As digital asset markets continue to mature, competition between platforms is increasingly defined not only by technology or product breadth, but also by governance standards and operational credibility. In this context, ZEAKS Trading Center has undertaken a structural reassessment of its global platform model, formally integrating compliance governance into its core operational logic.

This change represents a broader evolution in how the platform approaches long-term development, emphasizing internal discipline, regulatory alignment and operational accountability as foundational elements rather than external requirements.

From market entry to governance architecture

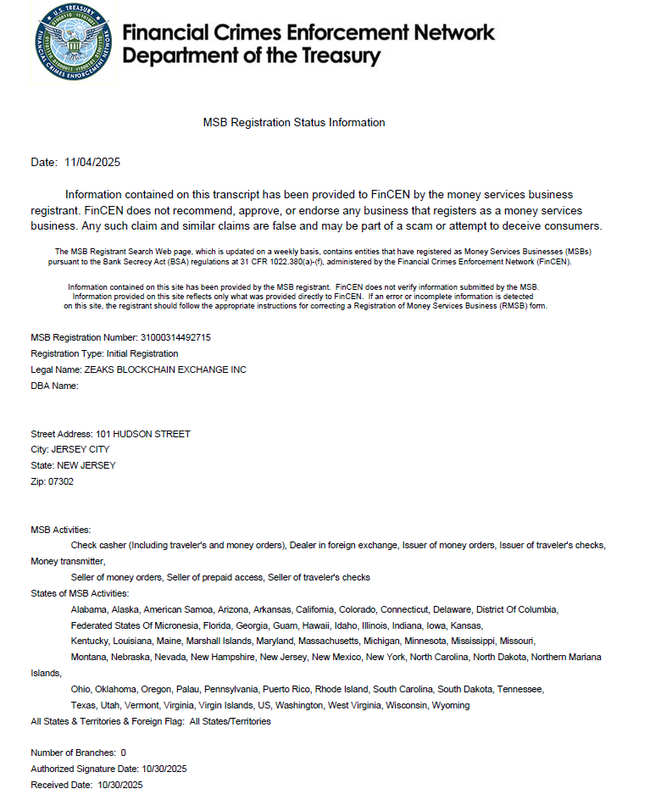

ZEAKS approaches compliance as an operational structure rather than a market entry checklist. The platform has been registered as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN) and conducts its operations within applicable U.S. regulatory reporting and oversight frameworks.

At the same time, ZEAKS continues to advance its European compliance roadmap. Its regulatory application process in Poland remains under review and is part of the platform’s long-term regional strategy, reflecting a measured, jurisdiction-specific approach to international expansion.

Institutional operational practices in daily execution

At the operational level, ZEAKS focused on integrating auditability, traceability and risk discipline into the platform’s daily processes. Its institutional operational framework includes several essential components, including:

Internal segregation and structured management of client assets

Automated AML and customer verification workflows

End-to-end audit trails for key operational activities

Data-driven risk monitoring and exception detection mechanisms

These practices are designed to function as integral elements of system design and decision-making, rather than stand-alone compliance layers.

Balancing global consistency and local adaptation

ZEAKS advances its global operations through a unified infrastructure framework complemented by localized execution. Core system architecture and risk principles remain consistent across all regions, while operational practices are adapted to align with jurisdiction-specific regulatory expectations and market conditions.

This approach allows the platform to maintain operational consistency across diverse markets without relying on a single regional growth story.

Redefining the role of a trading platform

ZEAKS views the evolution of digital asset platforms as a transition from purely technical execution environments to institutions capable of sustainable governance and accountability. Integrating compliance governance into operational design reflects this redefinition, positioning the platform as a long-term infrastructure participant rather than a short-term market entrant.

Through this framework, ZEAKS aims to support a more predictable, transparent and resilient operating environment for global users in an increasingly regulated industry landscape.

About ZEAKS Shopping Center

ZEAKS Trading Center is a global digital asset trading platform focused on creating operational frameworks based on governance discipline, risk management and system stability. Through continuous improvement of its internal processes and compliance methodologies, the platform supports user participation in various regulatory environments.

Disclaimer:

The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.