- XRP remained trapped in a fall corner, with $ 2.04 acting as a strong resistance.

- Chain metrics and whale activity alludes to weakness, not momentum, for an escape.

Ripple (XRP) was Exchanging in a defined range, at the time of the press, with critical support levels at $ 1.67 and $ 1.39 to help bulls absorb the pressure down.

Meanwhile, high resistance at $ 2.04 and $ 2.38 continues to reject the movements upwards.

At the time of writing this document, XRP was at a price of $ 1.99 after a daily gain of 11.49%, but this increase did not lead to any structural rupture.

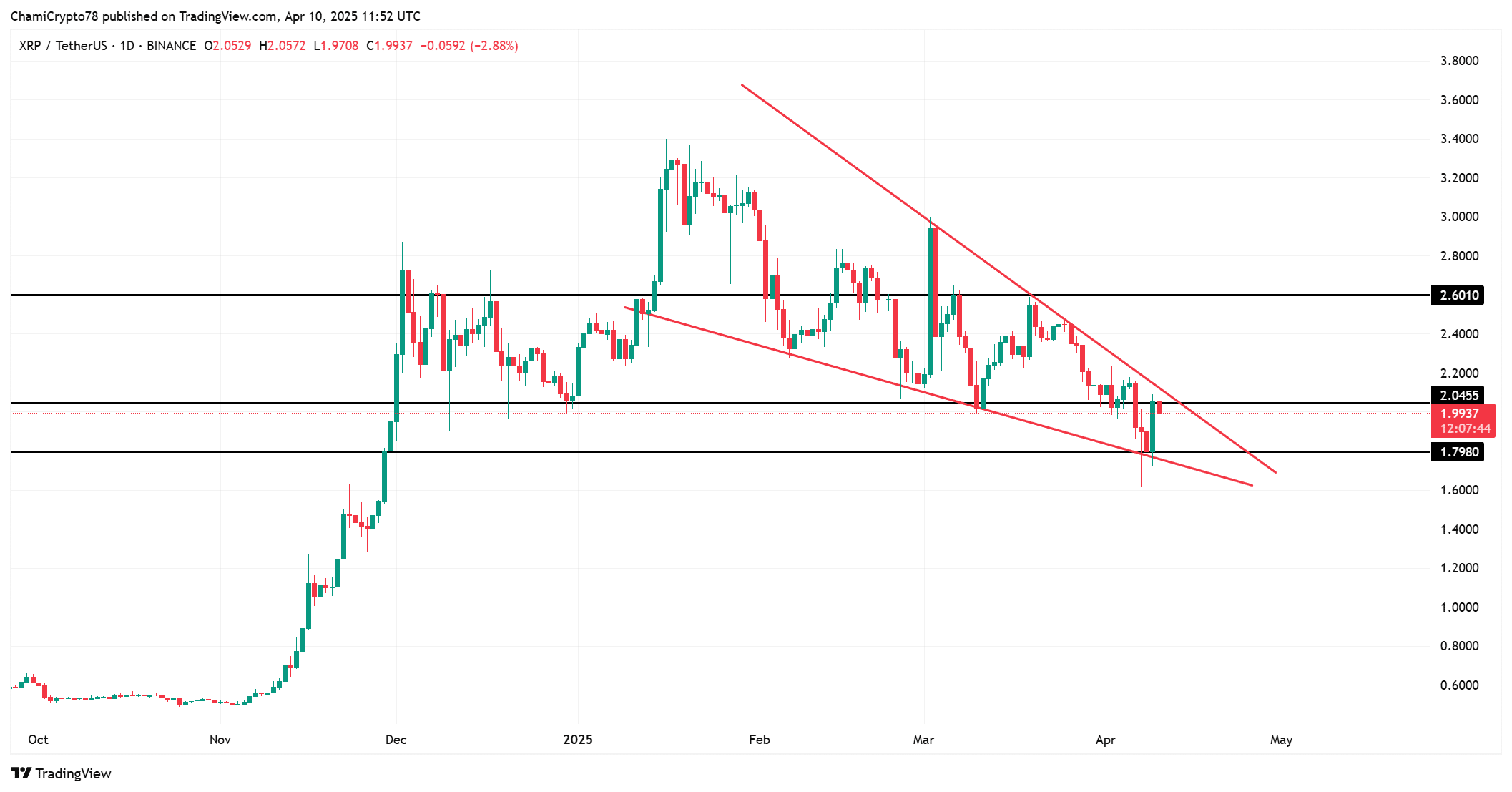

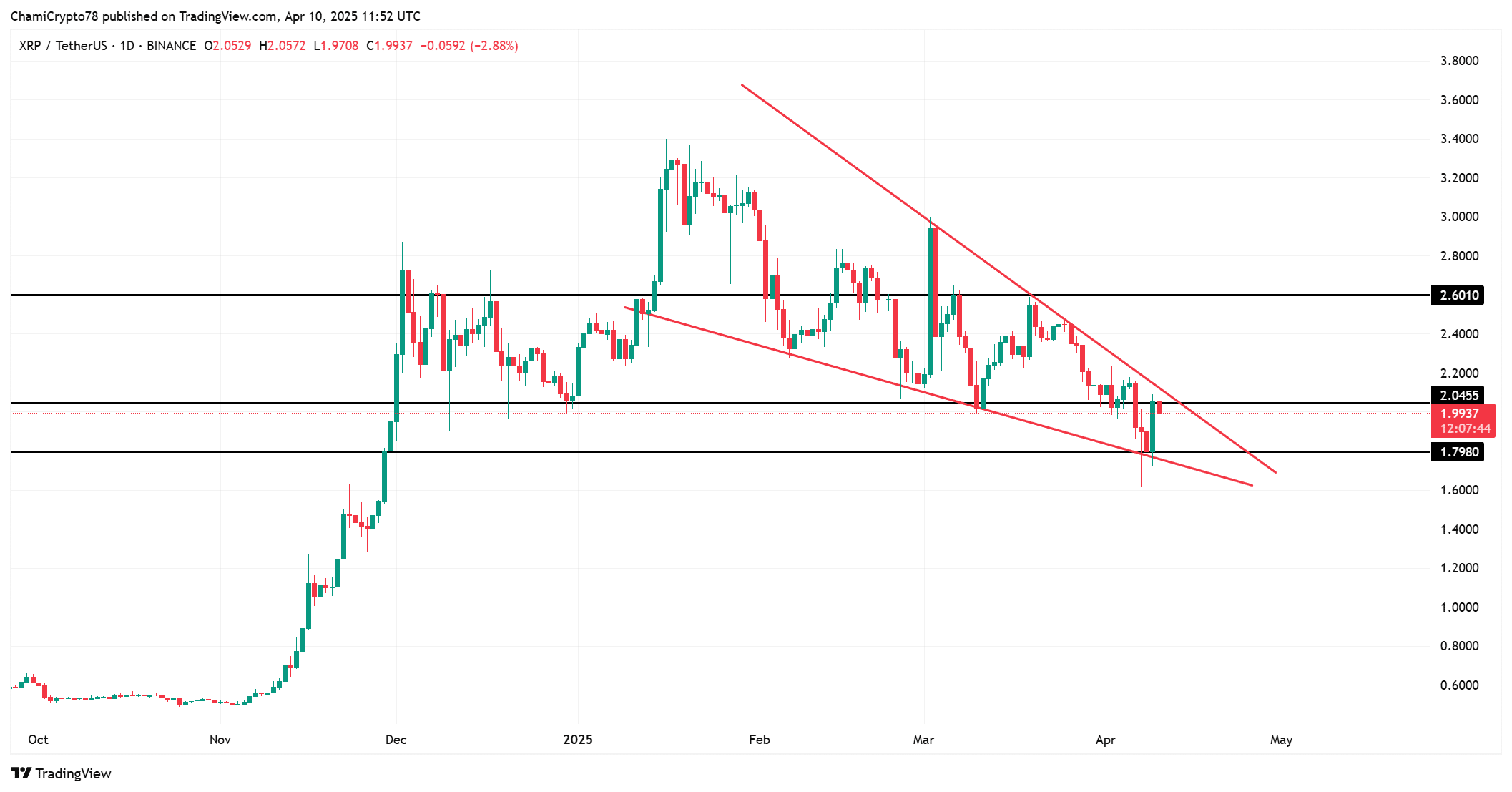

Why the technical model does not confirm a break

XRP remains confined in a falling corner diagram which has persisted for several months. Although the recent rebound of $ 1.79 has shown a certain force, the price is confronted with a rejection precisely with the resistance of $ 2.04 – the upper corner of the area.

In addition, the appearance of long upper wicks on candles near this resistance indicates strong sales pressure and limited bullish impulse.

This supports XRP’s lower perspectives, which will probably persist unless the price reaches a decisive daily above $ 2.04. For the moment, despite occasional short -term rallies, XRP continues to negotiate with a downward bias.

Source: tradingView

Why activity on the chain weakens the upward case

Beyond the action of the prices, the metrics in chain tell a more prudent story.

The divergence from daily active prices (DAA) addresses was -273%, which reflects a major disconnection between price and use. The price of XRP has climbed, but user activity has remained flat.

This disconnection often points to a rally supplied by speculation that real demand. In addition, similar divergence models have preceded inversions in the past.

The absence of strong addressing growth weakens confidence in this decision. Therefore, unless user activity increases, the rally lacks long -term strength.

