- XRP jumped 15% this week, riding the wave of a market rebound after the bearish end to the fourth quarter.

- Is this just the start of a bigger rally for XRP, or will it be a short-lived rebound?

The market rebounds. Barely a week into the new year, many coins are regaining the ground lost during the post-FOMC collapse. Ripple (XRP) is no exception, surging 15% to $2.40 – a crucial resistance point.

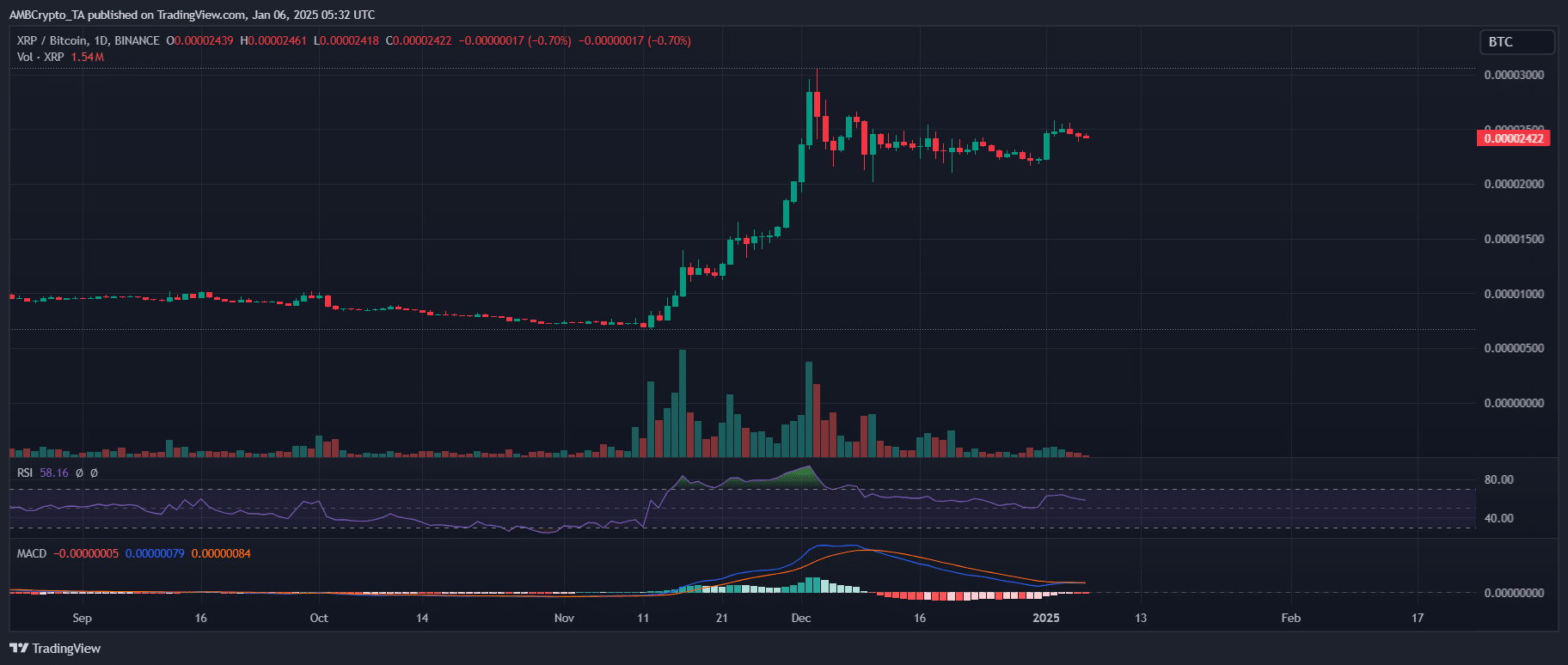

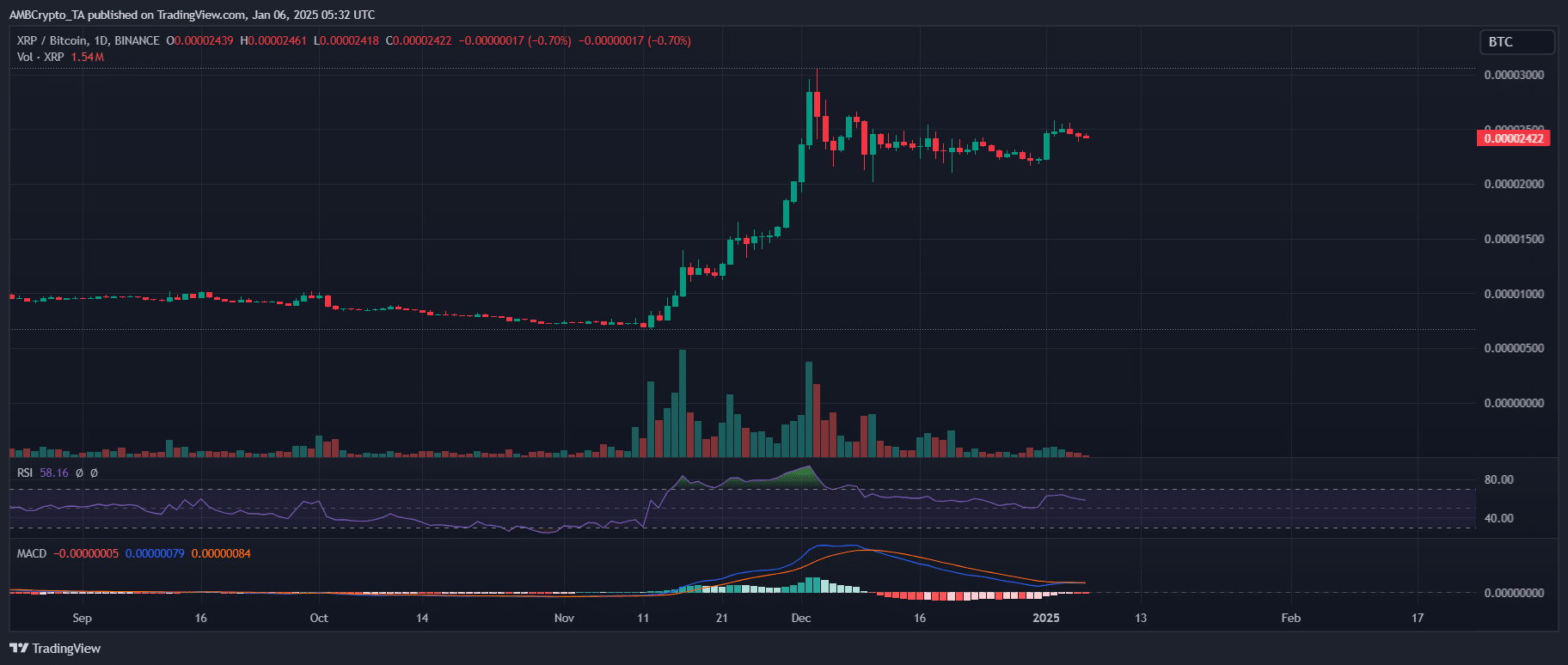

During the “Trump Pump” frenzy, the breakout of Ripple against Bitcoin (BTC) (XRP/BTC pair) was a clear signal of capital turnover, as investors changed focus and diversified their bets.

In November, on Election Day, Bitcoin surged 9% in a single day, reaching $99,000 in just two weeks.

But just as Bitcoin reached its peak, the XRP/BTC pair climbed more than 10%, showing that XRP was gaining ground.

Source: TradingView

Now, with the MACD lines on the verge of a bullish crossover, there is a chance this trend could repeat itself. If Bitcoin hits $100,000, Ripple could follow suit, aiming for a target of $3 before the end of the month.

For XRP Holders: Proceed with Caution

After a month of consolidation, Ripple is preparing for a possible breakout. The rise in Open Interest (OI) indicates that more investors are taking long positions, suggesting they are expecting a rally in the coming days.

However, there is a catch: $2.40 – $2.46 is a strong resistance zone, and without sufficient buying pressure, XRP may struggle to break through and face a reversal.

