Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

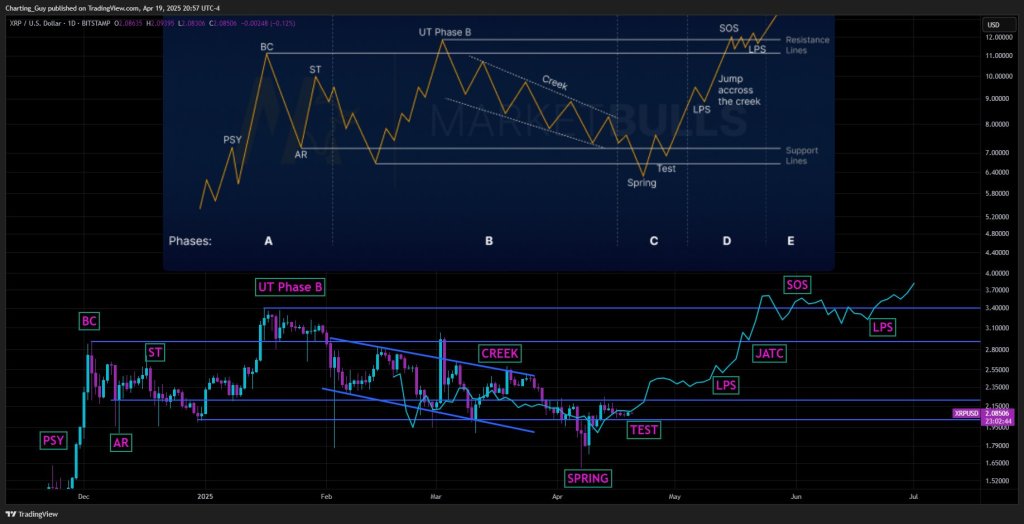

Crypto Analyst Charting Guy (@ChartingGuy), publishing on X on April 20, has mapped the daily XRP / US Dollar graphic on Bitstamp on a Wyckoff reactive manual and maintains that the model is now quite advanced to involve a summer brand to – and potential beyond – the region of $ 3.70.

“The Wyckoff motif ignites the XRP bull

The graph extends on the basis of five months which started with the preliminary supply (PSY) at the end of November. A vertical overvoltage brought the price in a point of aptitude for the purchase of $ 2.68 (British Columbia) in early December, immediately followed by an automatic reaction (AR) which was returned to around $ 1.90, anchoring the lower limit of what would become phase A of trading beach. A secondary test (ST) in mid-December revised the $ 2.72 area, completing the initial Wyckoff sequence.

Phase B took place until January: rebuilt demand, producing an increase in the increase (UT) in phase B which briefly pierced $ 3.40 in mid-January before the supply was reappoed. From this peak, XRP drew a descending and low angle channel – extended the “stream” – with ups and stockings gradually lower in early April. Throughout this descent, the superposition of the guy in cartography shows the familiar saw of the internal tests of Wyckoff, suggesting a distribution with low maintenance rather than a real distribution garnish.

Related reading

On April 7, the support of the market of market sub-jam, flowing at around $ 1.61, and immediately folded: the classic spring of phase C. A shallow test of the spring followed almost $ 2.00, satisfying the requirements of Wyckoff in terms of upward confirmation. From this moment, the projected path of the analyst increases.

Phase D begins with what Wyckoff called the last support point (LPS) between $ 2.35 and $ 2.55 in early May, followed by a stronger progression that crosses the February crest. This is followed by a jump through the stream (JATC) – a decisive thrust through the top of the downward channel and the horizontal resistance at around $ 2.70.

The model then shows an escape from prices above the summit in mid-January at $ 3.40 would constitute the sign of force (SOS) around $ 3.40 at the end of May, ending the transition to phase E. Subsequently, the cartography guy expects a second support in an even higher first point of support.

Related reading

In phase E, the scheme accelerates, taking XRP in the $ 3.70 zone by early July – a goal which is a checkout above the resistance band of $ 3.40 on the axis of the analyst’s prices. With the cash rate at $ 2.12 at the time of publication, the roadmap implies an increase of increase of almost 74% in the next two and a half months.

However, the graph warns that “it does not mean increasing now – the timing can be slightly offset”, stressing the probabilistic nature of Wyckoff. Nevertheless, the meticulous alignment of the action of the real world prices with the classic re -accumulation phases – with the labeled psyche, BC, AR, ST, UT, Spring, Test, LPS, JATC and SOS – has put weight in the bullish affair. If the market respects these technical steps, XRP could soon work with unaware prices since the peaks of the last cycle.

At the time of the press, XRP exchanged $ 2.11.

Star image created with dall.e, tradingView.com graphic