- XRP approaches resistance with bullish support from the RSI and Bollinger bands.

- Open interest and on-chain activity drive momentum, but NVT urges caution.

Ripple (XRP) is currently attracting bullish attention from retail and institutional investors. At press time, XRP was trading at $0.5421, up 1.93% in the last 24 hours. With crowd sentiment at 0.07 and smart money at 0.74, optimism is growing around the possibility of the altcoin breaking key resistance levels and continuing its upward trend.

However, market conditions remain complex and several factors could influence this trajectory.

XRP Chart Shows Potential

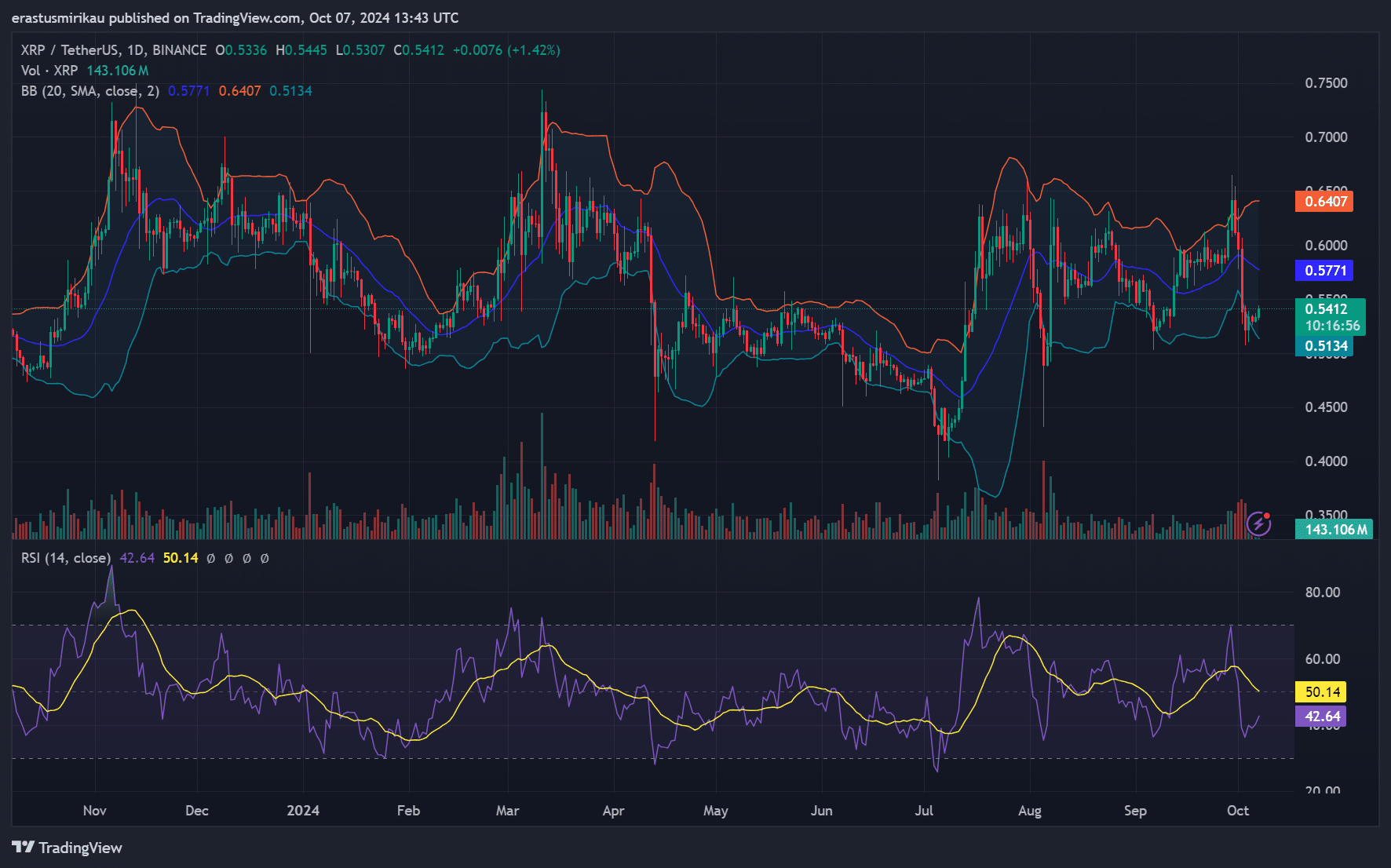

XRP’s price action is contained within its Bollinger bands, ranging between $0.5336 and $0.5445. The relative strength index (RSI) stands at 50.14, reflecting a neutral market position.

