Join our Telegram channel to stay up to date with the latest news

XRP price plunged 6% in the last 24 hours to trade at $2.46 at 4:00 a.m. EST on a 17% drop in trading volume to $8.54 billion.

The price of the Ripple token has been under significant pressure since Friday, with crypto trader Ali on X telling his 160,000 followers that on-chain data shows whale investors have sold 2.23 billion XRP since then.

2.23 billion $XRP sold by whales since Friday! pic.twitter.com/H9HLAHdm1b

– Ali (@ali_charts) October 14, 2025

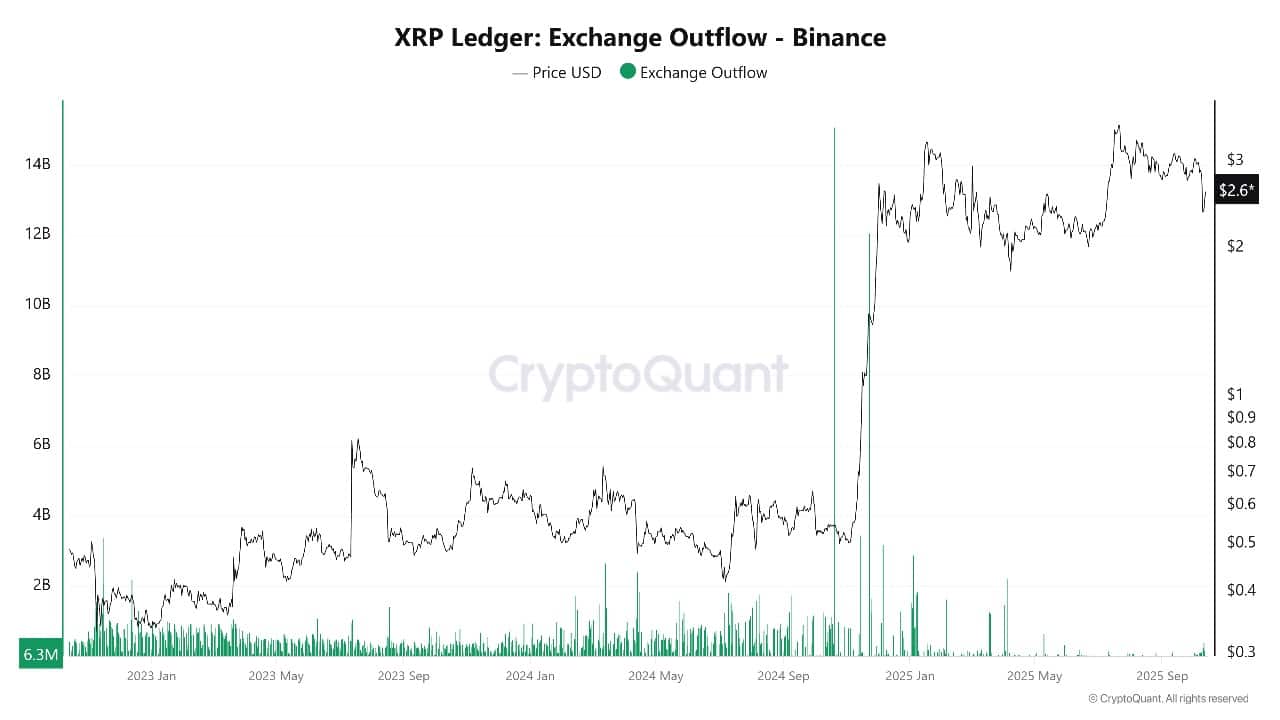

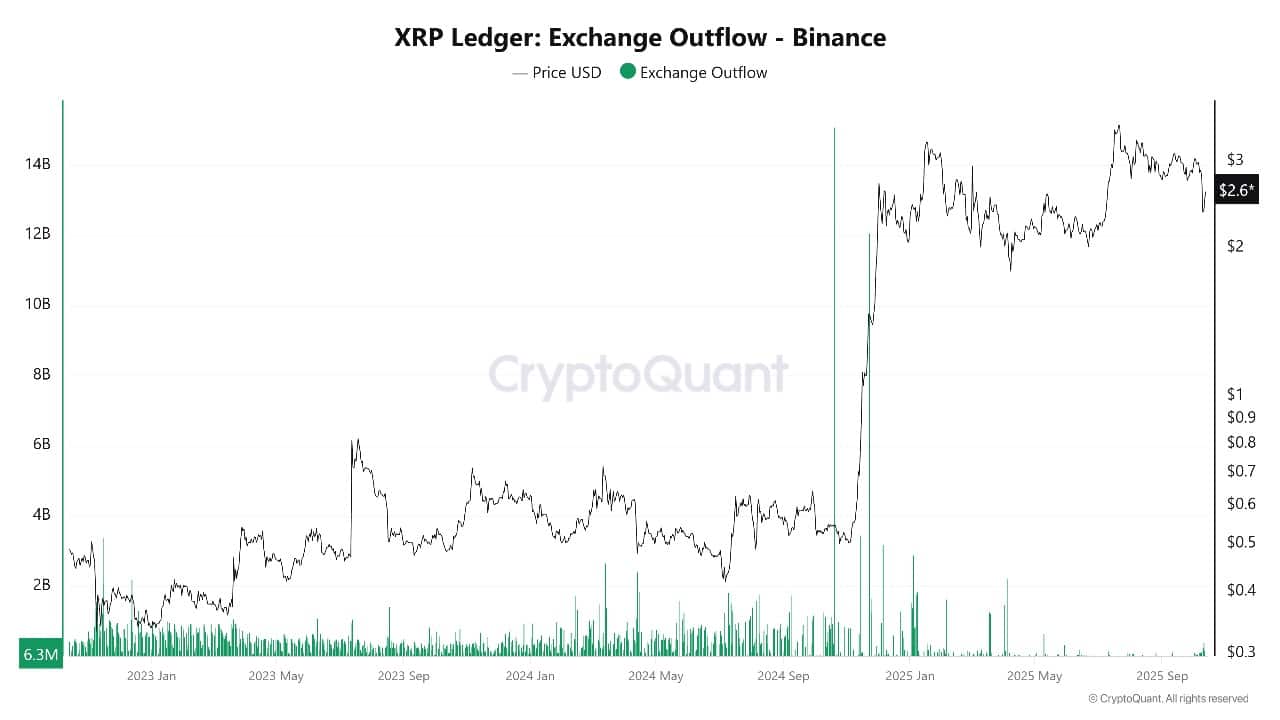

This is one of the largest capital outflows in months. The impact of these sales was immediate, with the price of XRP rising from almost $2.90.

The losses snowballed, with over $10 billion wiped from XRP’s market cap in less than a week.

On-Chain XRP Price Signals: Whales and the Battle for $2.30

On-chain data supports these reports, showing that whales are regularly releasing XRP. Data from platforms like Santiment shows a sharp decline in whale holdings, just as the price of XRP briefly fell below $2 for the first time since June.

The big wave of whale sales coincided with increased open interest on exchanges and an increase in trading volumes. For example, on October 13, XRP volume exploded to 244.6 million at one point, three times its average, showing a rush of buying activity below $2.55 as some courageous buyers fought to reach a bottom.

Source of XRP exchange exits: CryptoQuant

Analysts believe that if the whale sell-off continues, the price may struggle to stay above $2.20. But if the whales retreat and retail demand returns, buyers could take control, causing a rebound toward $2.90 to $3.00 and ultimately back to July highs.

Sentiment is still fragile, especially as the market awaits more news on possible XRP ETF spot approvals. If hopes for a US-listed XRP ETF rise again or macroeconomic stability returns, whale activity could quickly shift from selling to further accumulation.

