- XRP’s +20% surge reversed August’s losses.

- Both short- and long-term holders were in profit and might be tempted to take profits.

Ripple Labs earn against the SEC’s $2 billion claim, its native token, XRPrally of more than 20% on August 7. This update means that the long-running trial could soon be over, boosting altcoin market sentiment.

XRP reverses August losses

The update and the +20% surge effectively reversed XRP’s losses in August. At press time, the altcoin had returned to its late July value of $0.6. Furthermore, the rally tipped the scales in XRP’s favor to outperform Bitcoin (BTC) as the XRPBTC ratio surged over 20% on August 7.

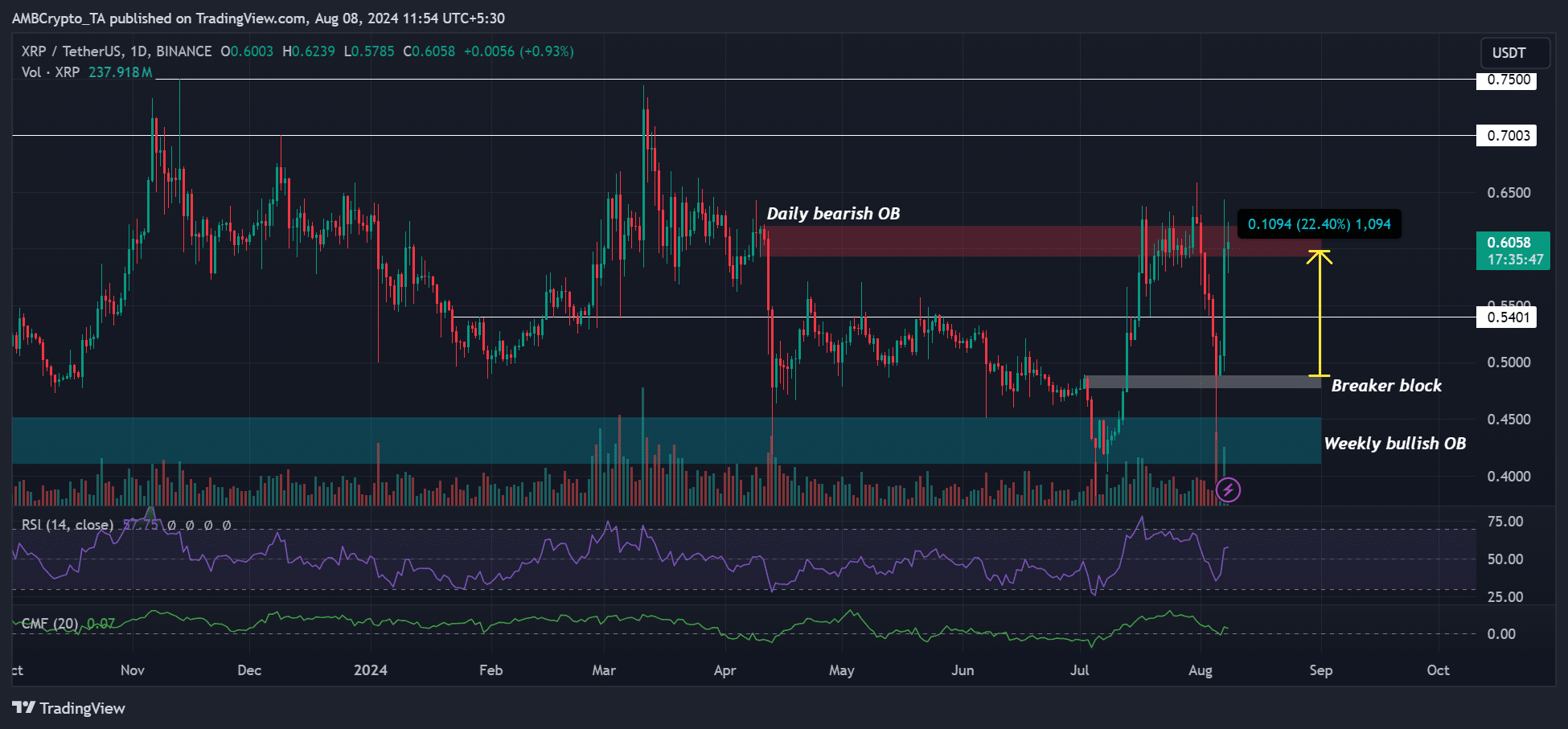

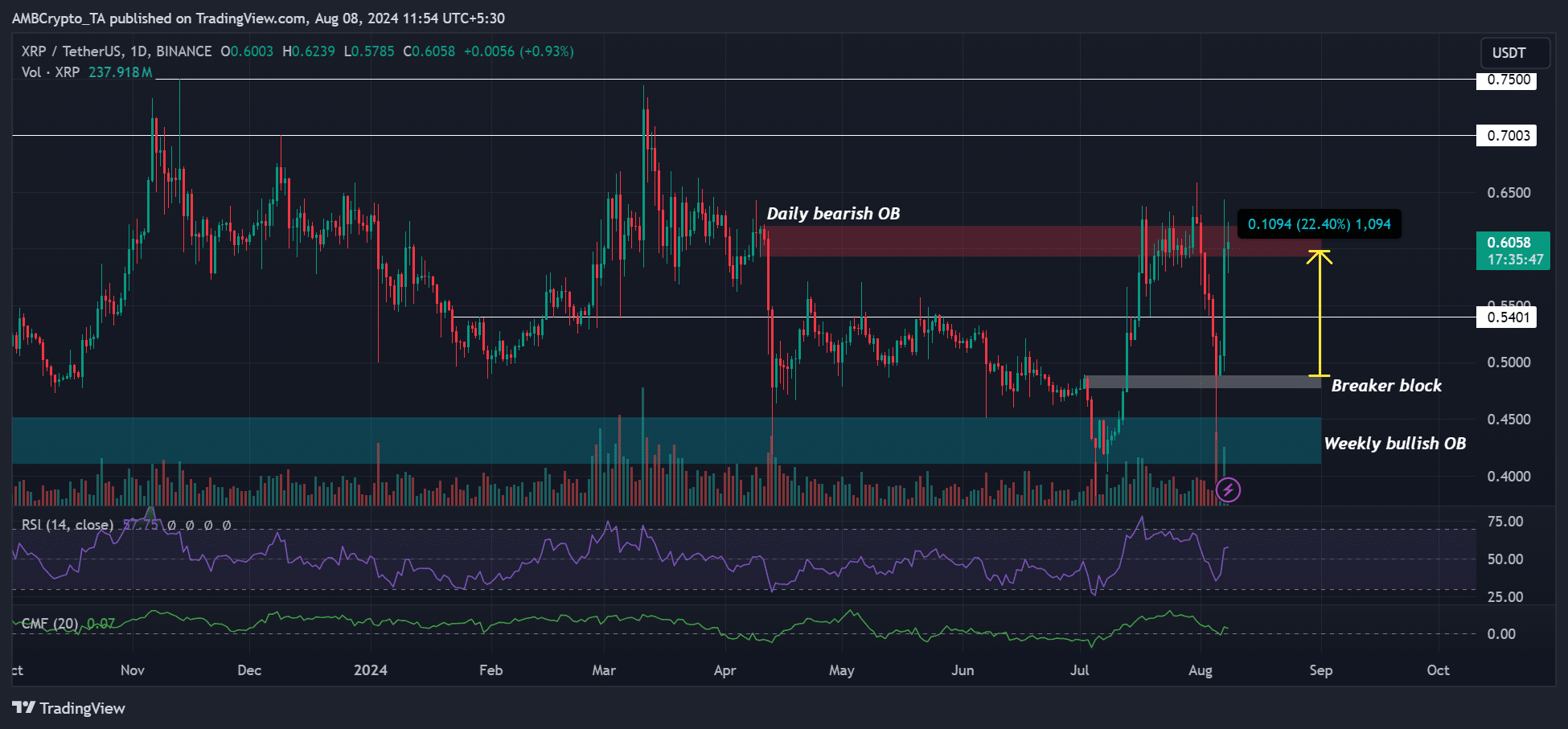

Meanwhile, the $0.6 price level was also a supply zone and a block of daily bearish orders (OB), marked in red.