The market is therefore neither overbought nor oversold. Therefore, traders could see this as preparation for a breakout. If the bullish momentum continues, a rise above $0.5445 could propel XRP further.

However, failure to exceed this level could see the price consolidate or even retrace.

Source: TradingView

While XRP price action and sentiment point to a bullish outlook, the Network Value to Transaction (NVT) ratio paints a more cautious picture. Currently, the NVT ratio stands at 388.20, down 4.89% in the last 24 hours as of press time, according to CryptoQuant.

A high NVT ratio generally indicates an overvalued network relative to trading volume, suggesting that the price might not be fully supported by underlying network activity. Therefore, despite the positive sentiment, traders should be wary of possible overvaluation.

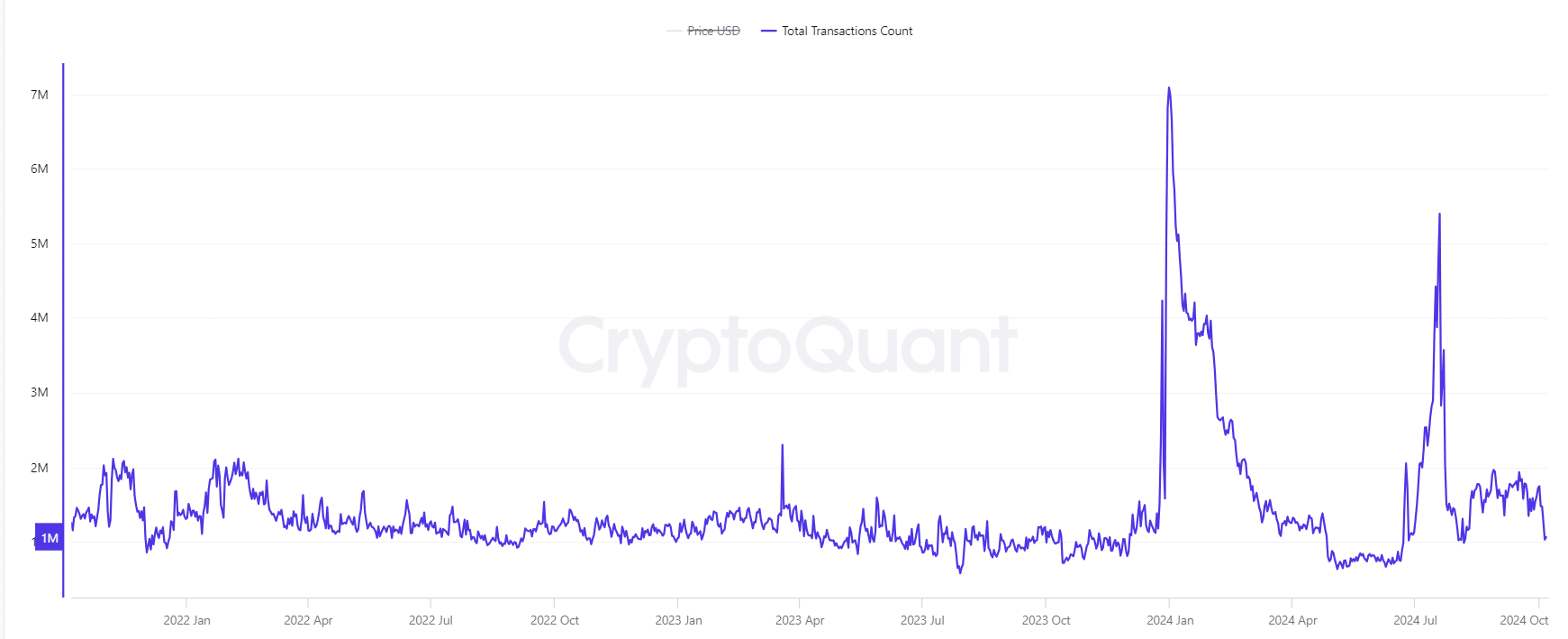

Growing On-Chain Activity: A Positive Signal

In contrast, on-chain metrics provide more encouraging data. The number of User activity reinforces the bullish narrative.

Additionally, increasing network engagement often correlates with stronger price action, making it a positive sign for the near-term outlook.