Source: Santiment

Why the value of Natagne / Ratio transactions risk signals

Adding to these concerns, the value of the network to the transaction (NVT) climbed to 474.93, indicating a significant overvaluation compared to the transaction activity of XRP.

Historically, high readings of the TNV indicate that stock market capitalizations exceeding the real usefulness of the network, which often precedes corrections.

This difference between evaluation and use must be closed either by increased activity or price decline. Consequently, unless the transaction volumes improve strongly, the current rally seems unbearable.

Source: Santiment

Why the activity of the whales and the lever -effect positioning increases the red flags

On April 9, Whale Alert declared a massive transaction of 230,770,000 XRP, worth more than $ 414 million, moved between unknown wallets. Such a large -scale movement generally reflects internal rebalancing, institutional changes or outside exchange.

However, without further clarity, it introduces uncertainty rather than confirming the trends in accumulation or distribution.

At the same time, liquidation data show that $ 2.1 million in long positions were destroyed compared to only $ 705,000 shorts, reporting an increased aggressive exposure.

If XRP continues to cope with a rejection of $ 2.04, more long liquidations could occur, by amplifying the downward pressure.

TThe hat is the reason why the behavior of whales and leveraging negotiation data suggest a high risk rather than a breakup configuration.

Source: Coringlass

Will XRP exceed $ 2.04 immediately?

It is unlikely that XRP exceeds $ 2.04 in the immediate term. The rejection to the upper border of the corner, the weak metrics on the chain and the lack of follow -up confirm that the momentum is not strong enough.

The network seems overvalued and large whale transfers add to short -term uncertainty.

Consequently, unless technical and chain conditions are improving, XRP will continue to fight below this resistance.