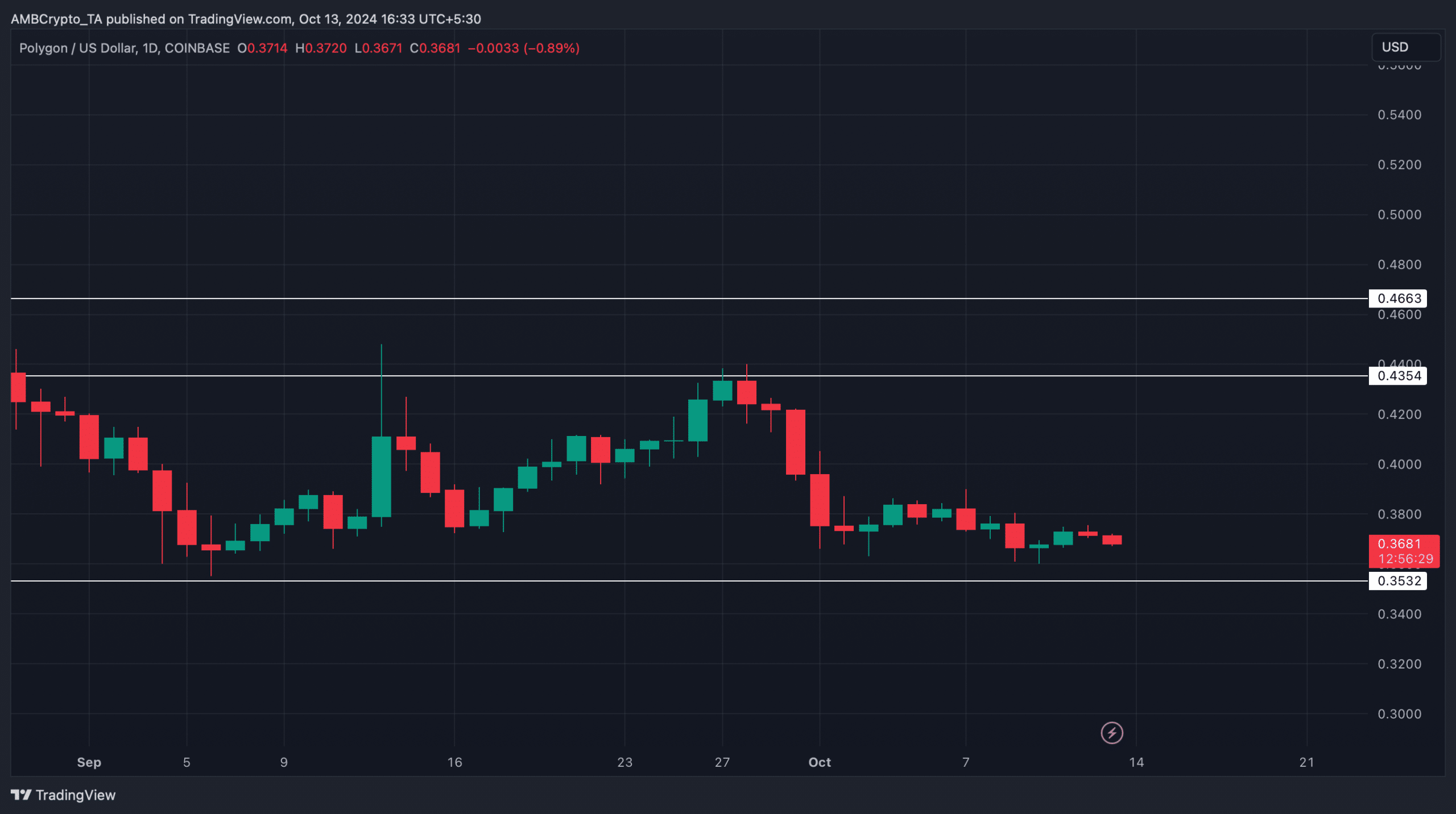

But the trend might change soon, as an uptrend appears on the token’s chart. AMBCrypto analysis revealed that a bullish descending triangle pattern appeared on the Polygon price chart.

It appeared in September and since then the price of the token has consolidated.

At the time of writing, POL was testing its support. A successful test could push the token towards the upper resistance of the pattern in the coming days.

Source: TradingView

What does POL have in store for us?

