- XRP resilience and high demand for diving purchase indicate a long -term rupture potential.

- With the momentum, can bulls go beyond resistance?

The third diving of Ripple (XRP) at $ 1,9925 last week, followed by an increase of 7.40%, shows a purchase of conventional drop in action. Trading at $ 2,38,55, a MacD Haussier crossover strengthened the upward trend, with resistance of $ 2.60 in sight.

Meanwhile, XRP / BTC approached the levels of early March, without any signs of over -expansion.

Although XRP resilience signals a long -term force, short -term volatility remains, because the feeling of profit and risk could shake up weak hands. An increase in exchange reserves suggest an increase in sales pressure.

If this trend continues, a retracement may be necessary before the next step, in particular with Bitcoin always under short -term pressure. This probably makes another correction on a market scale.

XRP holds fundamental solids in the middle of the low request for points

XRP / BTC shows the resistance, outperforming other high capital in the purchase of the decline. However, Ripple still moves in tandem with Bitcoin, not yet established as a completely independent asset.

While the fundamentals of XRP remain strong – the whales adding 150 million XRP in the last two days and the investors reaffect BTC funds in XRP – sales orders on the perpetual market increase.

With a low demand for points, addresses active at the lowest since December and an increase in retail distribution, another long pressure could question whale efforts. In this case, breaking the resistance of $ 2.60 will not be easy.

Source: tradingView (XRP / USDT)

On Binance, short orders dominated on March. The whales bought the dip of $ 1.99, triggering a short pressure which pushed the higher prices. A similar decision could reproduce, given the continuous accumulation of whales.

However, if Bitcoin does not break $ 85,000 and another boost, short-circuit pressure could lead to long holders, reversing the momentum. Ambcrypto breaks down the chances of playing.

Source: cryptocurrency

Volatility navigation: where xrp is located

On its 1D graphic, the price of XRP follows closely Bitcoin. Two drops at $ 1.99 in three weeks BTC corresponded below $ 80,000.

The resumption of XRP was stronger than that of the BTC, arousing the interest of investors, but if Bitcoin plunges again, the first could always review key support levels.

The risk remains high because the main stakeholders in the BTC are still underwater and demand in key accumulation areas remains low.