Source: CryptoQuant

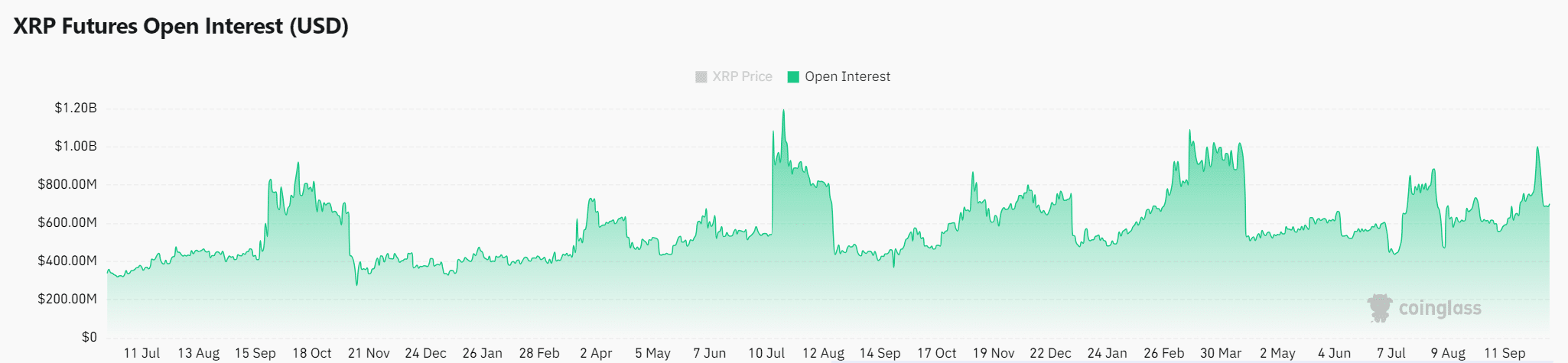

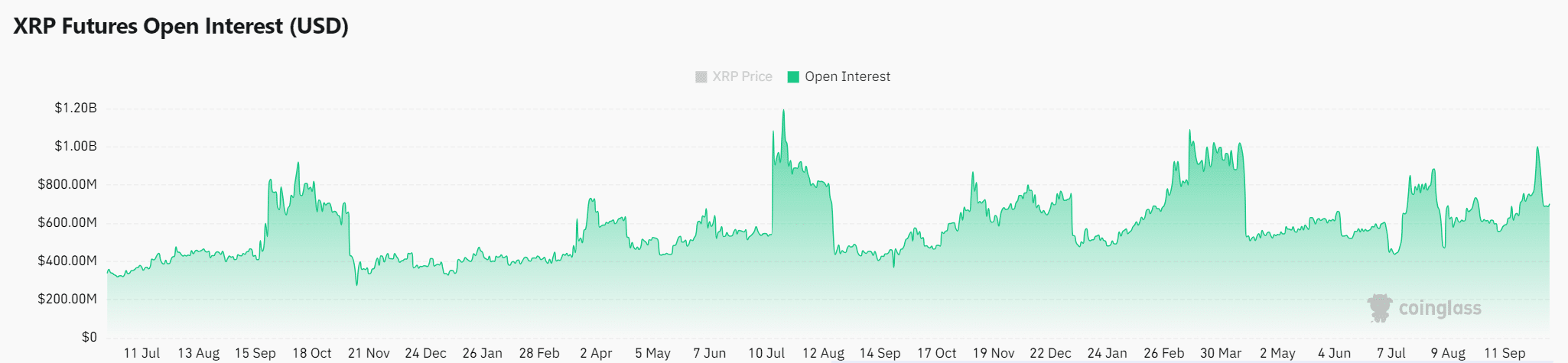

Open Interest Grows

Additionally, XRP’s open interest increased by 1.95% in 24 hours, reaching $714.94 million at press time. The growing open interest suggests increased trader participation and increased market confidence.

Therefore, this could signal growing momentum for XRP, as more traders take positions, anticipating a price breakout.

Source: Coinglass

Read XRP Price Forecast 2024-2025

In conclusion, XRP’s bullish sentiment, rising open interest, and increased on-chain activity suggest that momentum could drive prices higher. However, the high NVT ratio is a cautionary tale.

If XRP breaks through its immediate resistance, it could trigger a sustained rally. Therefore, investors should watch for a break above $0.5445.