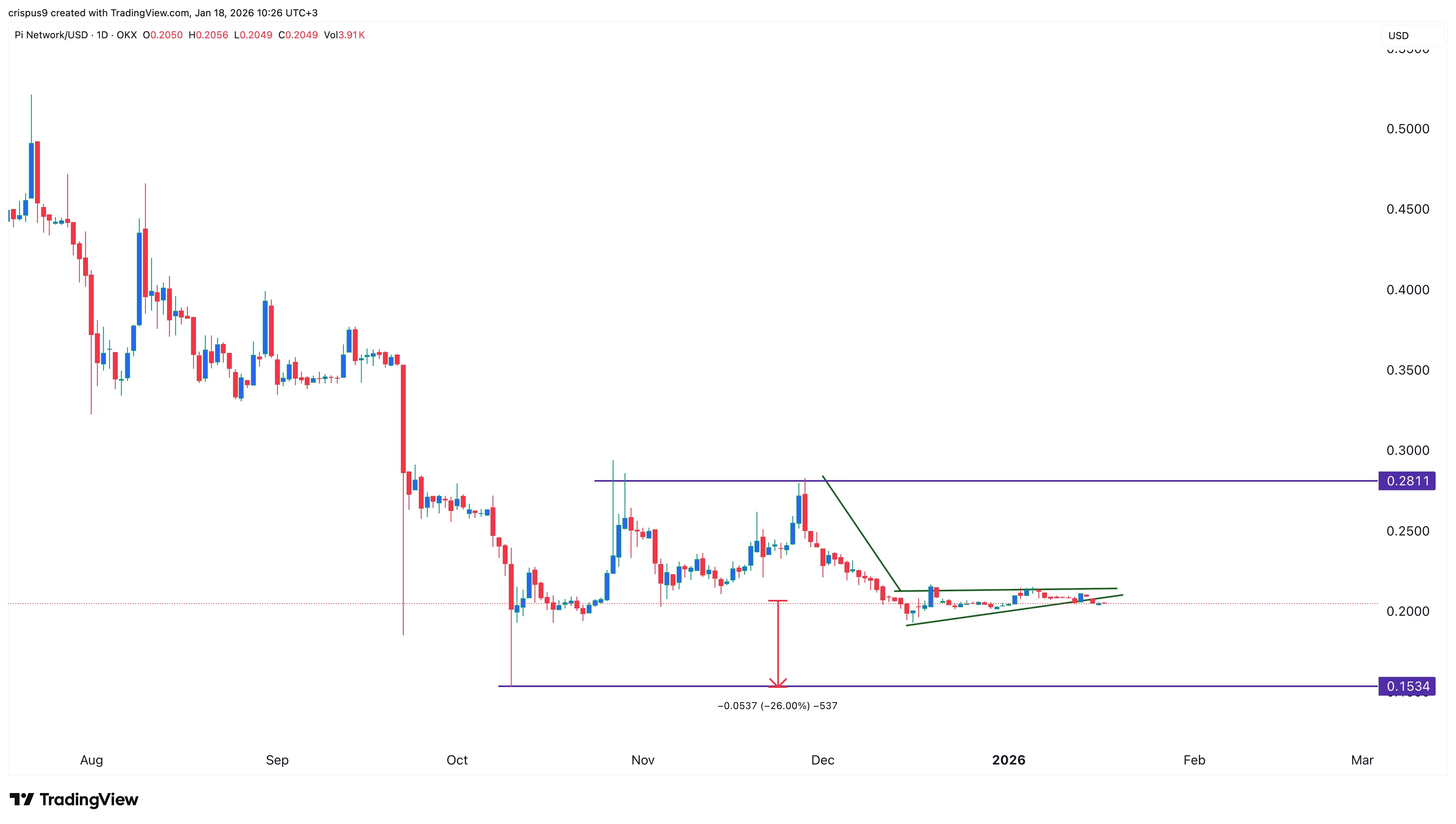

Pi Network price has turned horizontal over the past four weeks as demand remained low and supply continued to increase.

Summary

- The Pi Network price is stuck in a tight range this year.

- Demand for the token has declined, with 24-hour volume falling to $7 million.

- The token formed a rising wedge pattern, indicating a bearish breakout.

The Pi Coin (PI) value remained stuck at $0.2050, a key level that coincides with the November low. It has fallen more than 90% from its 2025 peak.

The continued weakness coincided with low volume, with the 24-hour figure falling to $7 million. Its volume was much lower, considering that the entire crypto market was worth $60 billion in volume during the same period. This is also a tiny amount for a cryptocurrency with a market capitalization exceeding $1.7 billion.

At the same time, the coin supply continued to increase due to the daily unlocking of its tokens. It unlocks over 100 million tokens this month and 1.2 billion over the next 12 months.

Other data shows the number of whales in the network fell from 23 to 20 earlier this year. A Pi network whale is defined as a user who holds tokens worth more than $10 million. However, the largest whale continued to accumulate tokens and now holds over 393 million tokens worth over $80 million.

The Pi Network price has also fluctuated as the media drought continues. The team has not made any significant announcements regarding market developments this year. The only news came out on January 10 when they released a new development library that makes it easy to integrate Pi payments into Pi applications.

Pi Network Price Technical Analysis

The daily time chart shows that the Pi Coin price has been moving sideways over the past few weeks. As a result, the Average True Range indicator has fallen, a sign of low volatility.

The token remained below the 50-day exponential moving average and the Supertrend indicator. More importantly, it formed a rising wedge pattern, consisting of two converging ascending trendlines.

The token also formed a bearish pennant pattern. Therefore, the most likely scenario is that it would undergo a strong bearish breakout in the coming days, as sellers target the all-time low of $0.1534, which it fell to in October last year.

On the other hand, breaking above the resistance level at $0.2250 would invalidate the bearish outlook.