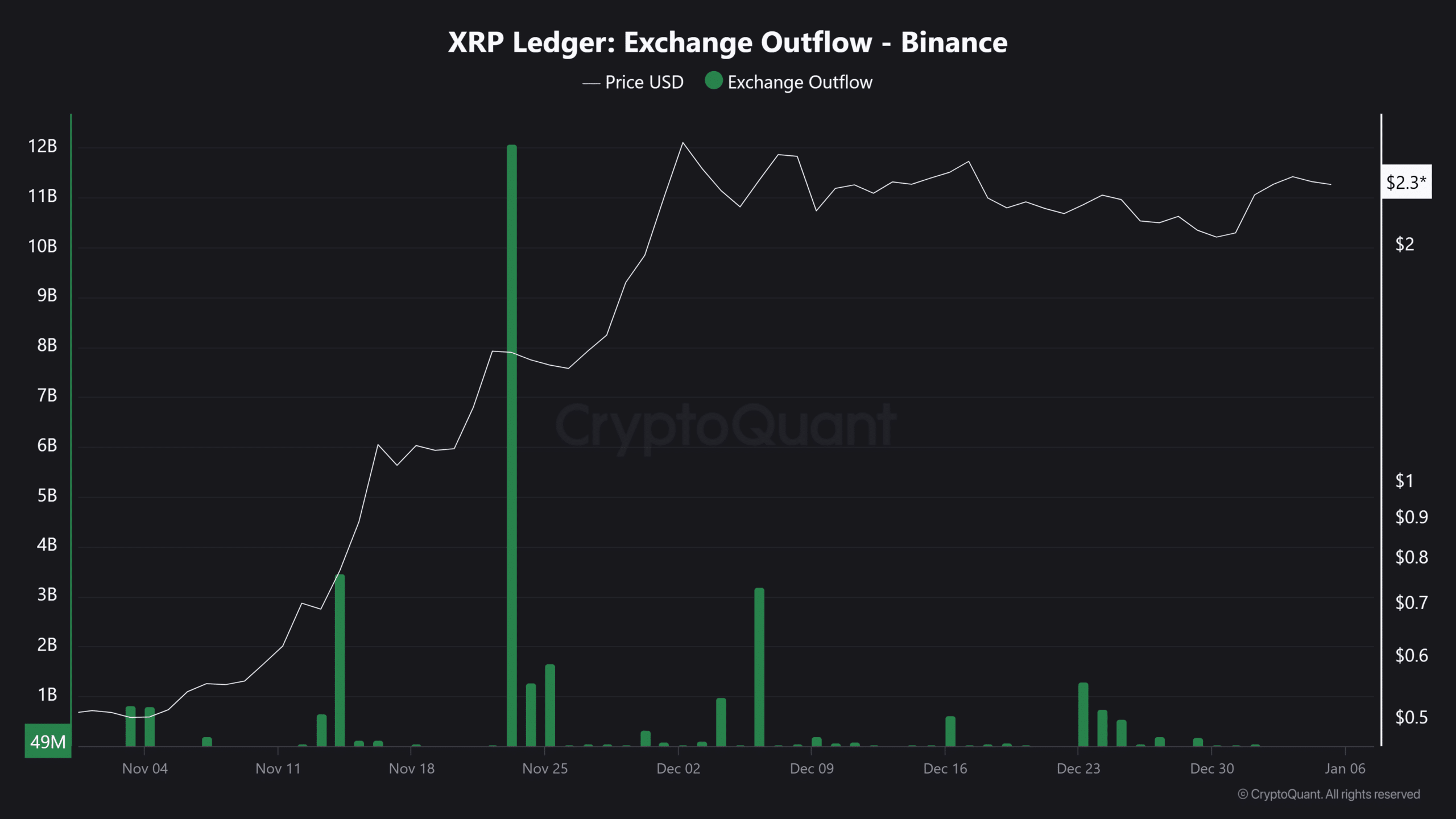

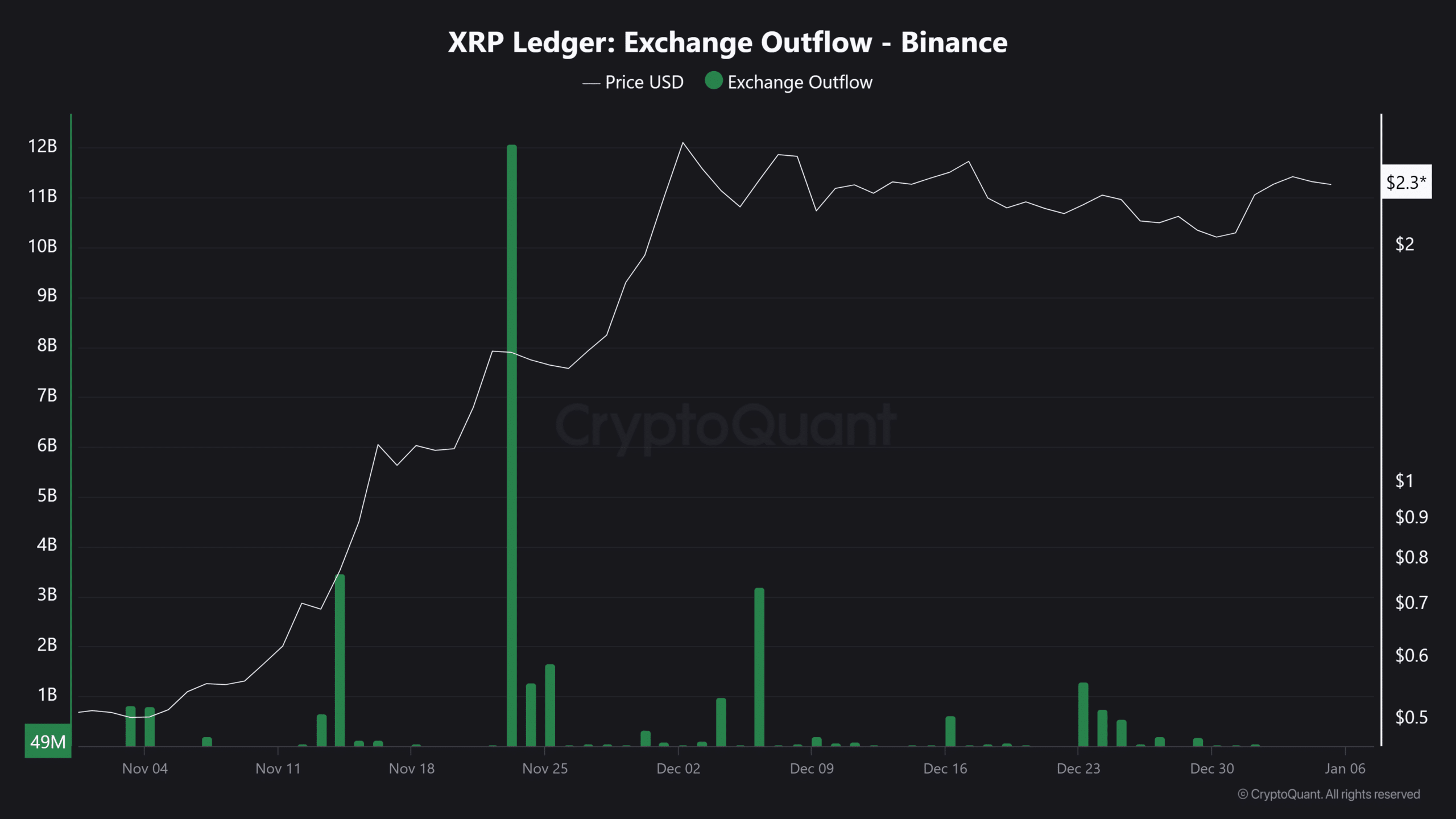

Additionally, exchange outflows are still below $50 million, a far cry from the $3 billion recorded when XRP hit its yearly high of $2.48.

Source: CryptoQuant

This indicates that the recent 15% rise is potentially due to whale stockpiling, perhaps triggered by new year buzz rather than widespread retailer interest.

Realistic or not, here is the market capitalization of XRP in terms of BTC

Clearly, the road ahead will not be easy. Ripple is well-positioned to attract capital from Bitcoin, but breaking above $2.46 could be the key to getting there.

With FOMO still lagging, it is unclear whether XRP can generate enough momentum.