- The increased activity on the chain and in speculative trade highlighted the short -term bullish feeling.

- The higher delay prospects have been lowering and $ 130 at $ 145 could be the levels that crush the Haussiers recovery hopes.

The Solana (soil) price rebounded compared to the lowest on Monday at $ 95.26 at $ 130 at the time of the press, a reversal of 36% in a week.

In an analysis, Ambcrypto noted that the $ 114 region was an important horizontal level. Now that Sol was negotiated again above this level, a recovery seemed possible.

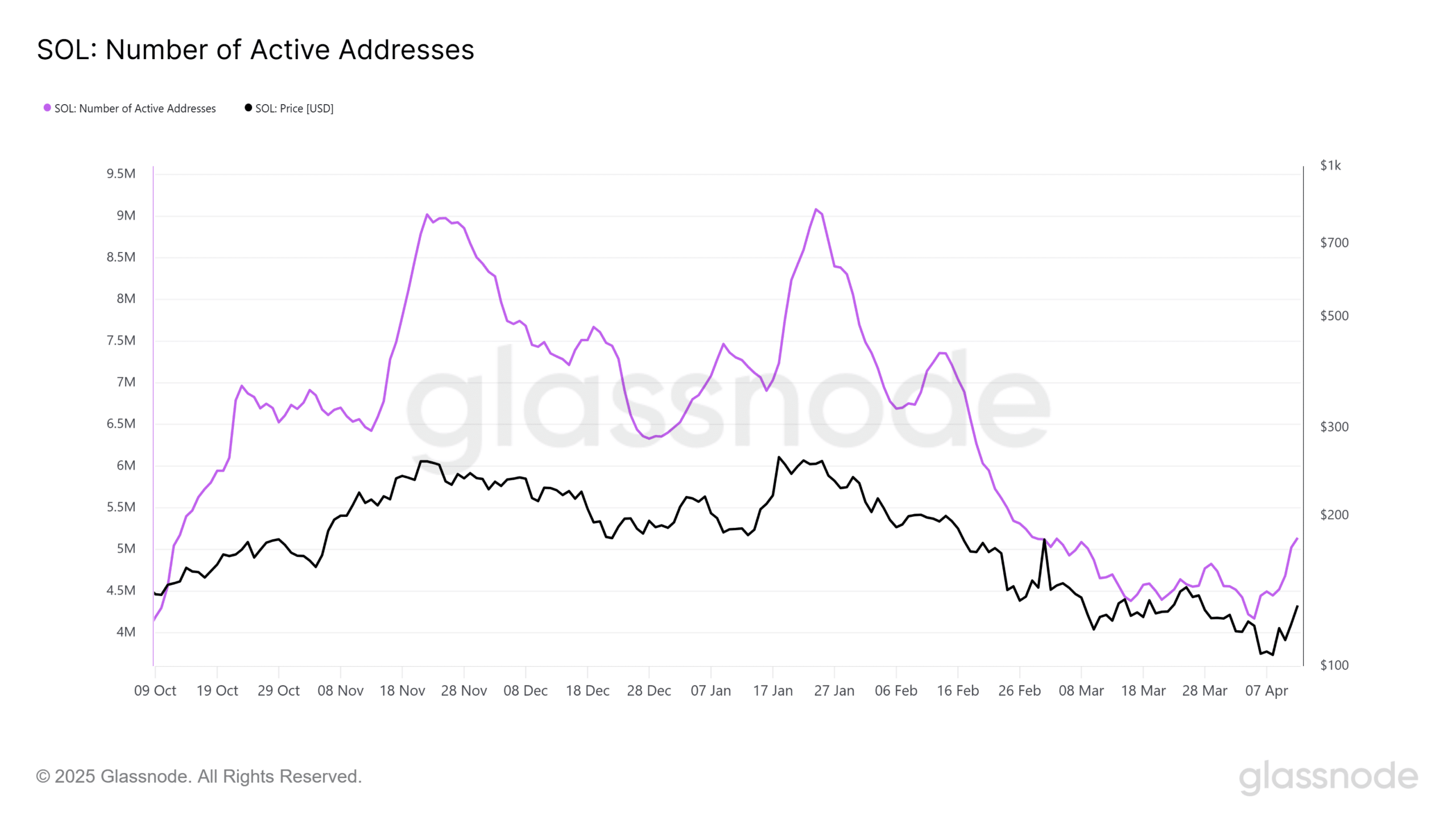

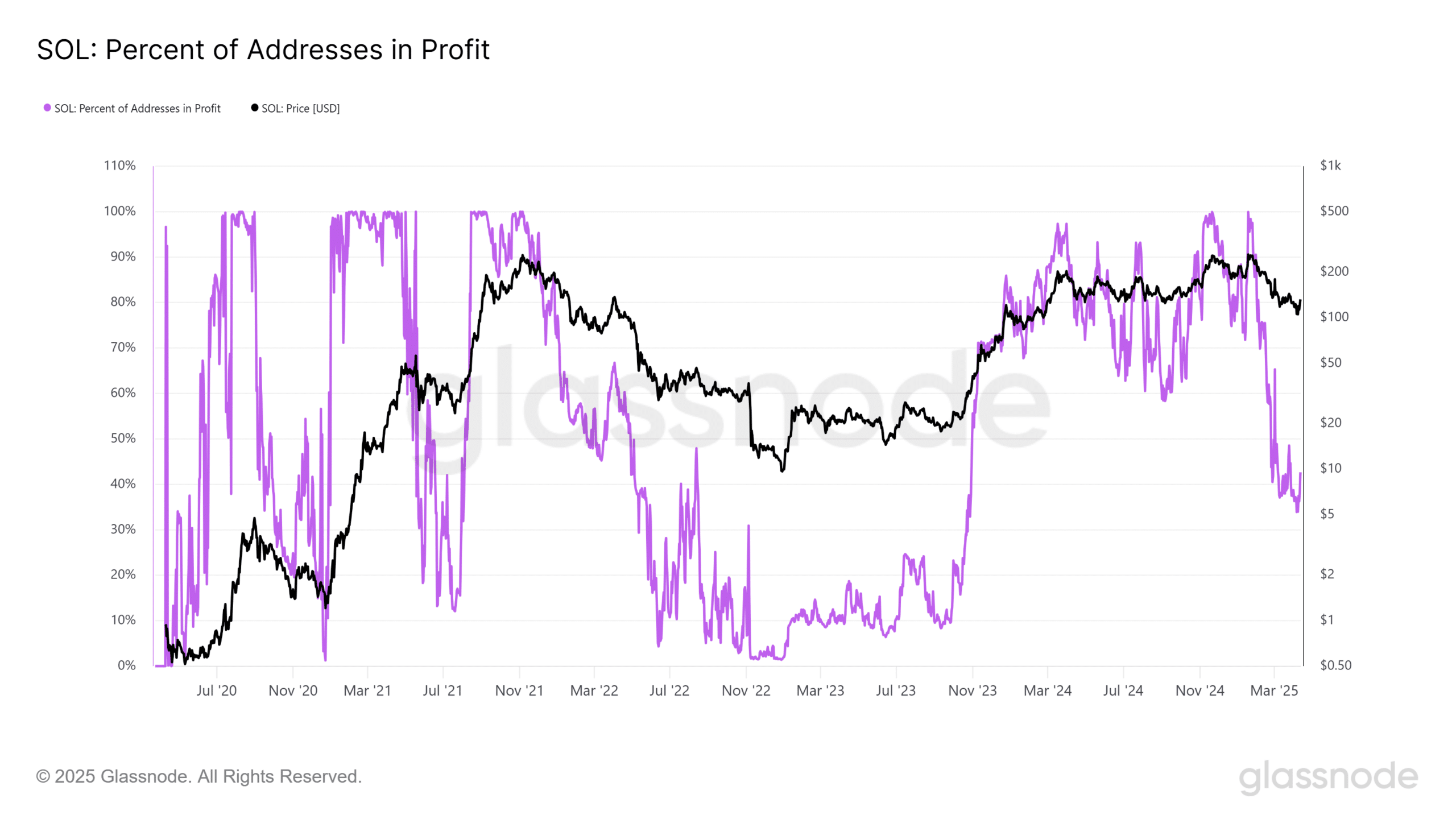

Source: Glassnode

The growing number of active addresses during last week has come parallel to the other rebound. The 7 -day mobile average (MA) was used to smooth the graph, and has shown that the downward trend in recent months could be reversed.

