- Bitcoin’s STH offer faces increasing pressure because market volatility of macro characteristics

- If BTC breaks below $ 72,000, the risk of capitulation could degenerate

On April 09, US President Donald Trump announced a 90 -day break on prices, triggering a single day increase of 8.27% in Bitcoin (BTC) – his longest green chandelier in almost a month. Then, on April 10, the inflation of American basic CPI fell below 3.0% for the first time since March 2021. In response, Bitcoin jumped 3.36% to $ 82,532 at the time of the press.

With these consecutive macro increases, the market seemed to gain momentum. However, a real test could wait for us.

Short -term holders (STHS) felt the pressure, because their price made amounted to $ 93,000 at the time of the press – well above the BTC level.

So, if the federal reserve delays the rate drops, will STH hold firm? Or will the resistance to assembly oblige them to capitulate?

Risk of capitulation of Bitcoin’s STH supply signals

The Bitcoin short -term holder offer (STH) is approaching a crucial inflection point.

On February 10, the BTC reached a STH summit at a 400,000 -year summit. However, he has since dropped to 360k, signaling a clear distribution.

This coincided with the largest cryptocurrency in the world raping three key support levels – a sign of sustained pressure from the sale of this cohort.

Source: Glassnode

Glassnod chain data revealed that most of these assets have accumulated around $ 93,000. The BTC negotiating below this price made, approximately 360K BTC remains in an unrealized loss state, increasing the risk of capitulation.

More critical, the STH has made the price at $ 131,000 and $ 72,000, defining critical liquidity areas.

If Bitcoin finds itself in the band less than $ 72,000, the beneficiary margins for these holders would crumble 22%, which put additional stress on short -term conviction. Historically, a violation of the lower band has catalyzed forced liquidations.

If Bitcoin maintains a movement of less than $ 72,000, the cascade sales pressure could materialize, amplify the titles.

Conversely, recovering $ 93,000 would overthrow the positioning of STH to profit, potentially attenuating the risk of supply and will revive optimistic impulse.

Macro-valatility trembling short-term confidence

From a macro-structure point of view, the action of bitcoin prices continues to consolidate below the pivot level of $ 85,000. Repeated discharges at this threshold indicate a liquidity zone which, if raped, could trigger a cascade of short liquidations.