XRP Price Technical Analysis: Sideways, But Watch Levels

Technically, the price action of XRP has been very unstable after last week’s sell-off. The weekly chart shows the price currently at $2.46, down nearly 17% over the past seven days and sitting below both the 50-week simple moving average (SMA) at $2.46 and the key Fibonacci retracement from 0.618 to $2.57, both crucial reference points for long-term traders.

If price remains below the $2.50 area, the next likely support lies in the $2.14 to $2.20 range, which is an area of prior strong demand and coincides with an oversold reading on the daily Relative Strength Index (RSI).

XRPUSDT Analysis source: Tradingview

If this zone fails, the path could open towards $1.90 and perhaps even a retest of the $1.01 level, which is the long-term 200-week SMA, last visited during the summer flash crash. On the positive side, re-establishment of the $2.57 to $2.65 band would be the first sign of strength, while any break above $2.90 would open the door for a return to the $3.66 high.

Momentum indicators are still bearish. The RSI is below 50 (currently 46.29), showing that bears hold the advantage. The MACD is negative but with a slight bullish divergence as the histogram flattens. The Average Directional Index (ADX) shows that the strength of the trend is increasing, meaning volatility may remain high until things stabilize.

In summary, XRP could remain volatile while whales decide their next move. If buyers hold the $2.14 area and break above the resistance, the price could quickly rally towards $2.90. But further whale selling risks pushing the price below $2.00 and bringing it closer to long-term retracement levels, especially if the ETF hopes for a stall or if macroeconomic uncertainty increases.

For traders and investors, the coming days will likely provide a key test for XRP’s long-term bullish narrative. Whales have shaken the market, and the next move could decide whether XRP rebounds or plunges to new 2025 lows.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news