- Aave’s new yield options allow it to compete with popular fintech solutions like Wise and Revolut

- The market has reacted positively since development, the purchase activity increasing in the last 24 hours

Aave (Aave) could call on investors on the market at the moment after a month of major sales, altcoin has lowered 19.42%. In response to this positive feeling, the crypto climbed 3.57% shortly after? That’s not all, because at the time of the press, there was more indications that the rally could continue.

During this market phase, merchants bought a large amount of AAVE. Throughout the value of the ecosystem accumulated during this period, continued to climb.

The Aave protocol surpasses Fintech solutions

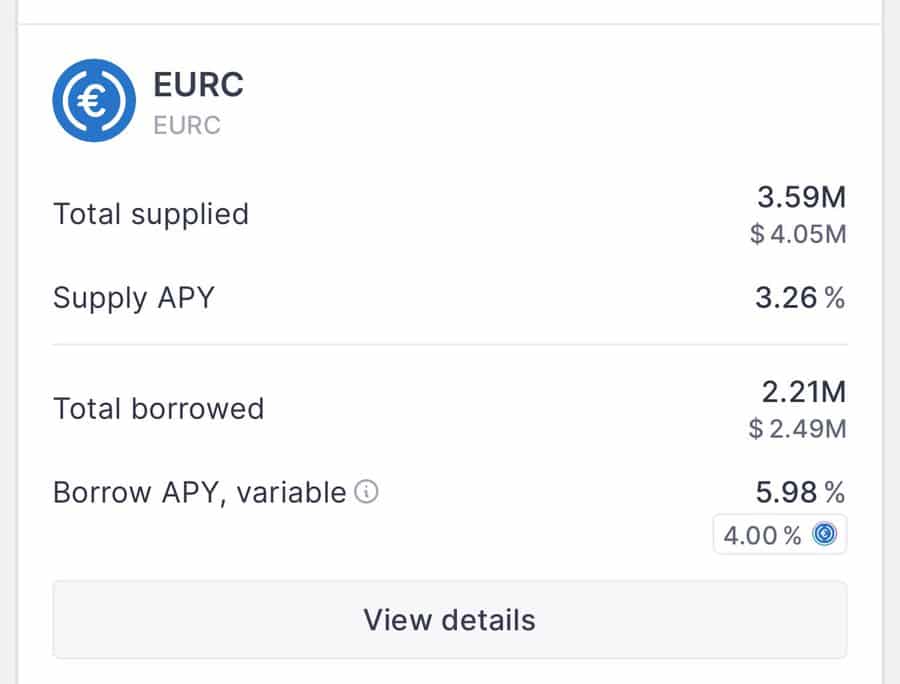

According to a recent article by the founder Stani Kulechov, Aave now provides more yield on its EUR part than the popular fintech solutions Wise and Revolut, which offer lower interest rates.

Source: Aave

Landers on Aave now earn up to 3.28% APY – higher than 2.24% WISE and 2.59% revolut (ultra plan).

Naturally, these high yields reshape as a lucrative magnet for eagerly -efficient users who are looking for better capital efficiency.

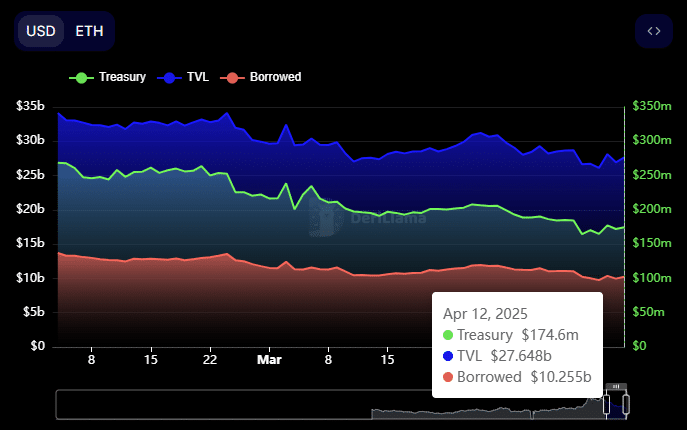

In addition to this, Defillama data revealed an increase in activity through the protocol, liquidity inputs marking a visible increase. Aaves loans have climbed to $ 10.255 billion – indicating an increase in user engagement at all levels.

Meanwhile, the protocol TVL reached $ 27.648 billion, referring to more deposits and stronger confidence in the Aave ecosystem.

Source: Defillama

This suggests that there is a tendency to grow among the participants on the market. By extension, this could affect the value of Aave on the graphics – the native token of the platform.