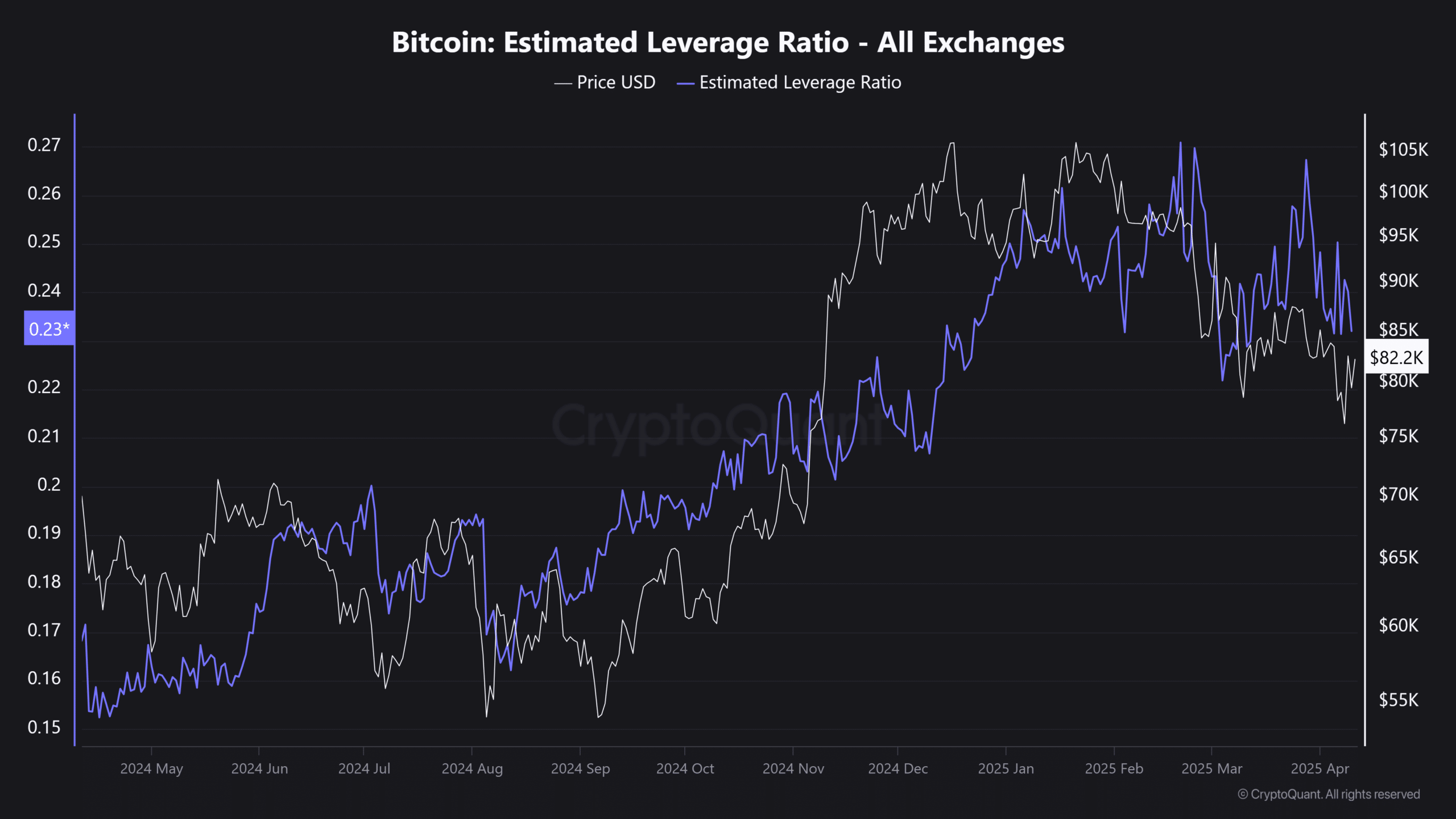

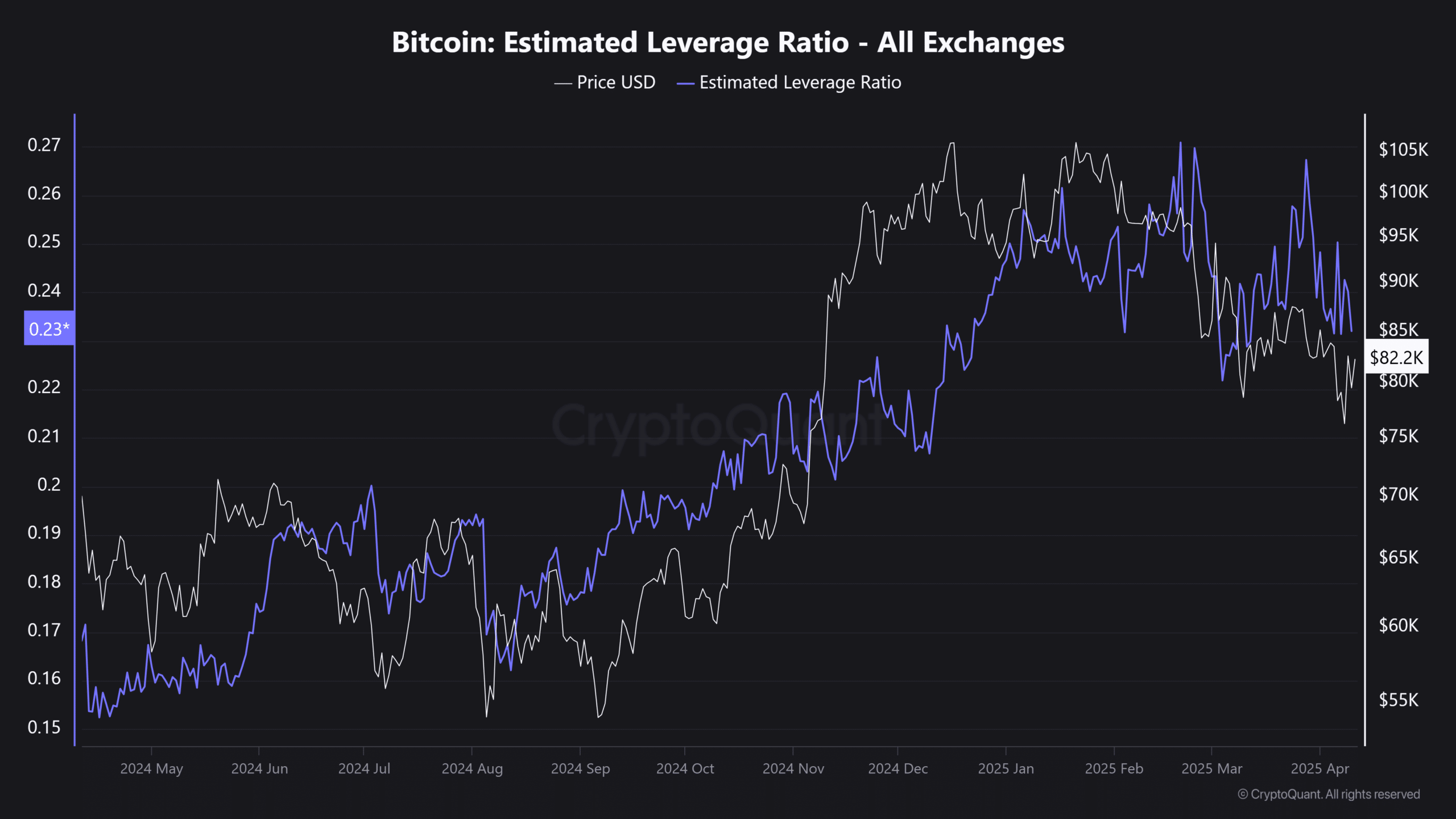

At the same time, the estimated lever report of Bitcoin (ELR) slipped below its reference base at the beginning of March – signaling a sustained designing phase. The long -term merchants remain opposed to the risk, with a significant reduction in high leverage positioning.

Source: cryptocurrency

Despite these challenges, however, Bitcoin has demonstrated a certain resilience.

Following the turbulence of the market -related market, the BTC market capitalization only experienced a withdrawal of $ 90 billion – a relatively modest circuit compared to other risk assets.

However, with the federal reserve less likely to soon reduce interest rates, macro uncertainty could push short -term holders to leave. Many of them bought about $ 93,000. And, if the price is not recovered soon, they can sell to avoid deeper losses.

With always high fear, low speculative demand and key resistance levels on the head, a drop to $ 72,000 remains a real possibility before Bitcoin can try sustained break.