Is crypto in a bear market? Is the four-year cycle broken? Will Bitcoin Reclaim $100,000 Before the End of the Year? Could 2026 give rise to a supercycle? These are all questions being asked by traders and investors as we close out the year, following a continued period of bearish price action across the entire crypto market.

Following yesterday’s surprisingly bullish US CPI data, coupled with an interest rate cut from the Bank of England, investors reacted with optimism and caution, with Bitcoin .cwp-coin-chart svg path { Stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

1.10%

Bitcoin

BTC

Price

$88,035.62

1.10% /24h

Volume in 24 hours

$47.63 billion

Price 7d

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

climbing +1.2% overnight and currently trading just below $88,000.

Just yesterday, the combined crypto market cap was close to $3 trillion. Still, a +1.5% rise brought it back towards $3.1 trillion, giving it some breathing room to avoid losing this key level, which would bring it back into the $2 trillion range.

Cryptocurrency Fear and Greed Chart

1 year

1m

1w

24h

Is crypto in a bear market? Reasons why poor price action could continue until 2026

A controversial opinion is that crypto has been in a bear market for a year now. There is some evidence to support this: Among the top 50 digital assets with a full year of price history, only privacy tokens Zcash (ZEC) and Monero (XMR) are in the green, along with BNB.

Bitcoin is down 14% year to date, while the rest including household names like DOT, LINK, ADA, SOL and .cwp-coin-chart svg path { Stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

3.39%

Ethereum

ETH

Price

$2,969.84

3.39% /24h

Volume in 24 hours

$28.12 billion

Price 7d

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

are down between -50% and -80% over the same period.

In the fourth quarter of 2025 alone, Bitcoin fell by over -30% after falling below $90,000, while it currently sits between $85,000 and $88,000. Although this pullback level is typical during bull runs, the correction also broke a key support level, prompting many renowned analysts to turn bearish in the medium term.

One leading analyst, Peter Brandt, has even called for BTC to collapse to $25,000 in 2026, arguing that each rise leads to diminishing returns for the leading digital asset and that previous parabolic runs have all declined by <80%. Brandt further states that the current parabolic advance has been violated and a 20% decline from the all-time high would take the price to $25,240.

And as the US and UK cut interest rates, the Bank of Japan is raising rates to their highest levels in 5 years, adding even more uncertainty to global markets as it could affect the yen carry trade, which is a popular investment strategy in which traders borrow Japanese yen (JPY) at very low interest rates and convert them to buy higher-yielding assets in other currencies like the USD.

JUST IN

: The Bank of Japan raises rates to the highest level in 30 years

pic.twitter.com/5Rdwz2eOEO

– Bar Chart (@Barchart) December 19, 2025

Global economic uncertainty, the ongoing war in Ukraine, and emerging tensions between the United States and Venezuela are among the reasons to be concerned about the state of crypto in 2026, and the current bearish price action suggests a yes to the question. Is crypto in a bear market?

RELATED: Bank of England Rate Decision and US CPI Fuel Volatility: BTC USD Fights for Foothold as Trump Targets Venezuela Oil

