- BTC Could Reflect Its 2020 Price Trend. Is a Post-COVID Pump Scenario in Sight?

- QCP Capital analysts predict BTC’s recent decline may be short-lived

Since hitting a high of over $73,000 in March, Bitcoin (BTC) has been consolidating for the past six months, hovering between $50,000 and $70,000. According to Bloomberg ETF analyst James Seyffart, however, the current price action mirrors It is 2020 model.

“Bitcoin is currently trading between $50,000 and $70,000 over the past six months, somewhat reminiscent of BTC trading between $7,000 and $10,000 from mid-2019 to early to mid-2020.”

After breaking through the $7,000-$10,000 price range in 2020, BTC closed the year at nearly $30,000, tripling its value. In 2021, BTC peaked at $69,000, more than double its value at the end of 2020.

As Seyffart points out, 2020 and 2024 share more than just similar price patterns. They also share BTC halving events that have historically been associated with massive rallies.

Is a parabolic rally likely for BTC?

While historical performance does not dictate future results, history always rhymes. Most market cycle analysts still maintain that BTC’s post-halving rally is still on the cards.

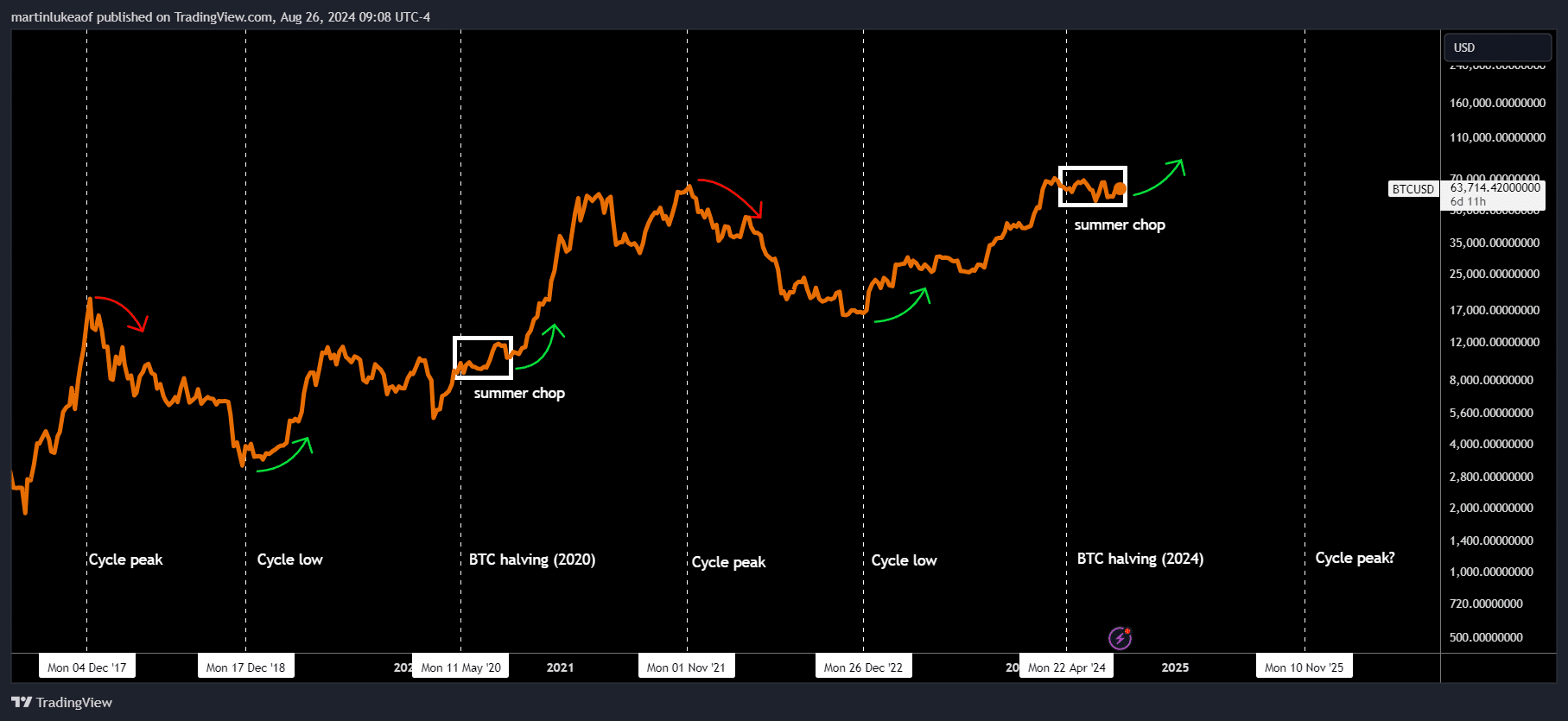

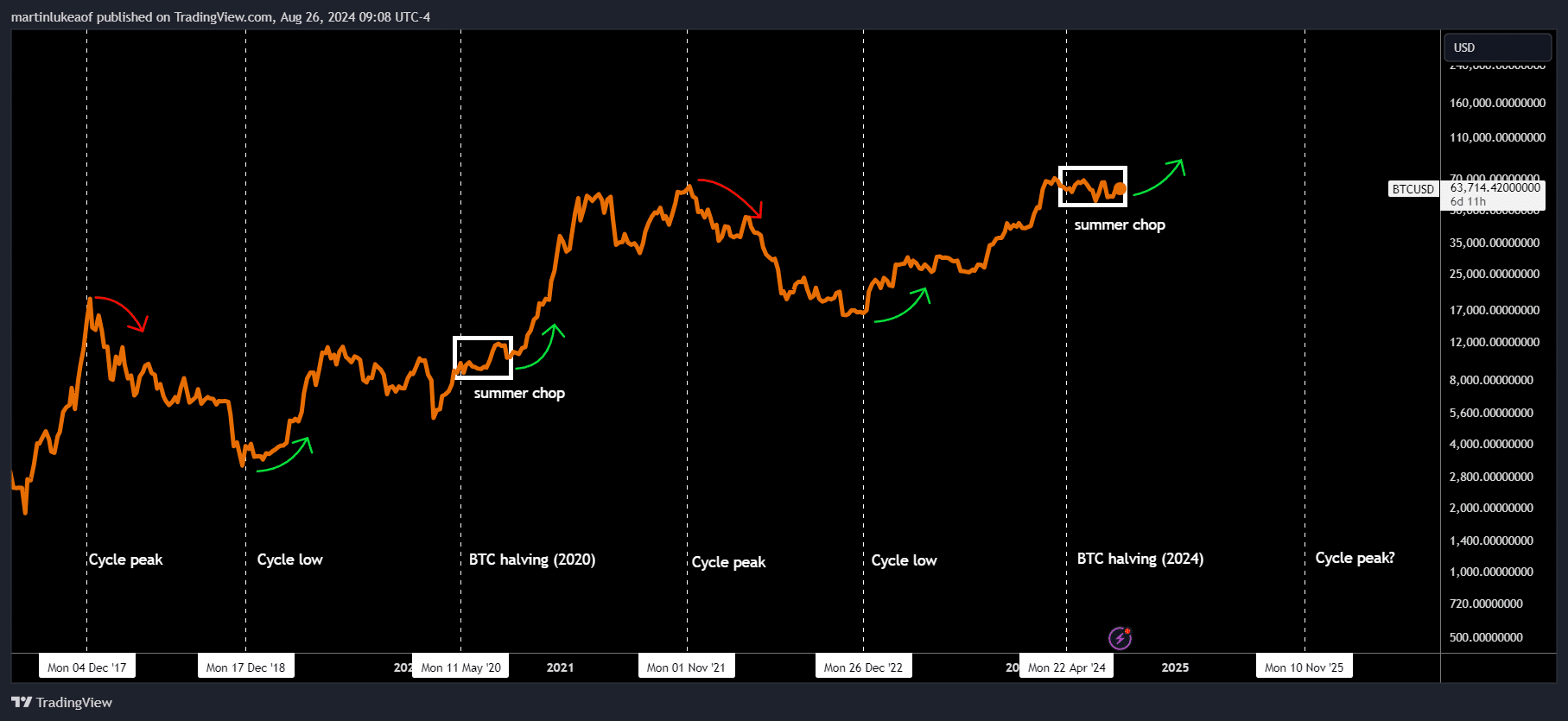

One of the analysts, Luke Martin, common an analysis similar to that of Seyffart and which projects a probable rise after the agitated market of the summer.

“Yeah! Very similar setup to mid/summer 2020. Choppy market after halving, consolidation during uptrend, cycle bottom about 1.5 years ago.”

