- XRP displays light gains Thursday after a US court blocked President Trump’s prices.

- The SEC announced the agenda and the panelists of its cryptographic round table on June 9.

- The open interests of XRP derivatives fall to $ 4.8 billion as the long increase in liquidations, signaling solid winds.

Ripple (XRP) hovers at around $ 2.28 at the time of writing the moment of writing, reflecting the bullish feeling on the cryptography market after a US court (United States) ceased President Donald Trump’s prices on Wednesday. Meanwhile, the Crypto Working Group of Securities and Exchange Commission (SEC) will organize a round table on June 9, bringing together key industry figures, notably Rebecca Rettig by Jito Labs.

According to a report by Reuters, the International Commerce Court judged that the American Constitution grants the Congress the exclusive power to regulate trade with other countries and that this authority cannot be replaced by the president’s emergency powers to protect the economy.

Dry announces a program and panelists of the round table

The dry Crypto working group has announcement The agenda and the panelists for its round table of June 9. The round table, nicknamed “DEFI and the American spirit”, will be held at the agency’s headquarters in Washington, DC

Nine members will be on the panel, of which Jill Gunter of Espresso Systems, Omid Malekan of the Columbia Business School, Rebecca Rettig by Jito Labs and Peter Van Valkenburgh Center Center, among others.

“DEFI illustrates the promise of the crypto, because it allows people to interact without intermediaries,” said Commissioner Hester Mr. Peirce, head of the Crypto Working Group. “I can’t wait to learn panelists about how we can create a regulatory environment in which Defi can prosper,” he added.

Technical perspectives: Can XRP validate a potential escape of 14%?

The XRP price increase in prices at the beginning of May has been overshadowed by a strong downward trend in the past two weeks, as it looks at the potential to extend losses around $ 2.20, the next area of interest for merchants who are considering drops.

The silver payment token lies under key mobile averages on the 4 -hour graph, including the exponential mobile average of 50 periods (EMA), EMA at 100 periods and EMA of 200 periods. This gives credibility to the short -term lower momentum, which is accentuated by the reversal of the relative resistance index (RSI) under the midfield 50.

If the indicator of divergence of Mobile Average Convergence (MacD) flashes a sales signal when the blue MacD line crosses the red signal line, the main areas rich in liquidity, such as demand zones at $ 2.20, $ 2.21 and $ 2.00, respectively, will be in sight.

Table XRP / USDT 4 hours

The motif of illustrated ditch on the graph above suggests that XRP has the potential To reverse its downward trend. This bullish model is characterized by two lines of downward trends which converge to the right of the graph, indicating a drop in the volume and the pressure of the sale.

Traders are looking for a break above the higher trend line, accompanied by an increase in commercial volume, to validate the corner of the fall. As observed on the graph, the target of 14% of $ 2.63 is determined by measuring the distance between the widest points of the pattern and extrapolating above the higher trend line.

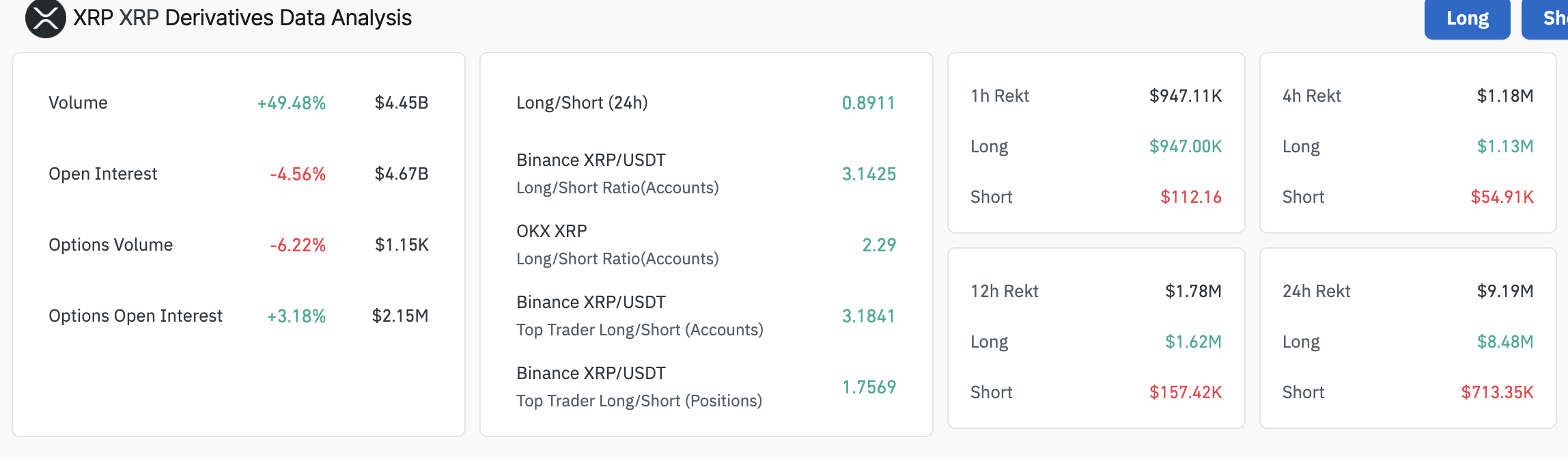

Meanwhile, XRP derivative data indicates that open interests (OO) decreased by approximately 4.6% to $ 4.67 billion in the last 24 hours. This coincides with an increase of almost 50% of the volume to $ 4.45 billion, referring to a developing bias in development as traders close positions in term contracts and options.

XRP derivative data | Quince source

The drop in OC as the volume increases underlying a significant increase in long-position liquidations, which has reached $ 8.5 million in the last 24 hours, compared to around $ 713,000 in shorts.

If this situation persists, traders can move cautiously in the midst of early volatility, in particular with the publication of inflation data for personal consumer expenses (PCE) on Friday.

Dry vs ripple the laws of trial faq

It depends on the transaction, according to a court decision published on July 14, 2023: for institutional investors or over -the -counter sales, XRP is a guarantee. For retail investors who bought the token via programmatic sales on scholarships, liquidity services on demand and other platforms, XRP is not security.

The United States Securities & Exchange Commission accused Ripple and its managers of having collected more than $ 1.3 billion thanks to an unregistered asset of the XRP token. While the judge has judged that programmatic sales are not considered to be titles, sales of XRP tokens to institutional investors are indeed investment contracts. In the latter case, Ripple has broken the US securities law and had to pay a civil fine of $ 125 million.

The decision offers a partial victory for Ripple and the dry, according to what we look at. Ripple obtains a great victory that programmatic sales are not considered to be titles, and this could well increase for the wider cryptography sector, because most of the assets watched by the repression of the dry are managed by decentralized entities that have sold their chips mainly to retail investors via exchange platforms, according to experts. However, the decision does not help much to answer the key question of what makes the digital asset security, it is therefore not yet clear if this trial provides for a precedent for other open cases which affect dozens of digital assets. Subjects such as which is the good degree of decentralization to avoid the “security” label or where to trace the line between institutional and programmatic sales persist.

The SEC has intensified its application measures to the blockchain industry and digital assets, depositing accusations against platforms such as Coinbase or Binance for having allegedly violated the American laws on securities. The SEC says that the majority of cryptographic assets are titles and therefore subject to strict regulations. Although defendants can use parties of Ripple’s decision in their favor, the SEC can also find reasons to maintain its current regulatory strategy by application.