Join our Telegram channel to stay up to date with the latest news

The price of XRP fell 3.9% over the past 24 hours to trade at $2.49 as of 3:46 a.m. EST on trading volume that plunged 8% to $5 billion.

This comes as Canary Capital filed a updated S-1 for its sports XRP ETF (exchange-traded fund), removing the “delaying amendment” that allowed the SEC to control the timing of registration.

The move paves the way for a potential launch on November 13, pending approval of the 8-A filing by Nasdaq.

🚨SCOOP: @CanaryFunds filed an updated S-1 for its $XRP spot ETF, removing the “delaying amendment” which prevents a registration from automatically becoming effective and gives the @SECGov timing control.

This defines the Canaries $XRP The ETF is set for a November 13 launch date, assuming… pic.twitter.com/MKvEN23t5P

– Eleanor Terrett (@EleanorTerrett) October 30, 2025

After the update, the ETF can now take effect automatically under Section 8(a) of the Securities Act of 1933.

The move also comes at a time when SEC Chairman Paul Atkins has shown support for companies using the automatic efficiency method, which Bitwise and Canary used to launch their SOL, HBAR, and LTC ETFs.

Atkins praised the use of the statutory 20-day waiting period during the shutdown, underscoring its effectiveness in facilitating public offerings.

With the updated submission, Canary’s XRP ETF can move forward without formal approval from the SEC, and it appears set to continue once the legal 20-day period has passed. The only potential delay would be if the SEC issues additional comments or concerns.