Catalysts that could cause a supercycle in 2026

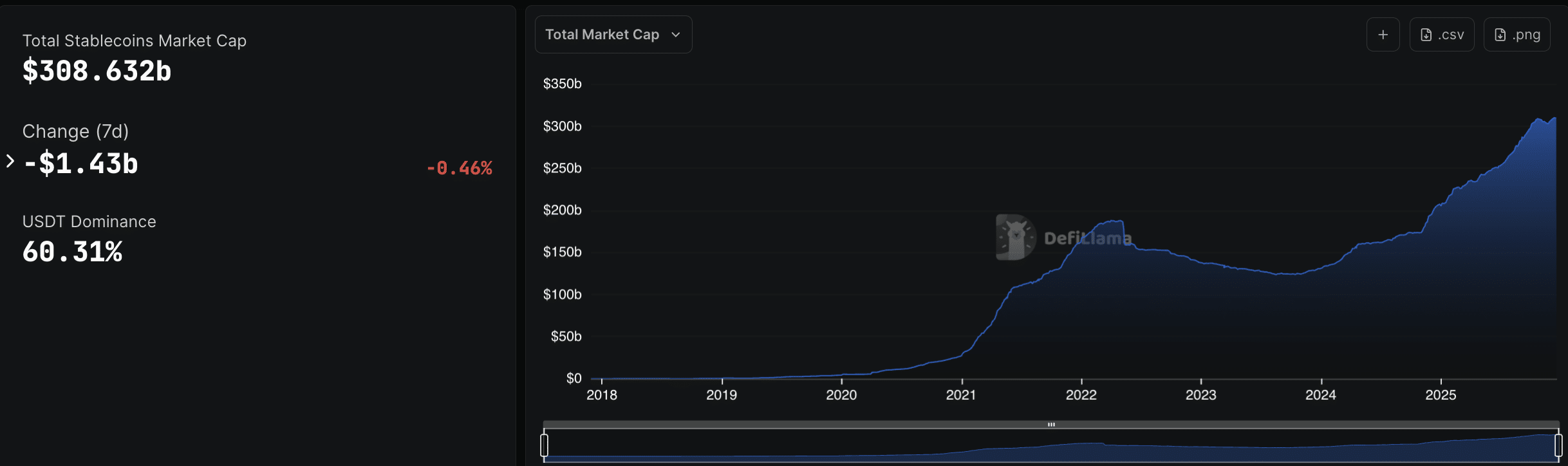

(SOURCE: DéfiLlama)

Liquidity is key, and for all those screaming that there is currently no liquidity in the market, the reality is that the stablecoin market cap has almost doubled in the last twelve months, from $165 billion to just over $300 billion today.

A bullish view on the liquidity issue could be formulated as follows: Now more than ever, the entire crypto ecosystem has an abundance of dry powder ready to enter speculative crypto assets at any time.

