Bitcoin (BTC) took the spotlights from the rest of the cryptography market in 2024, but the Trump administration quickly changed the rules of the game and a rotation in other assets could eventually occur, according to the Crypto Kaiko Research data company

In fact, the decentralized finance sector (DEFI) does not seem too bad, wrote the research analysts of Kaiko Adam McCarthy and Dessislava Aubert in a new report.

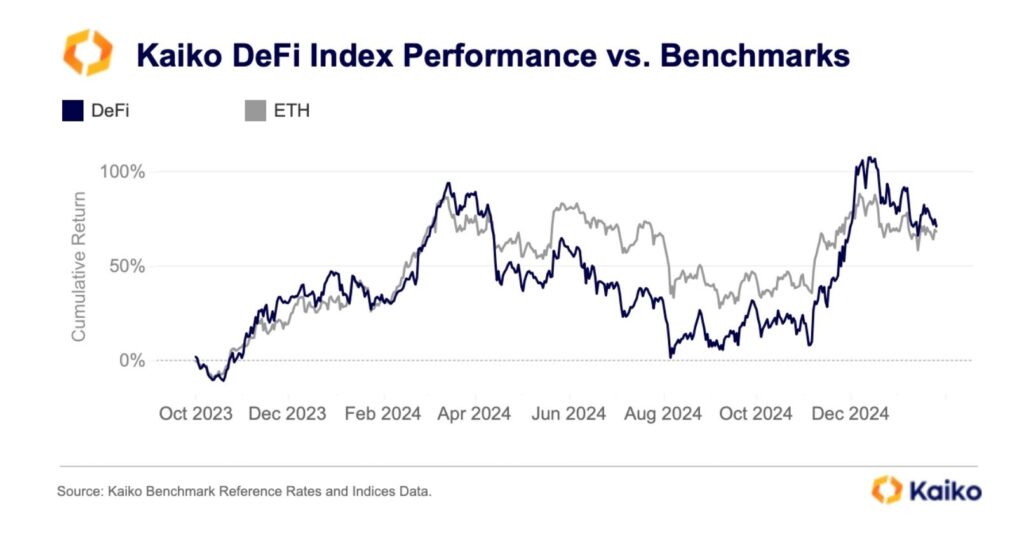

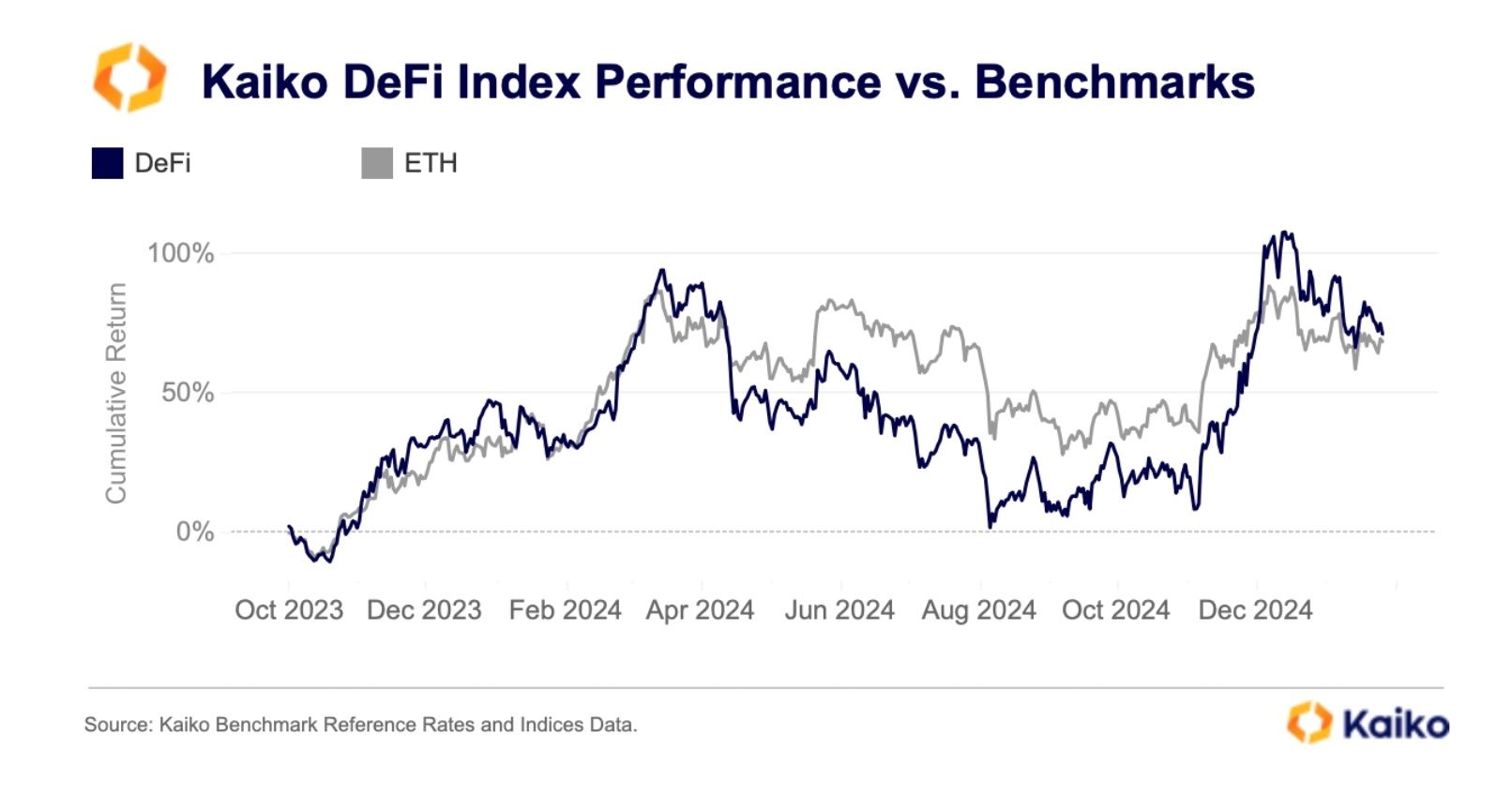

The company’s DEFI index (KSDEFI) has exceeded ether (ETH) since the instrument was created in October 2023, bringing around 75% yields in this time of time. This is remarkable since most of the protocols included in the index are built on Ethereum.

“This outperformance may persist in the second half of 2025, because several assets within the index benefit from strong rear winds,” said the report. “This trend highlights the decreasing correlation between the DEFI index and the ETH over time, because the decentralized financial sector continues to develop beyond the Ethereum ecosystem.”

The index is made up of 11 DEFI tokens, the most strongly weighted being united, Aave and Ondo. At least four of these tokens have powerful rear winds for the rest of the year, according to the report.

For example, regulatory developments in the United States can open up possibilities for UNISWAP decentralized exchanges and a decentralized lender to implement costs for each of their respective tokens, which means that protocol costs can end up being distributed to UNI and Aave holders.

The Ondo Finance tokenization protocol, for its part, will probably benefit from an acceleration of the tendency to tokenization while Wall Street continues to wade in the crypto, according to the report.

“The regulatory constraints on key markets have been an important obstacle (since 2020), but they are only part of the challenge. DEFI was also faced with structural problems, including high friction of users due to safety costs and problems. However, with the relaxation of the regulatory examination, the sector now has many growth possibilities, ”says the report.

This story originally appeared on Coindesk