XRP Price Movements Signal Potential Continued Downside

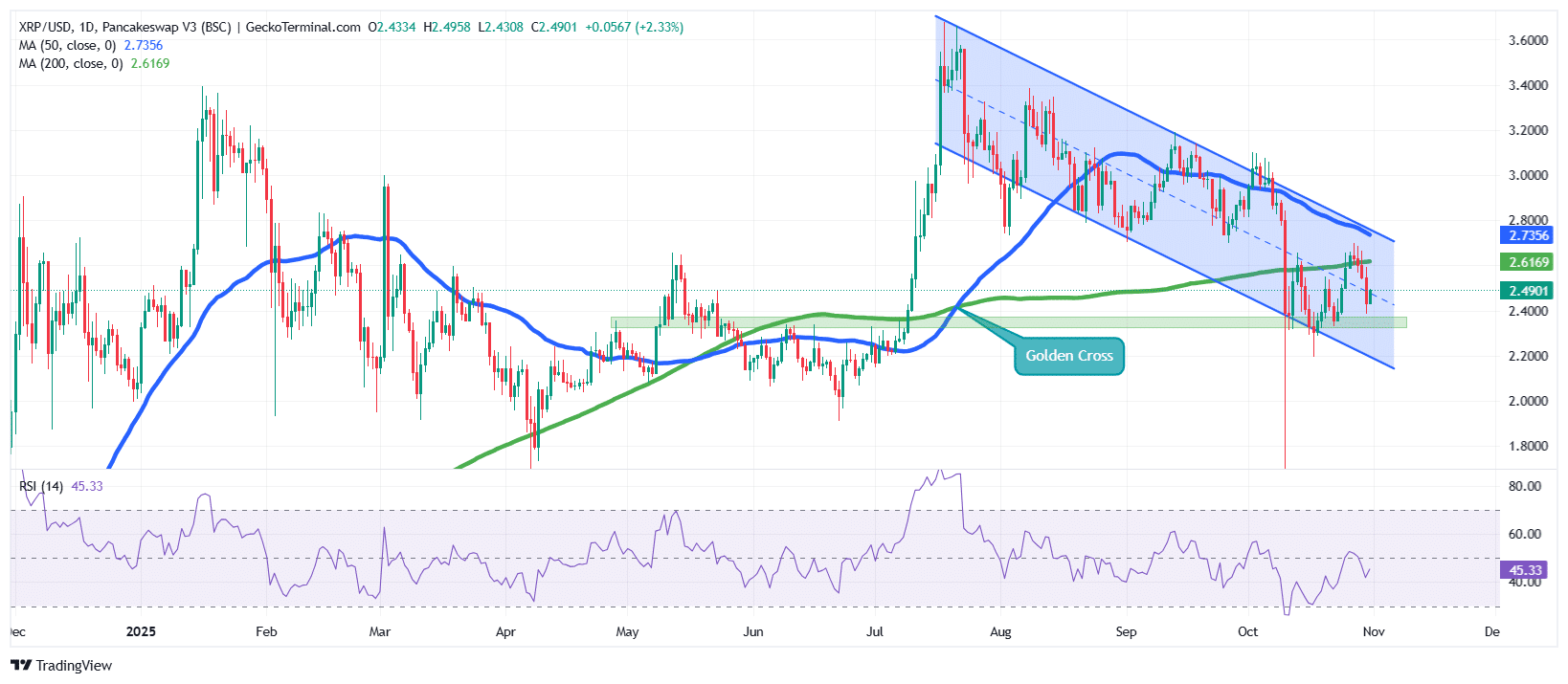

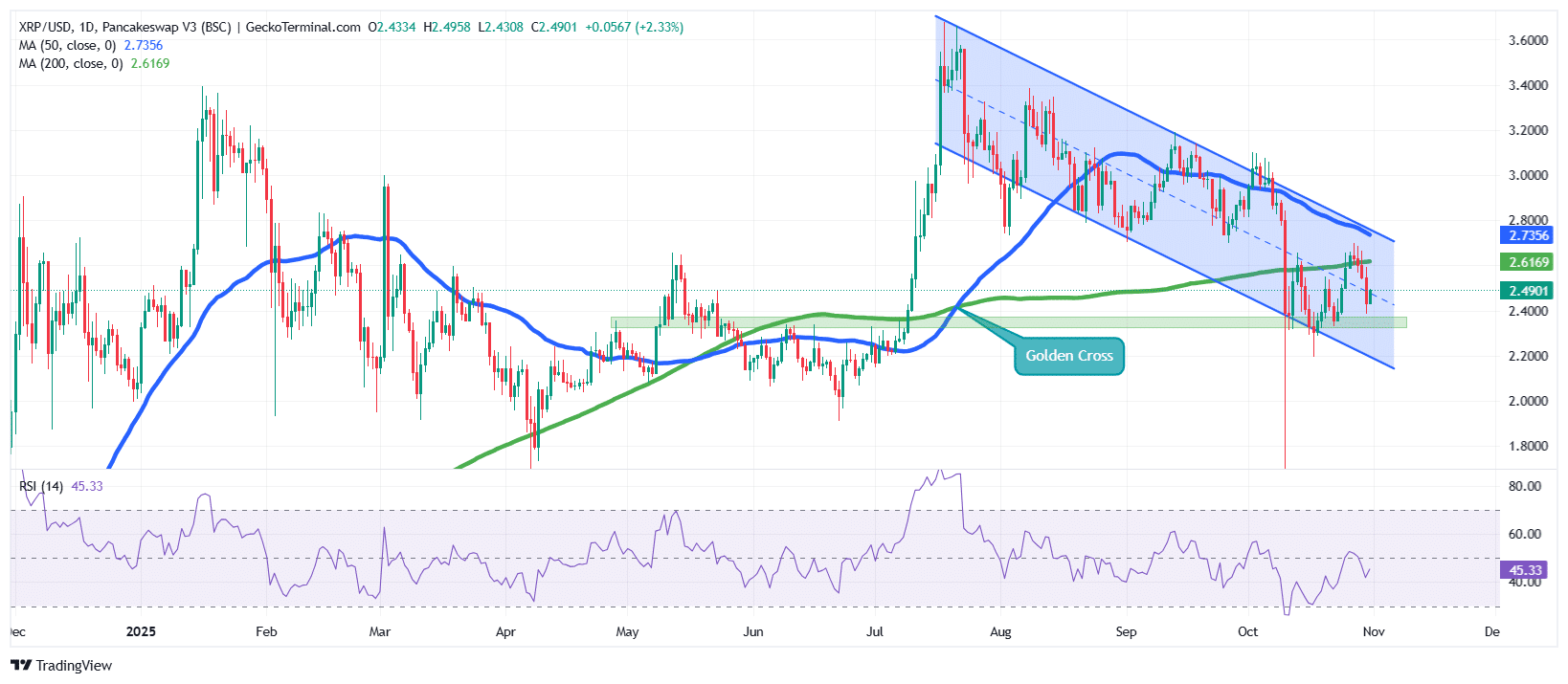

After a strong recovery in July which pushed the XRP Price Toward the $3.30 area, momentum shifted as the bears regained control, triggering a retracement that turned into a descending channel pattern.

Throughout this phase, bulls have attempted to defend the $2.40 to $2.45 support zone, but recent market structure suggests that sellers remain dominant.

The ongoing correction has forced the Ripple token price below its 50-day simple moving average (SMA), currently around $2.73, confirming that short-term momentum remains negative. The 200-day SMA, currently around $2.62, acts as a short-term pivot level, and a break below could open the door to further declines.

Despite the previous Golden Cross (when the 50-day SMA rose above the 200-day SMA), the recent pullback has neutralized this bullish signal, suggesting that XRP may need to retest deeper support levels before any recovery attempt.

Additionally, the Relative Strength Index (RSI) currently sits near 45.3, reflecting reduced buying pressure and a trend toward bearish sentiment.

Ripple Token targets support near $2.35

Given the current technical setup, XRP price appears poised to test its horizontal support zone around $2.35, an area that has held steady several times in recent months.

A decisive close below this level could see the Ripple token slide further towards $2.20, which aligns with the lower boundary of the descending channel.

Conversely, if the bulls manage to defend the $2.40 zone and push the price of the Ripple token above $2.73 (the 50-day SMA), XRP could attempt a breakout towards the upper boundary of the channel, near $2.80-2.85.

A confirmed close above this range would be the first signal of a potential bullish reversal.

New related:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news