The CEO of Blackrock urges dry to approve the tokenization of obligations, actions: what it means for the crypto

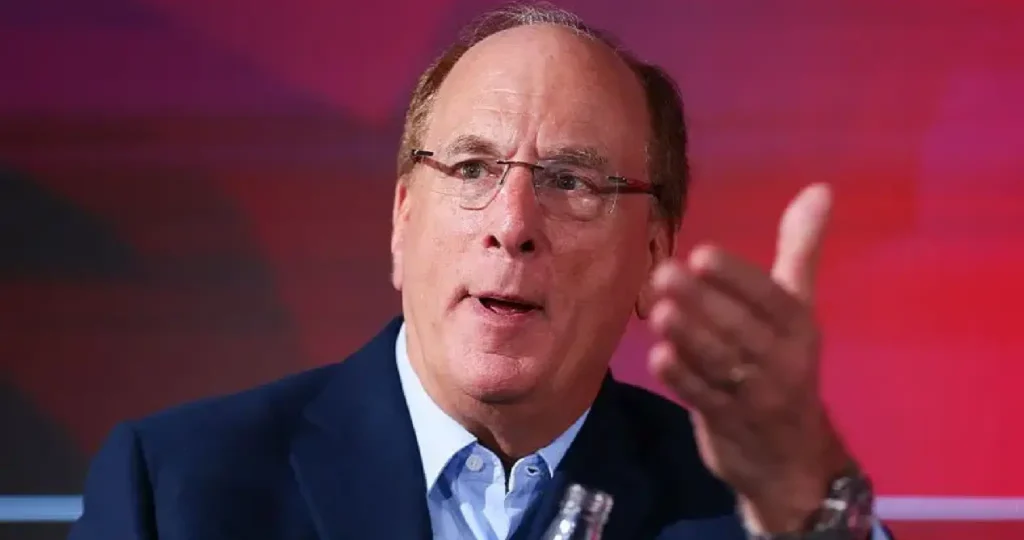

Larry Fink, CEO of Blackrock, the largest asset management company in the world, has expressed strong support for the tokenization of traditional assets such as obligations and actions, urging the American commission for securities and exchange (dry ) to quickly approve these movements. Fink, a vocal defender of digital assets, believes that the tokenization of these assets could democratize investment opportunities, offering people a new way to participate in global financial markets. His comments on CNBC on January 23 have rekindled discussions on the potential impact of tokenization in the cryptography sector.

Key implications for the tokenization of assets for crypto

Tokenization is the process of conversing active active ingredients into digital tokens that can be exchanged and followed on blockchain networks. This change could make significant changes both to traditional finances and to the cryptocurrency market. The urgent question, however, is how this transformation will affect different sectors within the crypto, and which projects will benefit or will face new competition.

The advantages of bonds and actions token

- 24/7 world trading: Tokenized assets such as obligations and actions could benefit from the blockchain’s ability to allow 24 -hour exchanges, the decomposition of traditional market hours and geographic limitations.

- Improved transparency: Blockchain technology allows transparent and unchanging registers, which could improve the confidence and safety of traditional assets.

However, these advantages strongly depend on regulatory approval and alignment with existing legal frameworks. Regulatory organizations, including the SEC, will play a key role in the guarantee that tokenized assets comply with financial regulations, which could make a challenge.

Impact on cryptocurrencies and related sectors

Although tokenization can rationalize the trading of traditional assets, it can also have an impact on several areas of the cryptography market, including stablecoins, the same and decentralized finances (DEFI).

- Stable: Tokenizing links that generate stable yields could question the domination of stablecoins. Investors could prefer these tokenized obligations, which would be linked to interest rates in the real world, on stablecoins supported by Crypto such as USDT or USDC.

- Same: Tokenized stocks (for example, GameStop or AMC) could look like mecoins in their speculative nature, communities supporting volatile and chain assets. This could potentially remove retail merchants from traditional mecoins, such as Dogecoin or Shiba Inu, to regulated but always speculative stock tokens.

- Decentralized finance (DEFI): Tokenizing stocks and obligations are opening up new possibilities for DEFI platforms, which could integrate these traditional assets into their offers. This could lead to a higher total locked value (TVL) in DEFI platforms, benefiting from decentralized exchanges (DEX) and loan protocols. The real tokenized assets would bring more diversity to the markets and would open new sources of income.

- Decentralized oracles: As tokenized assets would include native price data, there could be less dependence on decentralized oracles. This could disrupt the Oracle market and reduce the need for external data providers in DEFI applications.

Tokenization and regulatory challenges

Despite the potential advantages, the tokenization of shares and obligations must always overcome significant regulatory obstacles. These include:

- Know your customer’s requirements (KYC): Investors must verify their identity, which can complicate decentralized systems that prioritize anonymity.

- Restrictions of accredited investors: Legal limitations around who can invest in token workers can exclude certain users to participate in these markets.

- Compliance with laws on securities: Tokenized assets must comply with existing regulations, which can vary depending on the region and introduce complications around the list and the availability of assets.

The role of the influence of Blackrock and Larry Fink

Although Fink’s enthusiasm for token is clear, it is important to note that BlackRock, as a major actor in the asset management industry, has a direct interest in the tokenization of active world. Blackrock could potentially act as an intermediary in this new market, supervising the custody and the administrative functions of token obligations and actions. This can expand the stock market and obligations listed in the United States, benefiting institutions like BlackRock, which held important positions in these assets.

In addition, Fink’s influence could accelerate the regulatory approval of asset tokenization. The appointment of the American senator Cynthia Lummis as president of the Senate banks’ subcommittee on digital assets, associated with its pro-scriptto position, can more accelerate legislation aimed at integrating tokenized titles in the wider financial ecosystem .

Conclusion: Is tokenization a net positive for crypto?

The tokenization of obligations and actions is a double -edged sword for the cryptography sector. On the one hand, it could open new ways for growth, stimulate adoption in DEFI, expand markets and improve the liquidity of traditional assets. On the other hand, it could introduce more regulatory monitoring, which could stifle the fluid nature that made the cryptocurrencies decentralized so attractive.

The way to approval of token titles will probably be slow and difficult, but with influential figures such as Larry Fink supporting the initiative, pressure for regulatory clarity and innovation in digital assets could gain momentum. The coming months will determine whether tokenization turns out to be a boon for crypto or simply an extension of traditional finance in the digital age.