Join our Telegram channel to stay up to date with the latest news

Zcash (ZEC) has faced notable volatility as of late, reversing significantly from its recent highs while maintaining gains from its recent lows. Despite these fluctuations, the cryptocurrency is showing signs of resilience and renewed interest from traders in X. Given current market dynamics and technical signals, the pressing question is: will ZEC be able to turn this rebound into a sustainable uptrend?

ZEC Key Statistics

- Current price: $349

- Market capitalization: $5.8 billion

- Trading volume (24h): $1.17 billion

- Circulating supply: 16 million ZEC

- Total offer: 16 million ZEC

- CoinMarketCap Ranking: #22

Over the past 30 and 7 days, Zcash has fallen 51.90% and 35.22% from its recent highs, reflecting a notable pullback. Despite this, the cryptocurrency rose 15.05% from its lowest price during the same periods, showing signs of resilience and potential recovery.

ZEC/USD Market

Key levels

- Resistance: $400, $470, $550

- Support: $320, $280, $240

ZEC/USD sits near $349.15 on the chart, coming back sharply from its high of $744 and moving steadily below the parabolic SAR markers which continue to reflect a bearish tone. The overall flow of price action remains bearish, with consistent lower highs and lower lows shaping sentiment. For an upward shift to take shape, ZEC would need to challenge and clear resistance levels around $400, $470, and $550, areas where previous rallies lost momentum and sellers reasserted control.

The RSI reading at 38.63 indicates increasing exhaustion in the downtrend, creating the possibility – but not the guarantee – of a near-term corrective rebound if buyers begin to show interest. If selling pressure remains unchecked, the market could gravitate towards supports near $320, $280, and $240, each linked to previous consolidation phases. How ZEC behaves around these zones could determine whether the market finds a temporary bottom or slides into a deeper retracement, making upcoming price reactions particularly important to watch.