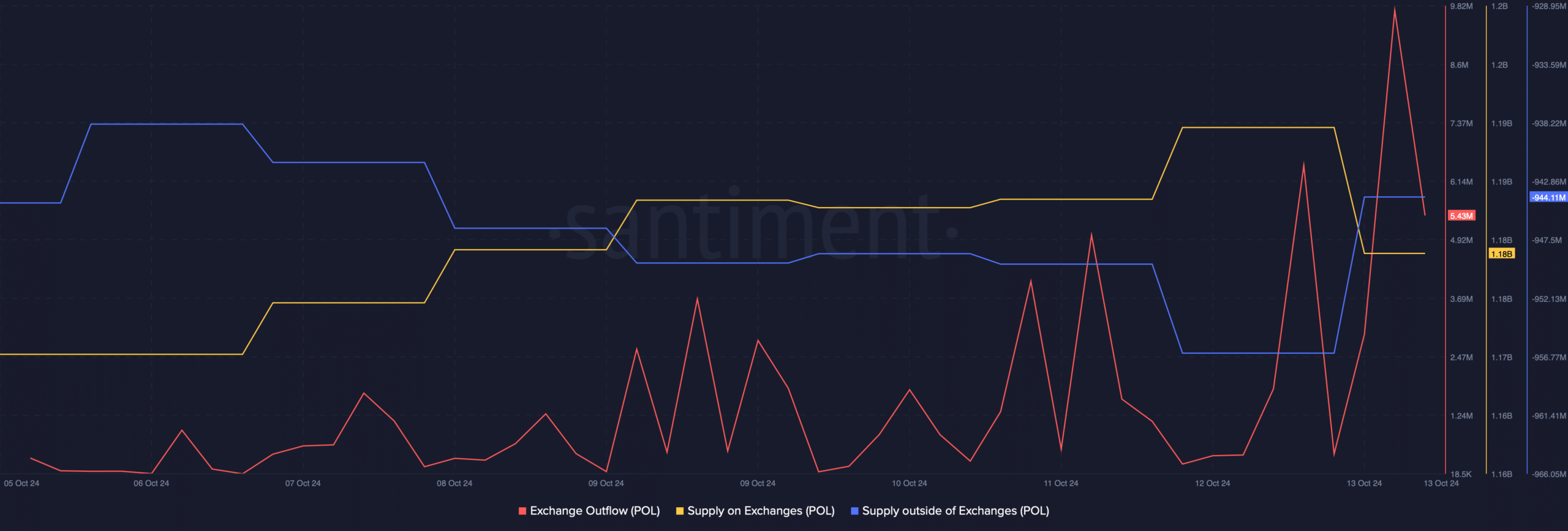

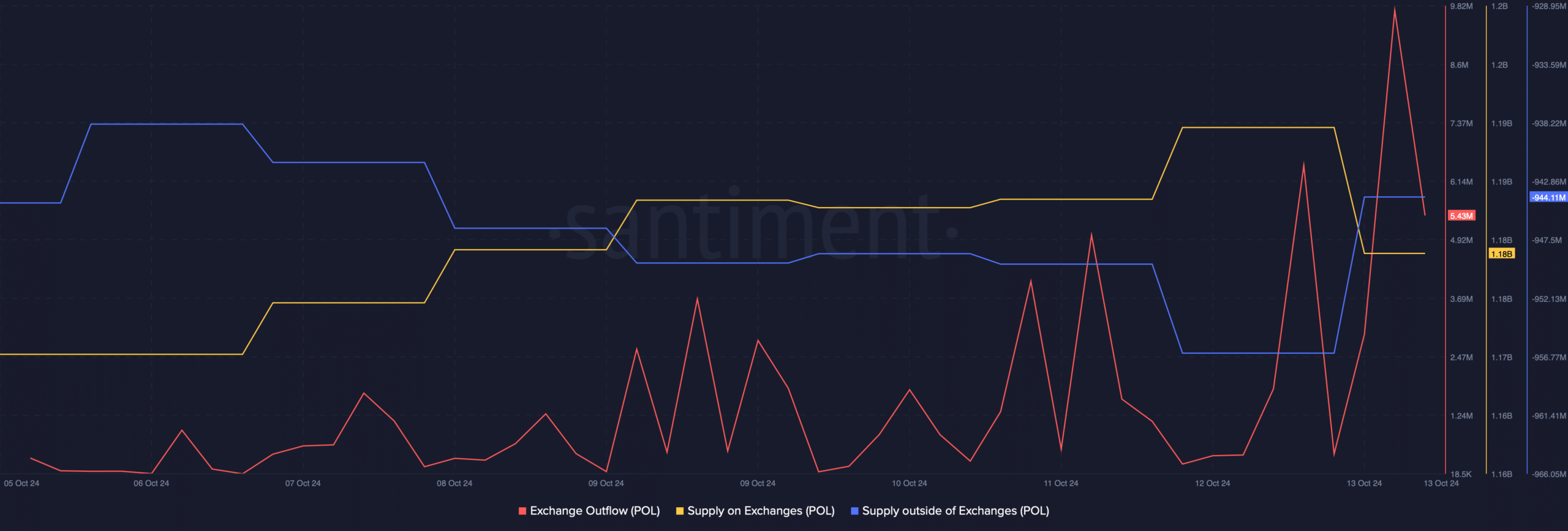

AMBCrypto then checked the token’s other datasets to discover the similarity of POL successfully testing support. According to our analysis, POL’s foreign exchange outflows have increased.

Polygon’s supply on exchanges has decreased, while its supply outside of exchanges has increased. These three measures indicated that buying pressure was high.

Whenever this happens, it portends a possible price rise in the coming days.

Source: Santiment

Is your wallet green? Discover the POL Profit Calculator

We then checked the daily Polygon chart to see upcoming targets. If the buying pressure causes the price to rise, then it will not be surprising to see the token move towards $0.43 again.

A jump above could push the token as high as $0.46. However, if the downtrend persists, Polygon could drop to $0.35.

Source: TradingView