- The greatest winners: Onyxcoin (XCN), Fartoin (Fartcoin), Jasmycoin (Jasmy).

- Larger losers: Tezos (XTZ), EOS (EOS), Movement (Movement).

The week has started to make the cryptography market, the American economy feeling the impact of the increase in trade tensions. However, things took a turn for the best by the end of the week. A key factor was the decision to exclude the technological sector from new prices.

Therefore, this gave the market a good help. In fact, among the first 100, few risks at risk even saw three -digit gains.

Weekly winners

Onyxcoin (XCN): the new generation crypto sees a three -digit overvoltage

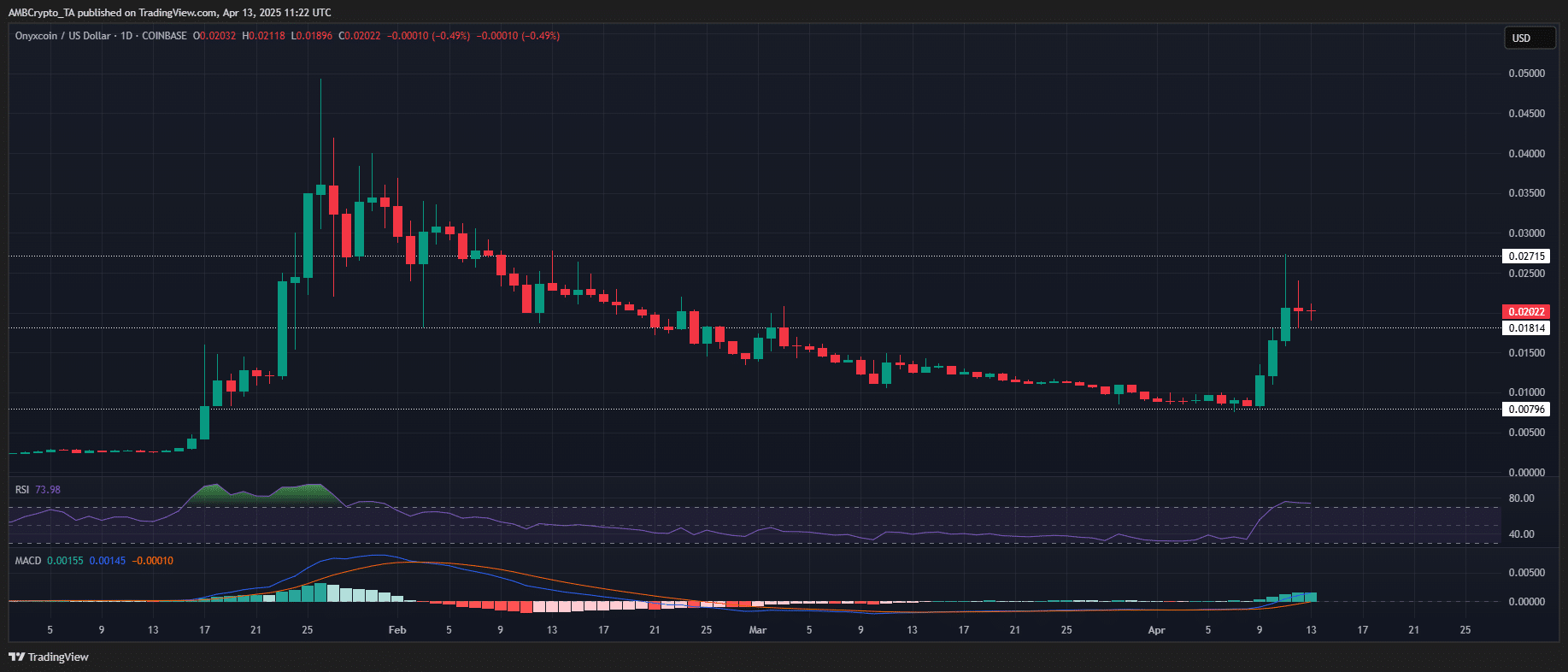

Onyxcoin (XCN) experienced a rebound in the middle of the week, summoning 43.88% in one day on April 9. This gathering was followed by two consecutive days of increased purchase activity, with price increases of 36.78% and 24.65%, respectively.

Consequently, the low -captain assets dominated the table of weekly Gaires, displaying an impressive increase of 120%. During only three days, the price erased two months of losses, racing $ 0.027.

Source: TradingView (XCN / USDT)

As expected, taking advantage was committed and the rally has surpassed, the RSI hitting a critical on -base condition at 81.09.

