- Soil has decreased by 35.5% in recent months.

- The daily active addresses of Solana and the activity on the chain have decreased, signaling pressure downwards.

Since he reached a local summit of $ 195 three weeks ago, Solana (soil) has undergone strong down pressure. During this period, Solana refused to reach a hollow of three months.

With such a strong downward trend, the question is what makes Solana decreases? The analysis suggests that Solana is fundamentally struggling with low activity on the chain.

The drop in Solana’s activity on the chain

The activity of the Solana chain has been in constant decrease in recent months. As such, the number of daily active addresses of the network refused to reach a three -month lower 3.5 million.

Source: Artemis

When active users decrease, it reflects a sharp drop in market interest and lower adoption. Often, lower active users lead to a reduced chain activity, which could cause prices to be depreciation.

Historically, a lower number of users is generally correlated with the drop in prices as demand drops.

Source: Artemis

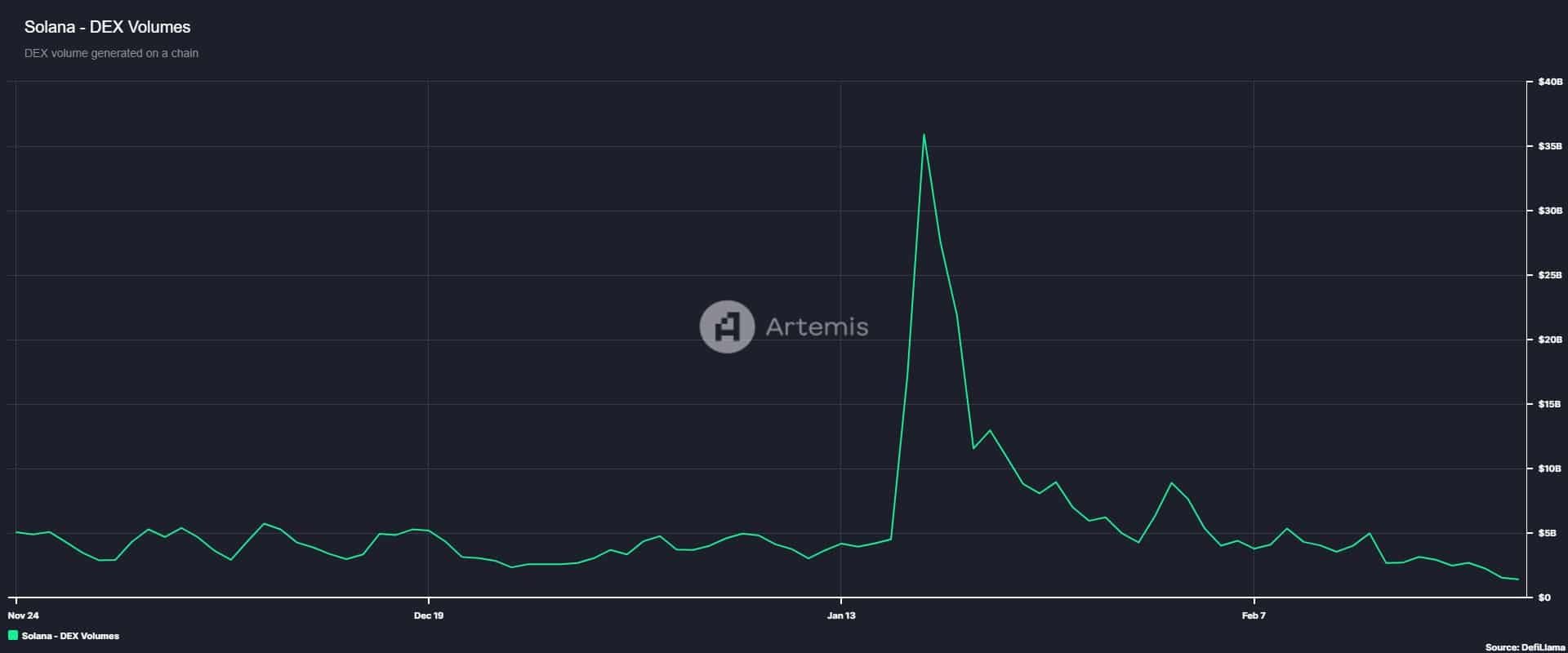

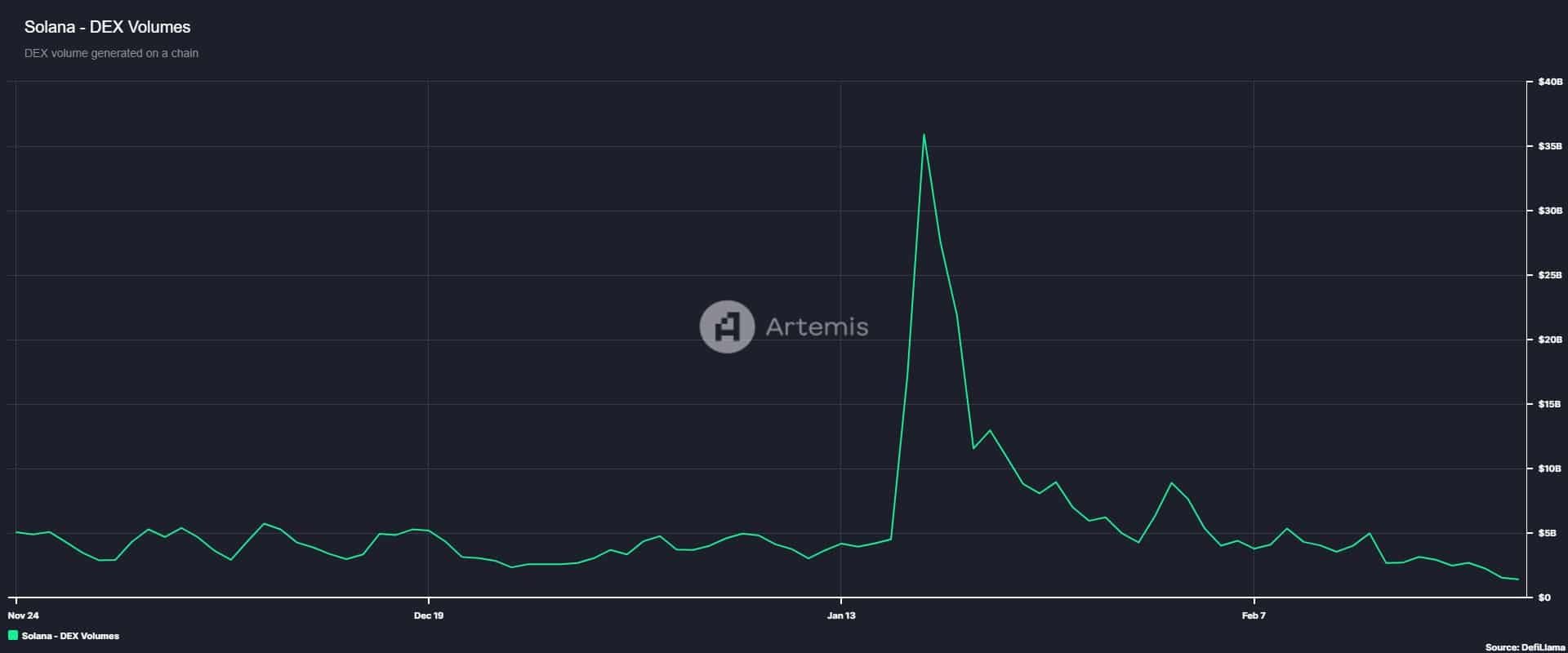

This reduced activity on the Solana chain is also highlighted by the decentralized exchange volume (DEX) in decline. According to Artemis Data, this dropped to a four -month $ 1.5 billion.