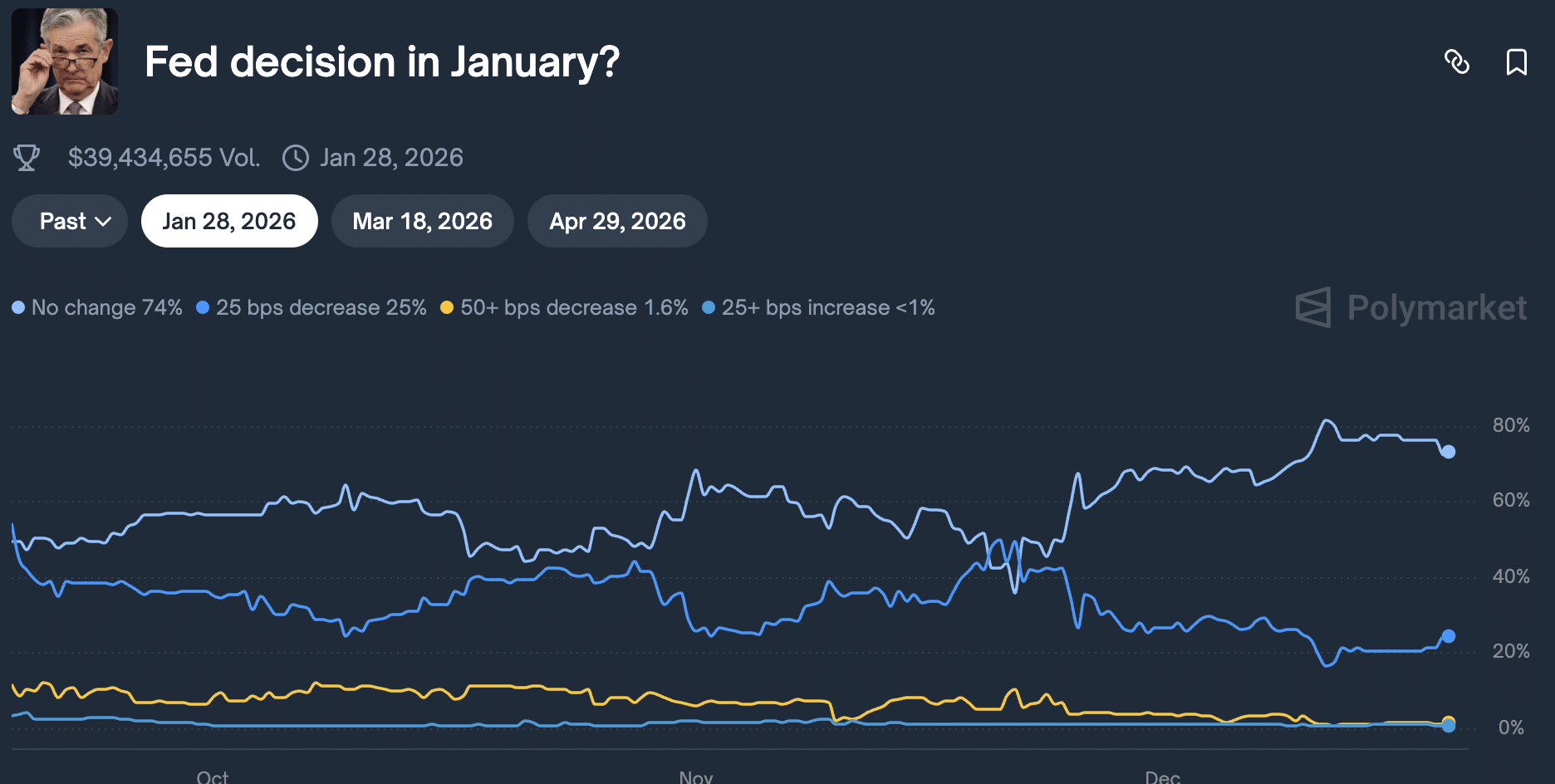

Then there is the United States; regardless of people’s feelings, it remains the nation everyone turns to when speculating on future global market movements. It has made three interest rate cuts in 2025, and Polymarket is now forecasting another cut for January, which would maintain the Federal Reserve’s policy of quantitative easing (QE).

(SOURCE: Polymarché)

QE generally increases liquidity in risky environments by increasing the money supply and injecting it into the financial system. With lower returns on safe assets like bonds, investors often move their capital to riskier markets, including stocks and cryptocurrencies, during QE, in search of higher returns.

Low interest rates and abundant liquidity tend to create a sense of risk appetite, in which investors feel more comfortable allocating capital to speculative assets such as Bitcoin and the broader crypto market. Historically, periods of significant QE, such as the 2020-2022 COVID-19 period, have coincided with crypto bull runs.

Support for the supercycle thesis has been expressed by industry leaders such as Binance founder CZ and Bitmine CEO Tom Lee, as well as many leading analysts and traders.

CZ says crypto could enter a supercycle by 2026, driven by US policy, Fed easing, and institutional adoption.

Bullish

pic.twitter.com/KbmACNTFcc

-Bitcoin Teddy (@Bitcoin_Teddy) December 16, 2025

DISCOVER: Top 20 cryptocurrencies to buy in 2025

Inflation Hedging Narrative and Regulatory Progress: Other Reasons Crypto Could Explode in 2026

Some investors view Bitcoin and other scarce crypto assets as a hedge against inflation, buying cryptocurrencies when money is printed because they fear fiat currencies will weaken. This discourse is reinforced during cycles of quantitative easing.

Just look back to 2021, at the height of the latest US quantitative easing cycle, which also saw the largest crypto bull run in history. Optimistic crypto traders claim that 2026 will mark the start of the next round of quantitative easing and therefore reject the claim that 2025 was THE increase, since it was a year of quantitative tightening.

The bill on market structure (clarity law) will be voted on next month!

This is what the US crypto industry and HODL are waiting for!

pic.twitter.com/kvB6hwnPVB

– Kenny Nguyen (@mrnguyen007) December 19, 2025

Additionally, the White House recently confirmed that the CLARITY Digital Asset Marketplace Act will pass the Senate as early as January. This is not a final vote; This is the committee stage, where the bill is amended and finalized before reaching the floor. Early signs indicate the bill will pass relatively easily.

The CLARITY Act aims to clarify which tokens are treated as securities and which as commodities, and to equitably divide oversight between the SEC and CFTC. If passed, crypto companies in the United States will finally benefit from a more transparent regulatory framework rather than regulation through protracted legal proceedings.

EXPLORE: Best Meme Coin ICOs to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Will post 2026 see a supercycle of stability and rate reduction or is crypto in a bear market? appeared first on 99Bitcoins.

: The Bank of Japan raises rates to the highest level in 30 years

: The Bank of Japan raises rates to the highest level in 30 years