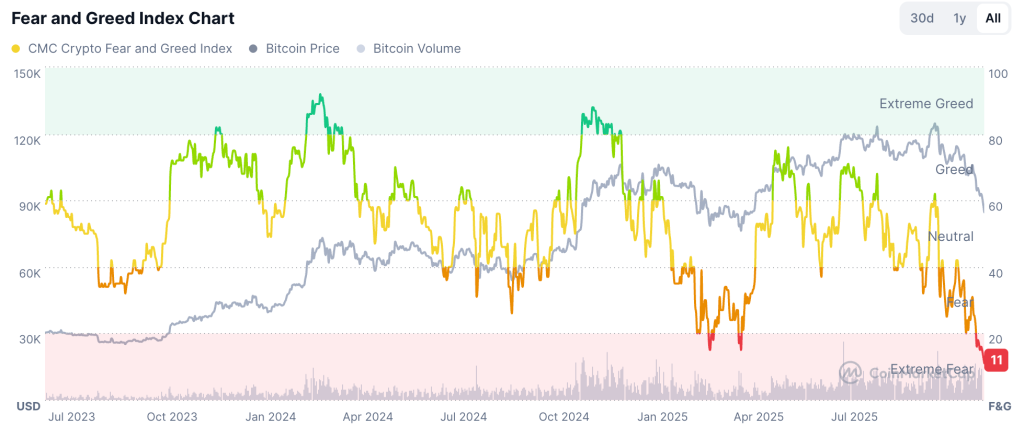

Fear is dominating trading in the crypto market today as the CMC Crypto Fear and Greed Index sits at 11, the lowest reading since its launch, while Bitcoin is trading around $83,000 after falling sharply from recent six-figure levels.

Recent market data and commentary attribute the decline to numerous liquidations, reduced cash flow into cash products, and renewed concerns about global growth and political uncertainty, all of which have driven a positioning toward cash and reduced exposure to higher-risk assets.

This change is visible across the entire market rather than in isolated pockets. In this environment, the price weakness of major tokens reflects greater caution rather than project-specific failures, reinforcing the sentiment that the cryptocurrency season remains in a defensive phase.

Crypto Fear and Greed Index (Source: CoinMarketCap)

Bitcoin sets the tone in the face of record fear

Bitcoin is now trading near $83,880, down about 7.5% over the past 24 hours, after briefly testing levels near $80,000. Derivatives activity shows an increase in long liquidations and negative funding, indicating a rapid reduction in leveraged positioning.

The move should be seen as an extension of a broader reset from October highs, with participants locking in gains and reducing exposure amid tightening financial conditions.

The decline in sentiment indicators is not limited to price. A fear reading at these levels suggests that risk tolerance has narrowed sharply, often resulting in slower turnover, less speculative trading, and a greater focus on capital preservation.

In such phases, the direction of Bitcoin tends to dominate flows in the market, leaving little room for secondary tokens to diverge significantly.

Large caps follow broader decline

Altcoins have followed the same downward path. BNB is trading near $821, Solana at around $126, and Cardano at nearly $0.404, each posting sharp declines of up to 12% over the past 24 hours.

Although liquidity on major platforms remains viable, flows are biased towards sellers and systematic reduction of exposure, indicating that pressure comes more from macroeconomic forces and sentiment than developments at the token level.

Rather than showing a new weakness specific to these networks, the declines reflect how even established ecosystems struggle when fear takes hold.

In conditions where Bitcoin is losing ground and trust is fading, large caps often move in tandem, shaped by a market-wide desire to reduce risk rather than by changes in their underlying structures or activities.

What’s Causing Extreme Fear During Altcoin Season

Several factors are converging behind this altcoin depression season. Bitcoin’s reversal from recent highs has disrupted momentum-driven positioning. Releases of some spot products reduce a key source of additional demand.

At the same time, global tensions, economic concerns and changing interest rate expectations continue to weigh on risk assets, including cryptocurrencies, more broadly.

These elements create an atmosphere where caution dominates decision-making. Participants generally reduce their exposure to complex positions, reduce their leverage and concentrate their liquidity on stable instruments until clearer signs of stability appear. This trend explains why the altcoin season remains distant, even if occasional and short-lived rebounds appear.

The current decline suggests a market focused on preservation rather than expansion. With historically low sentiment, new capital tends to wait for clearer confirmation before re-engaging. Recovery phases generally rely on Bitcoin stabilization, renewed confidence in macroeconomic conditions, and a gradual return of volume that indicates a willingness to reassess risk.

For now, the sharp pullback of Bitcoin, BNB, Solana, Cardano and almost all major coins illustrates how sentiment controls the cycle. The cryptocurrency season in its typical form, marked by broad participation and a rise in secondary assets, remains on pause until fear subsides and conditions show a sustainable balance between supply and demand.

The article Winter is Coming: Cryptocurrency Season Enters Dormant Phase as Bitcoin and Altcoins Pull Back appeared first on Cryptonews.

: Camilo Freedman/Bloomberg

: Camilo Freedman/Bloomberg