- WLD’s long/short ratio stood at 1.03, indicating strong bullish sentiment among traders.

- WLD could surge 60% to reach the $4.22 level if it closes a daily candle above the $2.70 level.

WLD, the native token of Worldcoin, seemed poised to experience a price drop due to its upcoming token unlock at press time, with the same scheduled between January 5 and January 12. In fact, recently a blockchain-focused social media platform published a post on X (formerly Twitter) stating that Worldcoin is about to unlock 37.23 million WLD tokens, worth almost $90.09 million.

Will the price of WLD fall?

This unlock creates selling pressure due to the amount of circulating supply it will release. The data revealed that these prominent tokens represent almost 4.5% of the total circulating supply. Based on historical data, such token unlocks have historically led to selling pressure and episodes of price depreciation.

Current price dynamics of WLD

Right now, the overall crypto market sentiment seems a bit confused, as while Bitcoin (BTC) has gained impressive bullish momentum, other cryptocurrencies appear to be struggling.

WLD appeared unaffected by the confusion, however, climbing 7.5% in 24 hours at press time. Additionally, this price surge appears to have attracted traders and investors, leading to an 85% increase in trading volume, according to CoinMarketCap.

On-chain bullish metrics

According to on-chain analytics firm Coinglass, intraday traders appear more optimistic about this price rise. Over the past 24 hours, intraday traders have increased their positions, with data showing WLD’s open interest increased by 27%.

