The chain data shows that activity on the XRP network recorded a big peak during last week, volatility, volatility has swallowed up the market.

XRP active addresses and volume have recently increased

In a new article on X, analyst Ali Martinez discussed the latest trend in XRP active addresses. The “active addresses” refer here to a chain indicator which keeps a trace of the total number of addresses which become “active” or online on the network each day.

An address is considered active when it participates in a kind of transfer activity. This applies, whether the address is involved as a sender or receiver. Thus, a single transaction always leads to the activation of at least two portfolios.

When the value of active addresses increases, this means that there are more addresses that make network transfers. Such a trend suggests that trade in assets increases among investors.

On the other hand, the lowering indicator implies that holders can pay less attention to cryptocurrency, because fewer of them are involved in transactions.

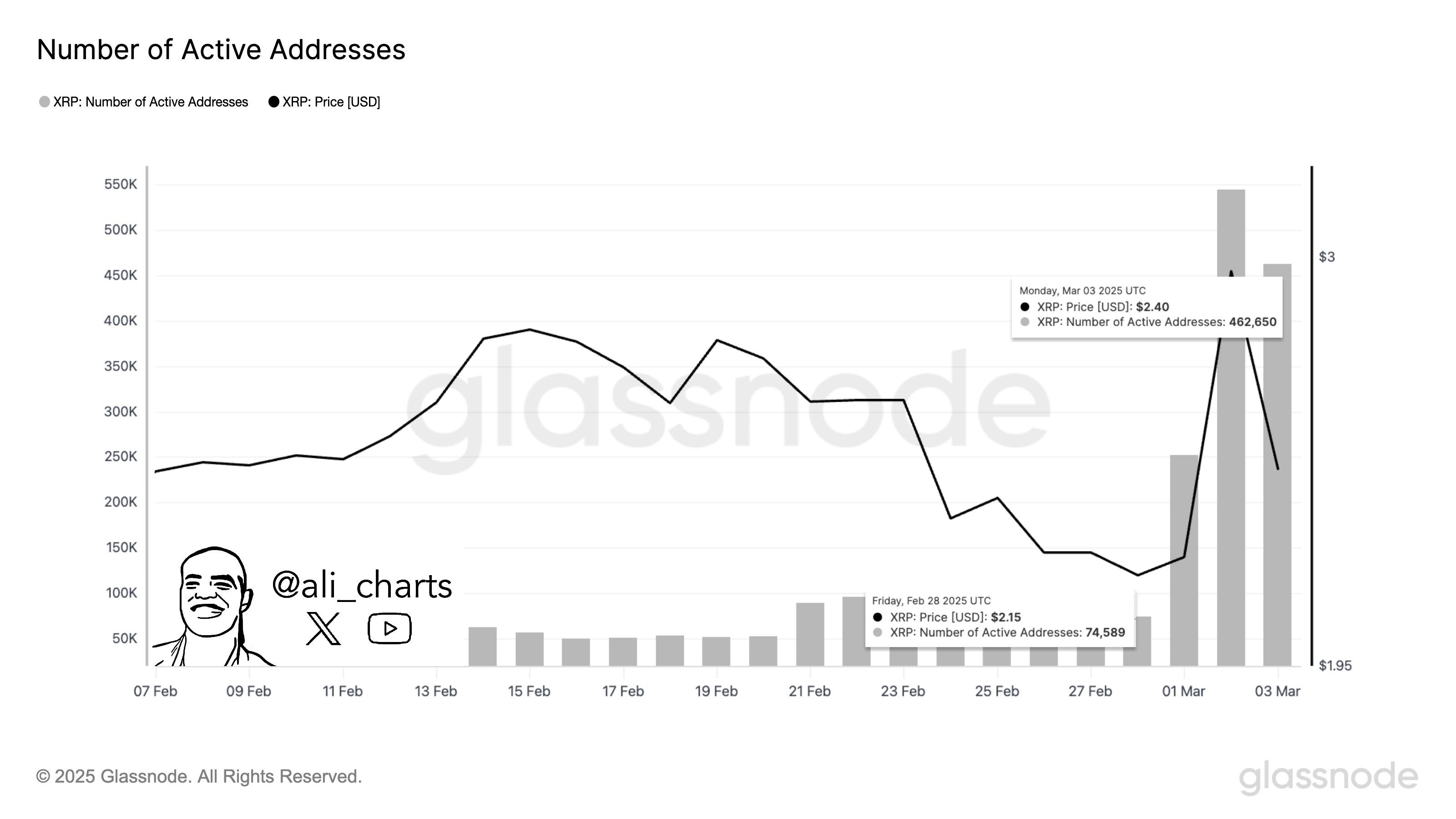

Now here is the Glassnode graph shared by the analyst who shows the trend in active XRP addresses in recent weeks:

The value of the metric appears to have witnessed a spike in recent days | Source: @ali_charts on X

As displayed in the above graph, the XRP active addresses finished in February in a hollow, but since this month of March, the indicator has experienced a strong renewal.

“The number of active XRP addresses has skyrocketed 620% last week, going from 74,589 to 462,650!” Martinez notes. The net of the indicator came while the medal crossed great volatility.

