Bitcoin (BTC) and the larger market of cryptography await the FOMC (Federal Open Market Committee) meeting on Wednesday and the later press conference by Jerome Powell.

The American Federal Reserve (Fed) will announce its last interest rate decision on Wednesday.

Bitcoin cryptography market awaits the FOMC verdict

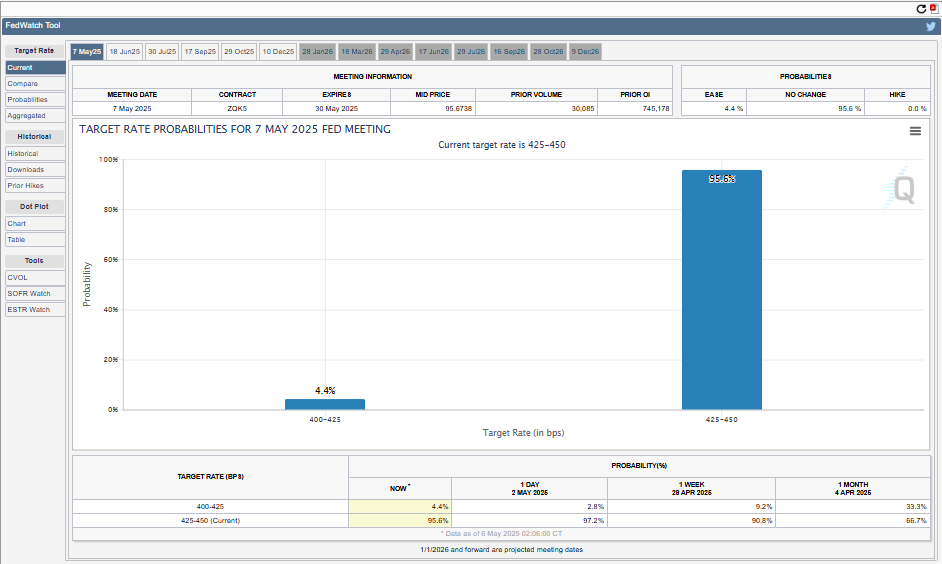

According to data on the CME Fedwatch tool, market players attribute a probability of 95.6% that the Fed will hold from stable rates to 4.25% to 4.5%. With this, the attention is now downright focused in the tone and advice from the Fed Chair, Jerome Powell, at the Wednesday conference.

“… If the 3.5% (now 4.4%) end up playing, the markets will have a mad positive reaction,” wrote Bitcoinsensus.

Despite the high probability that the Fed maintains stable interest rates, volatility remains almost certainty. The merchants have adopted a risk position, with a bitcoin price consolidating in the range of $ 94,000.

Similarly, the ETF entries (negotiated funds on the stock market) slow down, in parallel with the increase in liquidations. Swissblock analysts describe the atmosphere as a “battle” of resistance. They cite negative financing rates and high open interest, which suggests that bears intensify short positions.

“The range of $ 97,000 at $ 98,500 is essential. The momentum could trigger short liquidations, pushing the BTC upwards. But beware: a bear trap could turn into a bull trap if the conviction fades,” warned Swissblock.

This week’s FOMC meeting marks a pivotal moment for risk assets. Historical data show that three of the last five FOMC decisions have led to bitcoin bitcoin results. However, it comes in the midst of increased uncertainty.

The market always digests the prints of softer GDP, the current trade tensions in progress and the concerns of inflation, in particular in the light of Trump’s tariff rhetoric, which has darkened tariff expectations for June.

“This FOMC meeting on Wednesday May will lead to interest rate conservation, but the expectations of June also changed,” noted the merchant Veteran Mathew Dixon.

Powell’s words can trigger a breakage from Bitcoin – or a breakdown

Such ambiguity feeds market anxiety. In December 2023, Powell’s feet pivot sparked a “bloodbath” in the risk markets, and some traders are now afraid of rehearsal.

“The bull markets do not die of old age – they are murdered by the Fed. If the tone of Powell echoes Blood Bath in December or ignores negative GDP, the markets can repeat the same violent hunt … It is a drunk game of darts for Wall Street analysts,” said Trader Jim.

Meanwhile, analysts like Michaël Van de Poppe see the recent gathering of Gold as a dominant sign of prudence.

“We always see the risk mentality in the Fed meeting … Bitcoin construction is good … expecting to see eTh rising after Wednesday,” he said.

Another analyst, Crypto Seth, observed an increasing Degen activity while the Bitcoin price forms a local background around $ 94,000.

“Degens constitutes positions anticipating a move. Market manufacturers could simply evacuate and grasp the long before … Bitcoin could be jerky before the FOMC,” he said.

The wider macro backdrop is just as troubled. Analysts highlight the unresolved trade in China and their impact on consumption, labor markets and, ultimately, political results.

“Uncertainty is now a responsibility for Trump, not a negotiation tool,” they said.

Despite the whirling fears, an escape remains on the table. The bulls could get the green light if Jerome Powell hits a tone or more dominant indices later this year. According to the co-founder of Bitmex and former CEO, Arthur Hayes, the Fed Passing with quantitative relaxation (QE) could see the price of bitcoin becoming parabolic.

However, Bitcoin could review recent stockings in a net set if the Fed doubles the donut. Before the FOMC Wednesday meeting, the market walks on a tightrope, and all eyes are on Powell to decide how it gives.

Beincryptto data show that Bitcoin was negotiating $ 94,474 to date, down 0.16% in the last 24 hours.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.