- Litecoin has broken out of an ascending triangle pattern amid increasing buying volumes.

- Exchange inflow data shows sellers remain absent, suggesting confidence in the uptrend.

Litecoin (LTC) is up 12% over the past 30 days and 5% over the past seven days. At press time, LTC was trading at $69 with over 16% increase in trading volumes per CoinMarketCap.

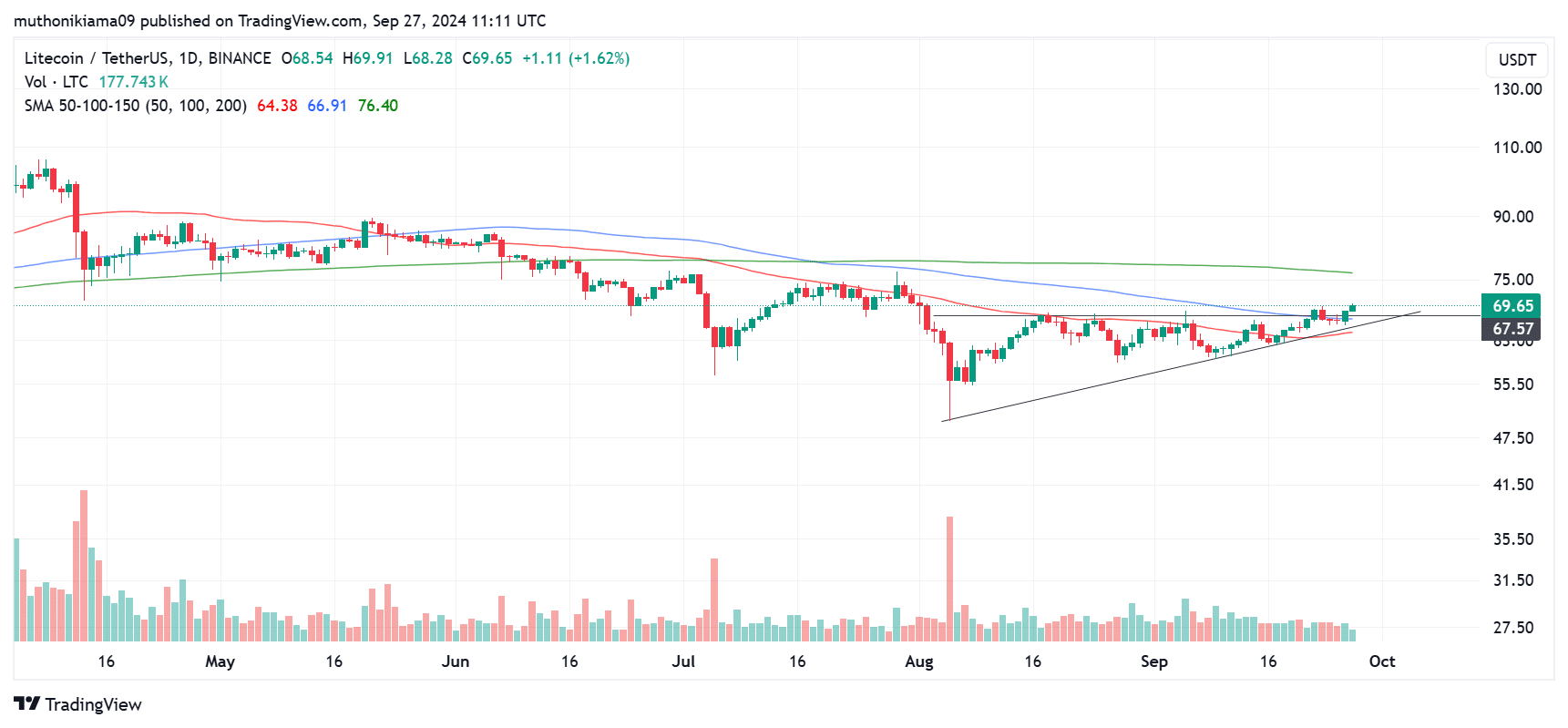

Litecoin broke out of an ascending triangle pattern on the daily chart after overcoming strong resistance at $67. This breakout suggests strong bullish momentum.

The breakout was also accompanied by an increase in buying pressure. The volume histogram bars, which are green, suggest that buyers have outpaced sellers, arguing for a sustained rally above this breakout zone.