Such a decline suggests reduced confidence in the network, as investors prefer centralized exchanges (CEX) to security problems.

Source: Artemis

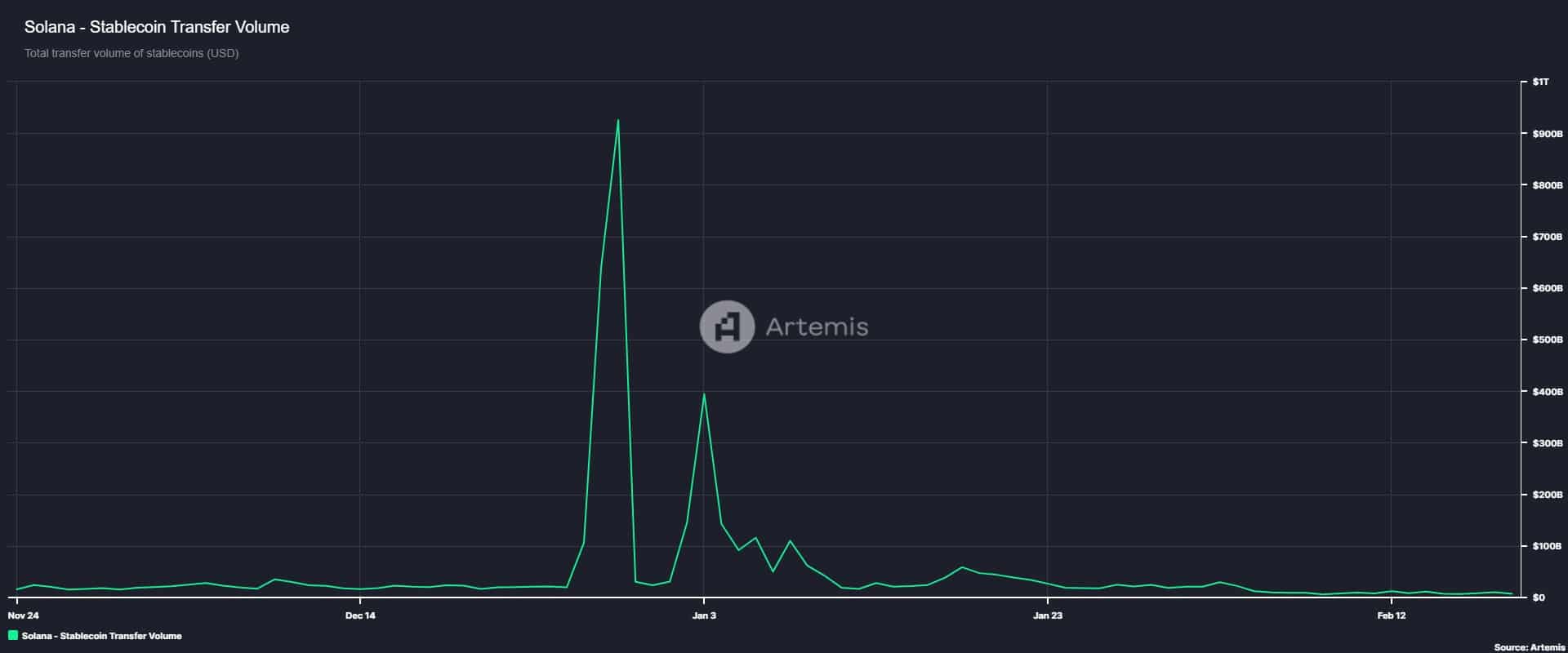

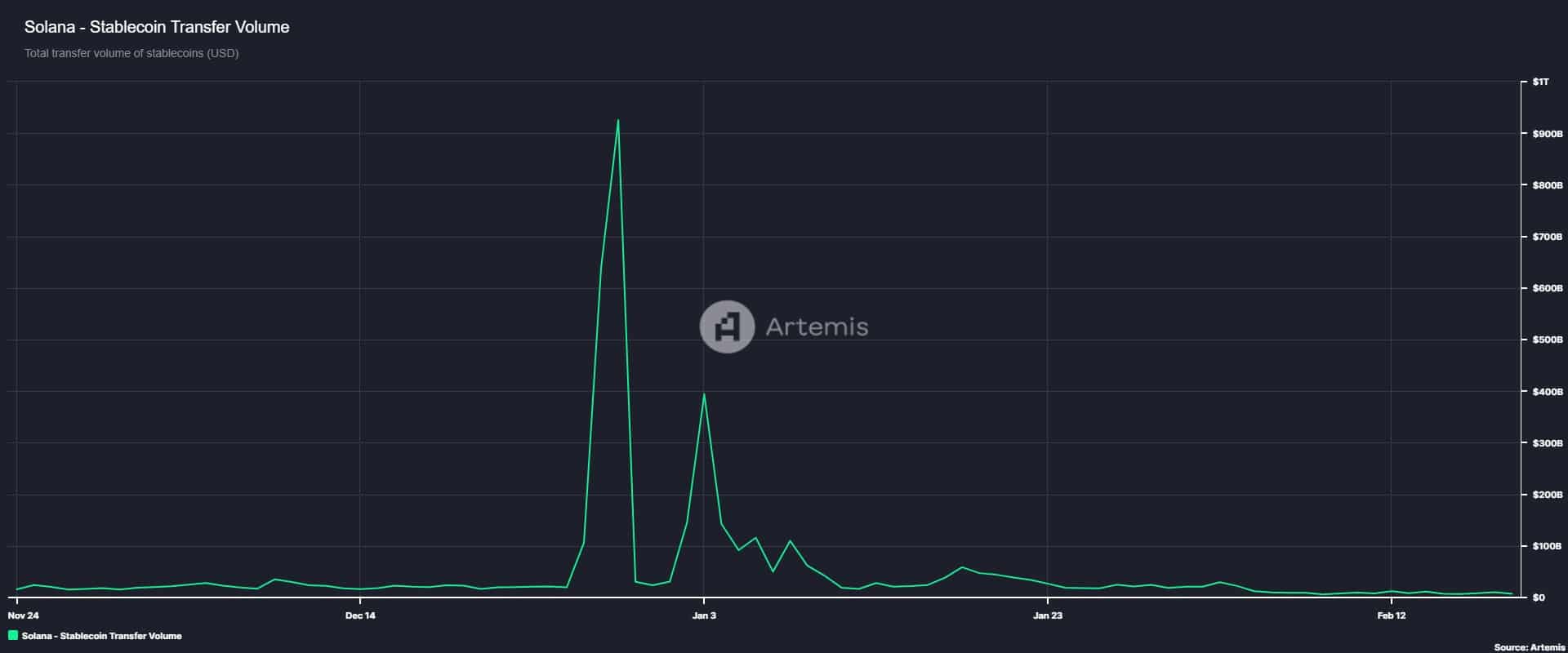

In addition, the Solana Stablecoin transfer volume fell to $ 7.1 billion. This marks a sustained drop of $ 394 billion a month ago.

Such a significant decline suggests that investors, in particular adults, are considering other channels like Ethereum (ETH).

This also reflects a feeling of risk among soil investors.

Impact on floor?

As expected, the reduction of activity on the chain has negatively affected the movements of soil prices. This had an impact on the side of the soil request. Usually, low demand leads to less purchase pressure, leaving the market to sellers and resulting in prices down.

At the time of writing the editorial staff, Solana was negotiated at a three -month $ 158. This marked a 7.09% drop in daily graphics. Solana also dropped by 35.52% in the last month.

With high pressure downwards and low demand, the soil could decrease more.

If the current trend persists, soil may increase to $ 154. However, if buyers take this opportunity to buy the drop, soil could get back to $ 175.