Crypto Sperax is recovering, up almost 200% in two days after the idea of a yield optimizer was floated. Will the SPA price be 10X from now on?

Bitcoin, Ethereum and meme coins have monopolized all the attention of cryptocurrencies. The crypto community expects Bitcoin to surpass $100,000 and Ethereum to reclaim $4,000.

While their eyes are on these coins, Sperax (SPA).cwp-coin-chart svg path { Stroke: ; line width: ; }

Price

Trading volume in 24 hours

Last price movement over 7 days

an altcoin traded on several exchanges, including Coinbase, defies gravity.

$spa volume exceeds market capitalization

Do you know what that means pic.twitter.com/sLCprhBTGy– Mahmoud Youssef (@mahmoudjo94) November 28, 2024

SPA Price Analysis: Sperax Crypto achieves incredible +200% increase in 48 hours

SPA surged nearly 200% in two days, becoming one of the top performers in the last 48 hours, according to Coingecko data.

(SPAUSDT)

At this rate, SPA is up 233% from November lows and breaking out of a multi-week trading range.

According to the daily chart, SPA is in a bullish breakout formation. If the bulls defend $0.011103, the coin would easily surpass 2024 highs.

Further tailwinds to this rally will occur if Bitcoin continues to post higher highs, closing above $100,000 in the coming days.

An analyst predicted SPA will reach $0.21605, almost 10 times spot rates, assuming sustained momentum.

(Source)

The question now is: what is Sperax crypto and why is it rallying so strongly?

EXPLORE: 15 Best Anonymous Bitcoin Wallets Without KYC in 2024

What is Sperax? Why is the Sperax rally so difficult?

Although meme coins are dominant, that doesn’t mean there isn’t activity in other subsectors.

DeFi projects are attracting billions, driving up the valuation of Uniswap, Aave, PancakeSwap and others.

Amidst this, Sperax, another DeFi protocol, is looking to differentiate itself from the crowd.

Based in New York, Sperax launched in 2020 with initial plans for a layer 1 blockchain.

However, the team then pivoted and focused on releasing an algorithmic stablecoin, Sperax USD (USD).

The stablecoin, like DAI, carries yield and lives on Arbitrum, not the Ethereum mainnet.

Holders received yield without staking or claiming. Yield comes from collateral deployed on other DeFi protocols, primarily Curve Finance.

Over the coming years, the project plans to build a full-fledged ecosystem in which USD will be at the heart.

EXPLORE: Best New Cryptocurrencies to Invest in in 2024

Why did the PPS increase by almost 200%?

Although SPA had a massive year, with gains, notably in the first half of 2024, the resumption of the uptrend follows the announcement of a yield optimizer.

The product, which is planned to be launched on Arbitrum, allow users can invest their stablecoins, USDC or USDT, and earn yield.

The Yield Optimizer automatically allocates funds among various predetermined strategies to maximize gains and reduce risks.

Once a user redeems their shares, they receive the full allocation and a return.

Once the idea is developed, the optimizer will drive its adoption, allowing beginners to achieve additional yield in a low-cost environment.

Since the team said it would be simple and have a user-friendly interface, the total value locked (TVL) of Sperax could increase.

(Source)

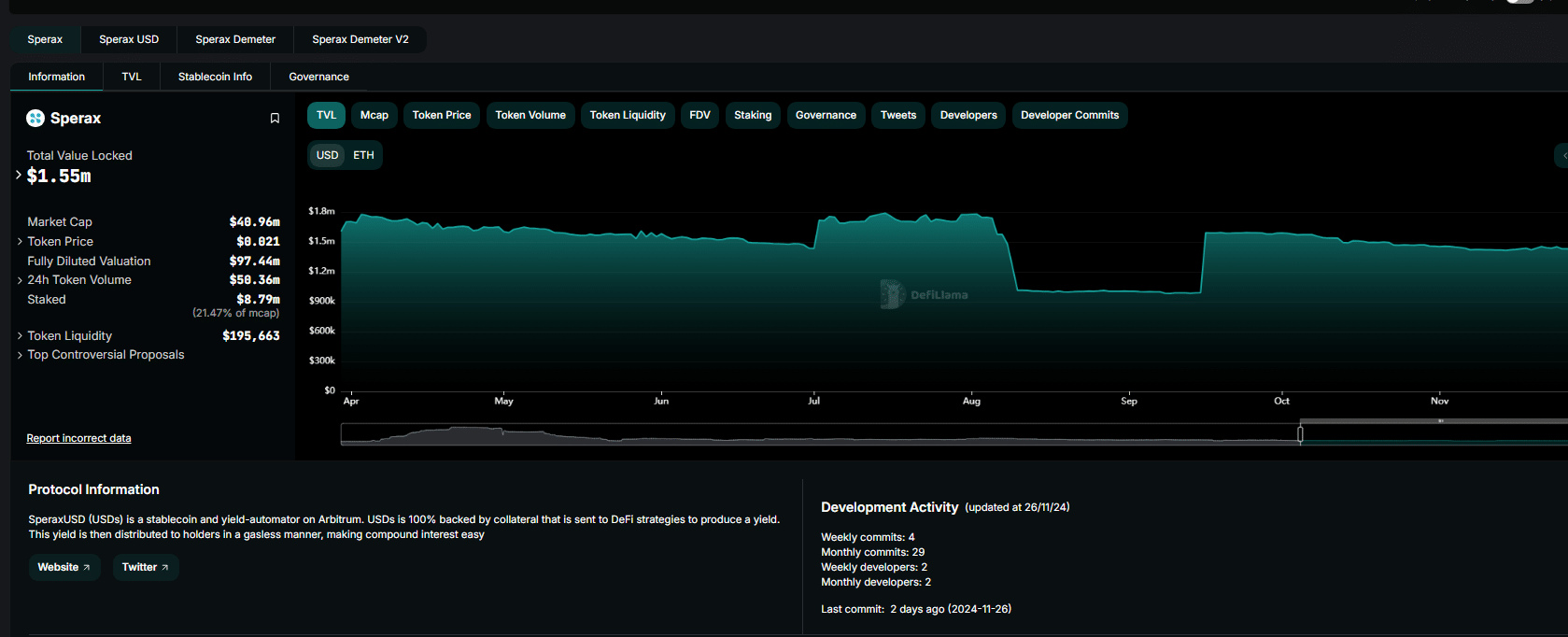

According to DeFiLlama, Sperax currently has a TVL of $1.55 million.

EXPLORE: FET Price Faces Unlock: Will AI Crypto Token Unlock Dent AI Coin Prices?

Join the 99Bitcoins News Discord here for the latest market update

Post yield optimization goes viral: Sperax crypto explodes but what is Sperax? appeared first on .