Source: TradingView

Bullish momentum builds after price broke above the 100-day simple moving average (SMA). If this trend continues, the next target for SLDs will be the 200-day SMA at $76.

Technical indicators turn bullish

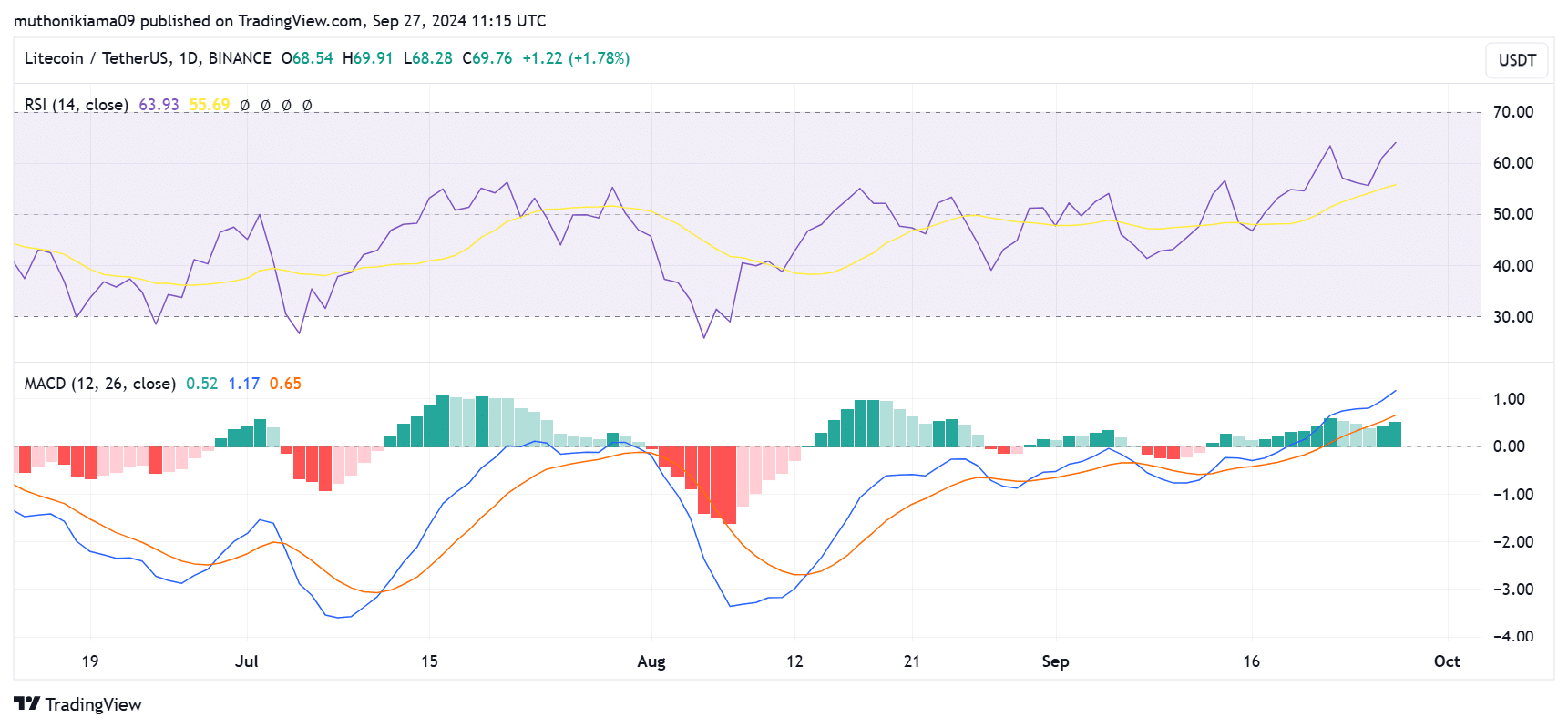

The Moving Average Convergence Divergence (MACD) indicator strengthens the bullish case for Litecoin. The MACD histogram bars have turned green and are positive. This indicates that the current uptrend is strong.

The MACD line is also positive and moving above the signal line, further confirming that the bulls are in control.

Source: TradingView

A look at the Relative Strength Index (RSI) line at 63 shows that buyers have outpaced sellers. The RSI line has also reached higher highs since August, demonstrating growing interest in LTC.

