- TVL of XRP exceeds $ 80 million, marking rapid expansion in the DEFI space.

- The growing network activity and the speculation of FNBs contribute to the strong bullish momentum of XRP.

XRP started 2025 with remarkable momentum, emerging as one of the fastest growth assets in the decentralized finance sector (DEFI).

Its total locked value (TVL) has skyrocketed, reflecting increasing adoption and confidence in its ecosystem.

Coupled with an activity and speculation on the network surrounding potential approval of the FNB XRP, the asset has drawn considerable attention from retail and institutional investors.

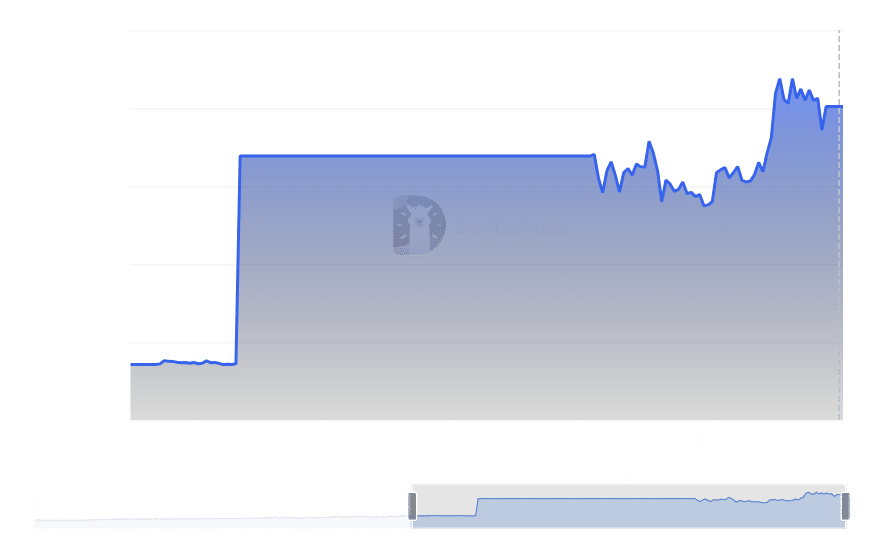

Total value overvoltages of XRP (TVL)

Ripple witnessed an explosive increase in its total locked value (TVL) this month, positioning itself among the fastest growth in the decentralized financing ecosystem (DEFI).

According to Defillama, XRP TVL exceeded $ 80 million, a remarkable increase compared to its levels below $ 20 million a few months ago.

This significant growth indicates confidence in confidence in the challenge applications of the Grand Book XRP and the expansion of liquidity.

Source: Defillama

A more in -depth examination of the TVL table indicates that it knew its first major peak in November 2024, crossing the bar of $ 60 million.

While metrics showed intermittent fluctuations in December, XRP began 2025 with a renewed rise trend, now stabilizing over $ 80 million.

This trajectory underlines the increasing imprint of XRP in Defi and the wider blockchain ecosystem.

