Join our Telegram channel to stay up to date with the latest news

XRP price fell 2.6% over the past 24 hours to trade at $2.40 as of 4 a.m. EST, representing a 14% increase in trading volume to $4.66 billion.

The Ripple token price drop came after Ripple Labs co-founder Chris Larsen sold 50 million XRP tokens worth nearly $120 million.

CHRIS LARSEN MAKES BIG MOVES 🚨

Ripple co-founder just transferred 50,000,000 $XRP this represents more than 123 million dollars for an unknown wallet!

A strategic game? Institutional configuration? Something big is coming… 🌊💥 pic.twitter.com/GaNmoeUGct

– XRP Update (@XrpUdate) October 20, 2025

Larsen’s sale, confirmed by on-chain trackers, is his first major transaction since July, fueling debate over whether he expects the coin to fall further in the near term. While some see it as a simple portfolio rebalancing, others say the move demonstrates caution on the part of XRP executives.

There was also better news when Evernorth, led by former Ripple executive Asheesh Birla, revealed plans for a SPAC merger that would raise $1 billion to build the largest public treasury XRP.

Evernorth secured $200 million from big names like SBI Holdings, Pantera Capital, Kraken, and GSR, promising to purchase XRP on the open market once the deal closes.

JUSTIN: Ripple-backed Evernorth plans to list on Nasdaq to raise more than $1 billion to build the largest publicly traded company. $XRP Treasury – Reuters. pic.twitter.com/KP0IIx3nnN

– Whale Insider (@WhaleInsider) October 20, 2025

XRP On-Chain Reaction: Exchange Entries and Institutional Moves

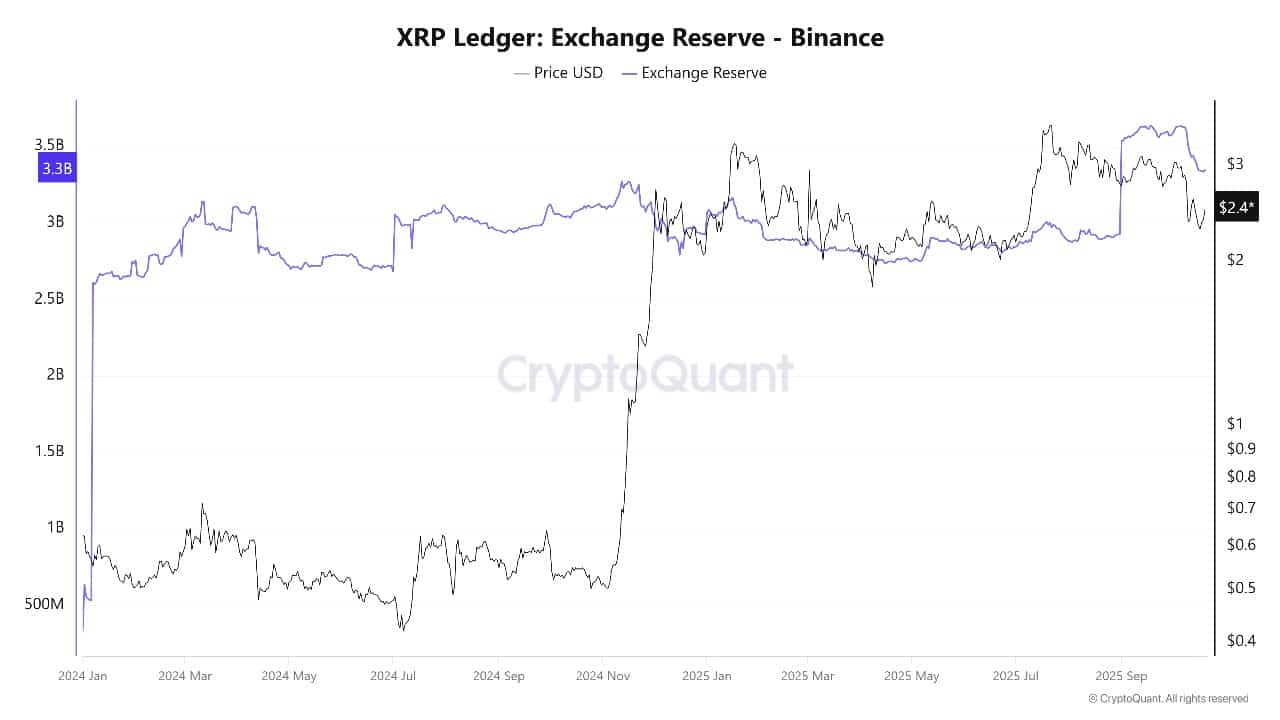

On-chain data from CryptoQuant shows that Larsen’s wallet sent approximately $140 million worth of XRP directly to exchanges, with another $35 million moving into new wallets. These types of large outflows usually mean possible sales or liquidations, which can cause sudden price drops as traders react.

XRP Exchange Reserve Source: CryptoQuant

Analysts say it is important to monitor these exchange flows. Large transfers like Larsen’s are often done for strategic reasons and signal that a major player is cashing out, reshuffling assets, or preparing for further moves involving XRP.

