Popular Payment for the Payment of Stablecoin Wirex has recently expanded on the American market. The application will allow us residents to use their stablescoins for daily transactions via visa cards.

Like Wirex, many other web 3 platforms are increasingly looking to enter the American market while legislators are growing regulatory clarity for stablecoins.

Use of stablecoins for everyday purchases on 80 million merchants

The entry of Wirex into the American market is supported by its collaboration with Bridge, a main provider of stablecoin payment infrastructure.

Thanks to this partnership, Wirex Pay allows users to transform directly from non -guardian portfolios using cards and bank transfers while maintaining total control of their assets.

“Although regulatory clarity is always beneficial for innovation, our expansion on the American market is mainly motivated by the growing demand for the demand of consumers of stable payments and the growing adoption of digital assets for daily transactions,” said Wirex co-founders.

Earlier in 2024, the American payment giant Stripe acquired a bridge in a historic contract of $ 1.1 billion. With the expansion of Wirex, American consumers can now use stablecoins to more than 80 million visa-visa merchants in 200 countries.

The co-founder of Wirex Pay highlighted the United States as a key market because of its large base of active crypto users. They anticipate a strong adoption in 2025 while stablecoins accepted greater acceptance.

This decision should stimulate higher transaction volumes and significantly contribute to income growth.

“Although it is too early to provide exact projections, we are convinced that the American launch of Wirex Pay will be a key growth engine for our business in the years to come,” said the co-founders.

Regulatory developments shaping the American Stablecoin market

American legislators are increasingly focusing on the regulation of stablescoin, which could accelerate market growth.

In February, CFTC commissioner Caroline Pham announced a CEO forum to develop cryptographic regulations, highly emphasizing stablecoins.

The main players in the industry, including Circle, Coinbase and Ripple, participate in discussions to help shape policies thanks to a regulatory framework.

Meanwhile, Bank of America also monitors developments closely. CEO Brian Moynihan said the bank could introduce stablecoin if favorable regulations were promulgated.

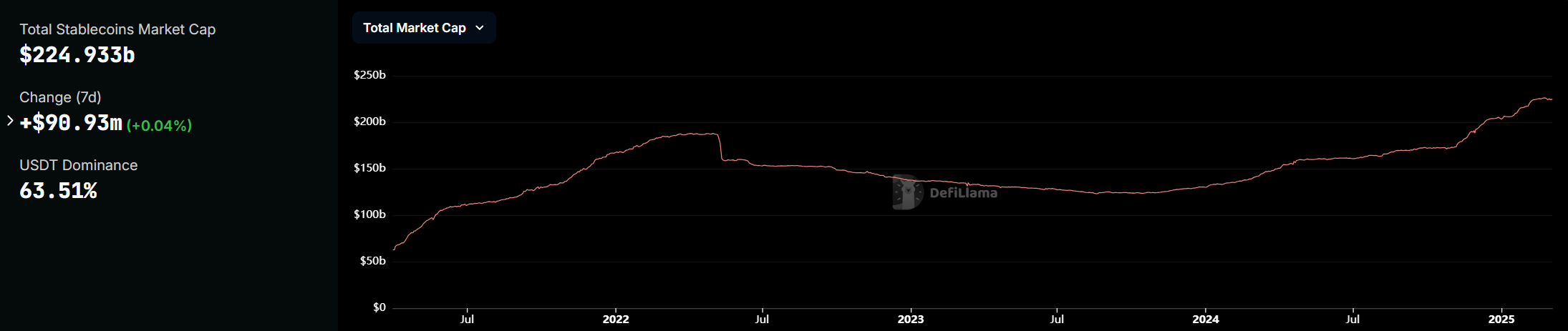

In addition, the Stablescoin market recently exceeded a record market capitalization of $ 225 billion. Regulatory clarity could still push adoption.

In the end, this would help integrate the stablecoins more deeply into traditional finance. Other web companies will probably seek to develop on the American market while regulatory developments continue to take place.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.