- The Fomo de Cardano bonus is under pressure, driven by the deterioration of the fundamentals on the chain

- Is ADA increasingly at risk of grasping a wider distribution phase?

Despite a rebound of 28% compared to its hollow of $ 0.50, Cardano (ADA) remains pinned near a key inflection point. His recent rally, although notable, could well lack strong follow -up.

More critical, Ada’s Fomo factor has also faded. Especially since he went from 8th to 10th by market capitalization, the psychological blow being significant.

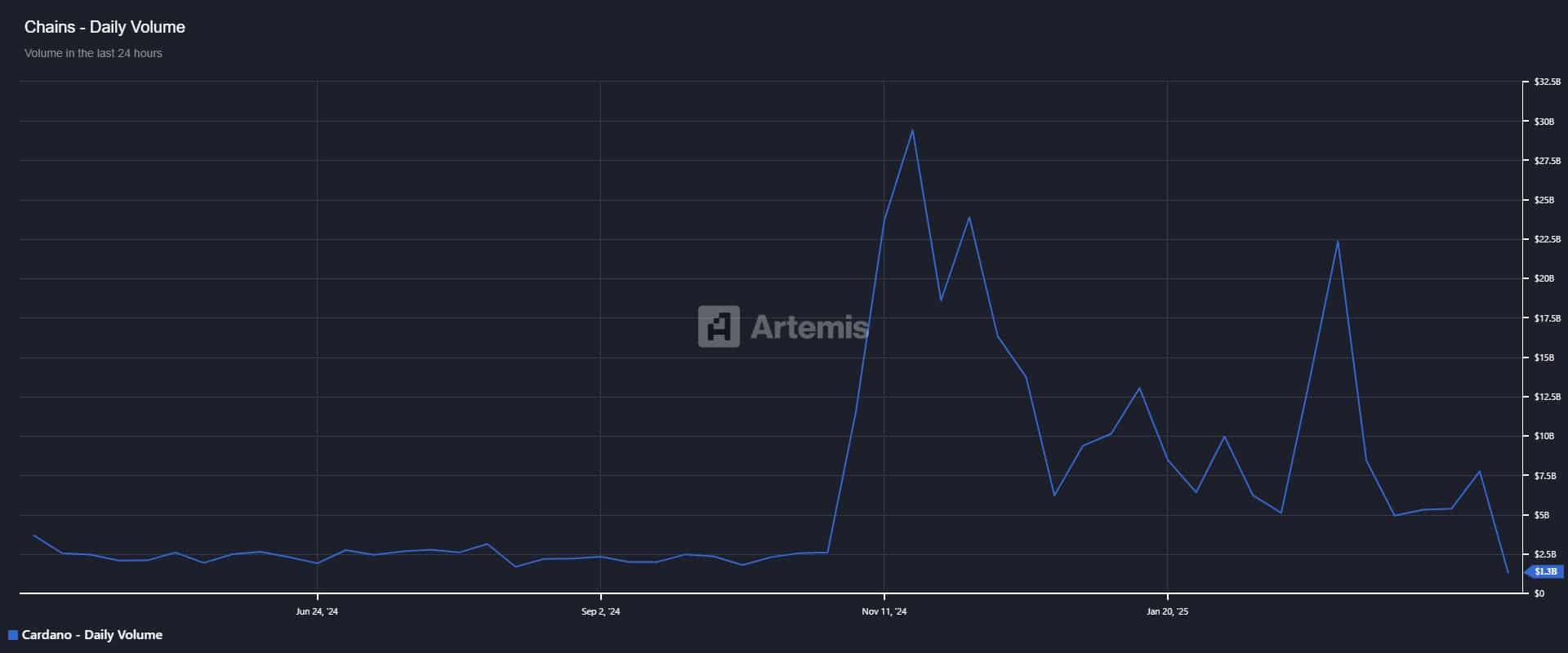

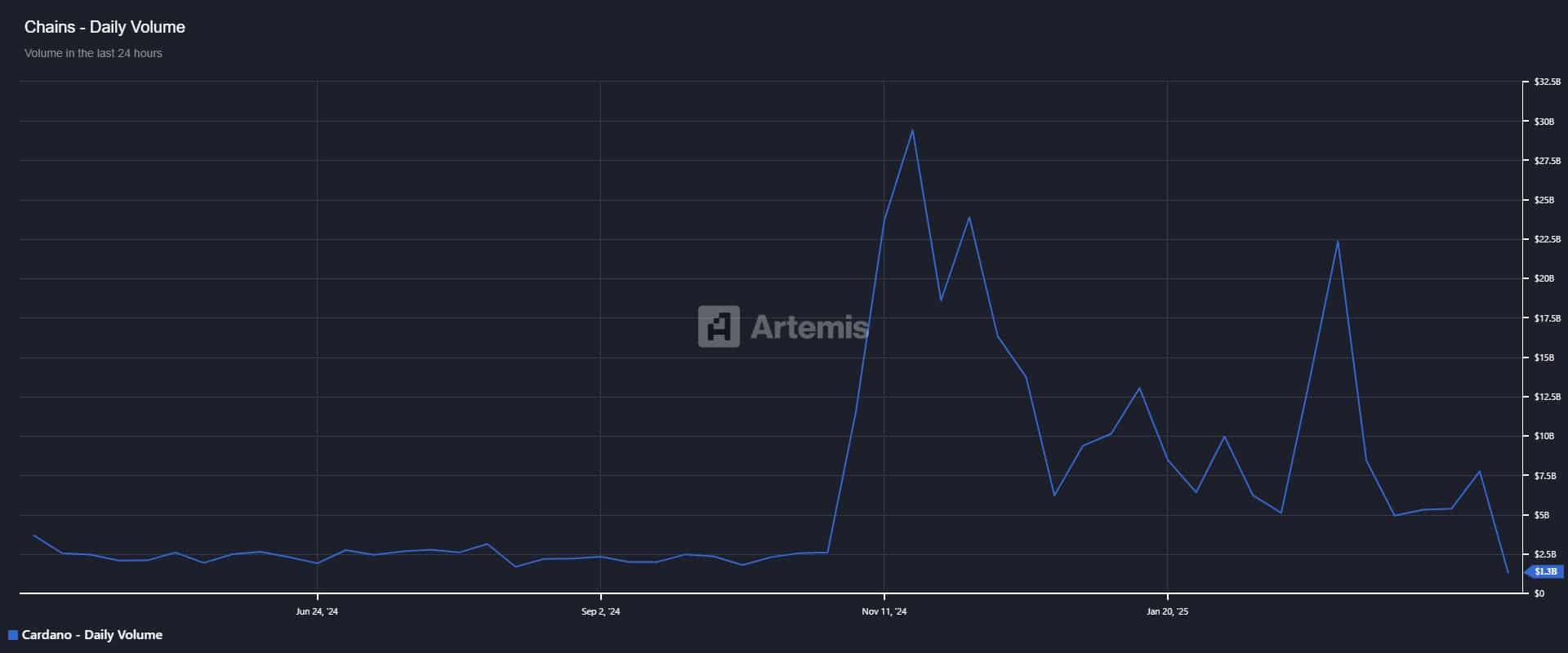

Channel metrics have confirmed this drop. The flow of the Cardano network fell to $ 1.35 billion, traced at pre -electoral levels. In fact, it is down compared to the peak of $ 7.80 billion recorded on April 07.

Source: Terminal artemis

To put it simply, Cardano gave way to his rivals Tron (TRX) and Dogecoin (Doge). This was not motivated by external force, but by its own fundamentals of deterioration and the lack of fresh liquidity entering the ecosystem.

With ADA’A structural support under the threat, the spotlights are now moving to ADA’s long -term holders. Do Hodlers start to lose conviction or is it just a Shakeout before Reaccumulation?

Key measures of LTH for the risk of distribution of cardano

Interestingly, the current market value of Cardano oscillates at the same levels as we see in November – about five months ago.

This places a large part of long -term holders (LTH), who entered the election -focused rally, to or near their cost base. Consequently, many are now seated at balance or have unrealized losses.

In this context, Ambcrypto examined if Cardano slides in a wider distribution phase. Especially since the pressure rises on these LTHs to unload, rather than pursuing the heaps in the hope of a rebound on the market.