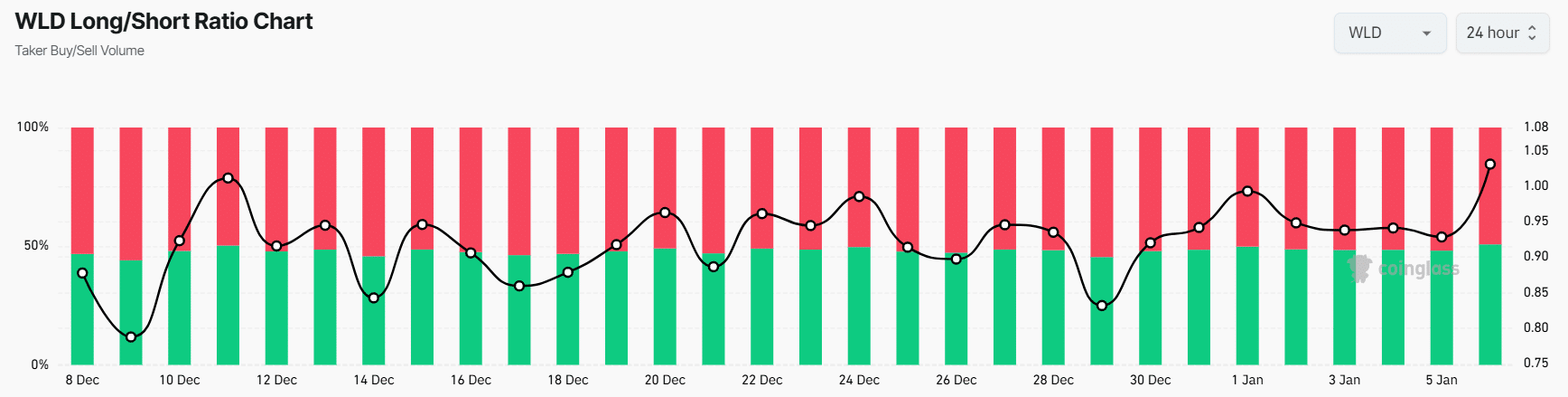

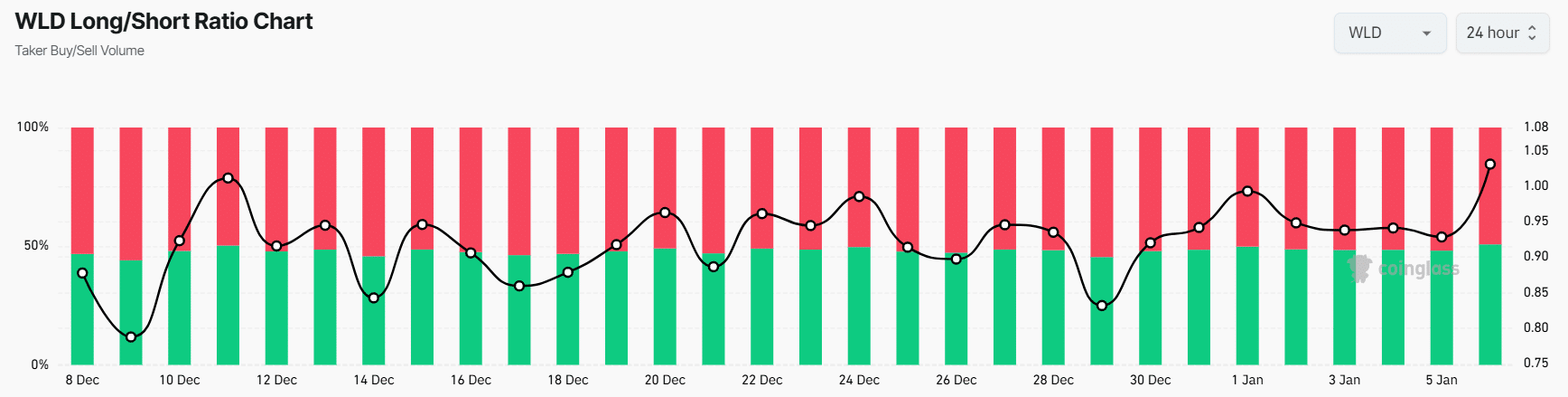

The WLD long/short ratio stood at 1.03, indicating strong bullish sentiment among traders. The data further highlighted that 51.5% of top traders held long positions, while 48.5% held short positions.