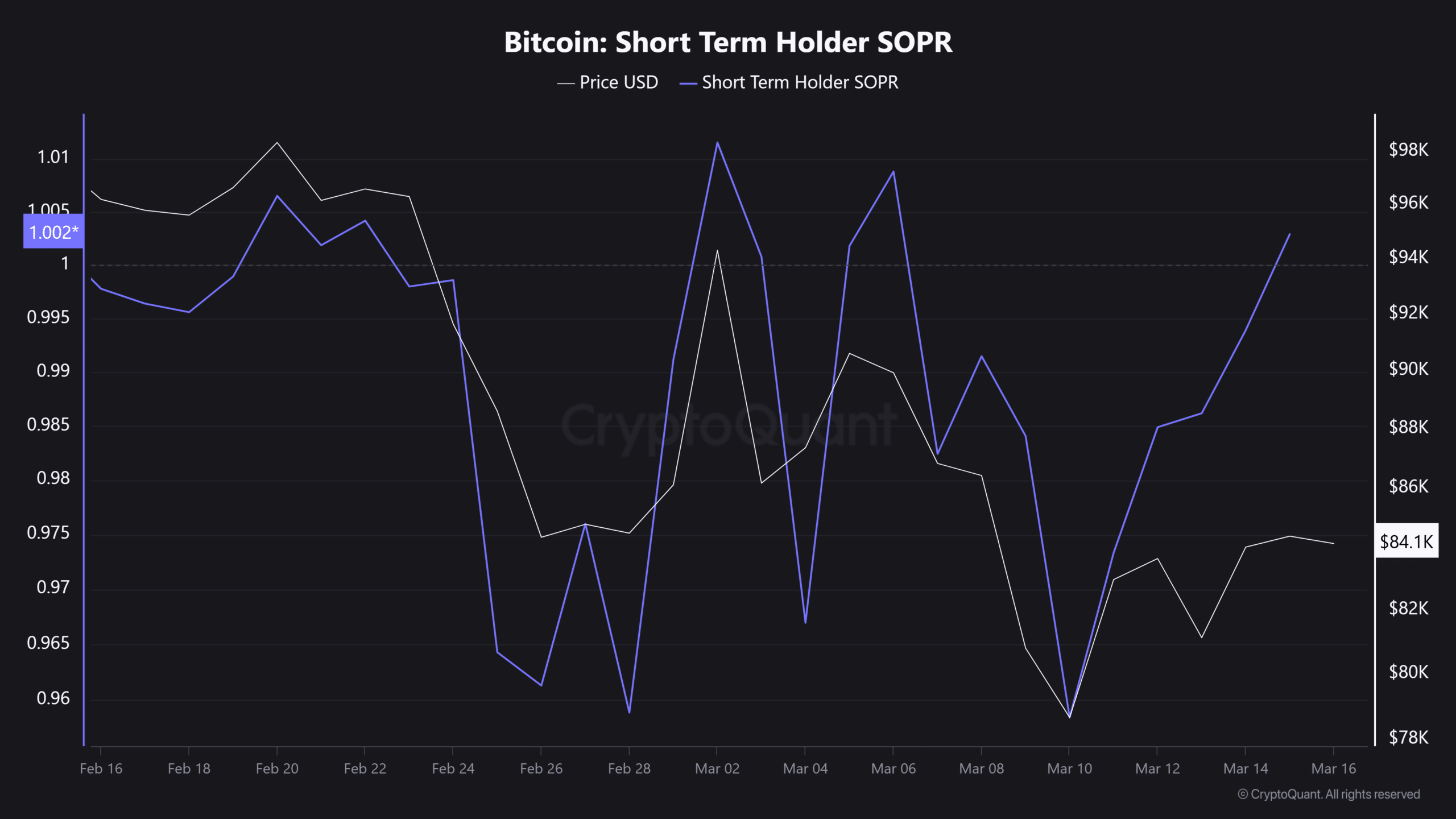

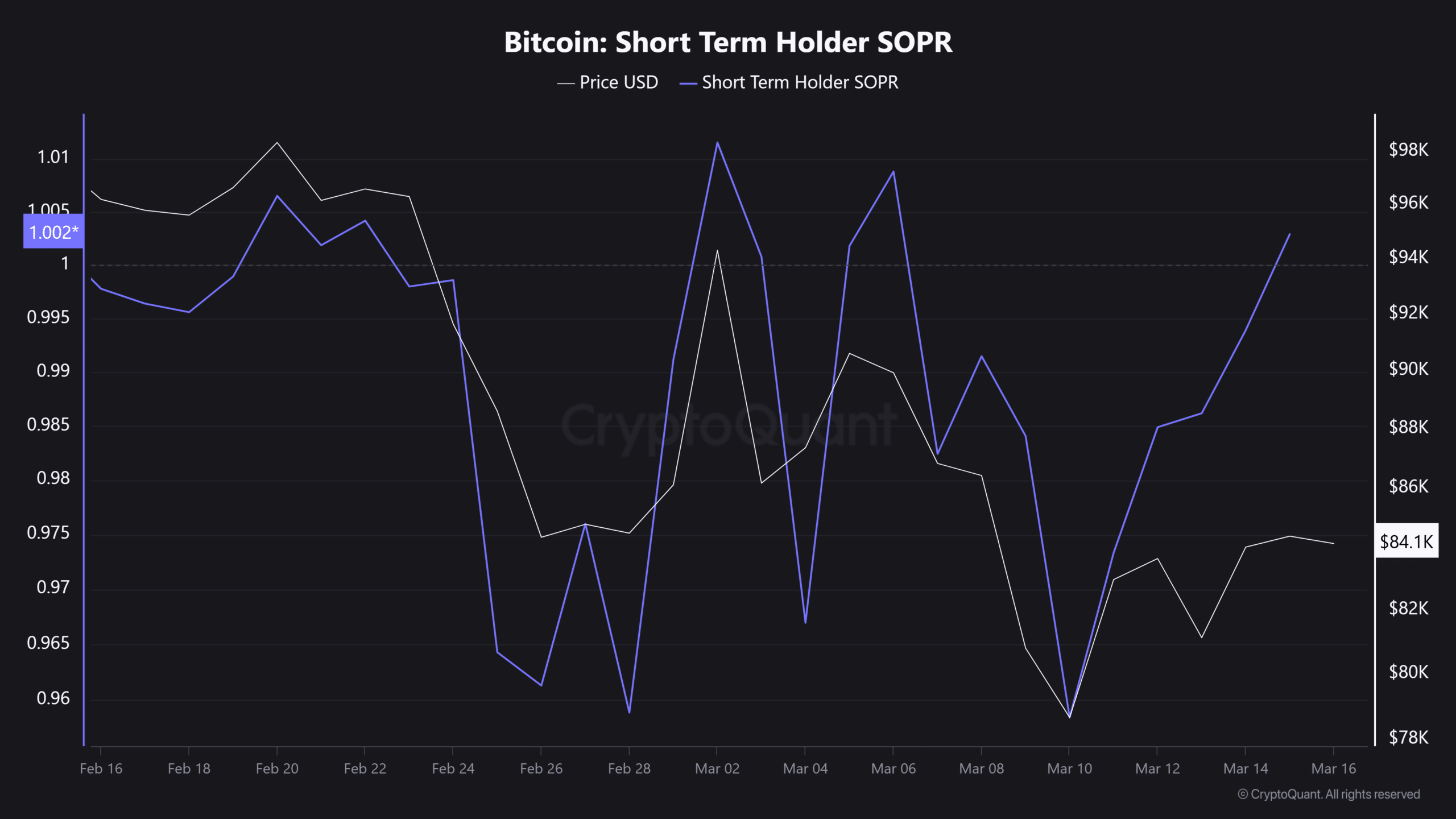

While the short -term holder SOPR recovered 1 while BTC rebounded from $ 81,000 to $ 84,000, a low request could make the absorption of this liquidity on the sales side.

Source: cryptocurrency

With resistance to Bitcoin, XRP can return to $ 2.26 in the short term. However, if BTC decreases below $ 80,000, a remedy of $ 2 or less is possible – an open opportunity can capitalize.

Despite fundamental solids, XRP remains sensitive to market -scale volatility, which makes a break greater than $ 2.60 difficult unless Bitcoin takes up key resistance levels and no longer restores risk appetite.