Source: X

Similar projections after the halving have also been made, last with a price target of $200,000 per BTC by 2025.

That said, Bitcoin has been on a roller coaster ride in recent days despite positive signals from the Fed about a potential policy pivot toward interest rate cuts. The world’s largest cryptocurrency recently surged above $64,000, only to fall back below $60,000, confusing investors and analysts alike.

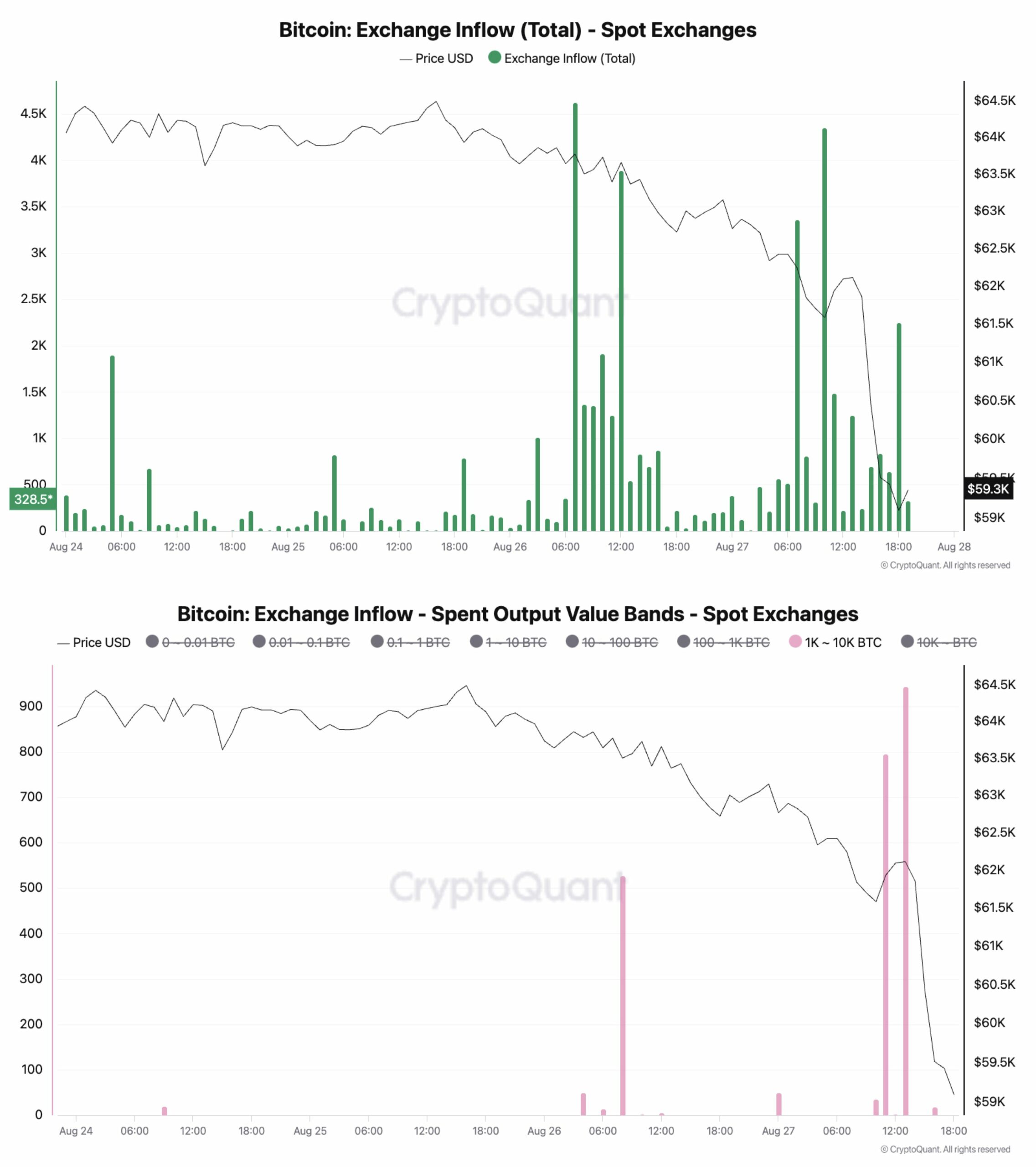

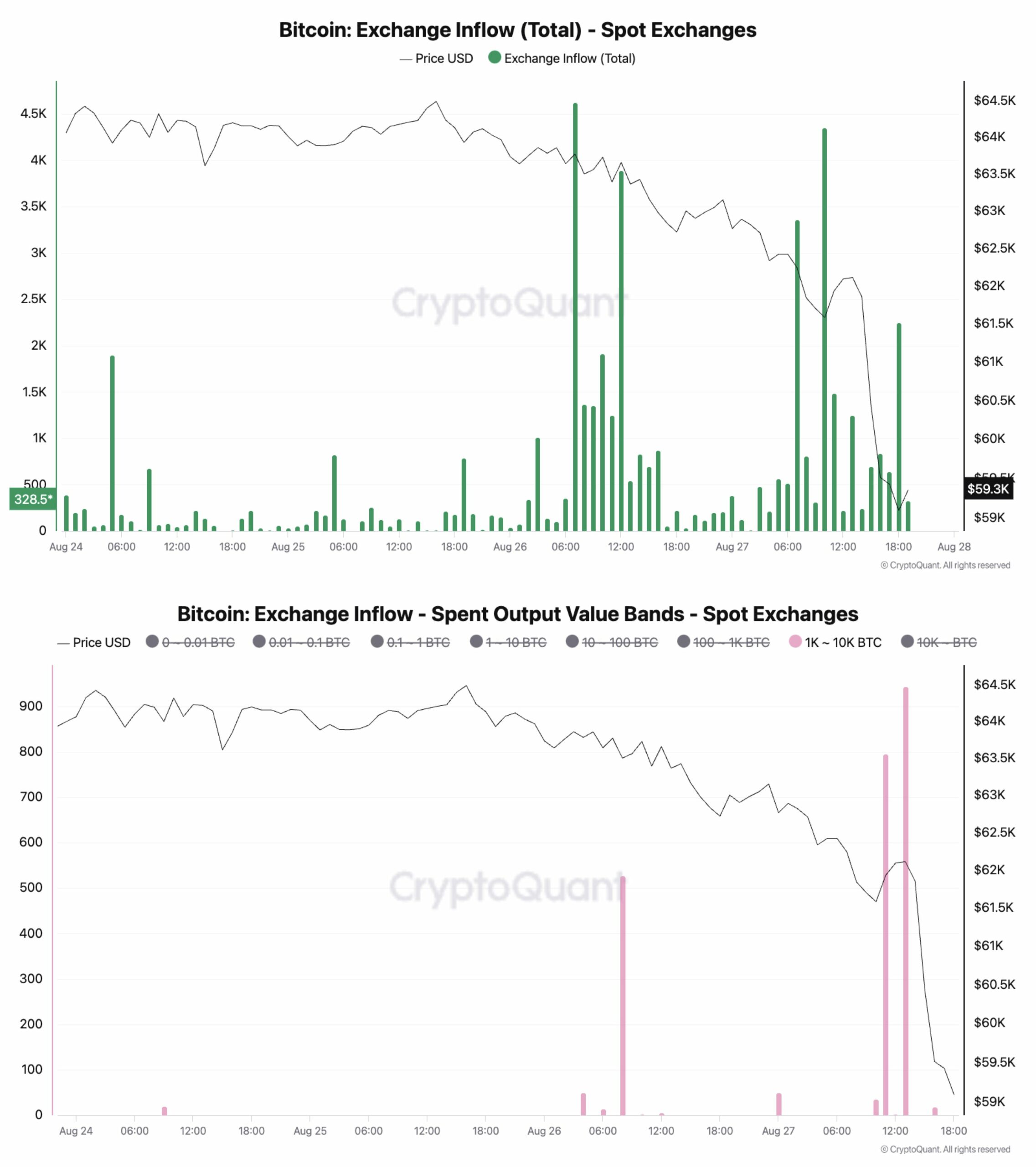

Julio Moreno, Head of Research at CryptoQuant, note that a massive drop in BTC on centralized exchanges from some large wallets triggered the midweek drop.

“There were increasing flows of #Bitcoin to spot exchanges just before today’s selloff (first chart).”

Source: CryptoQuant

On the contrary, analysts at QCP Capital revealed that, given the positive macroeconomic outlook, the current downward pressure could be short-lived before the next upward phase begins.

“We believe any decline in stocks (and cryptocurrencies) will be short-lived. With Powell and the Fed poised to kick off a rate-cutting cycle, increased liquidity will eventually push risk assets higher.”