Join our Telegram channel to stay up to date with the latest news

The price of

Garlinghouse said the crypto industry needs regulatory clarity rather than perfect legislation, arguing that a practical framework would encourage innovation in the digital assets sector. He stressed that waiting for an ideal bill could slow progress at a time when clearer rules are urgently needed.

The White House has also signaled strong support for the crypto bill. Patrick Witt, executive director of the President’s Council of Advisors on Digital Assets, noted that compromises are often necessary to achieve meaningful progress. He suggested that the current more crypto-friendly political environment presents the best opportunity yet for the adoption of market structure legislation.

“Let’s not let the perfect be the enemy of the good”: that’s the key. No piece of legislation has ever been perfect by anyone’s standards. What we need is a clear framework for innovation to flourish – exactly what the market structure will provide.

I will continue to say it…

– Brad Garlinghouse (@bgarlinghouse) January 21, 2026

Garlinghouse bullish on crypto

Garlinghouse shared his optimistic outlook for the broader crypto market in an interview with CNBC, predicting that digital assets will reach new all-time highs this year. However, not everyone thinks the CLARITY Act will have a major impact on XRP. Analyst UnknowDLT argued that the bill is unlikely to directly affect XRP, adding to the debate over whether market structure laws benefit all tokens equally or primarily support certain parts of the industry.

Meanwhile, White House crypto czar David Sacks said that once market structure legislation is passed, banks will fully enter the crypto space. He expects traditional banking and crypto to eventually merge into a single digital asset sector, with the same rules applying to all companies offering similar products. Sacks also said banks’ views on yield will shift, especially as they become more involved in stablecoins.

He pointed to the GENIUS Act, passed in August, which includes yield-related provisions, although it prevents stablecoin issuers from directly offering rewards. However, third-party crypto service providers can still provide revenue to users. Sacks emphasized that compromise is essential for the CLARITY Act to be signed into law, noting that previous crypto bills failed repeatedly before succeeding.

