Join our Telegram channel to stay up to date with the latest news

The price of

This comes as the long-awaited launch of the Bitwise XRP ETF begins trading today on the New York Stock Exchange under the symbol “XRP.”

Big News: Bitwise XRP ETF Set to Start Trading on the NYSE Tomorrow with the Ticker $XRP.

It has a 0.34% management fee, which is waived in the first month on the first $500 million in assets. This product provides investors with one-time exposure to XRP, the crypto asset that aims to… pic.twitter.com/0GLR37NnuI

– Bitwise (@BitwiseInvest) November 19, 2025

The ETF is expected to bring fresh liquidity from institutional buyers, but uncertainty still looms over the Ripple token after a difficult November.

Bitwise’s decision is big news for the XRP community. The fund has a management fee of 0.34% (waived for the first month) and is maintained by Coinbase.

Bitwise’s XRP ETF is designed as a spot product, promising direct exposure to the price of XRP, unlike previous crypto ETFs focused on futures.

With Grayscale and Franklin Templeton also set to launch XRP funds in the coming week, could these funds help stabilize the price of XRP?

XRP price under pressure as sellers dominate

XRP price action has been under sustained downward pressure. Glassnode data shows that more than 41% of the XRP supply is now at a loss, and only 58.5% of XRP holders are still in profit – the lowest level since late 2024, when XRP was trading near $0.53.

On-chain analytics reveal that whales have been selling off since summer, triggering a sentiment shift toward “anxiety.” Retail investors are also rushing for the exit, especially those who own less than 100 XRP tokens.