On the other hand, Evernorth’s SPAC model is designed for institutional accumulation, using lending, yield strategies, and direct market purchases of XRP for its treasury. These efforts could create consistent buying pressure over time, balancing sales in the near term if retailer confidence remains positive.

Evernorth’s public listing plans are also boosting the XRP ecosystem. If approved, it will enable open trading and provide institutions with new ways to own and manage XRP at scale.

XRP Price Analysis: Key Support and Resistance

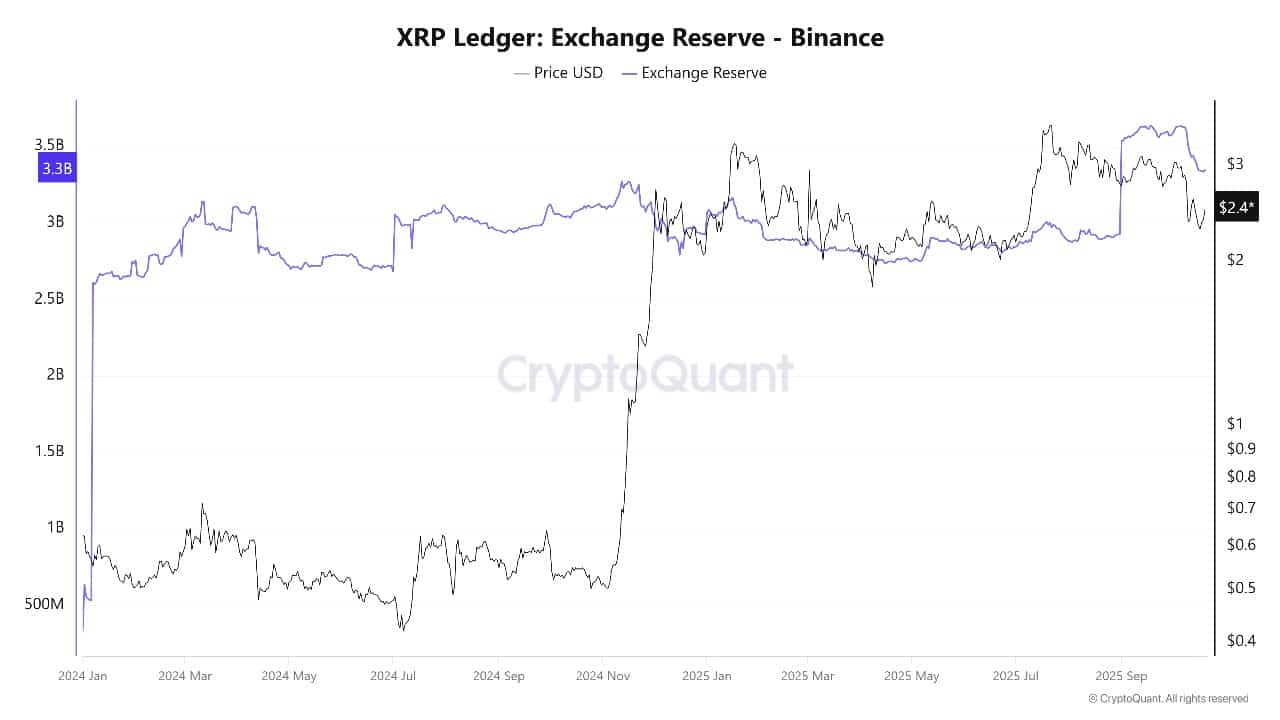

The XRP price chart for October shows that the coin is struggling to recover from a rapid fall below key support zones. It is trading just above $2.40, with the 50-day simple moving average (SMA) at $2.81 acting as overhead resistance, and the 200-day SMA at $2.59 may now provide a ceiling if the price attempts to rebound.

XRPUSDT analysis source: Tradingview

Short-term support lies around $2.40, but a stronger zone lies around $2.00, where buyers last stepped in. The chart shows a major resistance band between $2.80 and $2.59. If the price manages to climb above the moving averages, there is a chance to move back towards $2.80 or even the $3.00 region, which is a key psychological level for traders.

Currently, technical indicators are mixed. The relative strength index (RSI) reads 39, which is weak and suggests the market is oversold. This means that a short-term rebound could occur if buyers return. However, sellers are still in control and the MACD indicator is stable and negative, showing little momentum for a bullish push.

If XRP falls below $2.40, a test of the $2.00 to $2.05 region is likely. Below $2.00, the next supports are much lower, near $1.25. On the positive side, breaking through the resistance at $2.60 and $2.80 could allow the coin’s price to react positively, especially if buying on the Evernorth open market begins and more institutions join this trend.

For now, XRP price faces near-term headwinds from Larsen’s selloff and a sense of nervousness, but growing institutional moves like Evernorth’s $1 billion SPAC could help stabilize the market and attract new buyers.

If support levels hold, a rebound towards $2.60-2.80 remains possible in the coming weeks. A decisive break to the downside could, however, prompt a retest of the summer lows.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news