Source: Coinglass

WLD Technical Analysis and Key Levels

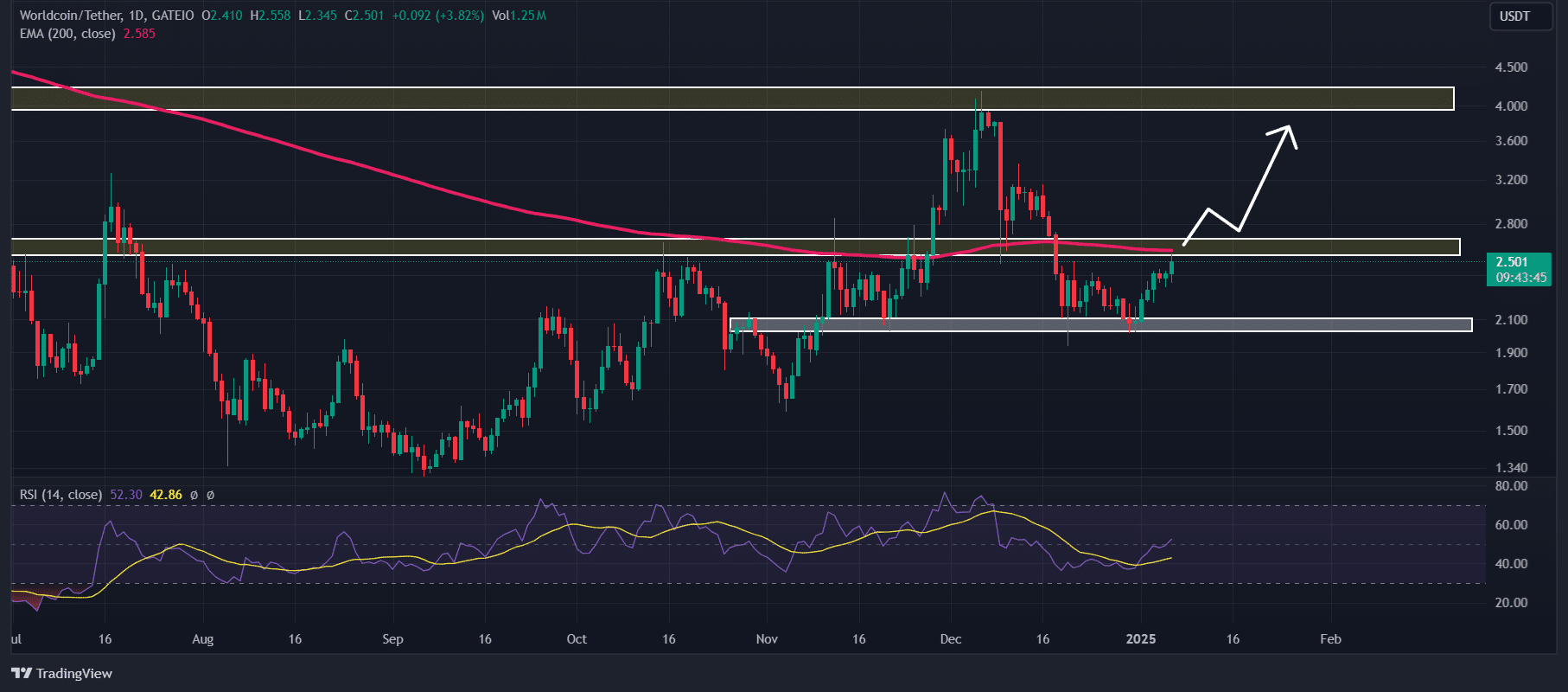

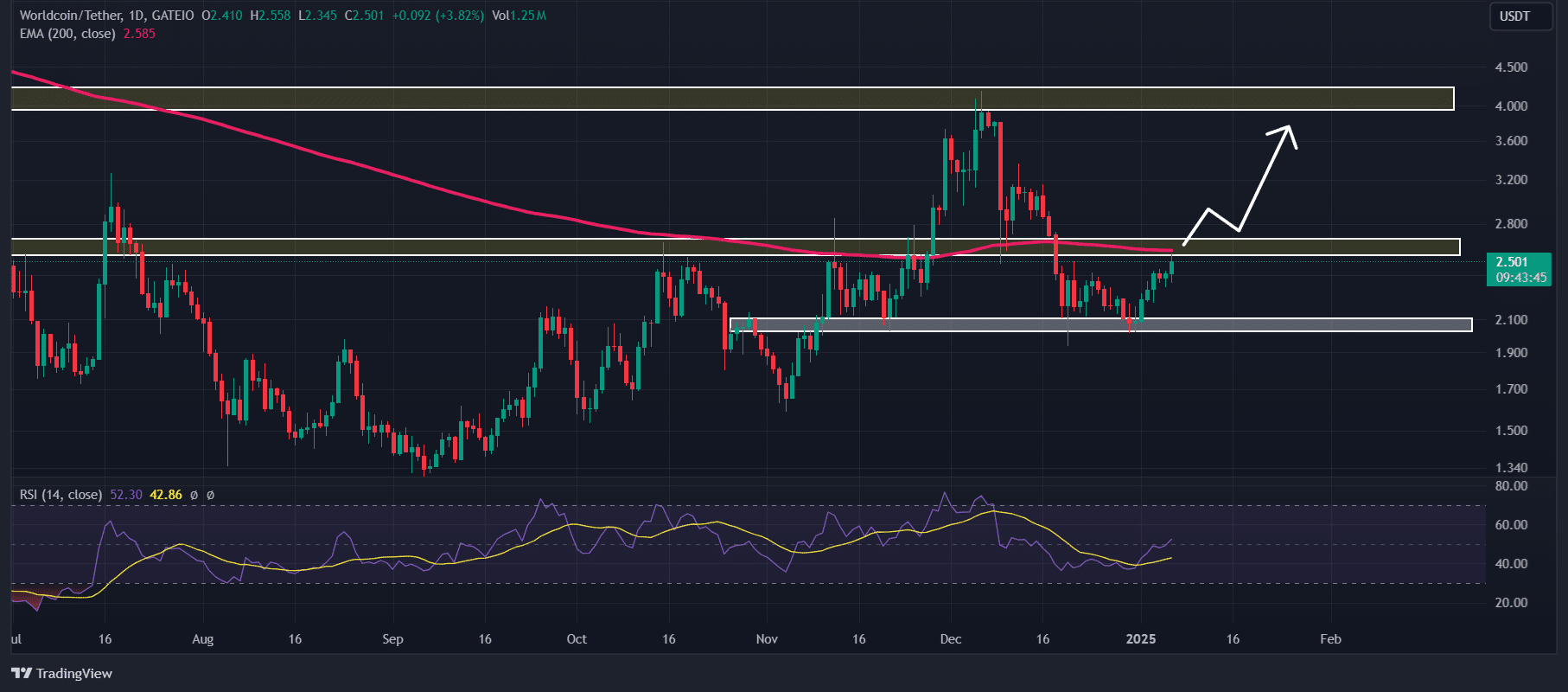

According to technical analysis by AMBCrypto, WLD appeared to face resistance at a horizontal level of $2.55 and the exponential moving average (EMA) of 200 on the daily time frame. However, the price struggled to clear this hurdle and continue its upward momentum.

Source: TradingView

Based on its recent price movement, if WLD breaks through the resistance level and closes a daily candle above the $2.70 level, it is very likely that it will surge 60% to reach the 4 level. $.22 in the future.

At the time of writing, WLD’s Relative Strength Index (RSI) was well below the overbought zone – a sign that the token has enough room for further rally in the near term.