If selling activity remains subdued and buyers continue to drive the action, Litecoin could be poised for further gains.

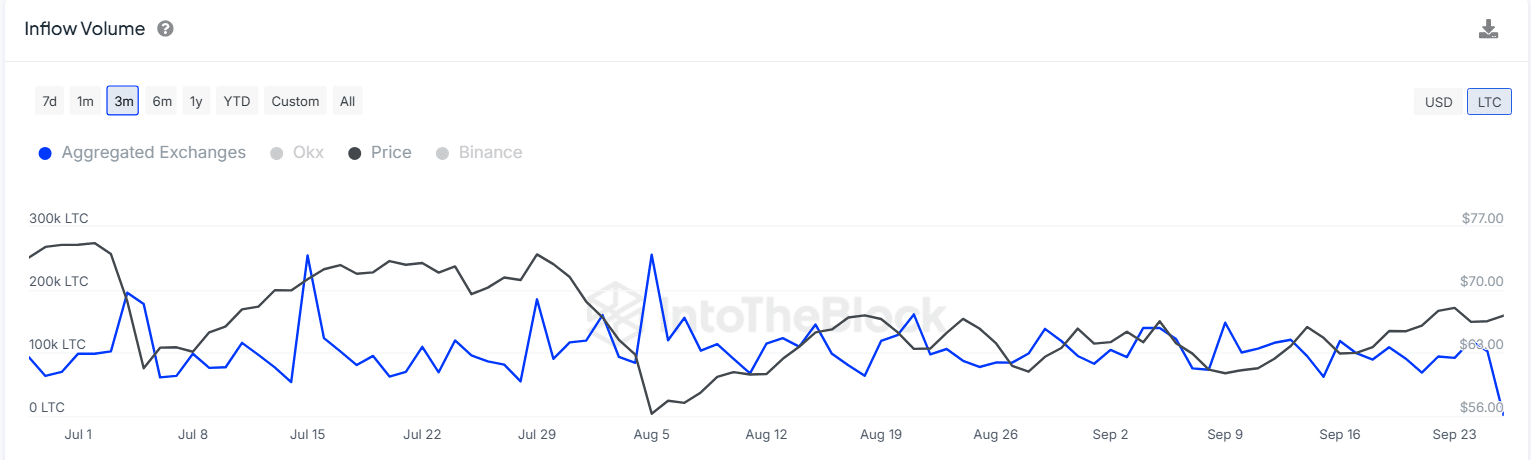

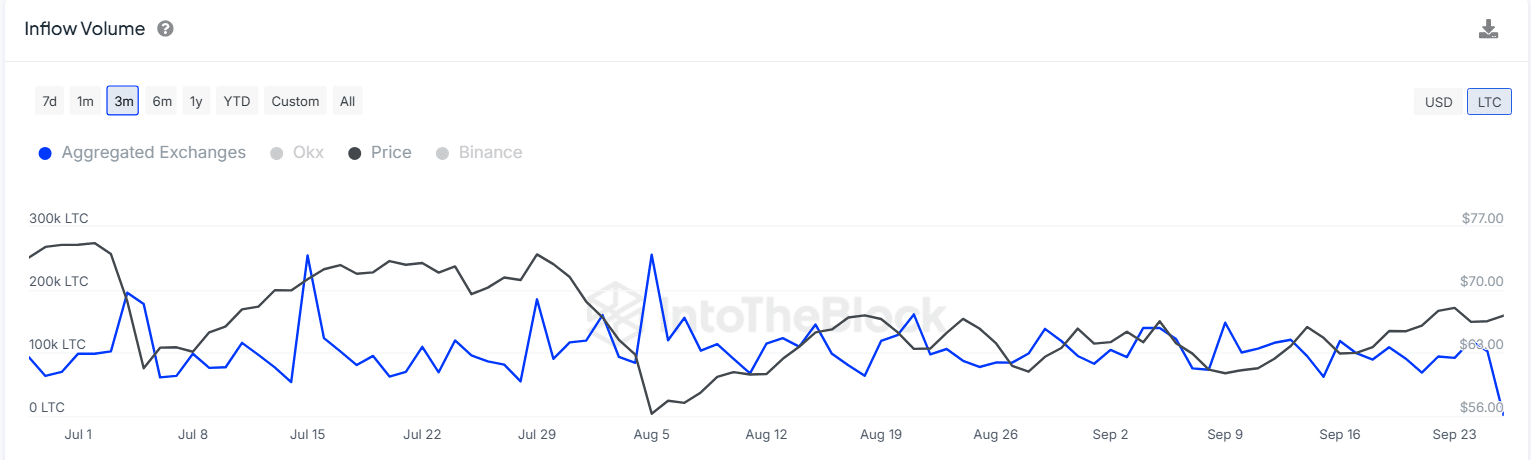

According to FX inflows data, since LTC rose above $66, there has been a notable decrease in FX inflows, suggesting a lack of selling interest and confidence in the rally.

