Join our Telegram channel to stay up to date with the latest news

The price of Zcash fell 4% in the last 24 hours, trading at $423, after developer activity for Zcash fell to its lowest level since November 2021, as ongoing governance tensions and a sharp price decline weigh on the ecosystem.

Data from Santiment shows that Zcash development activity has fallen to its lowest level since November 2021, coinciding with a price drop of around 40% over the past two months. Santiment noted that altcoins tend to thrive when development efforts are intense, while reduced activity can contribute to market stagnation and underperformance.

The slowdown comes amid a dispute between Electric Coin Company (ECC), Zcash’s main development team, and Bootstrap, the nonprofit organization that supports the protocol. ECC recently announced plans to spin off Bootstrap and create a new company, citing what it calls “malicious governance actions.”

📊 Unless you’ve been living under a crypto rock, you’ve probably seen headlines pouring in on Zcash in late 2025. The decade-old privacy coin increased its market cap by ~15x between September 22 and November 16.

🧑💻 However, we observed $ZECthe development activity of… pic.twitter.com/MORo1sD7ix

–Santiment (@santimentfeed) January 8, 2026

Bootstrap responded that board members had discussed external investments and alternative structures to take Zashi, Zcash’s self-custodial wallet for private transactions, private. In response, ECC announced the development of a new wallet, cashZ, which is expected to launch in the coming weeks.

Despite the conflict, the Zcash Foundation has reassured investors that the protocol’s open source design ensures continuity and resilience, preventing a single organization from controlling the blockchain. However, the market reacted negatively, with ZEC losing 14% over the past week and trading near $433 at the time of the report.

Institutional investors and whales, however, remain active. Nansen data shows that whales added $1.17 million in ZEC last week, while new wallets accumulated $2.14 million. Meanwhile, Zcash competitor Monero has overtaken ZEC in market capitalization, regaining its position as the leading privacy-focused cryptocurrency. The combination of governance tensions, declining development, and competitive pressures highlights the ongoing challenges for the Zcash ecosystem.