How did the market react to Aave?

Market buyers continued to accumulate Aave after the news of its development and attractive yields.

In fact, intotheblock data highlighted a significant increase in the amount of Aave bought on exchanges for long -term detention. At the time of writing this document, around $ 1 million in Aave had been bought on the market.

Source: intotheblock

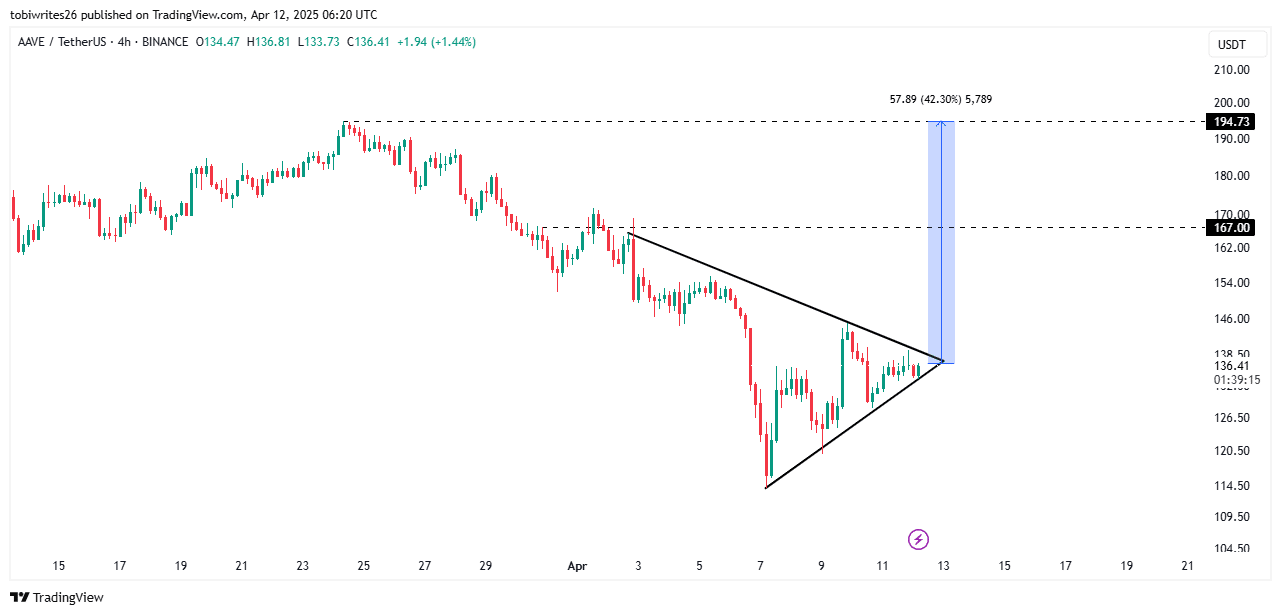

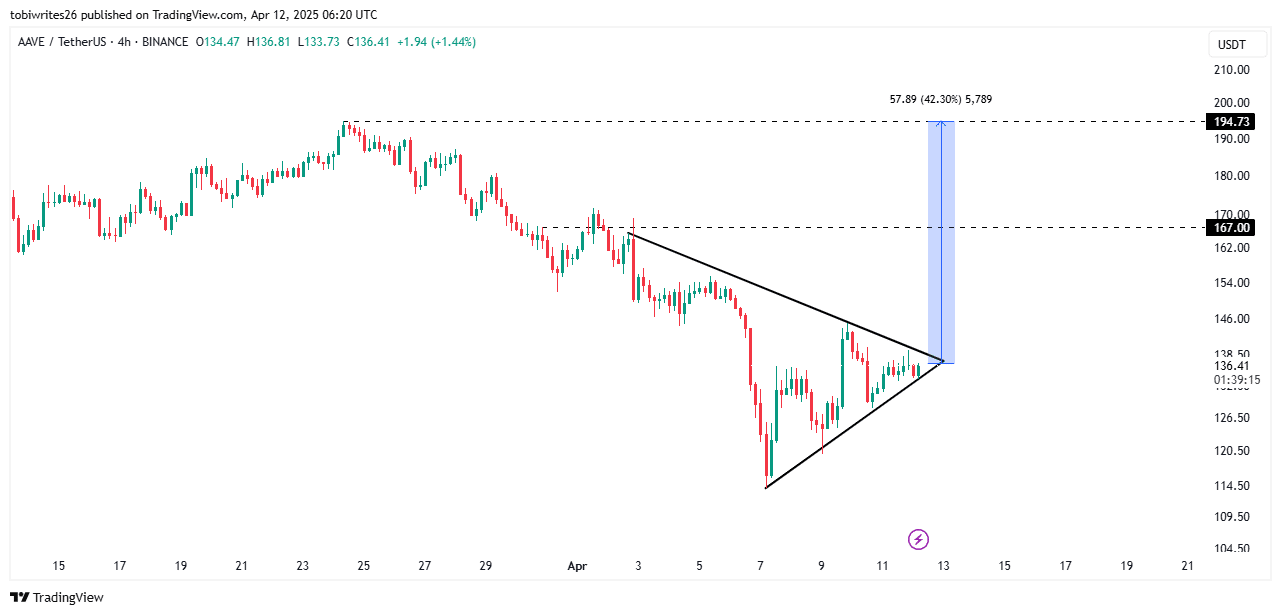

This growing interest, if it continues, could lead to a massive gathering of 42%, Altcoin reaching $ 194. This could be the case since the asset is negotiated in a symmetrical triangle model known as the bullish reason.

This model consists of convergent support and resistance lines. A violation of the resistance line would point out the start of a rally for Aave, with a short -term goal of $ 167 and a long -term goal of $ 194.

Source: tradingView