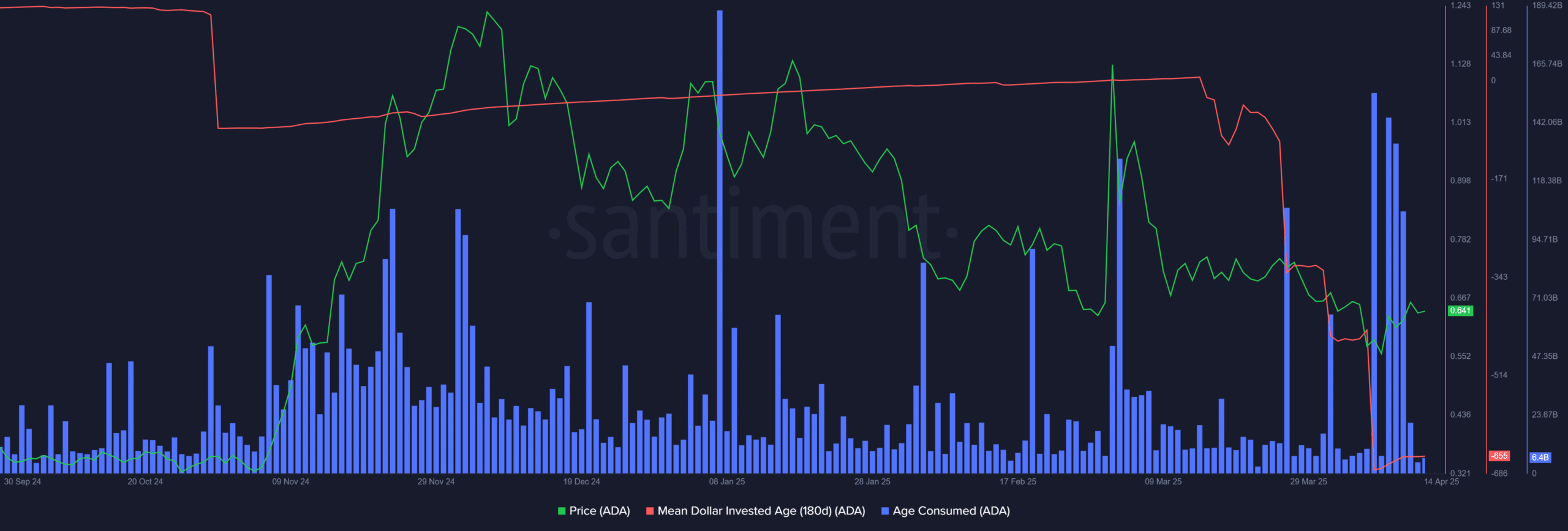

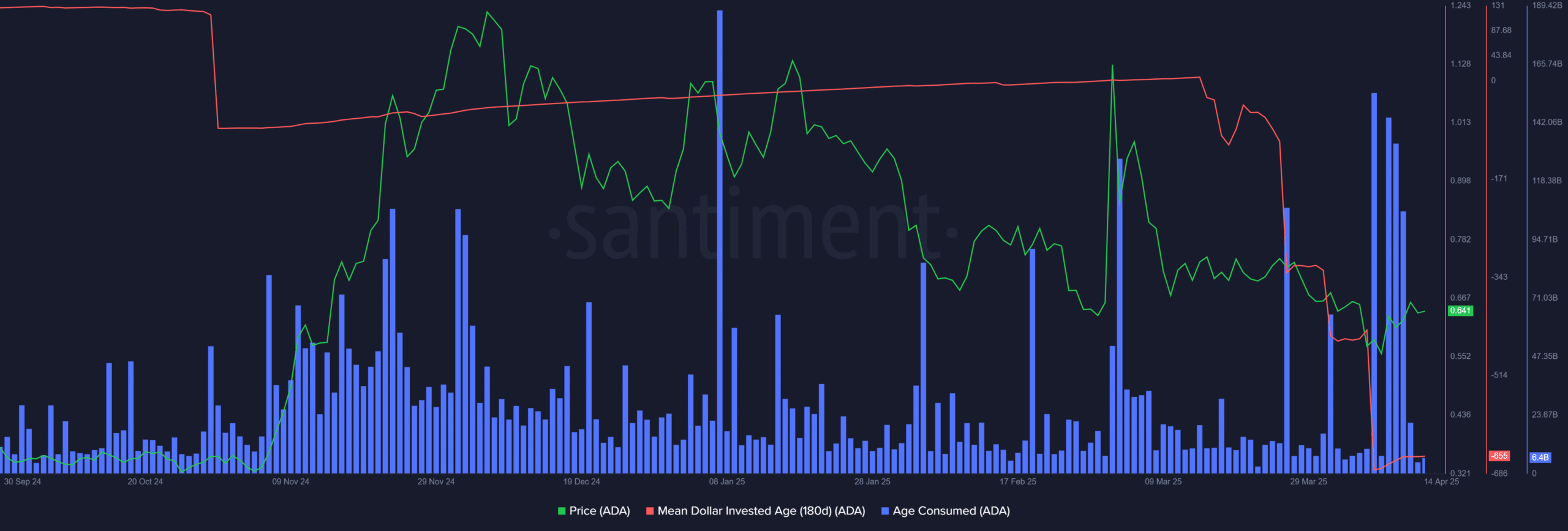

A key signal comes from the average age invested (MDIA) – 180 days, a metric which captures the average “age” of the capital invested in the ADA.

Since mid-March, Mdia has shown a pronounced downward trend, aligning with ADA’s failure to contain two critical resistance zones. This drop seemed to indicate that the older parts are moved or sold – a classic characteristic of the LTH Distribution Behavior.

Source: Santiment

The addition of additional weight to this thesis is the point of the age consumed, a metric reflecting the movement of the dormant parts. High levels here suggest that long -term assets are being reactivated, signaling strategic unloading by long -term holders.

The combined drop in MDIA and the age of age consumed highlighted the growing pressure of the sale of conviction portfolios – an unmistakable sign of distribution.

More critical, while the older parts go back to traffic and the Cardano network does not show a solid accumulation, ADA could be about to lose its support of $ 0.63.

Ventilation here would probably trigger a deeper correction, especially if a rebound on the market turns out to be short -lived.