Source: In the block

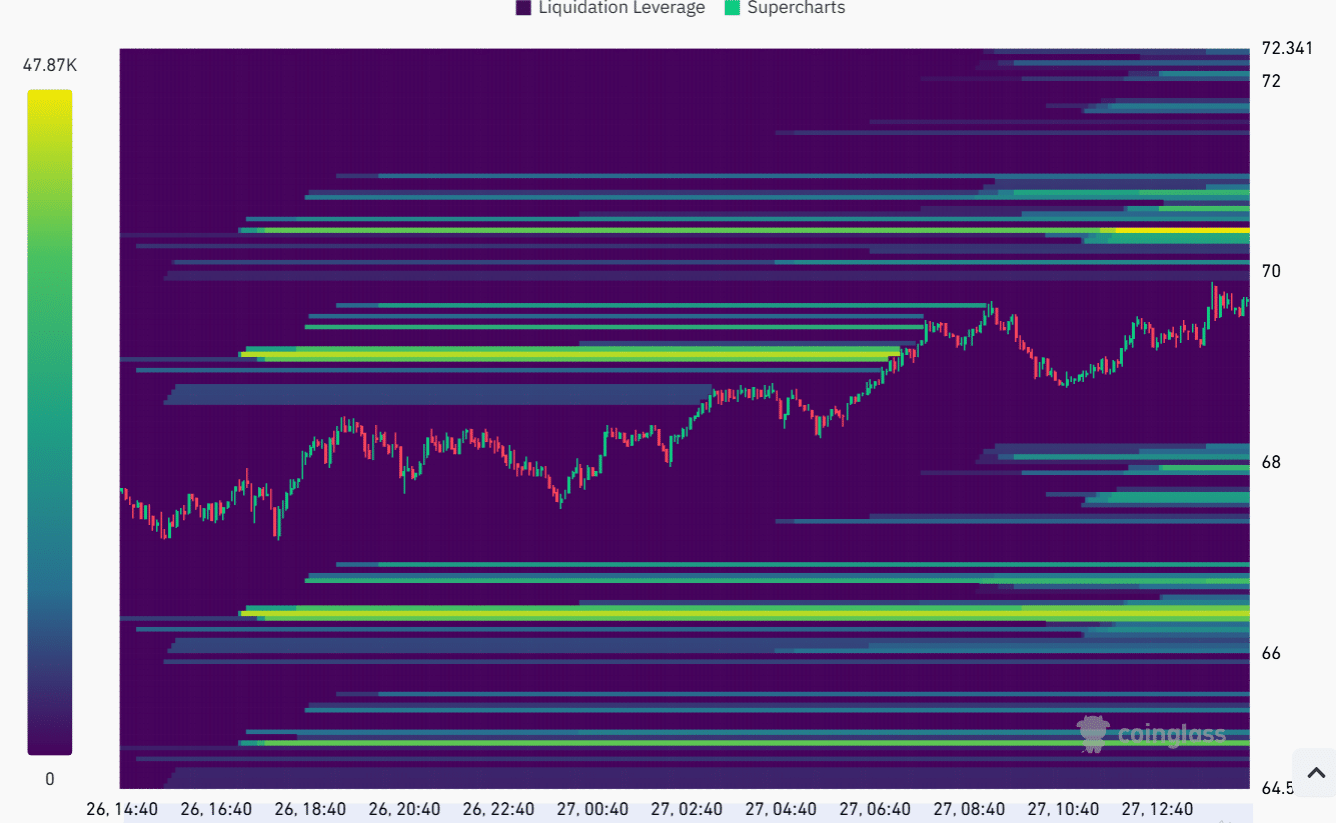

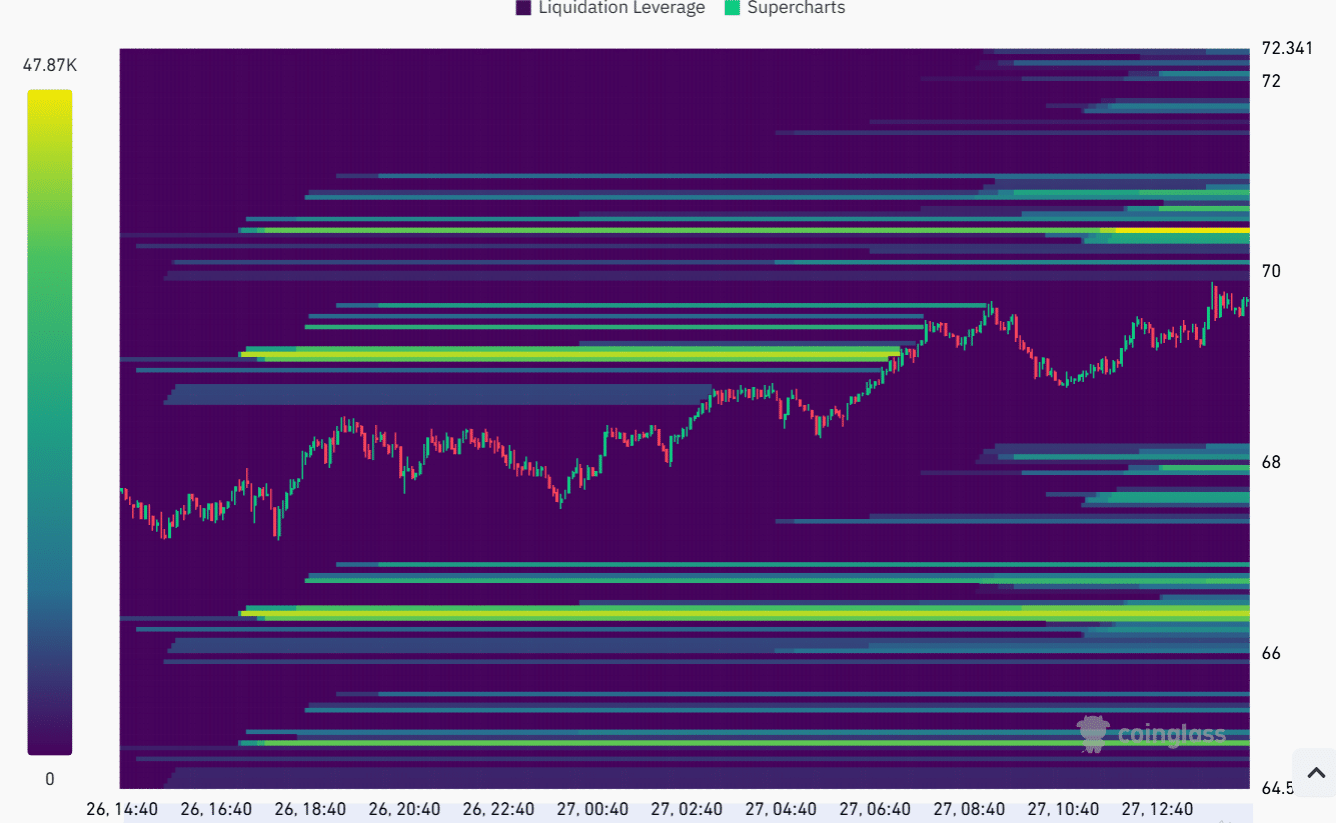

Liquidation Data and Funding Rates

Litecoin is approaching a high liquidity zone above $70. Areas with high liquidity tend to act as strong resistance levels due to strong selling pressure that makes it difficult for prices to rise.

Source: Coinglass

If LTC continues to gain and enters this zone, it could trigger price volatility. However, if there are a large number of buy orders that reinforce the bullish momentum, LTC could break through.

Read Litecoin (LTC) Price Forecast 2024-2025

An overview of financing rates on coin mechanism also shows that there is positive sentiment around Litecoin.

LTC funding rates have been mostly positive over the past seven days, suggesting that a majority of traders are long and betting on further price increases.