However, if the low capitalization assets reflects its price of price in January, where, despite the overexxation, the bulls absorbed sales and suffered the upward trend, a similar rebound could take place.

On January 23, the asset experienced a spectacular rally of 97.28% in one day, which increased the price to $ 0.025. THat declared, with XCN closing the week at 7.4% below its summit in the middle of the week of $ 0.027, the asset can face opposite winds by extending its rally in the coming week.

Therefore, it is essential to follow the volume profiles to assess whether the upward trend can resume strength or if a consolidation phase is imminent.

Fartoin (Fartcoin): The token focused on privacy strikes a key resistance zone

Fartcoin (Fartcoin) posted a strong upward performance this week, gathering more than 90% in the middle of an escape from a range of accumulation of several weeks.

The low capitalization token definitively released the key resistance to $ 0.64, overthrowing it in an intrajournual medium. The escape, initiated on April 9 with a good intraday gain of 50%, extended to retest the level of $ 0.98 in two sessions on the daily delay.

Currently, $ 0.87 has established itself as a short -term supply area on the 4h graph, with a price action showing signs of exhaustion.

The rally to the psychological level of $ 1.00 has stalled, coinciding with taking advantage. In addition, the RSI is lower than the conditions of overchat, and the MacD has turned down, indicating the drop in upward pressure.

Given these signals, Fartcoin may require a liquidity scanning or a stroke before the bulls can stage another attempt to recover the resistance level of $ 1.00.

Jasmycoin (Jasmy): The data -based part has a solid trend reversal

Jasmycoin (Jasmy) launched the week with a modest 4.85% rebound compared to a new 52 -week lower of 0.00897 $. What followed was a clear and regular recovery.

At the end of the week, Jasmy was negotiated at $ 0.0,1656, up 68.91%, making it the third best active of the week.

The rally followed a clean breach of its downward trend of several months. In addition, supported by the increase in the volume of purchase and a bullish crossover in indicators like the RSI, which has concentrated firmly in a positive territory.

Price action also suggests accumulation at lower levels, with stable green candles and limited volatility, unlike more speculative points observed elsewhere. This indicates stronger hands involved, perhaps leaving room for more upwards.

For the moment, the keys resistance is at $ 0.018 at $ 0.0194. A decisive break above which could open the door for a movement towards the next target at $ 0.022.

Other notable winners

Beyond the main performers, the wider market presented a significant price action.

Edge (Edge) led the rally with a dazzling overvoltage of 825%, surpassing the highest 1,000 tokens in terms of prices. Aergo (Aergo) and Finder Coin (RFC) followed with substantial price gains of 332.8% and 270%, respectively.

