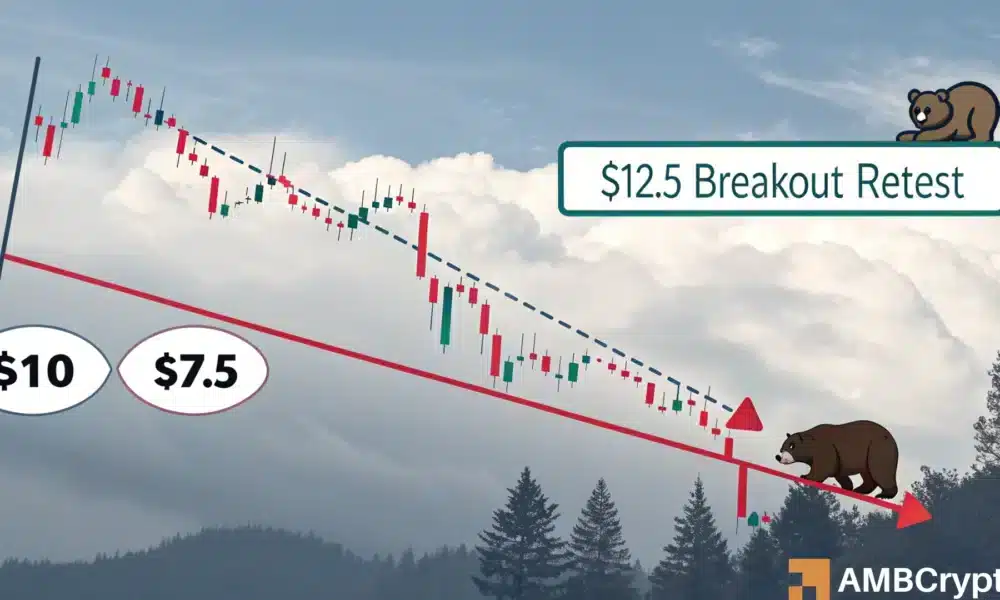

- Link’s detection of its $ 12.5 rupture zone referred to a possible downward continuation

- Chain and liquidation data supported a drop -in potential for levels of $ 10 and $ 7.5

After a week of coherent decline, ChainLink (Link) tested a key resistance area around $ 12.5 – a level that previously acted as a key support. The action of Altcoin prices seemed to be a remediation of the rupture area which could now turn into the resistance. In fact, this also alluded to a lack of conviction on the bullish side.

However, Link can see a greater withdrawal if the Bulls do not maintain this critical price level. The wider market remains undecided and Chainlink (link) recent the retracement has been in expectations.

Source: tradingView

In addition, the price failed to display a high level after exceeding almost $ 16.

Retry the descending trend line at around $ 12.5 without convincingly bounced is a sign of a weakening structure.