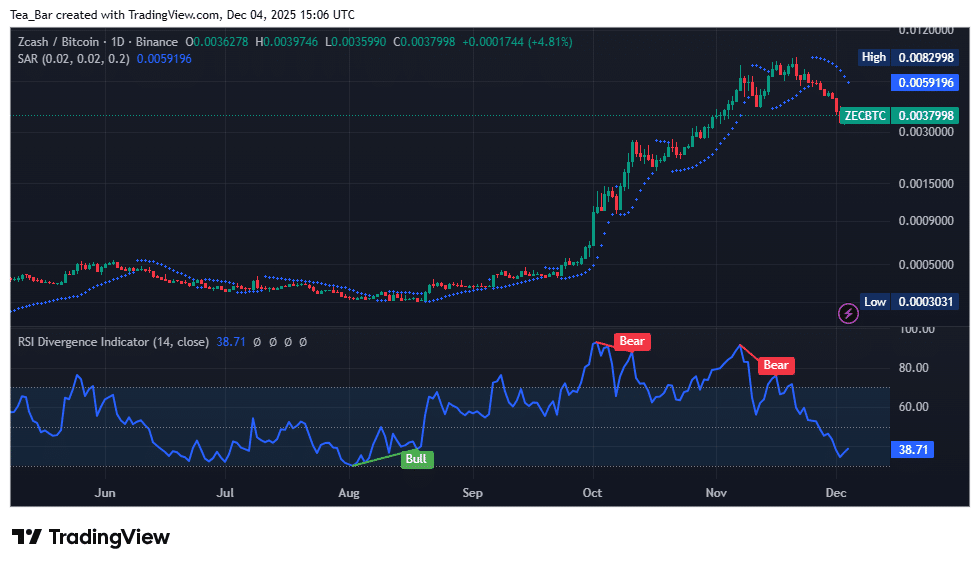

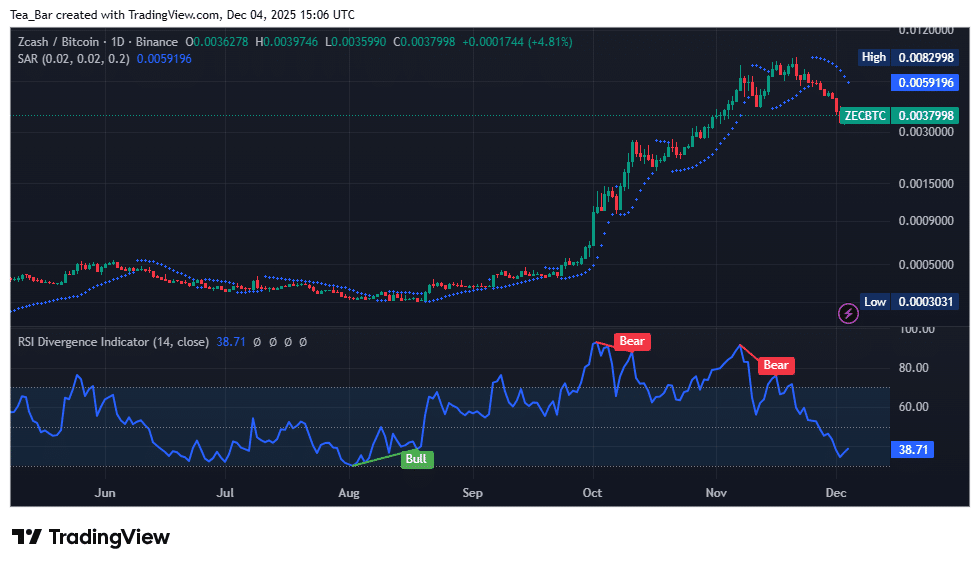

ZEC/BTC Performance Overview

ZEC/BTC is currently trading around 0.0037998, showing a continued pullback from its high of 0.0082998 as Parabolic SAR points remain above the candles, indicating continued bearish momentum. The decline is further supported by a weakening RSI to 38.71, reflecting sustained bearish pressure after consecutive bearish divergences in October and November. Unless the pair can regain levels near 0.0042000 or above to shift market sentiment, it remains susceptible to further pullbacks towards upcoming demand zones, making upcoming price action crucial in assessing whether buyers are willing to defend the current range.

Recent activity highlighted on that $ZEC has rebounded over the past few days, performing comparatively better than many other altcoins. Analysts on X interpret this move as indicative of a possible round bottom forming, which could signal the start of an emerging uptrend. This interpretation highlights the potential for near-term momentum gains, sparking renewed interest from traders looking for promising opportunities in the altcoin market.

Zcash Fundamentals: Privacy, Adoption, and Market Potential

Zcash’s fundamentals are increasingly being shaped by its technological upgrades and adoption potential. The Sapling network upgrade in October 2025 significantly reduced protected transaction costs, making private payments more convenient, while Ztarknet, a layer 2 inspired by Starknet, aims to scale transactions beyond 1,000 TPS without compromising privacy. These improvements could spur growth in the shielded pool, which currently represents 29% of ZEC’s supply, and historically, major protocol upgrades like Halo 2 in 2024 have coincided with substantial rallies. Exchange listings on platforms like Coinbase and Gemini also improve liquidity, although they can introduce short-term volatility.

Zcash (ZEC): More fundamental and technical information

Regulatory and institutional factors add a nuanced layer to Zcash’s prospects. Although the SEC’s rejection of leveraged crypto ETFs signals caution, institutional adoption continues, with Grayscale’s ZEC Trust and Cypherpunk Technologies holding notable positions. Zcash’s voluntary transparency could attract compliance-minded institutions, balancing concerns over the regulation of secrecy coins in regions like the EU. Market dynamics, including high volatility and whale activity, further influence price action. Given these developments, the key question remains: can Zcash’s protected transactions reach 50% of supply by 2026, solidifying its “privacy first” narrative?

Related news

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news