Such a rally will also depend on the strength of the momentum of the market. If it remains high, the violation is more likely.

On the contrary, Aave can continue to consolidate in this model, where the accumulation continues to occur.

Adoption remains high

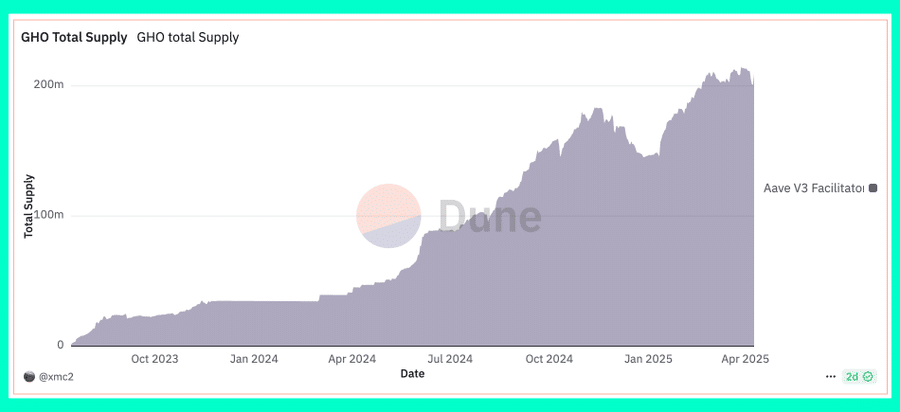

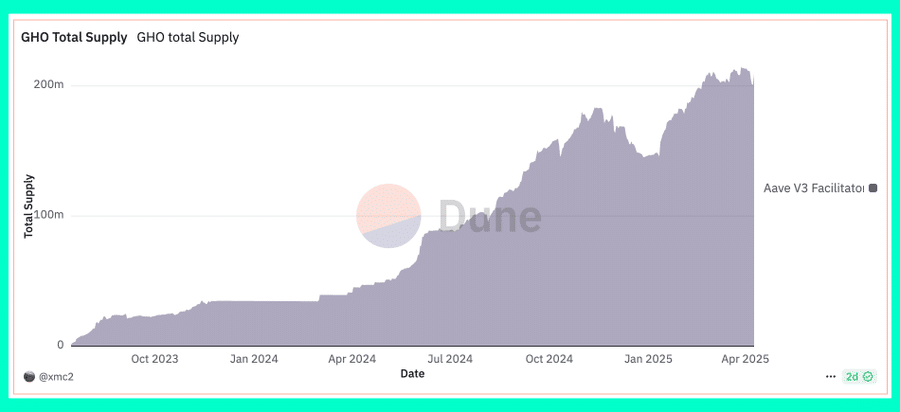

There has been an increasing adoption of Aave’s native stablecoin, the GHO, with the same massive growth of 442% in the past year.

Such an increase in the stablecoin supply implies a sustained utility of the stablecoin and, by extension, the Aave protocol. If the total supply increases, it would mean growing demand. This would most likely be reflected in the value of the value of Aave above on the graphics.

Source: Dune Analytics

Finally, the feeling of the market has been optimistic lately. Aave is more likely to achieve its short -term goal of $ 167 if this trend is maintained.