XRP Price Bulls Defend Key Support, Parabolic Reversal at Center

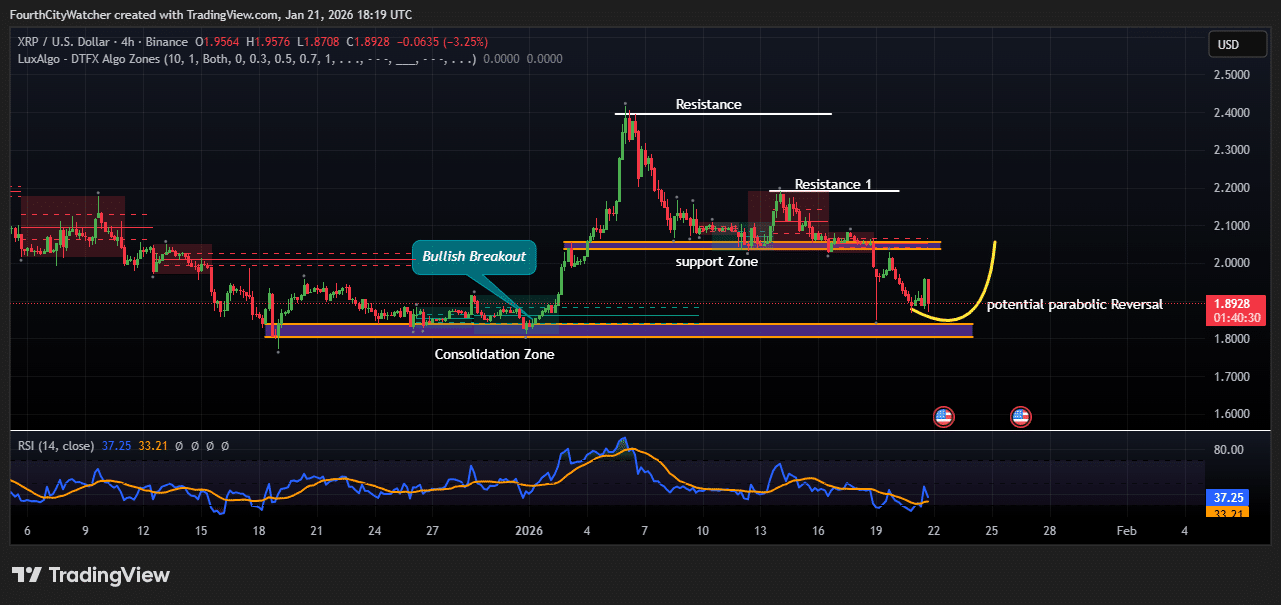

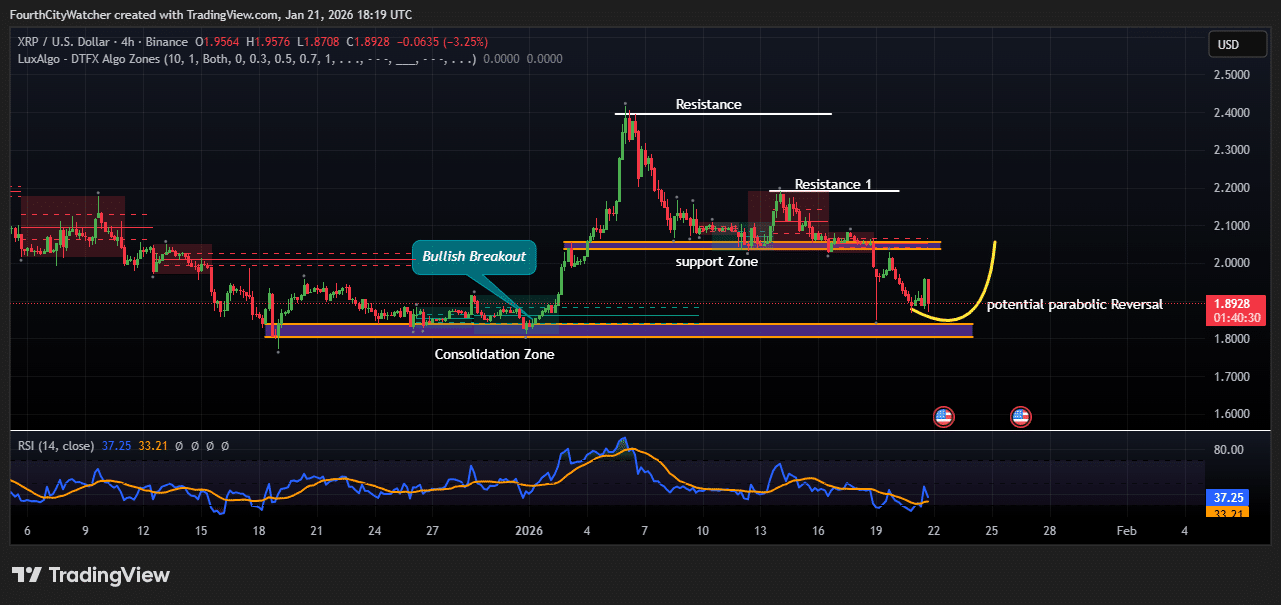

The XRPUSD pair remained under pressure on Wednesday, extending its short-term downtrend as sellers continued to dominate the 4-hour chart. The token was trading near $1.89, down more than 3% on the session, after failing to reclaim a critical resistance zone around the $2.05 to $2.10 range.

The chart shows that XRP previously benefited from a strong bullish breakout from an extended consolidation zone near $1.85, which fueled a strong rally towards the $2.40 zone earlier this month. However, this move was met with strong selling pressure, forming a clear rejection at the upper resistance level and triggering a broader correction phase.

After the pullback, XRP attempted to stabilize above the old support zone, near $2.00. This area briefly acted as a demand region, but repeated rejections during Resistance 1 weakened the bullish momentum. Once the price lost the psychological $2.00 level, the bears pushed XRP towards the $1.85 to $1.88 support band, which has always attracted buyers.

XRPUSD chart analysis. Source: Tradingview

Notably, the current structure suggests that XRP could form a rounded base. The highlighted potential parabolic reversal indicates that as long as the price remains above the lower support zone, the bulls could attempt a recovery move. A successful bounce from this level would likely first target the $2.00 region, followed by a retest of $2.10 if momentum improves.

Dynamic indicators remain mixed. The RSI (14) is hovering around 37, signaling that XRP is approaching oversold territory but has yet to confirm a strong bullish divergence. This suggests that downside risk still exists, even though selling pressure appears to be slowing.

From a market perspective, traders are closely monitoring whether buyers can defend the current demand zone. A break below $1.85 would invalidate the bullish reversal pattern and expose XRP to greater losses towards $1.70. On the positive side, reclaiming $2.00 would be an early signal that the bulls are regaining control.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news