Generally, investors are attracted to the market for periods like this and are making panic movements. In turn, high activity ends up increasing price volatility.

Since active addresses are always at a high level at the moment, it is possible that the net price action of cryptocurrency has not yet ended. Another indicator which is correlated with the activity of the network is the volume of transfer and as the analyst has pointed out in another post X, this metric has also increased recently.

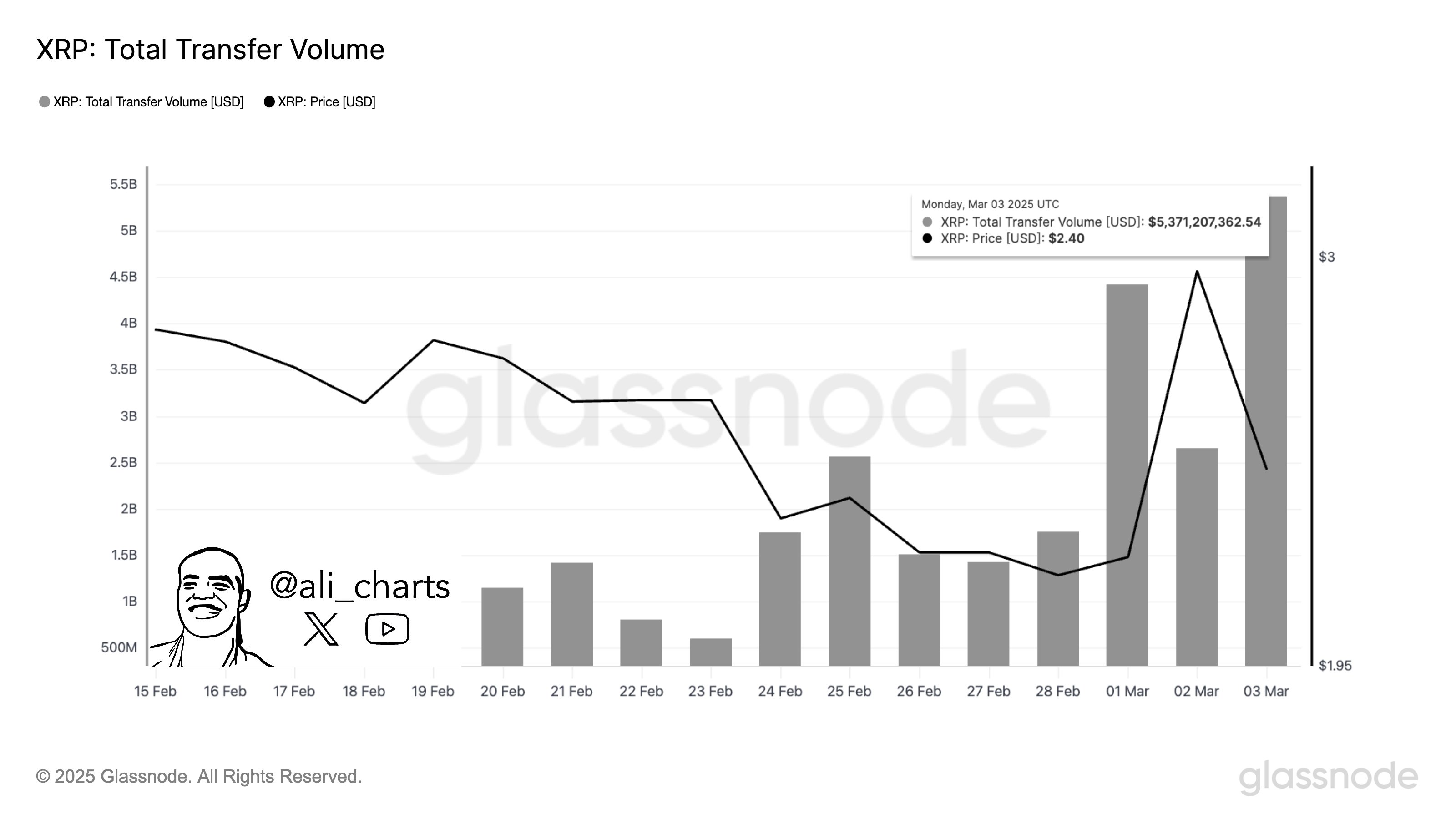

Looks like the value of the metric is quite high at the moment | Source: @ali_charts on X

The transfer volume measures the total quantity of the assets which is moved to the blockchain every day. This indicator and active addresses deal with the transaction activity, but they differ in that they put more weight on different sides of the market.

Small investors are more in number, so that the active trend on addresses tends to be correlated with their behavior. On the other hand, large transactions affect the volume of transfer to a greater measure, so that metric represents the activity of whales.

Since active addresses and the transfer volume have increased, it would seem that all sides of the market are busy making movements at the moment, which is not too surprising.

XRP price

At the time of writing this document, XRP is negotiated about $ 2.47, up more than 9% in the last seven days.

The price of the coin seems to have retraced its recent rally | Source: XRPUSDT on TradingView

Dall-E star image, Glassnode.com, tradingView.com graphic