Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

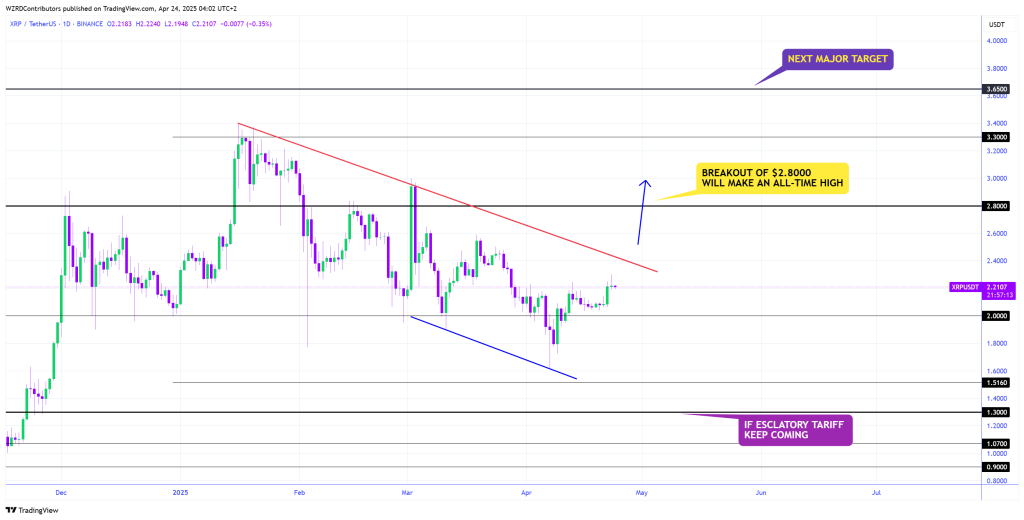

A new daily graphic shared by the market technician @cryptowzrd_ suggests that XRP is only a technical trigger for pricing. The analyst’s graphic – was published early Thursday on TradingView – Plot XRP / USDT on Binance and shows the token changing your hands at $ 2,2107 after an indecisive daily fence on Wednesday.

XRP targets $ 3.65

The most visible feature is a descending trend line (drawn in red) extending from Swing 3 February to around $ 3.40 to the last lower-high group. This line is currently cutting the price slightly above the market and has capped each rescue rally since mid-January. According to WZRD, a daily candle that crosses this “lower trend line” would ignite “a very fast impulsive movement” to the next horizontal barrier at $ 2.80.

Why $ 2.80 counts is stated in a bright yellow call on the graph: a fence above this level, in WZRD’s words, “make a top of all time” very likely. Above $ 2.80, the graph offers little historical structure up to $ 3.30 – the price that marked the weekly summit in January.

Related reading

Then, the analyst targets the $ 3.65 zone, reported as the “next main target” in purple. This strip is the highest black horizontal traced and represents the analyst’s first objective in the prices discovery territory.

Support is also clearly defined. The thick black horizontal at $ 2.00 is labeled the “main daily support target”. Under this, successive shelves are marked at $ 1,5160, $ 1.3,000, $ 1,0700 and $ 0.9,000, with an annotation at $ 1.30 warning that a break could materialize “if the climbing rate continues to come.” A second -handed blue trend line connects the stockings at the end of March and the beginning of April, creating a short -term structure in the short term whose upward resolution has already started to relax a lower momentum.

The comment that accompanies him from WZRD underlines the interaction between XRP spots and his performance against Bitcoin. He notes that XRP / BTC wraps inside a symmetrical triangle which “ripe” on a higher movement in dominance Bitcoin; Positive action would add tail breads to the pair of a dollar.

“XRPBTC needs the help of the dominance of Bitcoin. Overcoming its current location will help the market to obtain the next impulsive movement towards its upper upper trend line, where it ripens the symmetrical triangle and possibly grows more.

Conversely, a “jerky” bitcoin could maintain XRP in bottle between $ 2,2050 and $ 2.00, a range which defined a large part of the intraday trade on Tuesday. “The overall feeling of Bitcoin will also have an impact on XRP tomorrow, although I expect to see a positive price action from XRPBTC. My goal will remain on the development of the lower chronometer to obtain the next healthy commercial configuration”, writes the analyst.

For the moment, the objective, known as WZRD, is being developed in the context of the lower time: any decisive daily regulation above the red trend line would confirm the reversal of trends and would prepare the ground for a sprint at $ 2.80 – and, if this level fell, the analyst maintains that history will be in progress.

At the time of the press, XRP exchanged $ 2.13.

Star image created with dall.e, tradingView.com graphic