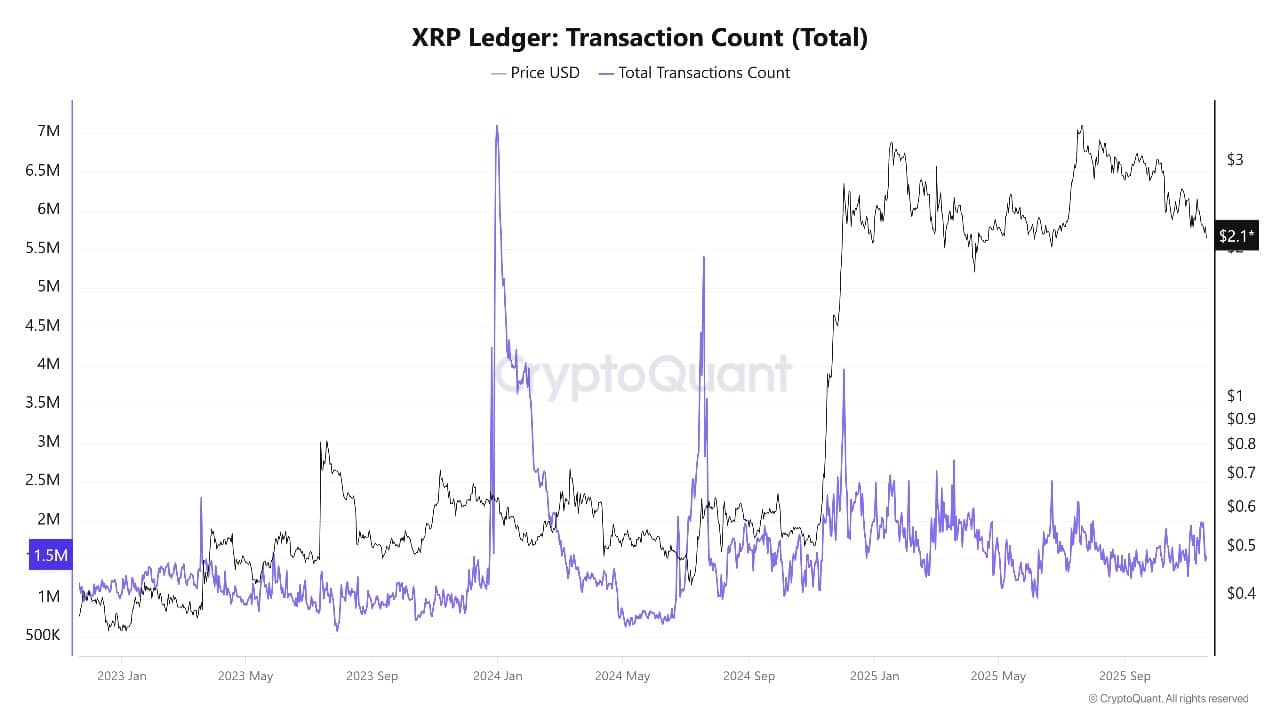

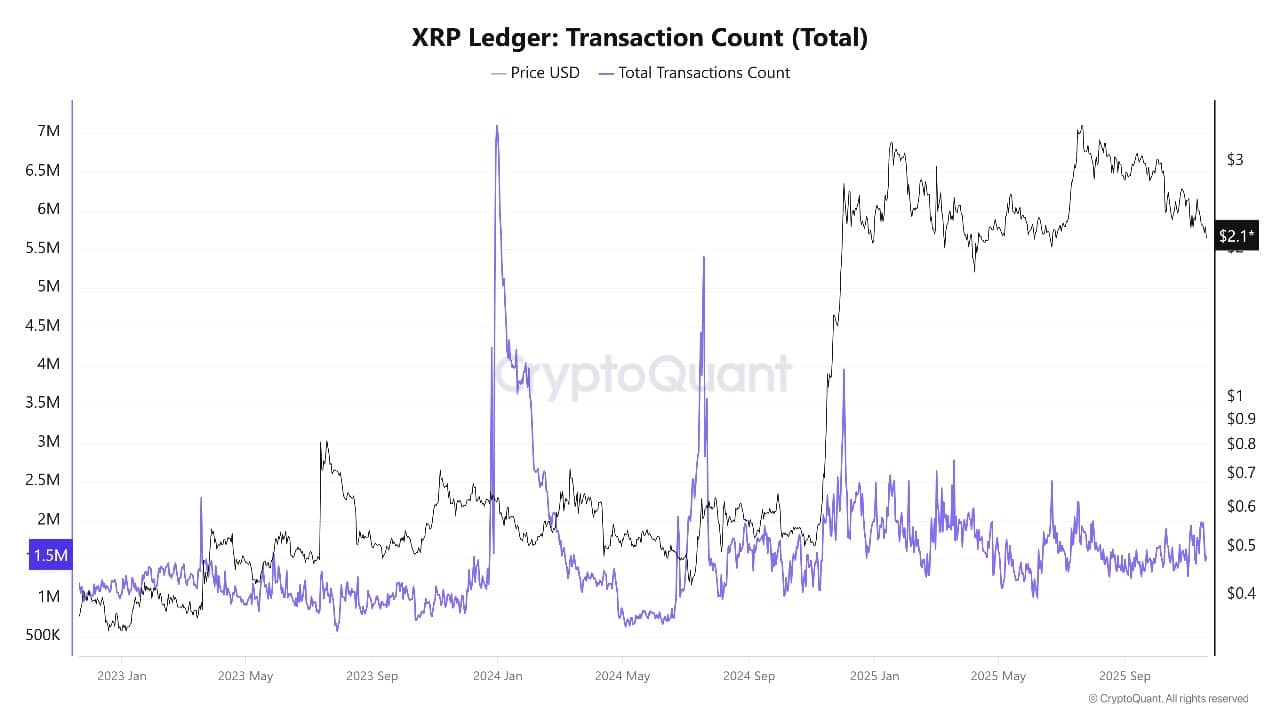

Nonetheless, usage of the XRP Ledger remains strong despite the price decline. XRPScan reports that trading volumes are high, with multiple daily spikes not related to speculative trading, but an increase in utility.

Recently, over two billion XRP was moved across the network in one day, showing that the payment and settlement use cases are still active. The ledger continues to record between 1.5 and 2 million successful transactions per day, outperforming many alternative blockchains, even as the coin’s price falls.

Source of XRP Ledger transaction count: CryptoQuant

XRP Price Bulls Could Take Back Control

XRP price is now trading at $2.12, below the 50-week simple moving average (SMA) at $2.53 and approaching key support levels indicated by the recent multi-month trading range.

The bears are in control as the coin struggles to hold above the critical $2.10 to $2.00 support zone. The 50-week SMA at $2.53 became strong resistance after the recent breakdown. The 200-week SMA sits well below $1.05, suggesting major long-term support remains distant.

Analysis of the XRPUSDT chart Source: Tradingview

The Relative Strength Index (RSI) is at 41, showing that XRP is not yet “oversold,” but the trend is bearish and momentum is lacking. The MACD indicator is negative, with the main line below the signal and histogram bars in red. This indicates that sellers are still in charge.

XRP price is currently stuck between $2.00 and $2.50, with the $2.00 area now serving as key support. If the bears break through this level, the price could quickly drop to $1.80 or even $1.60, close to the 61.8% Fibonacci retracement (to $1.60) of the previous big rally.

Below, the 200-week SMA at $1.05 is the final “line in the sand” for long-term bulls. However, for any rebound, XRP price must first recover $2.20 to $2.25 and then try to return the 50-week SMA at $2.53 to support. Only above $2.53 does the outlook begin to improve, with upside targets near $2.72 (23.6% Fibonacci) and $3.10 (previous local highs).

Will ETF Launches Stabilize XRP?

Today’s launch of the new Bitwise XRP ETF is attracting huge attention from institutional and retail investors. While this should add new liquidity and could attract new waves of buying, the broader negative sentiment and evidence of on-chain selloffs make a quick recovery uncertain.

If the current ETF launch sparks demand, XRP could find support and return to higher levels. But if buyers do not intervene strongly, price risks will drift to lower supports in the coming weeks.

The next few trading days will be crucial in deciding whether the XRP price can finally stabilize or whether the downward trend continues despite the latest crypto product launches on Wall Street.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news