Link’s lower configuration reinforced by data on the chain

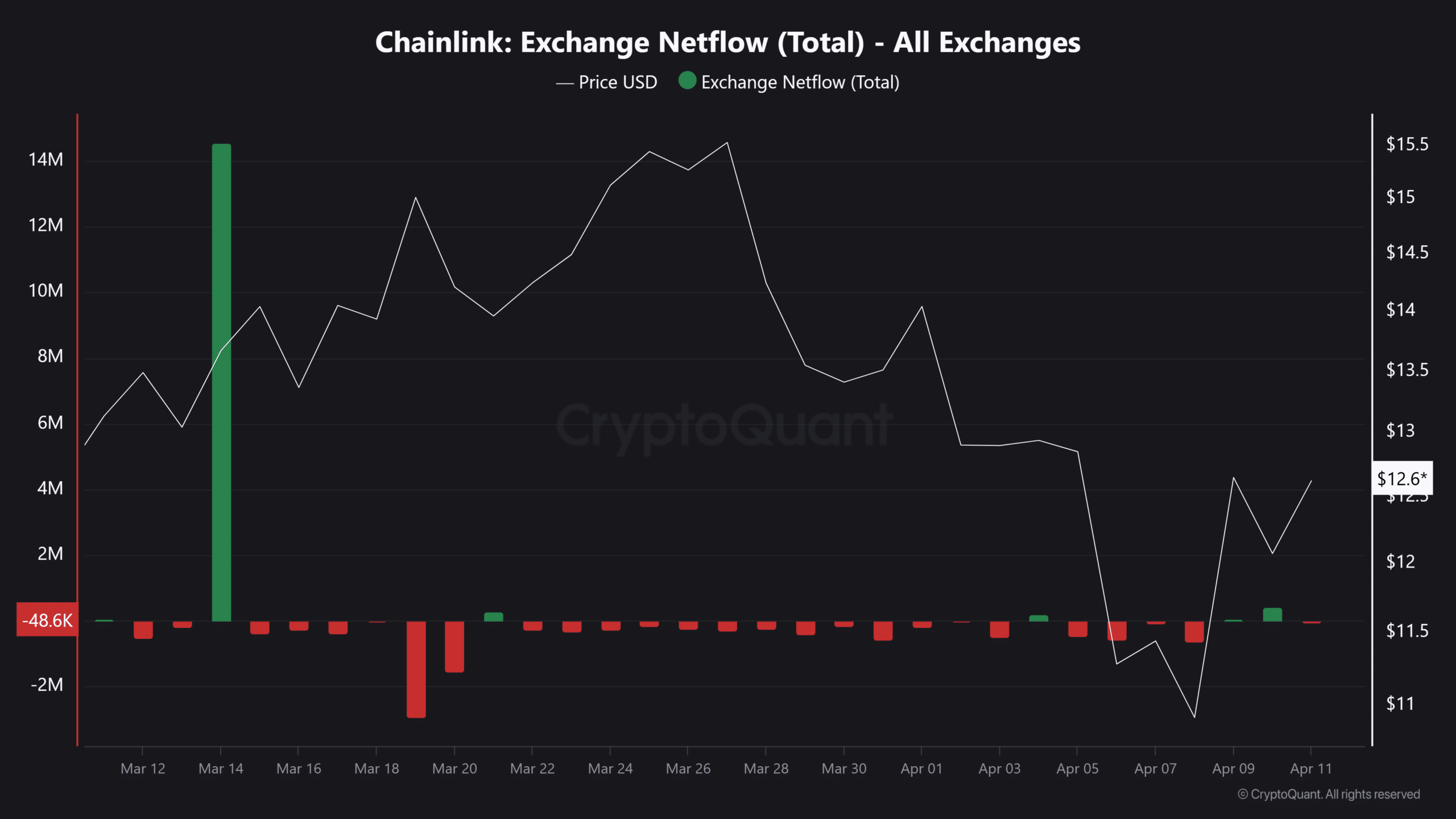

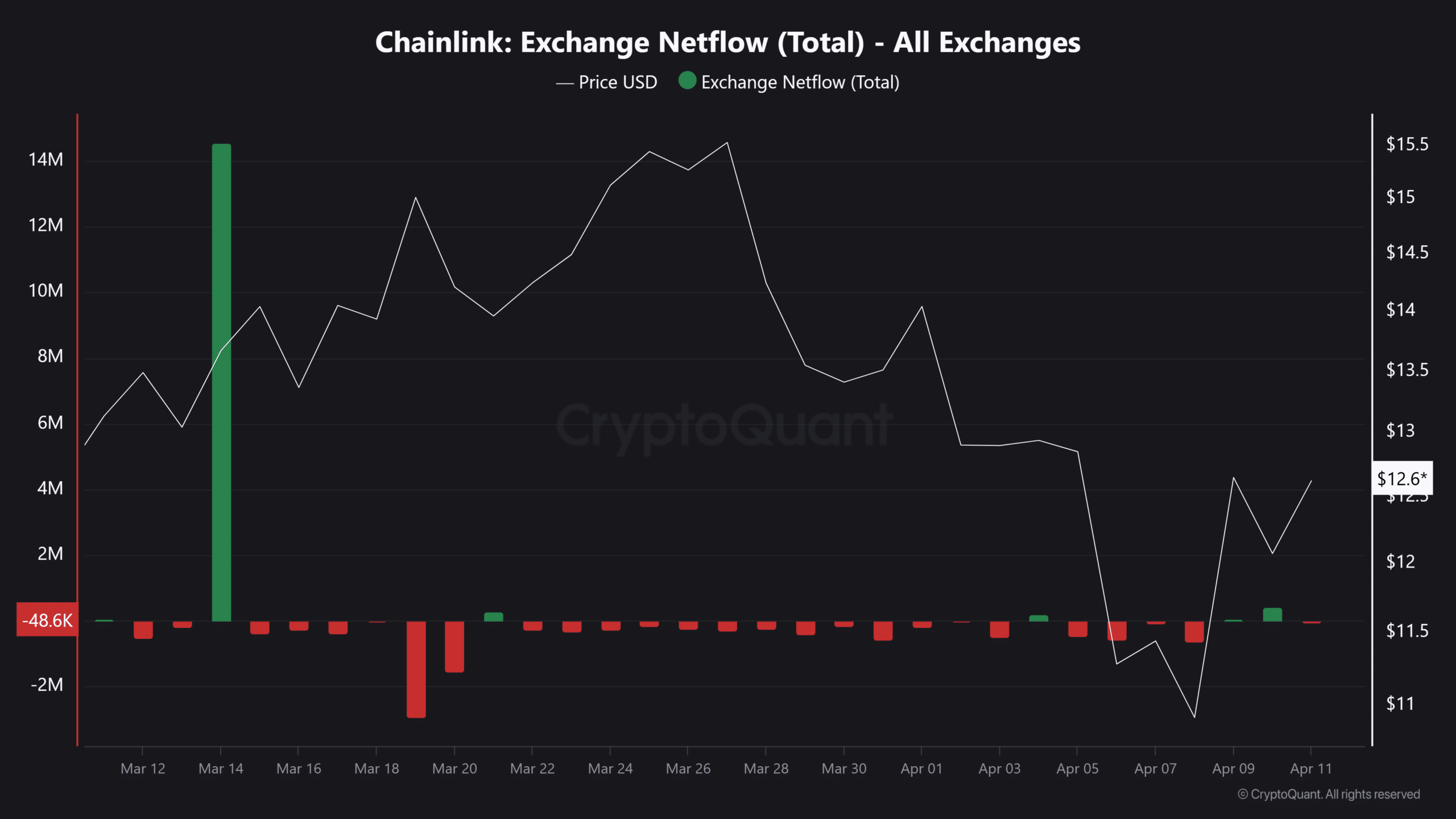

At the time of writing the writing moment, the data on the chain seemed not to be reassured to Link’s bulls.

According to Cryptochant, Altcoin’s net deposits on exchanges are only slightly higher than their 7 -day average. It is generally a sign of increased sales pressure.

Higher net deposits generally represent investors drawing decentralized exchanges funds and sending them to centralized exchanges in order to sell.

Now, although the increase has not exceeded the limits, it has coincided with a downward technical perspective. This convergence can justify Link’s lower bias on graphics.

Source: cryptocurrency

Liquidation clusters refer to a new drop beyond $ 10

Finally, leverage traders can still influence Link’s prices trajectory.

The thermal marshes of liquidation also revealed a group of long liquidation levels near the marking of $ 10. Merchants like to hunt these areas of liquidity during periods of uncertainty.

Source: Coringlass

If Link moves around $ 10, triggering liquidations, this sales pressure could trigger a cascade of events. Then, another $ 7.5 thrust – the previous summit of 2023 – would become likely.

The $ 12.5 zone must keep to avoid deeper losses. With high exchange deposits and liquidation pools visible below, the path of the slightest resistance is south for the moment.