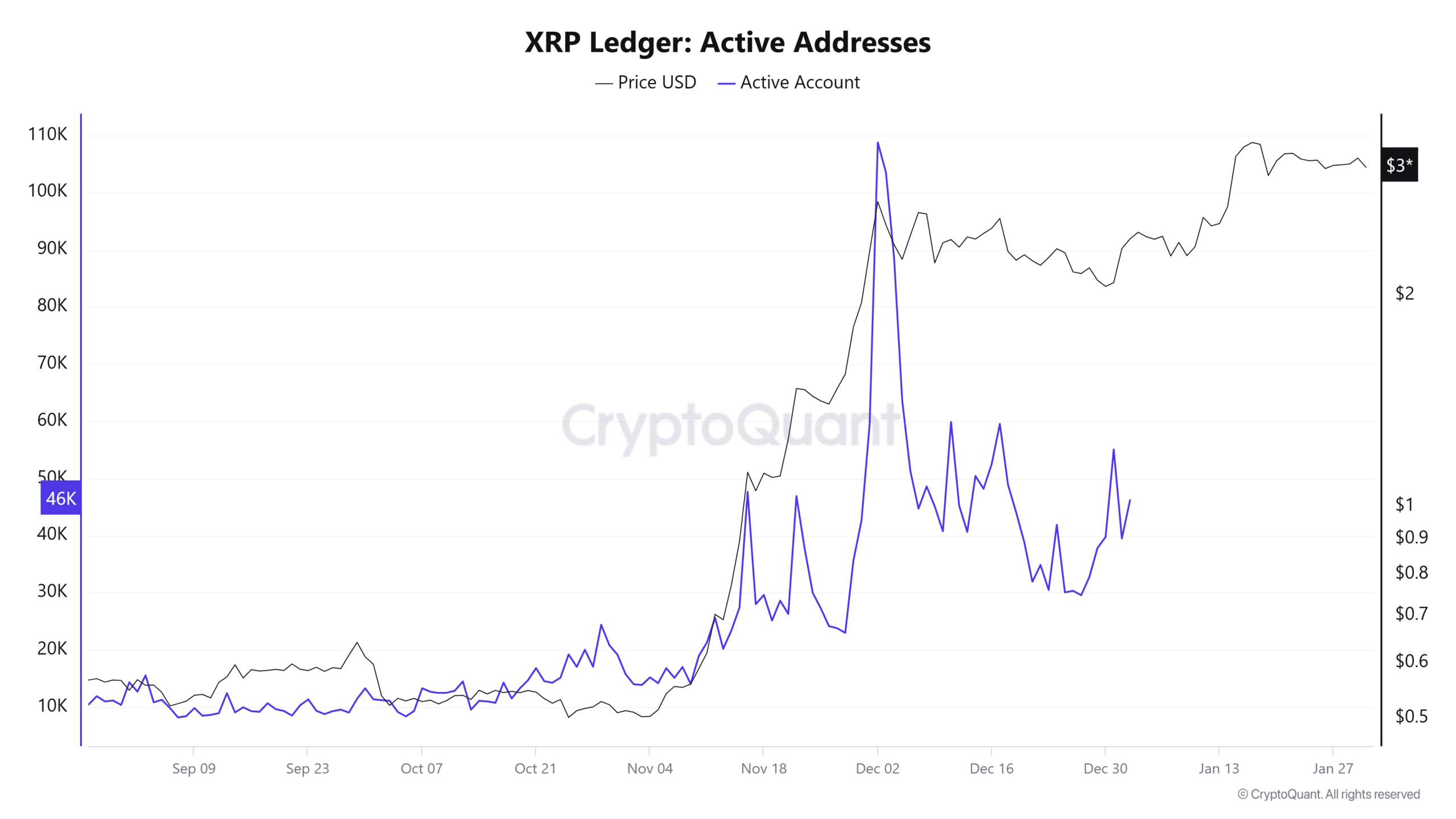

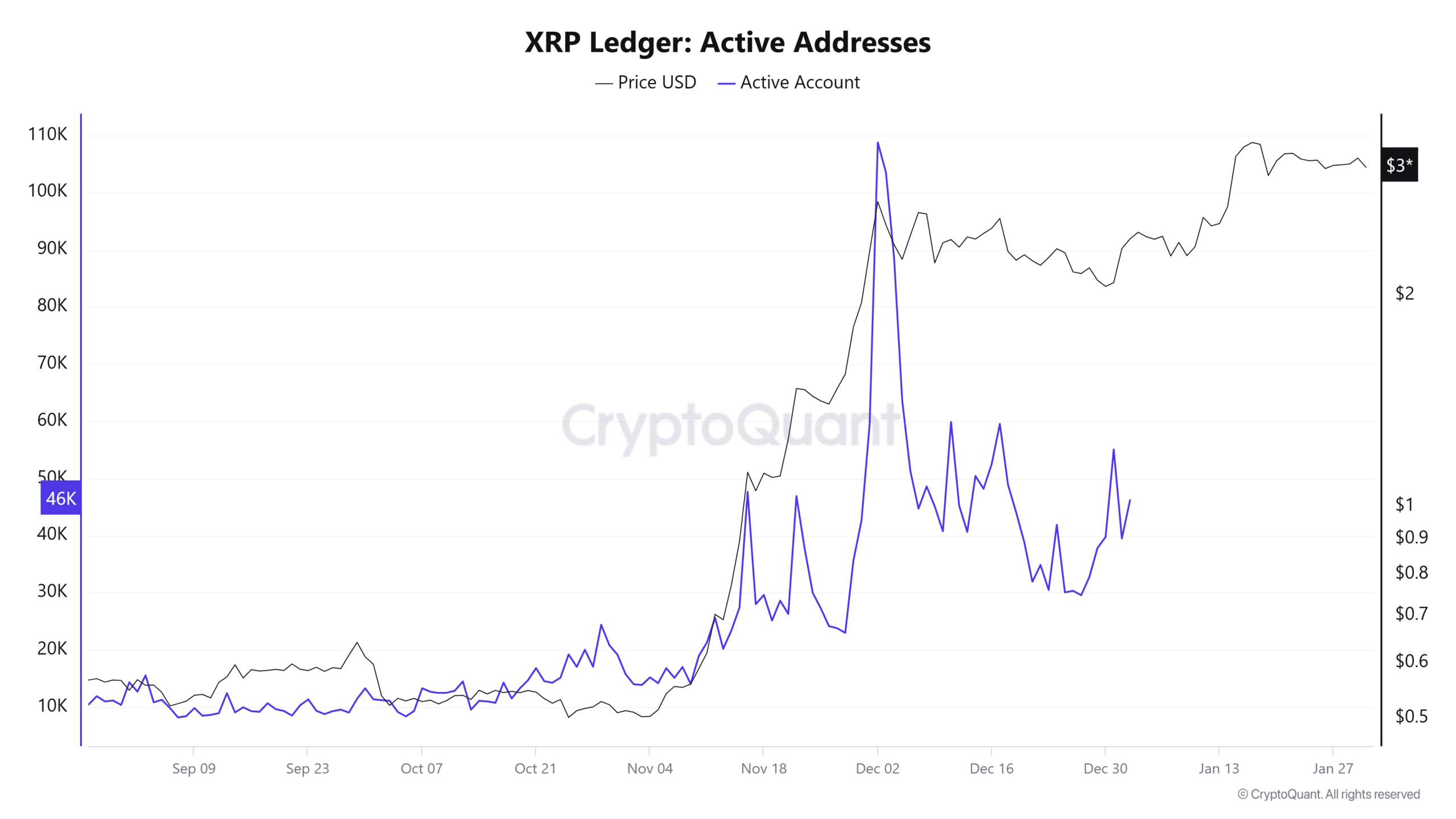

Network growth and addresses active on fuel on the chain

Beyond TVL overvoltage, XRP network activity has also displayed remarkable force.

Santiment data reveals a notable peak in network growth, reflecting an increasing number of new portfolio addresses interacting with blockchain.

This is a strong indicator of increasing adoption, which suggests that more users engage with the XRP ecosystem. However, there was a notable drop recently.

Likewise, cryptocurrency data on active addresses confirm this trend. His active addresses have constantly increased, culminating at more than 110,000 at the end of January 2025 before being slightly.

This increase in network participation suggests an increased negotiation activity and an increase in chain usefulness, factors that generally support prices.

Source: cryptocurrency

XRP maintains an upward structure

Ripple’s price has reflected its expansion of the network, retaining a global bullish structure despite minor corrections.

XRP was negotiated at $ 2.97 at the time of the press, reflecting an intraday drop of 1.94%. However, its long -term trend seemed intact, with XRP considerably increasing compared to its hollows of 2024.

Source: tradingView

The 50-day mobile average is at $ 2.61, well above the 200-day mobile average at $ 1.26, signaling a bull crossover and a sustained rise dynamic.

XRP reached a summit of $ 3.07 before experiencing slight resistance, indicating potential consolidation before another ascending leg.

STrong support is around $ 2.50, a level where increased purchasing activity could prevent the drop more.

The rise in TVL power, the expansion of the network and the favorable technical configuration suggest that it could maintain its solid performance in the coming weeks.

ETF speculation adds to market excitement

One of the motor factors of Ripple’s recent growth is speculation surrounding potential FNB approval.

While FNB Bitcoin have already made waves in traditional markets, analysts believe that regulatory clarity for altcoins like XRP could open the way to an ETF XRP Spot.

This would considerably increase institutional interest if it was approved, further supplying its liquidity and adoption.

Read the Prix forecasting of Ripple (XRP) 2025-26

With an increasing TVL, strong growth in the network and a solid price action, XRP is distinguished as one of the most promising assets in 2025.

The possibility of an FNB approval adds another bull’s layer of potential, making it a cryptographic asset to look in the coming months.