MA of 7 days of active address was already higher than the summits from early March when Sol was negotiated at $ 144.

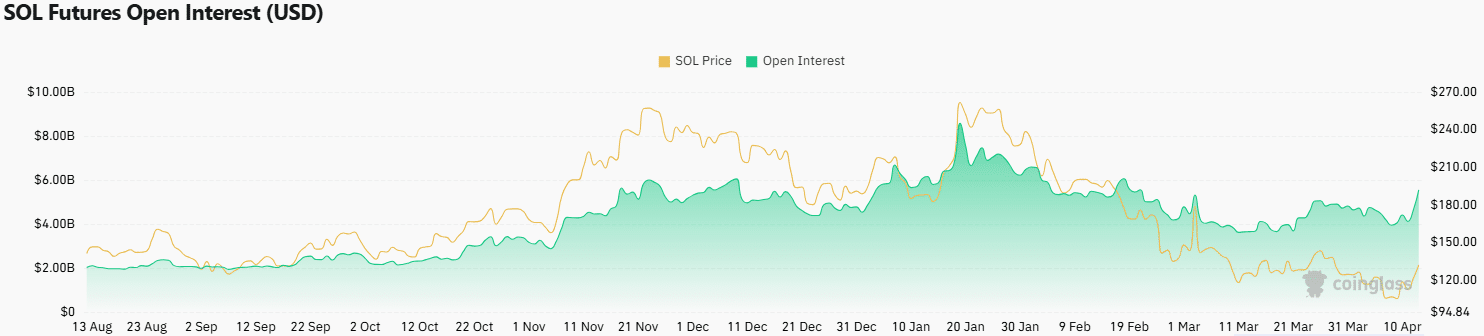

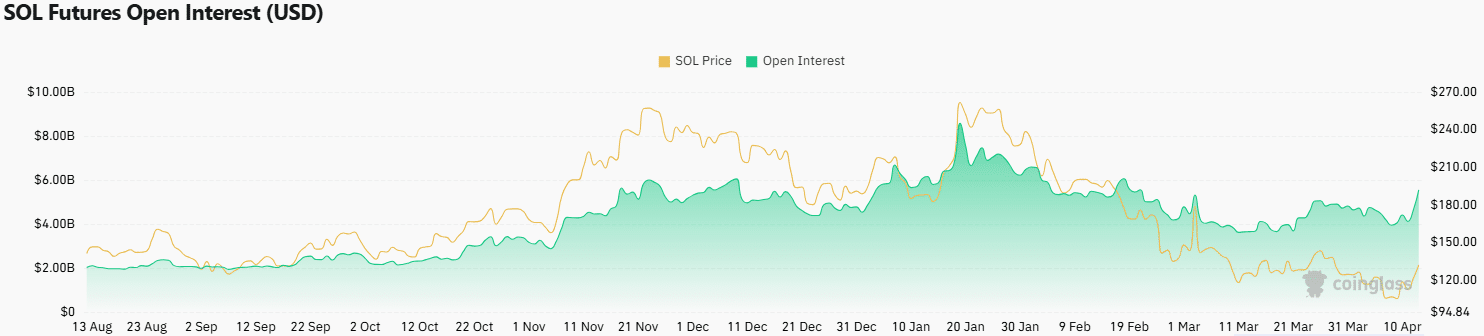

Source: Coringlass

The price rebound of almost 40% last week also caused a wave of speculative trading activities. The open interest (OI) has increased by almost $ 1.5 billion since April 8.

The OI was higher at the time of the press than at any time in March, another sign of a bullish turnaround.

Can Solana Bulls maintain this pressure, or did it bounce an opportunity to sell?