This means that sellers might be tempted to short the altcoin at this resistance level unless the bullish momentum continues.

Source: XRP/USDT, TradingView

However, a convincing reversal from the supply zone (red) to support could extend the bulls’ party to the $0.7 or $0.75 targets. This represents a potential additional gain of 12% and 20%, respectively.

On the other hand, XRP could retrace towards $0.54 if the supply zone attracts more profit-takers and pushes it lower. Given that some of the biggest XRP whales were dumping their holdings, the trend reversal was close to $0.6 and could not be reversed.

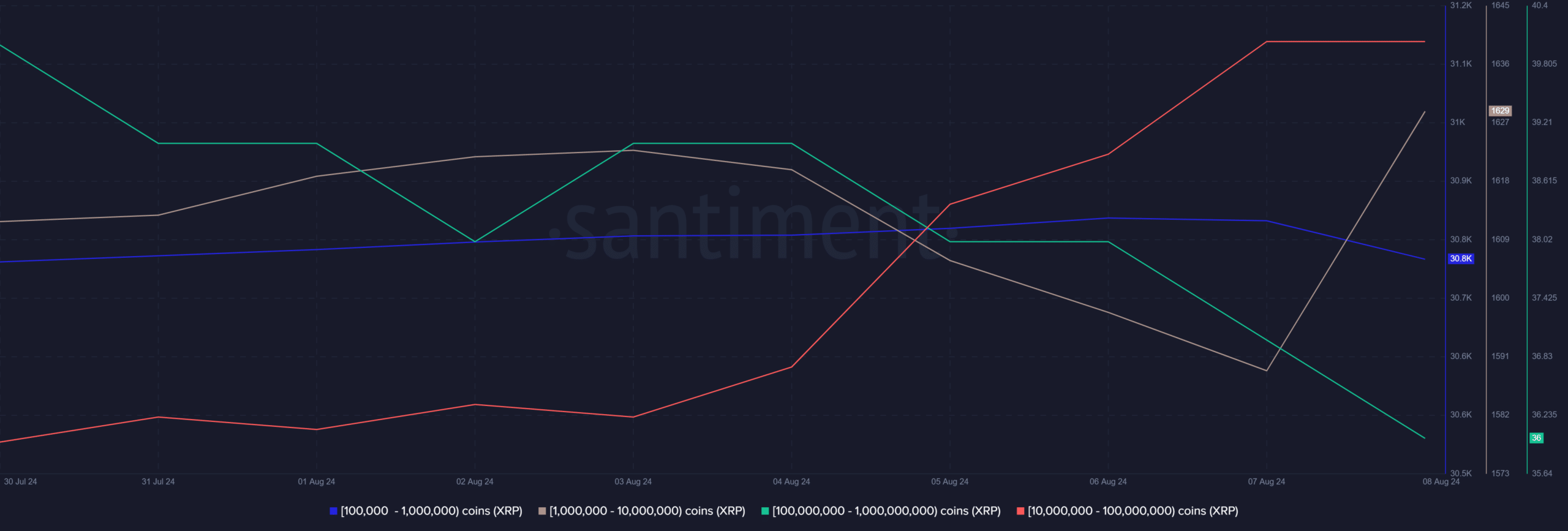

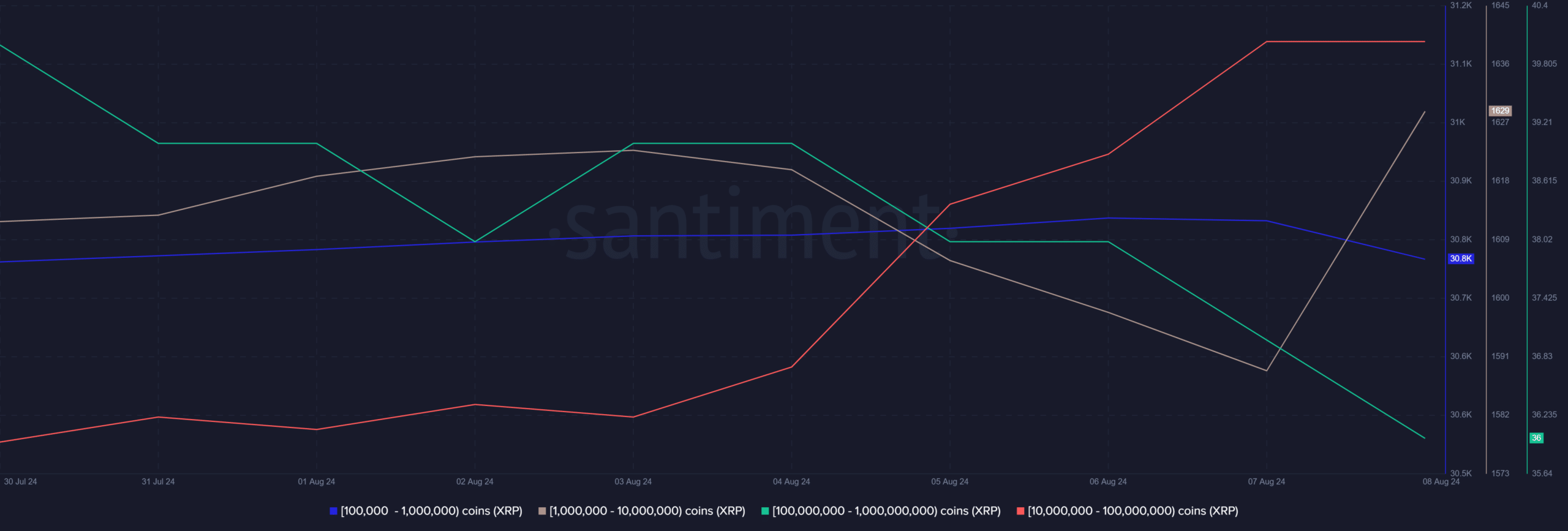

According to Santiment data, those holding between 100 million and 1 billion XRP tokens, or roughly $60 million to $600 million, were dumping their holdings. This cohort was also joined by those holding between 100,000 and 1 million XRP tokens.

Source: Santiment

At the same time, cohorts holding between $10 million and $100 million have been accumulating, suggesting that whale actions could cancel out if overall market sentiment does not deteriorate further.

Do the holders benefit?