Weekly losers

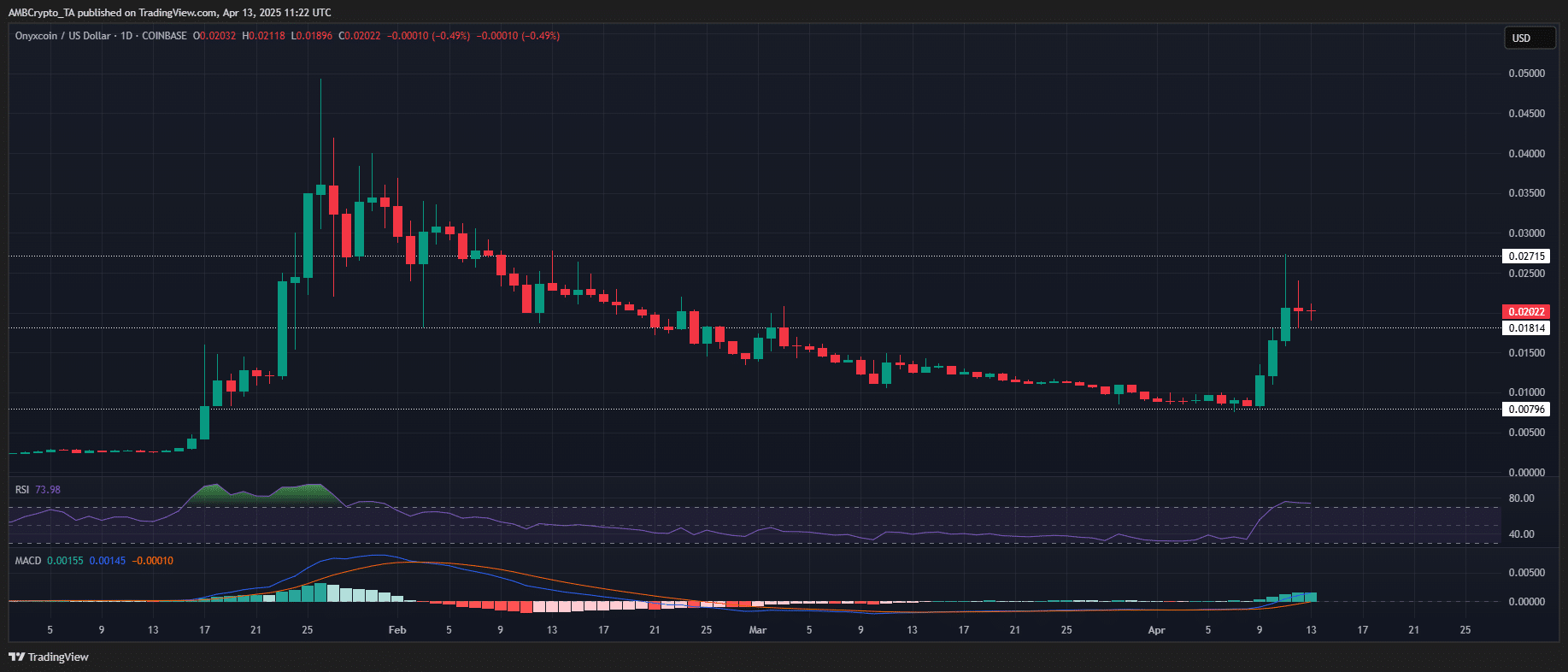

Tezos (XTZ): The chain token erases its post-electoral gains

Tezos (XTZ) ended the week as a larger underperforming, with a decrease of 17.20%, extending its consecutive weekly weekly losses.

On time 1D, prices’ action remains under significant down pressure, without absorption of noticeable submission to stop the momentum of sale.

Consequently, XTZ has formed a new lower low, breaking below its post-electoral peak of $ 1.90 and establishing new support at $ 0.53.

Source: tradingView (XTZ / USDT)

Despite the retracement, the demand remains low, without any sign of purchase of strong drops.

The absence of accumulation at these levels suggests that the downward momentum of XTZ could persist unless a strong support base materializes to absorb sales.

Without a change in market structure or a key rebound support, the asset should continue its short -term trend.

EOS (EOS): evolutionary blockchain pass from the winner to the loser

EOS (EOS) experienced an important pivot this week, going from the biggest winner last week to second on the losing record, displaying a weekly draw of 12.34%.

Altcoin launched the week with a rally of 7.28%, showing the first signs of an attempted rupture after having formed three consecutive lower stockings.

However, Momentum was quickly reversed while Bears was taking control, leading to a swallowing -uplift candle of 12.83%, erasing the first gains of the week and pushing the price to $ 0.65.

Over the time 4 hours, the price structure remains firmly down, with consecutive red volume bars indicating a strong distribution.

The lack of absorption on the offer suggests a lack of liquidity support, and without substantial purchase interest, the OOs could cope with a deeper withdrawal to test the next support at $ 0.53.

Movement (movement): the fitness platform displays lower stockings

The movement (moving) displayed a weekly draw of 12.78%, traced compared to last week’s fence at $ 0.37, placing it third among the best declins.

The action of prices continues to reflect a distribution phase, because the bulls fail to generate sufficient momentum for a structural break. In fact, tHroughout the week, the move exchanged in a consolidation channel between $ 0.24 and $ 0.40.

However, the absence of absorption on the request near local stockings confirms a low market participation, without sign of accumulation or basic training.

Despite a 21% increase in volume (up to $ 76.88 million), the increase seems to reflect opportunistic liquidity scales rather than a real gap in the dynamics of the flow flows.

The RSI remains in a downward trajectory, strengthening the lower bias, while the absence of a higher movement confirmed, which suggests a movement could be installed for another liquidity purge below the $ 0.24 beach.

Other notable losers

In the wider market, several tokens have undergone significant price retractions.

Metfi (Metfi) led the drops, faced with a 51% shortcut, while MMX (MMX) and the actor (Ban) followed with 41.7% and 40% of withdrawals, respectively.

Conclusion

Here is the weekly summary of the best winners and losers. It is important to remember the very volatile nature of the market, where price fluctuations can occur quickly.

As such, the realization of an in -depth reasonable diligence (DYOR) before making investment decisions is highly recommended.