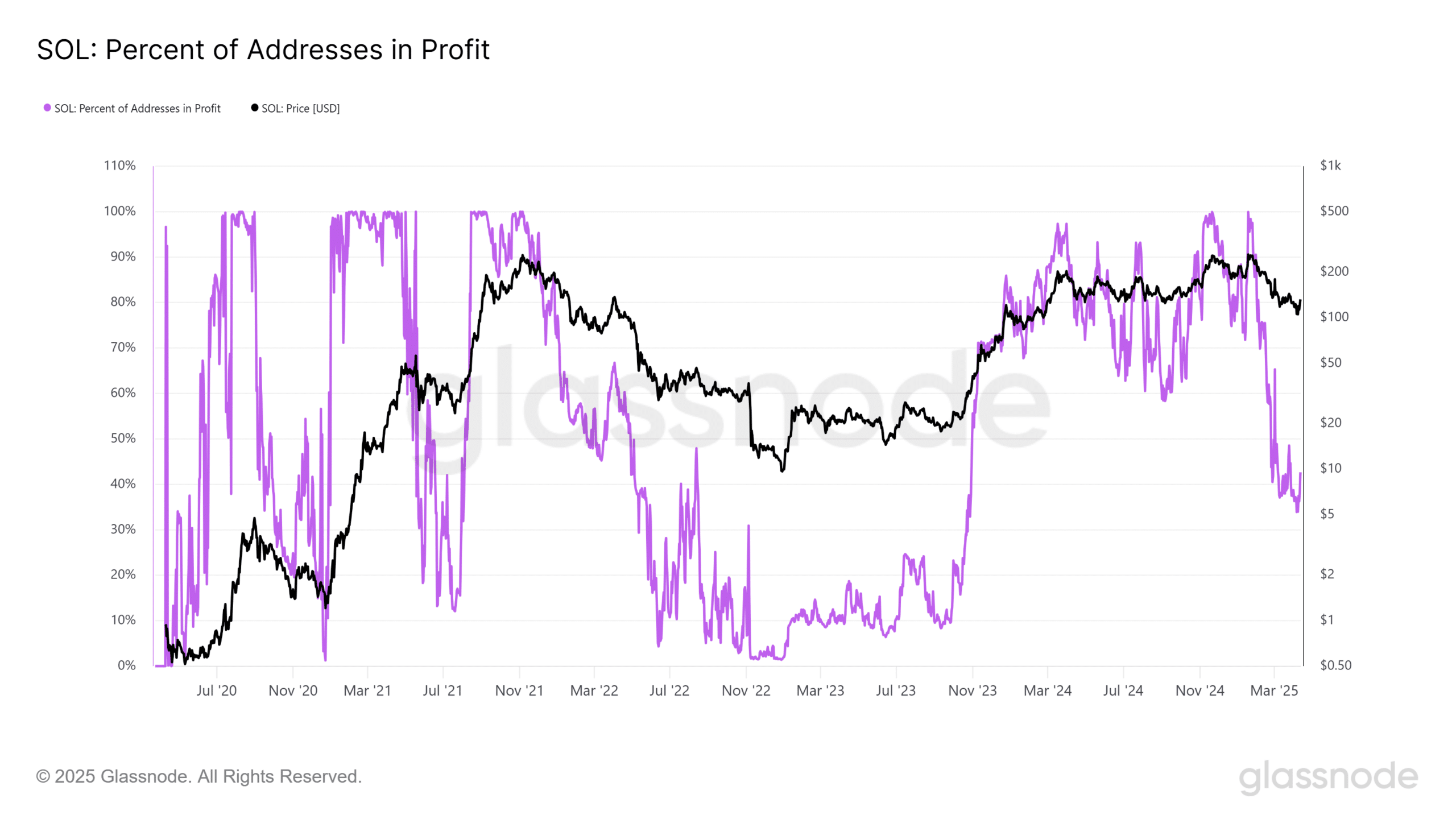

Source: Glassnode

The percentage of unique addresses whose purchase price was lower than the current price of the market was represented in the metric above. The solara downward trend of $ 240 in January has seen metrics falling to lows not seen since November 2023.

At the time, Solana’s price was $ 40 and the lowering market ended. The circumstances were different this time. Throughout 2024, the region from $ 120 to $ 130 had served as a strong support.

The drop in the percentage of profit addresses said that holders would use a price rebound to try to leave the profitability threshold. Consequently, the recent price rebound may not materialize in the inversion bulls.