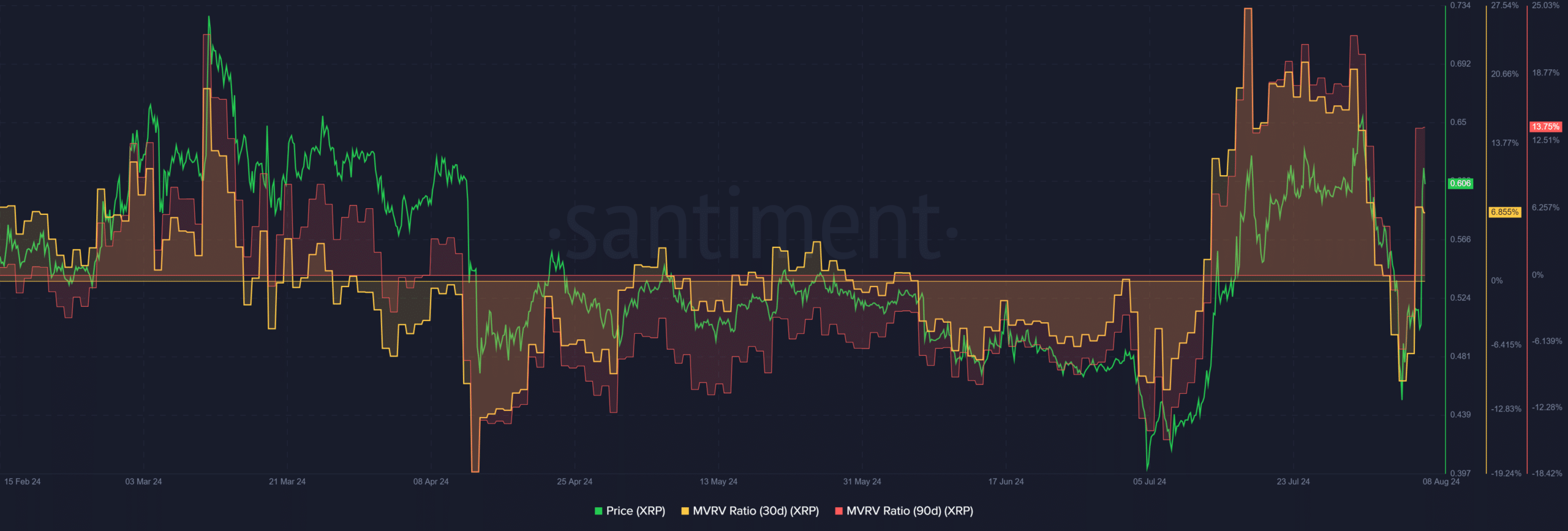

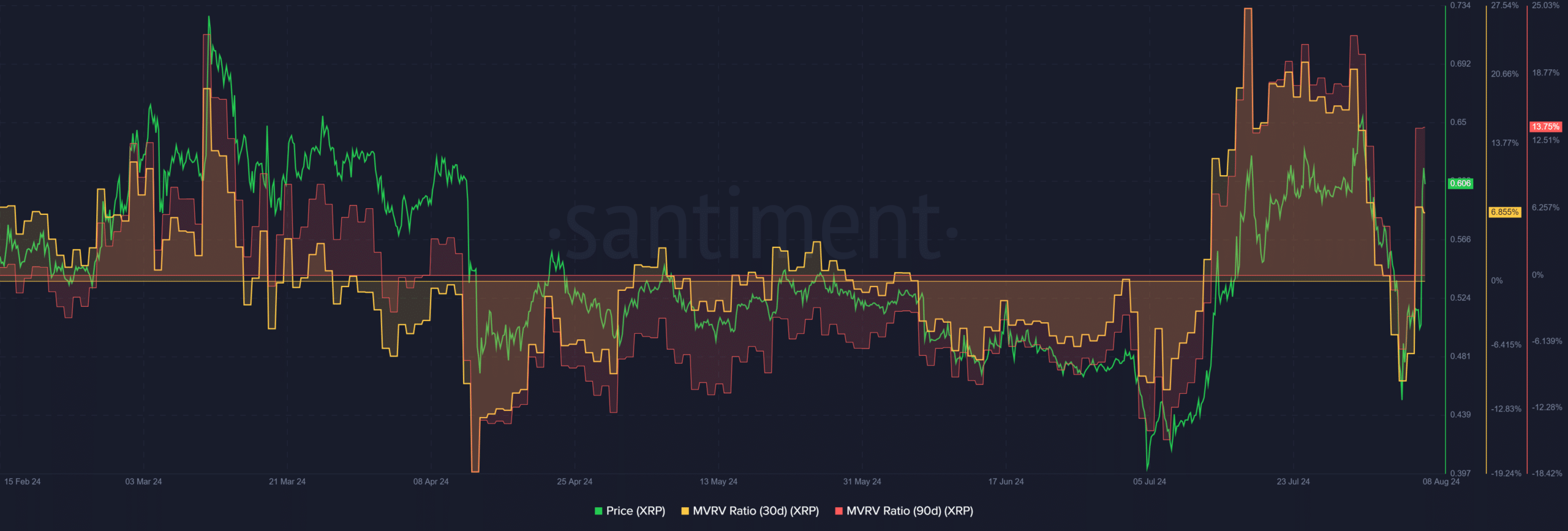

Interestingly, the SEC victory also allowed short- and long-term holders to benefit differently from this windfall. For example, XRP holders who had purchased the altcoin a month earlier saw their portfolios jump by 6.8%.

On the contrary, those who held their shares for more than 3 months enjoyed a profit of 13.75%, as shown by the 90-day MVRV (Market Value to Realized Value) ratio.

Source: Santiment

On the one hand, the rise in MVRV indicated that the altcoin was becoming increasingly overvalued and expensive relative to the cost of acquisition for most holders.

This could signal a likely trend reversal, especially amid rising unrealized profits, which could prompt holders to take profits.

In short, the supply zone at $0.6 was a key level to watch if extended upside was likely in the near term.