Zcash eyes bullish recovery as parabolic bottom forms

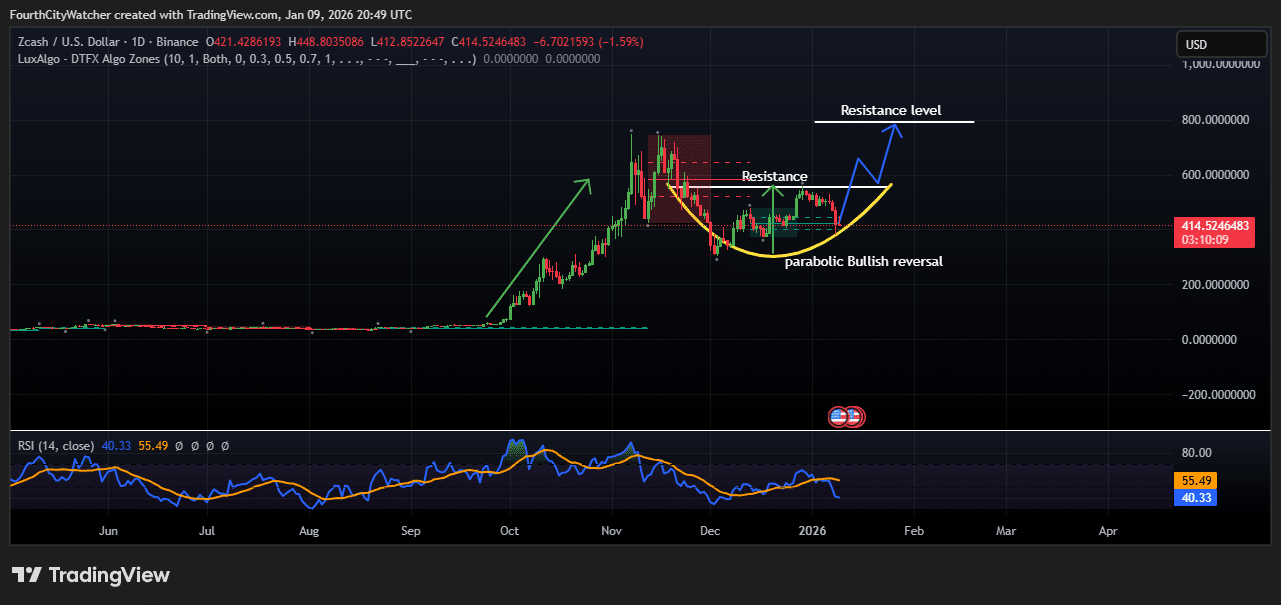

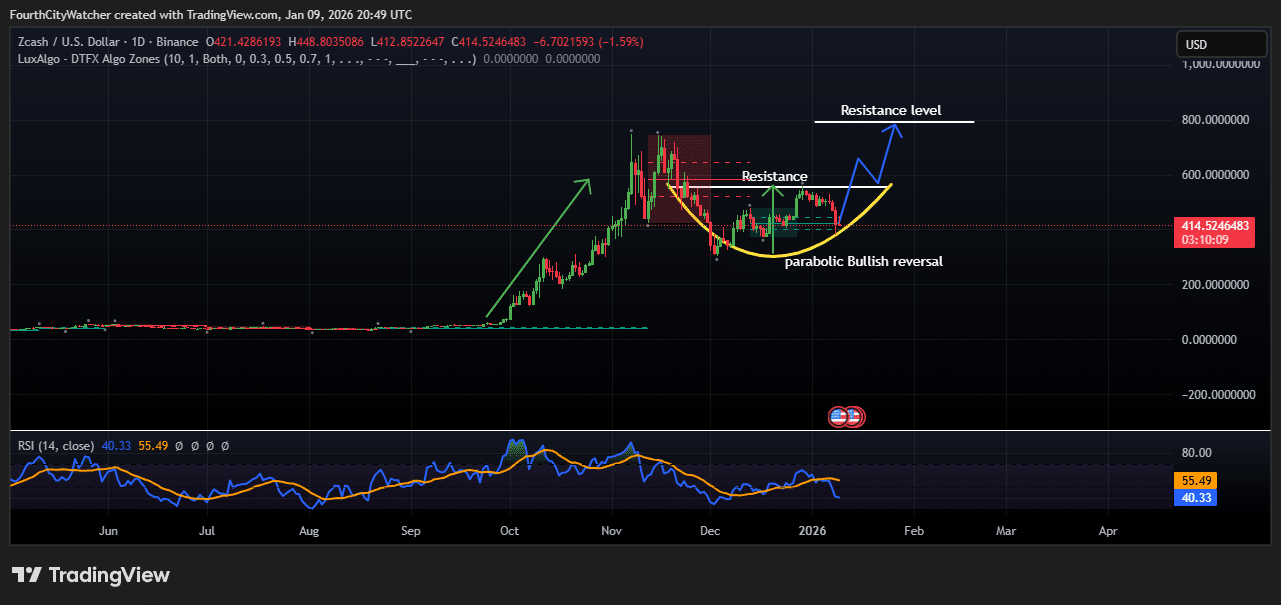

Zcash recovered after a sharp price rally that began around September 2025. The coin peaked between $750 and $800 before dropping to around $400, where it currently trades. The chart shows the formation of a parabolic bullish reversal pattern, which resembles a cup or curved bottom.

There is a key resistance zone between $500 and $550. The price must exceed this level to confirm the next upward movement. If Zcash breaks this resistance, the next target could be its previous high, around $750-$800. The parabolic shape on the chart indicates that the upward movement could accelerate once resistance is broken, which would signal a stronger rally.

ZECUSD chart analysis. Source: Tradingview

The relative strength index (RSI) is hovering around 40, which is close to oversold territory. This shows that the coin has been heavily sold off recently and buyers may step in soon. If the RSI rises above 50-55, it would indicate increasing buying momentum and increase the chances of a successful bullish reversal.

Support is currently near $400, making it an important level to watch. If price holds above this support, it could provide a good entry point for traders looking to profit from the next upward move. Breaking the resistance around $500-550 is the main condition for the next rally.

The parabolic bottom pattern and oversold RSI support the possibility of a price recovery. Traders should watch for a break above $500-$550 as confirmation, which could pave the way for a rally towards $750-$800. Until then, $400 remains a key support level to watch.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news