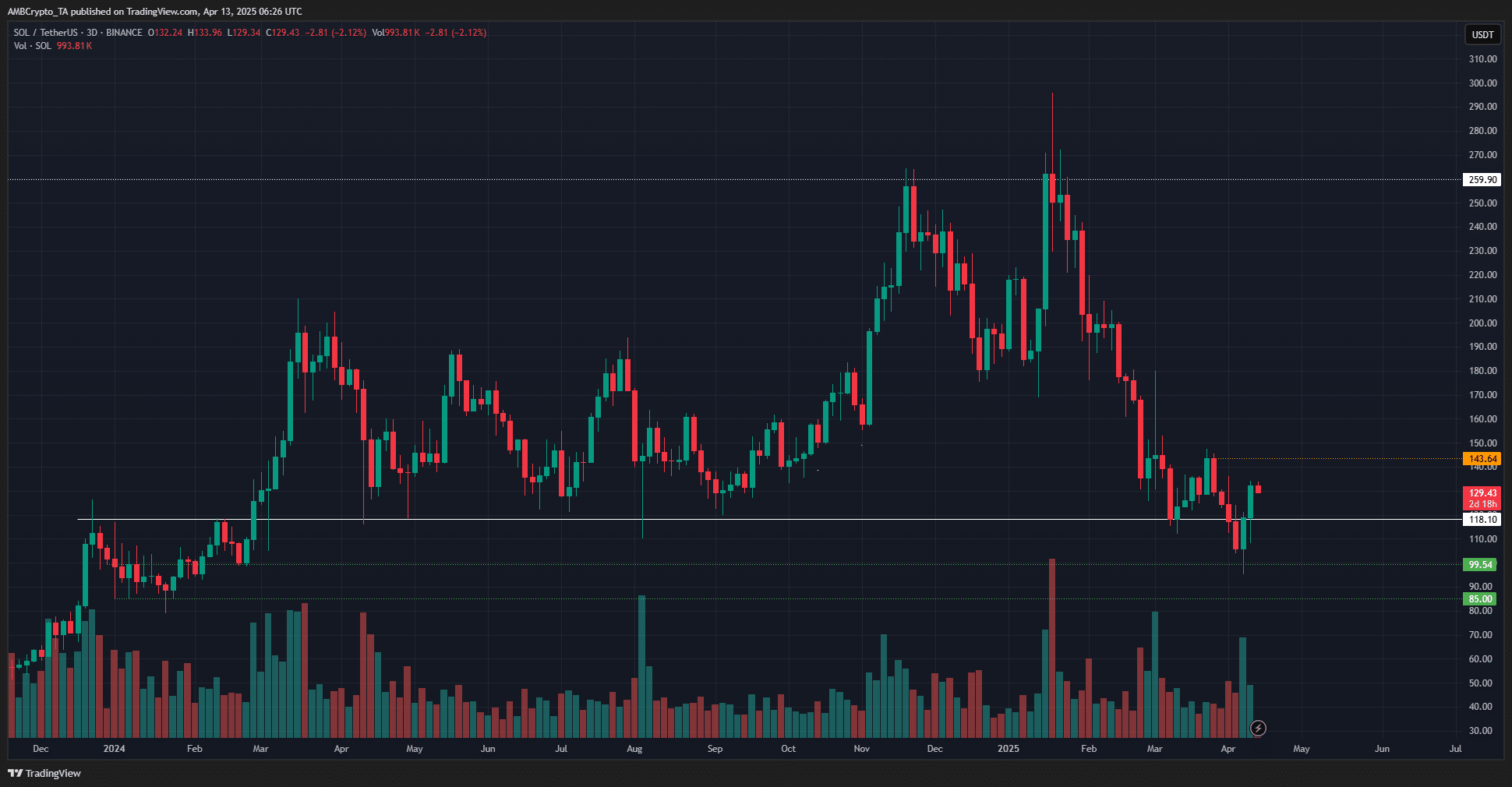

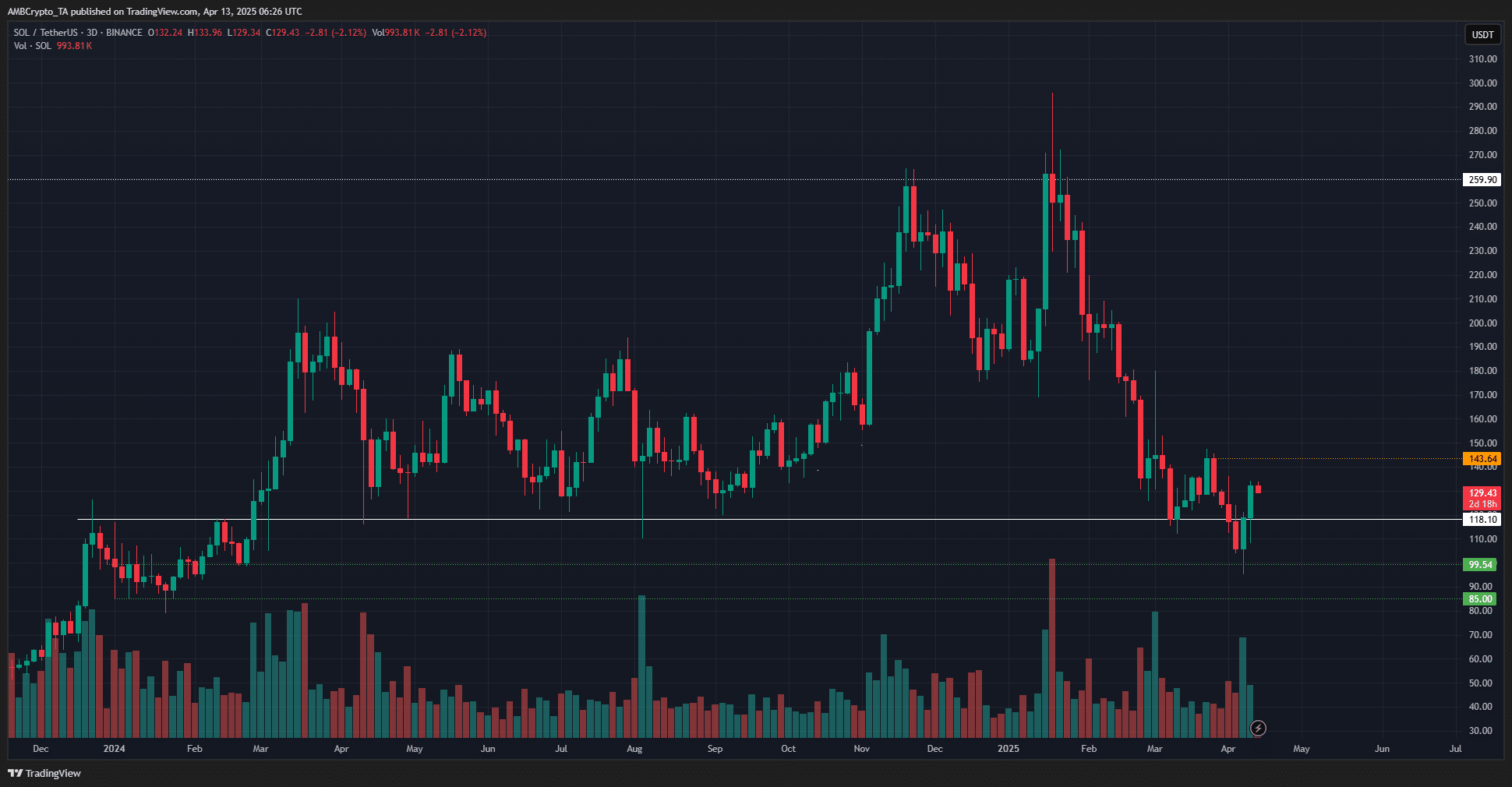

Source: Sol / USDT on tradingView

The 3 -day graph has highlighted this downward trend, with lower ups and lower stockings since January. The level of $ 143 was the recent lower, and Sol was not about to violate this level. Traders and investors can use an escape beyond this level to return their bias optimistic.

Meanwhile, the support levels of $ 99 and $ 85 were the next price targets, as long as the structure has been down.